Expeditors International of Washington, Inc. (NASDAQ:EXPD) today

announced third quarter 2019 financial results including the

following highlights compared to the same quarter of 2018:

- Diluted Net Earnings Attributable to Shareholders per share

(EPS1) remained constant at $0.92

- Net Earnings Attributable to Shareholders decreased 2% to $160

million

- Operating Income increased 2% to $207 million

- Revenues decreased 1% to $2.1 billion

- Airfreight tonnage volume decreased 7% and ocean container

volume decreased 2%

“The third quarter presented challenges that were not unexpected

in terms of growth in the global economy and ongoing trade disputes

that extend well beyond just the United States and China,” said

Jeffrey S. Musser, President and Chief Executive Officer. “We saw

volumes drop in our air and ocean products but believe this was

consistent with the overall market. In addition to volume changes,

we also believe the market experienced corresponding changes in

buy/sell rates and we were adept at negotiating in the changing

pricing environment.

“We’ve always believed that a true global network of offices is

critical to achieving success in the supply chain, and that played

out as expected with outsized growth in regions where business has

transitioned. Further, the trade environment has placed an

increased need for products such as customs brokerage, and our

results show that we continue to execute well in this area. A broad

range of solutions, technology and expertise has never been more

important to help mitigate the uncertainty and ambiguity of the

current marketplace.

“Our focus on providing an extremely high level of service,

coupled with deep knowledge and expertise, remains a winning

strategy. We can’t execute this strategy without our global team

and, as always, we are incredibly thankful for their effort and

dedication.”

Bradley S. Powell, Senior Vice President and Chief Financial

Officer, added, “We again demonstrated strong performance in our

customs brokerage, Transcon, ocean forwarding, and order management

businesses during the quarter. In addition, we boosted our

operating efficiency by paying close attention to costs across our

global network.” Mr. Powell also noted that the Company’s effective

tax rate was 24.9% in the quarter, compared to 21.8% in the third

quarter of 2018. The three-month period ended 2018 benefited from

required discrete adjustments as a result of interpretations issued

related to the 2017 Tax Act for foreign tax credits earned as a

result of withholding taxes paid on repatriated foreign earnings

and a state income tax refund that settled during the quarter in

2018.

Expeditors is a global logistics company headquartered in

Seattle, Washington. The Company employs trained professionals in

176 district offices and numerous branch locations located on six

continents linked into a seamless worldwide network through an

integrated information management system. Services include the

consolidation or forwarding of air and ocean freight, customs

brokerage, vendor consolidation, cargo insurance, time-definite

transportation, order management, warehousing and distribution and

customized logistics solutions.

_______________________

1Diluted earnings attributable to

shareholders per share.

NOTE: See Disclaimer on Forward-Looking

Statements on the following page of this release.

Expeditors International of Washington,

Inc.

Third Quarter 2019 Earnings Release,

November 5, 2019

Financial Highlights for the three and

nine months ended September 30, 2019 and 2018 (Unaudited)

(in 000's of US dollars except per share

data)

Three months ended September

30,

Nine months ended September

30,

2019

2018

% Change

2019

2018

% Change

Revenues

$

2,074,855

$

2,090,947

(1)%

$

6,130,485

$

5,902,768

4%

Directly related cost of transportation

and

other expenses1

$

1,400,499

$

1,429,633

(2)%

$

4,140,320

$

3,963,070

4%

Salaries and other operating

expenses2

$

467,806

$

458,160

2%

$

1,403,813

$

1,360,142

3%

Operating income

$

206,550

$

203,154

2%

$

586,352

$

579,556

1%

Net earnings attributable to

shareholders

$

160,221

$

162,692

(2)%

$

453,069

$

438,989

3%

Diluted earnings attributable

to

shareholders per share

$

0.92

$

0.92

—%

$

2.60

$

2.46

6%

Basic earnings attributable to

shareholders

per share

$

0.94

$

0.94

—%

$

2.65

$

2.51

6%

Diluted weighted average shares

outstanding

173,483

177,173

174,463

178,447

Basic weighted average shares

outstanding

170,415

173,394

171,084

174,675

_____________________

1Directly related cost of transportation

and other expenses totals Operating Expenses from Airfreight

services, Ocean freight and ocean services and Customs brokerage

and other services as shown in the Condensed Consolidated

Statements of Earnings.

