STEALTHGAS INC. (NASDAQ: GASS), a ship-owning company serving the

liquefied petroleum gas (LPG) sector of the international shipping

industry, announced today its unaudited financial and operating

results for the third quarter and nine months ended September 30,

2023.

OPERATIONAL AND FINANCIAL

HIGHLIGHTS

- All-time record Net Income of $43.0 million for the nine-month

period corresponding to a basic EPS of $1.12. Strong profitability

continued for the third quarter with Net Income of $15.7 million

for the three-month period corresponding to a basic EPS of $0.41, a

134% increase compared to last year.

- Significantly increased period coverage. About 50% of fleet

days for 2024 are secured on period charters, with total fleet

employment days for all subsequent periods generating approximately

$195 million (excl. JV vessels) in contracted revenues.

- Expanded the share repurchase program by an additional $10

million for a total of $25 million. To date, 3.9 million shares

have been repurchased, more than 10% of the outstanding

shares.

- Massively reduced debt by $149.4 million from $277.1 million as

of December 31, 2022, net of deferred finance charges, to $127.7

million as of September 30, 2023.

- Revenues at $34.7 million for Q3 23’ despite having reduced the

number of vessels in the fleet from 34 vessels at the end of Q3 22’

to 27 vessels at the end of Q3 23’.

Third Quarter 2023 Results:

- Revenues for the three months ended September 30, 2023 amounted

to $34.7 million compared to revenues of $34.9 million for the

three months ended September 30, 2022, a decrease of $0.2 million,

or 1%, while the fleet over the corresponding periods was reduced

from 34 vessels at the end of Q3 2022 to 27 vessels at the end of

Q3 2023 so the vessels remaining in the fleet saw a rise in

revenues due to better market conditions.

- Voyage expenses and vessels’ operating expenses for the three

months ended September 30, 2023 were $2.4 million and $12.3

million, respectively, compared to $6.8 million and $14.1 million,

respectively, for the three months ended September 30, 2022. The

$4.4 million, or 65%, decrease in voyage expenses was the result of

lower spot voyage days, while the $1.8 million, or 13%, decrease in

vessels’ operating expenses was mainly due to the decrease in the

average number of owned vessels in our fleet.

- Drydocking costs for the three months ended September 30, 2023

and 2022 were $0.1 million and $1.8 million, respectively.

Drydocking expenses during the third quarter of 2023 mainly relate

to the preparation for drydocking of one vessel, compared to the

drydocking of four vessels in the same period of last year.

- Management fees for the three months ended September 30, 2023

and 2022 were $1.1 million and $1.3 million, respectively. The

change is attributed to the decrease in the average number of owned

vessels in our fleet.

- General and administrative expenses for the three months ended

September 30, 2023 and 2022 were $1.7 million and $0.8 million,

respectively. The change is mainly attributed to the increase in

stock based compensation expense.

- Depreciation for the three months ended September 30, 2023 and

2022 was $5.5 million and $6.9 million, respectively, as the number

of our vessels declined.

- Gain on sale of vessels for the three months ended September

30, 2023 was $4.7 million which was due to the sale of two of the

Company’s vessels.

- Interest and finance costs for the three months ended September

30, 2023 and 2022, were $2.5 million and $3.5 million,

respectively. The $1.0 million, or 29%, decrease from the same

period of last year is mostly due to the reduction in debt

outstanding despite increases in variable interest rates as well as

profits from closing of swap positions due to debt

prepayments.

- Interest income for the three months ended September 30, 2023

and 2022 was $0.8 million and $0.3 million, respectively. The

increase is mainly attributed to increases in interest rates over

the corresponding period.

- Equity earnings in joint ventures for the three months ended

September 30, 2023 and 2022 was a gain of $0.9 million and $6.1

million, respectively. The $5.2 million decrease was mainly due to

the gain from a sale of a vessel that was recorded in one of the

joint ventures during the three months ended September 30,

2022.

- As a result of the above, for the three months ended September

30, 2023, the Company reported net income of $15.7 million,

compared to net income of $6.7 million for the three months ended

September 30, 2022 an increase of $9.0 million, or 134%. The

weighted average number of shares outstanding, basic, for the three

months ended September 30, 2023 and 2022 was 37.3 million and 37.9

million, respectively.

- Earnings per share, basic, for the three months ended September

30, 2023 amounted to $0.41 compared to earnings per share of $0.18

for the same period of last year.

- Adjusted net income1 was $12.0 million corresponding to an

Adjusted EPS1 of $0.31 for the three months ended September 30,

2023 compared to Adjusted net income of $6.1 million corresponding

to an Adjusted EPS of $0.16 for the same period of last year, an

increase in Adjusted net income of $5.9 million, or 97%.

