Facebook Looks to Build Underwater Ring Around Africa

April 07 2019 - 11:29AM

Dow Jones News

By Drew FitzGerald

Facebook Inc. is circling Africa. Literally.

The company is in talks to develop an underwater data cable that

would encircle the continent, according to people familiar with the

plans, an effort aimed at driving down its bandwidth costs and

making it easier for the social media giant to sign up more

users.

The three-stage project, named Simba after the lead character in

"The Lion King," could link up with beachheads in several countries

on the continent's eastern, western and Mediterranean coasts,

though the exact route and number of landings is in flux, the

people said.

Facebook spokesman Travis Reed declined to comment on the

company's plans for Africa. "We look all over the world when we

consider subsea cable routes," he said.

Simba isn't Facebook's first foray into subsea cables, the

high-capacity fiber-optic lines that carry most of the world's core

internet traffic. The company has led projects linking markets in

North America, Europe and East Asia, usually sharing the investment

burden with traditional telecommunications companies, which lack

the cash to lay down the cables on their own.

"When you're one of the biggest users of bandwidth, it's

entirely rational to cut out the middleman and get the capacity

at-cost," said Alan Mauldin, an analyst at market researcher

TeleGeography.

Negotiations for the Simba project are continuing, the people

said, cautioning that talks could still fall apart.

Google parent Alphabet Inc. is also in talks to build a cable

system called Equiano down Africa's western coast, according to

people familiar with its plans. China's Huawei Technologies Co. is

rolling out subsea cable links to Africa through a subsidiary

building a cable through the Indian Ocean.

Industry executives say the proposed Simba system is uniquely

ambitious. The project would give Facebook's European and Asian

data centers a dedicated and reliable link to growing African

markets where its apps like WhatsApp are already popular. The

company has funded regional networks in developing economies like

Uganda to help connect the roughly 3.8 billion people across the

globe who still lack internet access.

The system also could benefit partner telecom companies like MTN

Group and Vodafone PLC that already serve booming economies in

South Africa and Nigeria. Those companies could help pay for the

cable project in exchange for some of its fiber-optic capacity,

said one of the people familiar with Facebook's plans. An MTN

spokeswoman declined to comment. Vodafone didn't immediately

respond to a request for comment.

Tech companies like Facebook and Alphabet, wary of the wholesale

telecom market and the regulatory burdens that come with it, tend

to avoid selling bandwidth on cables they help fund. They have

access to whole strands of fiber-optic wire, allowing them to

shuttle most of their data through private networks separated from

the broader internet.

Facebook has taken a long-term view with past network

investments. Its Internet.org nonprofit has financed access to a

small group of websites through Free Basics, a no-cost wireless

service offered in several countries. Regulators in other countries

have banned the program, arguing against the limited version of the

web that the Facebook-backed group has curated.

Facebook is one of several large U.S. technology companies that

have taken a growing role in planning and financing the internet's

plumbing to serve their interests. In the process, they have

supplanted traditional telecom companies that used to dominate the

industry.

Alphabet has built fiber-optic cables in several cities and

launched broadband-beaming balloons over hard-to-reach areas.

Microsoft Corp. is pushing U.S. authorities to allow broadband

service to use the "white spaces" in the radio spectrum between the

channels reserved for television broadcasts.

A project as large as the one proposed by Facebook could cost up

to $1 billion to build, said Greg Varisco, chief executive of

Cinturion, a privately held company planning its own cable system

in the Indian Ocean.

Mr. Varisco said the social networking company will likely see

the project through because its executives are planning for needs

several years in the future. But working with several different

telecom companies and government regulators could pose a

challenge.

"They're not small projects, and they've got a lot of politics

to work through," he said.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

April 07, 2019 11:14 ET (15:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

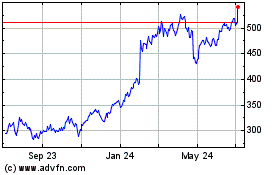

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

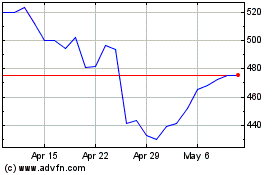

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024