2Salaries and other operating expenses

totals Salaries and related, Rent and occupancy, Depreciation and

amortization, Selling and promotion and Other as shown in the

Condensed Consolidated Statements of Earnings.

The three and nine months ended September 30, 2019 include the

effect of changing our presentation of certain import services from

a net to a gross basis and our revised presentation of destination

services, which increased revenues and directly related operating

expenses in customs brokerage and other services but did not change

operating income.

During the three and nine months ended September 30, 2019, we

repurchased 0.9 million and 4.1 million shares of common stock at

an average price of $69.51 and $72.60 per share, respectively.

During the three and nine months ended September 30, 2018, we

repurchased 2.0 million and 7.8 million shares of common stock at

an average price of $73.47 and $71.58 per share, respectively.

Employee Full-time Equivalents

September 30, 2019

2019

2018

North America

6,861

6,635

Europe

3,427

3,270

North Asia

2,483

2,655

South Asia

1,674

1,640

Middle East, Africa and India

1,565

1,478

Latin America

860

831

Information Systems

939

904

Corporate

383

351

Total

18,192

17,764

Third quarter year-over-year

percentage increase (decrease) in:

Airfreight kilos

Ocean freight FEU

2019

July

(5)%

2%

August

(9)%

(1)%

September

(9)%

(7)%

Quarter

(7)%

(2)%

___________________

Investors may submit written questions via

e-mail to: investor@expeditors.com. Questions received by the end

of business on November 8, 2019 will be considered in management's

8-K “Responses to Selected Questions.”

Disclaimer on Forward-Looking

Statements:

Certain portions of this release contain forward-looking

statements, which are based on certain assumptions and expectations

of future events that are subject to risks and uncertainties,

including our ability to maintain a differentiated, knowledgeable

workforce; the impact of the 2017 Tax Act and related

interpretations on our effective tax rate; and risk factors and

uncertainties detailed in our Annual Report as updated by our

reports on Form 10-Q, filed with the Securities and Exchange

Commission.

EXPEDITORS INTERNATIONAL OF WASHINGTON, INC.

AND SUBSIDIARIES

Condensed Consolidated Balance

Sheets

(In thousands, except per share

data)

(Unaudited)

September 30, 2019

December 31, 2018

Assets:

Current Assets:

Cash and cash equivalents

$

1,215,970

$

923,735

Accounts receivable, less allowance for

doubtful accounts of $11,853 at September 30, 2019 and $15,345 at

December 31, 2018

1,319,032

1,581,530

Deferred contract costs

130,690

159,510

Other

103,521

70,041

Total current assets

2,769,213

2,734,816

Property and equipment, less accumulated

depreciation and amortization of $468,059 at September 30, 2019 and

$446,977 at

December 31, 2018

494,153

504,105

Operating lease right-of-use assets

374,231

—

Goodwill

7,927

7,927

Deferred federal and state income taxes,

net

44,351

40,465

Other assets, net

16,578

27,246

Total assets

$

3,706,453

$

3,314,559

Liabilities:

Current Liabilities:

Accounts payable

$

744,002

$

902,259

Accrued expenses, primarily salaries and

related costs

207,752

215,813

Contract liabilities

152,717

190,343

Current portion of operating lease

liabilities

61,842

—

Federal, state and foreign income

taxes

17,273

18,424

Total current liabilities

1,183,586

1,326,839

Noncurrent portion of operating lease

liabilities

313,580

—

Commitments and contingencies

Shareholders’ Equity:

Preferred stock, none issued

—

—

Common stock, par value $0.01 per share.