- EBITDA1 for the three months ended September 30, 2023 amounted

to $22.9 million. Reconciliations of Adjusted Net Income, EBITDA

and Adjusted EBITDA1 to Net Income are set forth below.

- An average of 27.6 vessels were owned by the Company during the

three months ended September 30, 2023 compared to 34.0 vessels for

the same period of 2022.

______________________________1 EBITDA, Adjusted EBITDA,

Adjusted Net Income and Adjusted EPS are non-GAAP measures. Refer

to the reconciliation of these measures to the most directly

comparable financial measure in accordance with GAAP set forth

later in this release.

Nine Months 2023 Results:

- Revenues for the nine months ended September 30, 2023 amounted

to $109.4 million, a decrease of $0.6 million, or 0.5%, compared to

revenues of $110.0 million for the nine months ended September 30,

2022, primarily due to reduction in the fleet size.

- Voyage expenses and vessels’ operating expenses for the nine

months ended September 30, 2023 were $9.9 million and $40.2

million, respectively, compared to $15.6 million and $40.3 million

for the nine months ended September 30, 2022. The $5.7 million, or

37%, decrease in voyage expenses was mainly due to the decrease in

spot days. The $0.1 million decrease in vessels’ operating expenses

despite the reduction in fleet size was primarily the result of

cost overruns in certain cost categories like spares and crew and

was more pronounced during the Q1 23’ and less so during Q3

23’.

- Drydocking costs for the nine months ended September 30, 2023

and 2022 were $2.6 million and $2.3 million, respectively. The

costs for the nine months ended September 30, 2023 mainly related

to the completed drydocking of three of the larger handysize

vessels, while the costs for the same period of last year related

to the drydocking of five vessels.

- General and administrative expenses for the nine months ended

September 30, 2023 and 2022 were $3.7 million and $2.6 million,

respectively. The change is mainly attributed to the increase in

stock based compensation expense.

- Depreciation for the nine months ended September 30, 2023 was

$18.1 million, a $2.9 million decrease from $21.0 million for the

same period of last year, due to the decrease in the average number

of our vessels.

- Impairment loss for the nine months ended September 30, 2023

was $2.8 million relating to two vessels, for which the Company has

entered into separate agreements to sell them to third

parties.Impairment loss for the nine months ended September 30,

2022 was $0.5 million relating to one vessel, for which the Company

had entered into an agreement to sell and subsequently delivered to

its new owner.

- Gain on sale of vessels for the nine months ended September 30,

2023 was $7.6 million, which was primarily due to the sale of seven

of the Company’s vessels.

- Interest and finance costs for the nine months ended September

30, 2023 and 2022 were $7.6 million and $8.7 million respectively.

Despite increases in interest rates during that period, interest

costs fell mainly due to the decrease of our outstanding

indebtedness.

- Interest income for the nine months ended September 30, 2023

and 2022 was $2.8 million and $0.4 million, respectively. The six

fold increase is mainly attributed to increases in interest rates

and in our average cash and cash equivalents including deposits

over the corresponding period.

- Equity earnings in joint ventures for the nine months ended

September 30, 2023 and 2022 was a gain of $11.4 million and a gain

of $9.7 million, respectively. The $1.7 million increase from the

same period of last year is mainly due to a gain on sale of one of

the Medium Gas carriers owned by one of our joint ventures.

- As a result of the above, the Company reported a net income for

the nine months ended September 30, 2023 of $43.0 million, compared

to a net income of $26.6 million for the nine months ended

September 30, 2022 an increase of $16.4 million, or 62%. The

weighted average number of shares outstanding, basic, as of

September 30, 2023 and 2022 was 37.8 million and 37.9 million,

respectively.

- Earnings per share, basic, for the nine months ended September

30, 2023 amounted to $1.12 compared to earnings per share, basic,

of $0.70 for the same period of last year.

- Adjusted net income was $40.0 million, or $1.04 per share, for

the nine months ended September 30, 2023 compared to adjusted net

income of $26.1 million, or $0.69 per share, for the same period of

last year, an increase of $13.9 million, or 53%.

- EBITDA for the nine months ended September 30, 2023 amounted to

$66.0 million. Reconciliations of Adjusted Net Income, EBITDA and

Adjusted EBITDA to Net Income are set forth below.

- An average of 30.1 vessels were owned by the Company during the

nine months ended September 30, 2023, compared to 35.0 vessels for

the same period of 2022.

- As of September 30, 2023, cash and cash equivalents (including

restricted cash) amounted to $79.8 million and total debt amounted

to $127.7 million.