Issued and outstanding: 170,243 shares at September 30, 2019 and

171,582

shares at December 31, 2018

1,702

1,716

Additional paid-in capital

23,301

1,896

Retained earnings

2,301,156

2,088,707

Accumulated other comprehensive loss

(118,774

)

(105,481

)

Total shareholders’ equity

2,207,385

1,986,838

Noncontrolling interest

1,902

882

Total equity

2,209,287

1,987,720

Total liabilities and equity

$

3,706,453

$

3,314,559

EXPEDITORS INTERNATIONAL OF

WASHINGTON, INC.

AND SUBSIDIARIES

Condensed Consolidated Statements

of Earnings

(In thousands, except per share

data)

(Unaudited)

Three months ended September

30,

Nine months ended September

30,

2019

2018

2019

2018

Revenues:

Airfreight services

$

715,450

$

833,338

$

2,171,928

$

2,366,326

Ocean freight and ocean services

585,374

585,810

1,697,824

1,636,701

Customs brokerage and other services

774,031

671,799

2,260,733

1,899,741

Total revenues

2,074,855

2,090,947

6,130,485

5,902,768

Operating Expenses:

Airfreight services

522,868

620,554

1,574,717

1,727,383

Ocean freight and ocean services

424,215

435,313

1,234,845

1,199,887

Customs brokerage and other services

453,416

373,766

1,330,758

1,035,800

Salaries and related

356,331

351,577

1,069,592

1,042,420

Rent and occupancy

41,987

38,202

124,407

113,186

Depreciation and amortization

12,386

13,335

38,456

40,833

Selling and promotion

10,133

10,632

32,852

32,385

Other

46,969

44,414

138,506

131,318

Total operating expenses

1,868,305

1,887,793

5,544,133

5,323,212

Operating income

206,550

203,154

586,352

579,556

Other Income (Expense):

Interest income

5,501

4,704

18,123

14,171

Other, net

1,895

566

5,822

2,357

Other income (expense), net

7,396

5,270

23,945

16,528

Earnings before income taxes

213,946

208,424

610,297

596,084

Income tax expense

53,319

45,357

156,029

155,871

Net earnings

160,627

163,067

454,268

440,213

Less net earnings attributable to the

noncontrolling

interest

406

375

1,199

1,224

Net earnings attributable to

shareholders

$

160,221

$

162,692

$

453,069

$

438,989

Diluted earnings attributable to

shareholders per share

$

0.92

$

0.92

$

2.60

$

2.46

Basic earnings attributable to

shareholders per share

$

0.94

$

0.94

$

2.65

$

2.51

Weighted average diluted shares

outstanding

173,483

177,173

174,463

178,447

Weighted average basic shares

outstanding

170,415

173,394

171,084

174,675

EXPEDITORS INTERNATIONAL OF

WASHINGTON, INC.

AND SUBSIDIARIES

Condensed Consolidated Statements

of Cash Flows

(In thousands)

(Unaudited)

Three months ended September

30,

Nine months ended September

30,

2019

2018

2019

2018

Operating Activities:

Net earnings

$

160,627

$

163,067

$

454,268

$

440,213

Adjustments to reconcile net earnings to

net cash from operating activities:

Provisions for losses on accounts

receivable

757

1,969

453

2,232

Deferred income tax benefit

(5,822

)

(23,610

)

(17

)

(17,522

)

Stock compensation expense

12,155

13,902

49,361

43,171

Depreciation and amortization

12,386

13,335

38,456

40,833

Other, net

652

666

812

770

Changes in operating assets and

liabilities:

Decrease (increase) in accounts

receivable

43,885

(210,092

)

246,175

(156,321

)

(Decrease) increase in accounts payable

and accrued

expenses

(58,816

)

115,629

(141,199

)

127,860

Decrease (increase) in deferred contract

costs

10,301

(34,623

)

28,550

(51,235

)