Fleet Update Since Previous

Announcement

The Company announced the conclusion of the

following chartering arrangements (of three or more months

duration):

· A three-year

time charter extension for its 2018 built LPG carrier Eco Freeze,

until May 2027.

· A three-year

time charter extension for its 2018 built LPG carrier Eco Ice,

until Sep 2027.

· A three-year

time charter extension for its 2011 built LPG carrier Gas Myth,

until Jan 2027.

· A twelve

months time charter extension for its 2007 built LPG carrier Gas

Flawless, until Dec 2024.

· A twelve

months time charter extension for its 2014 built LPG carrier Eco

Invictus, until Oct 2024.

· A twelve

months time charter extension for its 2021 built LPG carrier Eco

Blizzard, until Oct 2024.

· A six months

time charter extension for its 2016 built LPG carrier Eco Nical,

until Apr 2024.

· A six months

time charter extension for its 2016 built LPG carrier Eco Alice,

until Mar 2024.

· A six months

time charter for its 2018 built LPG carrier Eco Arctic, until Mar

2024.

· A twelve

months time charter for its LPG carrier Eco Oracle, to be delivered

in Jan 2024.

· A twelve

months time charter for its LPG carrier Eco Wizard, to be delivered

in Jan 2024.

As of November 2023, the Company has total

contracted revenues of approximately $195 million.

For the remainder of the year 2023, the Company

has about 85% of fleet days secured under period contracts, and 50%

for the year 2024.

On October 6, 2023, the 40,000 cbm vessel

newbuilding Eco Sorcerer was delivered in Korea to our joint

venture. The vessel has been deployed on a twelve-month time

charter.

Board Chairman Michael Jolliffe

Commented

2023 has turned out to be a tremendous year for

gas shipping overall and especially for StealthGas. So far for the

first nine months of 2023 we have reported our strongest

performance on record, with a basic EPS of $1.12. For the third

quarter, in what normally would be a seasonally weak quarter, we

reported net income of $15.7 million, the second-best quarter on

record, only surpassed by the first quarter of this year. As the

market is firming we took advantage of the momentum and entered

into a number of long period charters some with durations as long

as three years thus securing part of our future revenues. We have

thus extended the duration of our contract coverage to over 50% for

2024.

Also part of our strategy is deleveraging, and

so far during this year we have more than halved our outstanding

debt, repaying $151 million and greatly reducing our interest rate

expenses in the process while at the same time keeping 15 out of

the 27 vessels debt-free. At the same time we sought to expand the

repurchase of shares with an additional $10 million as we used the

initial $15 million, and during a short period of time we have so

far repurchased over 10% of the outstanding shares with the aim to

return value to our shareholders. The market remains firm as we are

entering the seasonally stronger winter months and is buoyant for

the larger sized vessels, in what we hope will prove a well-timed

diversification of the fleet with the addition of larger sized

vessels. We believe we are well positioned to benefit from strong

markets and to continue to generate shareholder value.

Conference Call details:

On November 21, 2023 at 11:00 am ET, the

company’s management will host a conference call to discuss the

results and the company’s operations and outlook.

Conference call participants should pre-register

using the below link to receive the dial-in numbers and a personal

PIN, which are required to access the conference call.

Online Registration:

https://register.vevent.com/register/BIc9d639270b9242e791b8bf60598acfb3

Slides and audio webcast: There

will also be a live and then archived webcast of the conference

call, through the STEALTHGAS INC. website (www.stealthgas.com).

Participants to the live webcast should register on the website

approximately 10 minutes prior to the start of the webcast.

About STEALTHGAS INC.

StealthGas Inc. is a ship-owning company serving

the liquefied petroleum gas (LPG) sector of the international

shipping industry. StealthGas Inc. has a fleet of 33 LPG carriers,

including six Joint Venture vessels in the water, and two 40,000

cbm newbuilding Medium Gas Carriers to be delivered by the end of

Q1 2024. These LPG vessels have a total capacity of 397,747 cubic

meters (cbm). StealthGas Inc.’s shares are listed on the Nasdaq

Global Select Market and trade under the symbol “GASS.” Visit our

website at www.stealthgas.com

Forward-Looking Statements

Matters discussed in this release may constitute

forward-looking statements. Forward-looking statements reflect our

current views with respect to future events and financial

performance and may include statements concerning plans,

objectives, goals, strategies, future events or performance and

underlying assumptions and other statements, which are other than

statements of historical facts. The forward-looking statements in

this release are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including without

limitation, management’s examination of historical operating

trends, data contained in our records and other data available from

third parties. Although STEALTHGAS INC. believes that these

assumptions were reasonable when made, because these assumptions

are inherently subject to significant uncertainties and

contingencies which are difficult or impossible to predict and are

beyond our control, STEALTHGAS INC. cannot assure you that it will

achieve or accomplish these expectations, beliefs or projections.

Important factors that, in our view, could cause actual results to

differ materially from those discussed in the forward-looking

statements include any resurgence of the COVID-19 pandemic, the

strength of world economies and currencies, general market

conditions, including changes in charter hire rates and vessel

values, charter counterparty performance, changes in demand that

may affect attitudes of time charterers to scheduled and

unscheduled drydockings, shipyard performance, changes in

STEALTHGAS INC’s operating expenses, including bunker prices,

drydocking and insurance costs, ability to obtain financing and

comply with covenants in our financing arrangements, or actions

taken by regulatory authorities, potential liability from pending

or future litigation, domestic and international political

conditions, the conflict in Ukraine and related sanctions, the

conflict in Israel and Gaza, potential disruption of shipping

routes due to accidents and political events or acts by

terrorists.

Risks and uncertainties are further described in

reports filed by STEALTHGAS INC. with the U.S. Securities and

Exchange Commission.

Fleet

List For

information on our fleet and further information: Visit our website

at www.stealthgas.com

Fleet Data: The following key

indicators highlight the Company’s operating performance during the

periods ended September 30, 2022 and September 30, 2023.

|

FLEET DATA |

Q3 2022 |

Q3 2023 |

9M 2022 |

9M 2023 |

|

Average number of vessels (1) |

34.0 |

|

27.6 |

|

35.0 |

|

30.1 |

|

|

Period end number of owned vessels in fleet |

34 |

|

27 |

|

34 |

|

27 |

|

|

Total calendar days for fleet (2) |

3,128 |

|

2,537 |

|

9,559 |

|

8,214 |

|

|

Total voyage days for fleet (3) |

3,028 |

|

2,529 |

|

9,420 |

|

8,125 |

|

|

Fleet utilization (4) |

96.8% |

|

99.7% |

|

98.5% |

|

98.9% |

|

|

Total charter days for fleet (5) |

2,185 |

|

2,351 |

|

7,814 |

|

7,337 |

|

|

Total spot market days for fleet (6) |

843 |

|

178 |

|

1,606 |

|

788 |

|

|

Fleet operational utilization (7) |

87.9% |

|

96.9% |

|

92.5% |

|

96.6% |

|

1) Average number of vessels is the number of

owned vessels that constituted our fleet for the relevant period,

as measured by the sum of the number of days each vessel was a part

of our fleet during the period divided by the number of calendar

days in that period. 2) Total calendar days for fleet are the total

days the vessels we operated were in our possession for the

relevant period including off-hire days associated with major

repairs, drydockings or special or intermediate surveys. 3) Total

voyage days for fleet reflect the total days the vessels we

operated were in our possession for the relevant period net of

off-hire days associated with major repairs, drydockings or special

or intermediate surveys. 4) Fleet utilization is the percentage of

time that our vessels were available for revenue generating voyage

days, and is determined by dividing voyage days by fleet calendar

days for the relevant period. 5) Total charter days for fleet are

the number of voyage days the vessels operated on time or bareboat

charters for the relevant period. 6) Total spot market charter days

for fleet are the number of voyage days the vessels operated on

spot market charters for the relevant period. 7) Fleet operational

utilization is the percentage of time that our vessels generated

revenue, and is determined by dividing voyage days excluding

commercially idle days by fleet calendar days for the relevant

period.

Reconciliation of Adjusted Net Income,

EBITDA, adjusted EBITDA and adjusted EPS:

Adjusted net income represents net income before

gain on derivatives excluding swap interest paid/received,

impairment loss, net gain/loss on sale of vessels and share based

compensation. EBITDA represents net income before interest and

finance costs, interest income and depreciation. Adjusted EBITDA

represents net income before interest and finance costs, interest

income, depreciation, impairment loss, net gain/loss on sale of

vessels, share based compensation and gain on derivatives.

Adjusted EPS represents Adjusted net income

divided by the weighted average number of shares. EBITDA, adjusted

EBITDA, adjusted net income and adjusted EPS are not recognized

measurements under U.S. GAAP. Our calculation of EBITDA, adjusted

EBITDA, adjusted net income and adjusted EPS may not be comparable

to that reported by other companies in the shipping or other

industries. In evaluating Adjusted EBITDA, Adjusted net income and

Adjusted EPS, you should be aware that in the future we may incur

expenses that are the same as or similar to some of the adjustments

in this presentation.