(Decrease) increase in contract

liabilities

(13,211

)

36,256

(36,933

)

49,149

(Decrease) increase in income taxes

payable, net

(671

)

9,292

(33,284

)

(9,258

)

(Decrease) increase in other, net

(744

)

930

47

862

Net cash from operating activities

161,499

86,721

606,689

470,754

Investing Activities:

Purchase of property and equipment

(15,521

)

(11,733

)

(37,943

)

(37,642

)

Other, net

232

1,109

1,525

(886

)

Net cash from investing activities

(15,289

)

(10,624

)

(36,418

)

(38,528

)

Financing Activities:

Proceeds from issuance of common stock

60,713

47,806

120,190

169,566

Repurchases of common stock

(61,999

)

(147,828

)

(296,922

)

(555,760

)

Dividends Paid

—

—

(85,184

)

(79,180

)

Payments for taxes related to net share

settlement of equity awards

—

—

(6,674

)

(3,215

)

Distributions to noncontrolling

interest

—

(633

)

—

(633

)

Purchase of noncontrolling interest

—

(613

)

—

(613

)

Net cash from financing activities

(1,286

)

(101,268

)

(268,590

)

(469,835

)

Effect of exchange rate changes on cash

and cash equivalents

(11,604

)

(5,071

)

(9,446

)

(22,878

)

Change in cash and cash equivalents

133,320

(30,242

)

292,235

(60,487

)

Cash and cash equivalents at beginning of

period

1,082,650

1,020,854

923,735

1,051,099

Cash and cash equivalents at end of

period

$

1,215,970

$

990,612

$

1,215,970

$

990,612

Taxes Paid:

Income taxes

$

61,201

$

59,313

$

196,169

$

183,444

EXPEDITORS INTERNATIONAL OF

WASHINGTON, INC.

AND SUBSIDIARIES

Business Segment Information

(In thousands)

(Unaudited)

UNITED

STATES

OTHER

NORTH

AMERICA

LATIN

AMERICA

NORTH

ASIA

SOUTH

ASIA

EUROPE

MIDDLE

EAST,

AFRICA

AND

INDIA

ELIMI- NATIONS

CONSOLI- DATED

For the three months ended September

30, 2019:

Revenues1

$

692,229

88,088

38,341

624,351

196,569

320,769

115,397

(889

)

2,074,855

Directly related cost of transportation

and

other expenses2

$

389,254

51,420

22,990

489,195

145,345

221,149

81,592

(446

)

1,400,499

Salaries and other operating expenses3

$

210,767

25,731

14,547

70,410

32,482

86,156

28,151

(438

)

467,806

Operating income

$

92,208

10,937

804

64,746

18,742

13,464

5,654

(5

)

206,550

Identifiable assets at period end

$

2,059,345

128,336

72,029

489,322

164,976

563,289

226,657

2,499

3,706,453

Capital expenditures

$

7,644

513

833

523

631

5,119

258

—

15,521

Equity

$

1,578,682

60,526

27,217

216,061

77,733

169,450

111,355

(31,737

)

2,209,287

For the three months ended September

30, 2018:

Revenues1

$

629,043

92,875

43,443

748,589

205,392

327,212

118,047

(73,654

)

2,090,947

Directly related cost of transportation

and

other expenses2

$

345,236

58,464

27,635

601,699

158,226

227,418

83,992

(73,037

)

1,429,633

Salaries and other operating expenses3

$

204,240

23,935

13,399

74,067

31,623

84,136

27,384

(624

)

458,160

Operating income

$

79,567

10,476

2,409

72,823

15,543

15,658

6,671

7

203,154

Identifiable assets at period end

$

1,694,556

174,402

53,322

540,465

156,887

508,855

212,817

(6,504

)

3,334,800

Capital expenditures

$

6,889

301

227

1,280

910

751

1,375

—

11,733

Equity

$

1,334,952

66,399

25,663

197,939

86,048

157,973

119,718

(31,360

)