EBITDA, adjusted EBITDA, adjusted net income and

adjusted EPS are included herein because they are a basis, upon

which we and our investors assess our financial performance. They

allow us to present our performance from period to period on a

comparable basis and provide investors with a means of better

evaluating and understanding our operating performance.

|

(Expressed in United States Dollars,

except number of shares) |

Third Quarter EndedSeptember 30th, |

Nine Months Period EndedSeptember 30th, |

|

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

|

Net Income - Adjusted Net Income |

|

|

|

|

|

Net income |

6,733,657 |

|

15,740,616 |

|

26,552,524 |

|

43,047,783 |

|

|

Less gain on derivatives |

(713,507 |

) |

(197,247 |

) |

(1,779,309 |

) |

(493,355 |

) |

|

(Less)/Plus swap interest (paid)/received |

(8,844 |

) |

217,754 |

|

(90,425 |

) |

607,042 |

|

|

(Less)/Plus (gain)/loss on sale of vessels, net |

-- |

|

(4,719,796 |

) |

408,637 |

|

(7,645,781 |

) |

|

Plus impairment loss |

-- |

|

-- |

|

529,532 |

|

2,816,873 |

|

|

Plus share based compensation |

85,529 |

|

920,688 |

|

525,260 |

|

1,649,189 |

|

|

Adjusted Net Income |

6,096,835 |

|

11,962,015 |

|

26,146,219 |

|

39,981,751 |

|

|

|

|

|

|

|

|

Net income - EBITDA |

|

|

|

|

|

Net income |

6,733,657 |

|

15,740,616 |

|

26,552,524 |

|

43,047,783 |

|

|

Plus interest and finance costs |

3,549,687 |

|

2,481,489 |

|

8,668,720 |

|

7,612,283 |

|

|

Less interest income |

(306,815 |

) |

(834,799 |

) |

(378,193 |

) |

(2,759,952 |

) |

|

Plus depreciation |

6,929,887 |

|

5,549,825 |

|

20,982,015 |

|

18,141,842 |

|

|

EBITDA |

16,906,416 |

|

22,937,131 |

|

55,825,066 |

|

66,041,956 |

|

|

|

|

|

|

|

|

Net income - Adjusted EBITDA |

|

|

|

|

|

Net income |

6,733,657 |

|

15,740,616 |

|

26,552,524 |

|

43,047,783 |

|

|

Less gain on derivatives |

(713,507 |

) |

(197,247 |

) |

(1,779,309 |

) |

(493,355 |

) |

|

(Less)/Plus (gain)/loss on sale of vessels, net |

-- |

|

(4,719,796 |

) |

408,637 |

|

(7,645,781 |

) |

|

Plus impairment loss |

-- |

|

-- |

|

529,532 |

|

2,816,873 |

|

|

Plus share based compensation |

85,529 |

|

920,688 |

|

525,260 |

|

1,649,189 |

|

|

Plus interest and finance costs |

3,549,687 |

|

2,481,489 |

|

8,668,720 |

|

7,612,283 |

|

|

Less interest income |

(306,815 |

) |

(834,799 |

) |

(378,193 |

) |

(2,759,952 |

) |

|

Plus depreciation |

6,929,887 |

|

5,549,825 |

|

20,982,015 |

|

18,141,842 |

|

|

Adjusted EBITDA |

16,278,438 |

|

18,940,776 |

|

55,509,186 |

|

62,368,882 |

|

|

|

|

|

|

|

|

EPS - Adjusted EPS |

|

|

|

|

|

Net income |

6,733,657 |

|

15,740,616 |

|

26,552,524 |

|

43,047,783 |

|

|

Adjusted net income |

6,096,835 |

|

11,962,015 |

|

26,146,219 |

|

39,981,751 |

|

|

Weighted average number of shares, basic |

37,924,542 |

|

37,332,943 |

|

37,891,672 |

|

37,815,107 |

|

|

EPS - Basic |

0.18 |

|

0.41 |

|

0.70 |

|

1.12 |

|

|

Adjusted EPS |

0.16 |

|

0.31 |

|

0.69 |

|

1.04 |

|

|

|

|

|

|

|

|

|

|

|

StealthGas Inc. Unaudited

Consolidated Statements of Income (Expressed in

United States Dollars, except for number of shares)

|

|

|

|

|

|

Quarters EndedSeptember 30, |

|

Nine Month Periods EndedSeptember 30, |

|

|

|

|

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

|

34,885,398 |

|

|

34,653,846 |

|

|

110,031,503 |

|

|

109,388,521 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Voyage expenses |

|

|

6,342,084 |

|

|

1,951,151 |

|

|

14,295,103 |

|

|

8,550,984 |

|

|

|

Voyage expenses - related party |

|

431,035 |

|

|

426,428 |

|

|

1,354,552 |

|

|

1,353,380 |

|

|

|

Vessels' operating expenses |

|

13,862,097 |

|

|

12,102,515 |

|

|

39,560,293 |

|

|

39,516,125 |

|

|

|

Vessels' operating expenses - related party |

259,500 |

|

|

199,000 |

|

|

774,450 |

|

|

703,000 |

|

|

|

Drydocking costs |

|

|

1,770,727 |

|

|

62,409 |

|

|

2,347,352 |

|

|

2,614,010 |

|

|

|

Management fees - related party |

|

1,338,145 |

|

|

1,072,119 |

|

|

3,910,830 |

|

|

3,483,120 |

|

|

|

General and administrative expenses |

|

820,599 |

|

|

1,652,958 |

|

|

2,588,510 |

|

|

3,673,358 |

|

|

|

Depreciation |

|

|

6,929,887 |

|

|

5,549,825 |

|

|

20,982,015 |

|

|

18,141,842 |

|

|

|

Impairment loss |

|

|

-- |

|

|

-- |

|

|

529,532 |

|

|

2,816,873 |

|

|

|

Net (gain)/loss on sale of vessels |

|

-- |

|

|

(4,719,796 |

) |

|

408,637 |

|

|

(7,645,781 |

) |

|

Total expenses |

|

|

31,754,074 |

|

|

18,296,609 |

|

|

86,751,274 |

|

|

73,206,911 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations |

|

|

3,131,324 |

|

|

16,357,237 |

|

|

23,280,229 |

|

|

36,181,610 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (expenses)/income |

|

|

|

|

|

|

|

|

|

|

|

Interest and finance costs |

|

(3,549,687 |

) |

|

(2,481,489 |

) |

|

(8,668,720 |

) |

|

(7,612,283 |

) |

|

|

Gain on derivatives |

|

|

713,507 |

|

|

197,247 |

|

|

1,779,309 |

|

|

493,355 |

|

|

|

Interest income |

306,815 |

|

|

834,799 |

|

|

378,193 |

|

|

2,759,952 |

|

|

|

Foreign exchange gain/(loss) |

|

|

38,352 |

|

|

(29,894 |

) |

|

83,057 |

|

|

(162,893 |

) |

|

Other expenses, net |

|

|

(2,491,013 |

) |

|

(1,479,337 |

) |

|

(6,428,161 |

) |

|

(4,521,869 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before equity in earnings of investees |

640,311 |

|

|

14,877,900 |

|

|

16,852,068 |

|

|

31,659,741 |

|

|

Equity earnings in joint ventures |

|

6,093,346 |

|

|

862,716 |

|

|

9,700,456 |

|

|

11,388,042 |

|

|

Net Income |

|

|

6,733,657 |

|

|

15,740,616 |

|

|

26,552,524 |

|

|

43,047,783 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share |

|

|

|

|

|

|

|

|

|

|

- Basic & Diluted |

|

|

0.18 |

|

|

0.41 |

|

|

0.70 |

|

|

1.12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares |

|

|

|

|

|

|

|

|

|

- Basic |

|

|

37,924,542 |

|

|

37,332,943 |

|

|

37,891,672 |

|

|

37,815,107 |

|

|

- Diluted |

|

|

37,924,542 |

|

|

37,436,333 |

|

|

37,891,672 |

|

|

37,855,518 |

|

|

|

StealthGas Inc. Unaudited

Consolidated Balance Sheets (Expressed in United

States Dollars)