1,957,332

UNITED

STATES

OTHER

NORTH

AMERICA

LATIN

AMERICA

NORTH

ASIA

SOUTH

ASIA

EUROPE

MIDDLE

EAST,

AFRICA

AND

INDIA

ELIMI- NATIONS

CONSOLI- DATED

For the nine months ended September 30,

2019:

Revenues1

$

2,033,088

265,035

111,277

1,879,155

555,128

952,790

336,383

(2,371

)

6,130,485

Directly related cost of transportation

and

other expenses2

$

1,142,701

157,997

64,149

1,475,395

407,642

657,720

236,184

(1,468

)

4,140,320

Salaries and other operating expenses3

$

636,243

76,283

41,342

208,781

97,324

258,339

86,385

(884

)

1,403,813

Operating income

$

254,144

30,755

5,786

194,979

50,162

36,731

13,814

(19

)

586,352

Identifiable assets at period end

$

2,059,345

128,336

72,029

489,322

164,976

563,289

226,657

2,499

3,706,453

Capital expenditures

$

23,544

1,509

1,071

1,167

1,235

8,015

1,402

—

37,943

Equity

$

1,578,682

60,526

27,217

216,061

77,733

169,450

111,355

(31,737

)

2,209,287

For the nine months ended September 30,

2018:

Revenues1

$

1,790,869

257,206

122,170

2,065,405

560,070

977,967

342,589

(213,508

)

5,902,768

Directly related cost of transportation

and

other expenses2

$

957,997

157,599

75,694

1,640,724

423,612

677,167

242,208

(211,931

)

3,963,070

Salaries and other operating expenses3

$

620,029

70,036

38,996

211,576

92,409

248,906

79,782

(1,592

)

1,360,142

Operating income

$

212,843

29,571

7,480

213,105

44,049

51,894

20,599

15

579,556

Identifiable assets at period end

$

1,694,556

174,402

53,322

540,465

156,887

508,855

212,817

(6,504

)

3,334,800

Capital expenditures

$

16,092

4,020

899

2,623

1,934

9,167

2,907

—

37,642

Equity

$

1,334,952

66,399

25,663

197,939

86,048

157,973

119,718

(31,360

)

1,957,332

1In 2019, the Company revised its process

to record the transfer, between its geographic operating segments,

of revenues and the directly related cost of transportation

expenses for freight service transactions between Company origin

and destination locations. This change better aligns revenue

reporting with the location where the services are performed, as

well as the transactional reporting being developed as part of the

Company’s new accounting systems and processes. Prior year segment

revenues have not been revised. The change in presentation had no

impact on consolidated or segment operating income. The 2019

results also include the effect of changing the presentation of

certain import services from a net to a gross basis, which

increased segment revenues and directly related operating expenses

but did not change operating income. The impact of these changes on

reported segment revenues was immaterial and prior year segment

revenues have not been revised.

2Directly related cost of transportation

and other expenses totals Operating Expenses from Airfreight

services, Ocean freight and ocean services and Customs brokerage

and other services as shown in the Condensed Consolidated

Statements of Earnings.

3Salaries and other operating expenses

totals Salaries and related, Rent and occupancy, Depreciation and

amortization, Selling and promotion and Other as shown in the

Condensed Consolidated Statements of Earnings.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191105005348/en/

Jeffrey S. Musser President and Chief Executive Officer (206)

674-3433

Bradley S. Powell Senior Vice President and Chief Financial

Officer (206) 674-3412

Geoffrey Buscher Director - Investor Relations (206)

892-4510

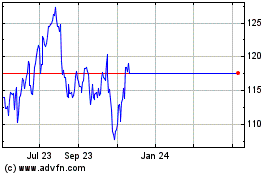

Expeditors International... (NASDAQ:EXPD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Expeditors International... (NASDAQ:EXPD)

Historical Stock Chart

From Apr 2023 to Apr 2024