|

|

|

|

|

|

|

December 31, |

|

September 30, |

|

|

|

|

|

|

|

2022 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

55,770,823 |

|

|

73,216,142 |

|

|

|

Short term investments |

|

|

26,500,000 |

|

|

-- |

|

|

|

Trade and other receivables |

|

|

4,630,536 |

|

|

3,754,076 |

|

|

|

Other current assets |

|

|

|

270,514 |

|

|

43,224 |

|

|

|

Claims receivable |

|

|

|

182,141 |

|

|

55,475 |

|

|

|

Inventories |

|

|

|

3,064,011 |

|

|

1,844,197 |

|

|

|

Advances and prepayments |

|

|

681,413 |

|

|

1,669,215 |

|

|

|

Restricted cash |

|

|

|

2,519,601 |

|

|

667,458 |

|

|

|

Vessel held for sale |

|

|

|

11,107,182 |

|

|

34,879,925 |

|

|

Total current assets |

|

|

|

104,726,221 |

|

|

116,129,712 |

|

|

|

|

|

|

|

|

|

|

|

|

Non current assets |

|

|

|

|

|

|

|

|

Advances for vessel acquisitions |

|

|

23,400,000 |

|

|

23,400,000 |

|

|

|

Operating lease right-of-use assets |

|

|

-- |

|

|

124,268 |

|

|

|

Vessels, net |

|

|

|

628,478,453 |

|

|

509,862,136 |

|

|

|

Other receivables |

|

|

|

162,872 |

|

|

44,046 |

|

|

|

Restricted cash |

|

|

|

10,864,520 |

|

|

5,916,169 |

|

|

|

Investments in joint ventures |

|

|

46,632,720 |

|

|

38,742,762 |

|

|

|

Deferred finance charges |

|

|

165,666 |

|

|

1,015,456 |

|

|

|

Fair value of derivatives |

|

|

|

|

7,102,855 |

|

|

2,711,898 |

|

|

Total non current assets |

|

|

716,807,086 |

|

|

581,816,735 |

|

|

Total assets |

|

|

|

821,533,307 |

|

|

697,946,447 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

Payable to related parties |

|

|

2,476,663 |

|

|

2,119,288 |

|

|

|

Trade accounts payable |

|

|

11,838,243 |

|

|

9,112,796 |

|

|

|

Accrued liabilities |

|

|

|

6,923,992 |

|

|

4,468,024 |

|

|

|

Operating lease liabilities |

|

|

-- |

|

|

96,062 |

|

|

|

Deferred income |

|

|

|

5,234,978 |

|

|

3,839,245 |

|

|

|

Current portion of long-term debt |

|

|

30,083,806 |

|

|

16,614,811 |

|

|

Total current liabilities |

|

|

|

56,557,682 |

|

|

36,250,226 |

|

|

|

|

|

|

|

|

|

|

|

|

Non current liabilities |

|

|

|

|

|

|

|

|

Operating lease liabilities |

|

|

-- |

|

|

28,206 |

|

|

|

Deferred income |

|

|

|

21,451 |

|

|

109,734 |

|

|

|

Long-term debt |

|

|

|

247,028,823 |

|

|

111,077,917 |

|

|

Total non current liabilities |

|

|

247,050,274 |

|

|

111,215,857 |

|

|

Total liabilities |

|

|

|

303,607,956 |

|

|

147,466,083 |

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' equity |

|

|

|

|

|

|

|

|

Capital stock |

|

|

|

435,274 |

|

|

445,104 |

|

|

|

Treasury stock |

|

|

|

(25,373,380 |

) |

|

(34,189,223 |

) |

|

|

Additional paid-in capital |

|

|

443,620,122 |

|

|

446,006,981 |

|

|

|

Retained earnings |

|

|

|

94,056,852 |

|

|

137,104,635 |

|

|

|

Accumulated other comprehensive income |

|

5,186,483 |

|

|

1,112,867 |

|

|

Total stockholders' equity |

|

|

517,925,351 |

|

|

550,480,364 |

|

|

Total liabilities and stockholders' equity |

|

821,533,307 |

|

|

697,946,447 |

|

|

|

StealthGas Inc. Unaudited

Consolidated Statements of Cash Flows (Expressed

in United States Dollars)

|

|

|

|

|

|

|

|

Nine Month Periods EndedSeptember 30, |

|

|

|

|

|

|

|

|

2022 |

|

|

2023 |

|

|

Cash flows from operating activities |

|

|

|

|

|

|

|

|

Net income for the period |

|

|

|

26,552,524 |

|

|

43,047,783 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net income to net

cash |

|

|

|

|

|

|

provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation |

|

|

|

|

20,982,015 |

|

|

18,141,842 |

|

|

|

Amortization of deferred finance charges |

|

|

698,877 |

|

|

1,263,253 |

|

|

|

Amortization of operating lease right-of-use assets |

|

|

63,026 |

|

|

70,636 |

|

|

|

Share based compensation |

|

|

|

525,260 |

|

|

1,649,189 |

|

|

|

Change in fair value of derivatives |

|

|

|

(1,869,734 |

) |

|

317,341 |

|

|

|

Equity earnings in joint ventures |

|

|

|

(9,700,456 |

) |

|

(11,388,042 |

) |

|

|

Dividends received from joint ventures |

|

|

|

9,486,900 |

|

|

14,589,215 |

|

|

|

Impairment loss |

|

|

|

|

529,532 |

|

|

2,816,873 |

|

|

|

Loss/(Gain) on sale of vessels |

|

|

|

408,637 |

|

|

(7,645,781 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

(Increase)/decrease in |

|

|

|

|

|

|

|

|

|

Trade and other receivables |

|

|

|

(1,312,432 |

) |

|

995,286 |

|

|

|

Other current assets |

|

|

|

|

(138,561 |

) |

|

227,290 |

|

|

|

Claims receivable |

|

|

|

|

(500,249 |

) |

|

-- |

|

|

|

Inventories |

|

|

|

|

(2,786,366 |

) |

|

1,500,675 |

|

|

|

Changes in operating lease liabilities |

|

|

|

(63,026 |

) |

|

(70,636 |

) |

|

|

Advances and prepayments |

|

|

|

(631,944 |

) |

|

(987,802 |

) |

|

|

Increase/(decrease) in |

|

|

|

|

|

|

|

|

|

Balances with related parties |

|

|

|

3,617,682 |

|

|

(354,739 |

) |

|

|

Trade accounts payable |

|

|

|

3,449,280 |

|

|

(2,653,718 |

) |

|

|

Accrued liabilities |

|

|

|

|

1,353,075 |

|

|

(1,206,302 |

) |

|

|

Deferred income |

|

|

|

|

(665,410 |

) |

|

(1,307,450 |

) |

|

Net cash provided by operating activities |

|

|

|

49,998,630 |

|

|

59,004,913 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

Insurance proceeds |

|

|

|

|

282,787 |

|

|

126,666 |

|

|

|

Advances for vessels acquisitions |

|

|

|

(23,400,000 |

) |

|

-- |

|

|

|

Proceeds from sale of vessels, net |

|

|

|

23,887,379 |

|

|

80,109,781 |

|

|

|

Acquisition and improvement of vessels |

|

|

|

|

(780,217 |

) |

|

(71,729 |

) |

|

|

Maturity in short term investments |

|

|

|

8,066,100 |

|

|

26,500,000 |

|

|

|

Advances to joint ventures |

|

|

|

-- |

|

|

(2,636 |

) |

|

|

Return of investments from joint ventures |

|

|

-- |

|

|

4,688,785 |

|

|

Net cash provided by investing activities |

|

|

|

8,056,049 |

|

|

111,350,867 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

|

|

|

Additional paid-in capital |

|

|

|

-- |

|

|

747,500 |

|

|

|

Stock repurchase |

|

|

|

|

|

|

(8,815,843 |

) |

|

|

Deferred finance charges paid |

|

|

|

(534,600 |

) |

|

(988,166 |

) |

|

|

Advances from joint ventures |

|

|

|

3,129,801 |

|

|

-- |

|

|

|

Advances to joint ventures |

|

|

|

(4,266,484 |

) |

|

-- |

|

|

|

Loan repayments |

|

|

|

|

(75,913,139 |

) |

|

(150,654,446 |

) |

|

|

Proceeds from long-term debt |

|

|

|

59,400,000 |

|

|

-- |

|

|

Net cash used in financing activities |

|

|

|

(18,184,422 |

) |

|

(159,710,955 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net increase in cash, cash equivalents and restricted cash |

|

|

39,870,257 |

|

|

10,644,825 |

|

|

Cash, cash equivalents and restricted cash at beginning of

year |

|

|

45,700,537 |

|

|

69,154,944 |

|

|

Cash, cash equivalents and restricted cash at end of

period |

|

|

85,570,794 |

|

|

79,799,769 |

|

|

Cash breakdown |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

|

72,660,000 |

|

|

73,216,142 |

|

|

|

Restricted cash, current |

|

|

|

2,335,892 |

|

|

667,458 |

|

|

|

Restricted cash, non current |

|

|

|

10,574,902 |

|

|

5,916,169 |

|

|

Total cash, cash equivalents and restricted cash shown in

the statements of cash flows |

85,570,794 |

|

|

79,799,769 |

|

Company Contact:

Konstantinos Sistovaris

STEALTHGAS INC.

00-30-210-6250-001

E-mail: info@stealthgas.com

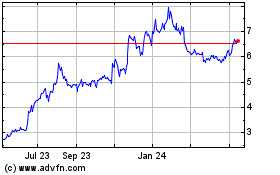

StealthGas (NASDAQ:GASS)

Historical Stock Chart

From Mar 2024 to Apr 2024

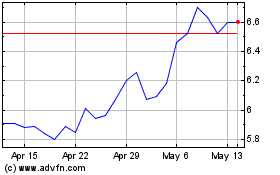

StealthGas (NASDAQ:GASS)

Historical Stock Chart

From Apr 2023 to Apr 2024