UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

|

Filed by the Registrant

[X]

|

Filed by a Party other than the Registrant [ ]

|

|

|

|

|

Check the appropriate box:

|

|

|

[ ]

|

Preliminary Proxy

Statement

|

|

|

|

|

[ ]

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

[ ]

|

Definitive Proxy

Statement

|

|

|

|

|

[X]

|

Definitive Additional

Materials

|

|

|

|

|

[ ]

|

Soliciting Material

Pursuant to §240.14a-12

|

Eastside

Distilling, Inc.

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement if other than the Registrant)

Payment

of Filing Fee (Check in the appropriate box):

|

[X]

|

No fee required.

|

|

|

|

|

|

[ ]

|

Fee computed on table below per

Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

(1)

|

Title of each class

of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number

of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or

other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum

aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

[ ]

|

Fee paid previously with preliminary

materials.

|

|

|

|

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

|

|

|

|

(1)

|

Amount Previously

Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or

Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

EASTSIDE

DISTILLING, INC.

SUPPLEMENT

TO

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

AND

PROXY STATEMENT DATED JUNE 15, 2020

FOR

THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 30, 2020

TO

THE STOCKHOLDERS:

This

supplement provides updated information with respect to the 2020 annual meeting of stockholders (the “Annual Meeting”)

of Eastside Distilling, Inc., a Nevada corporation (the “Company”), to be held on July 30, 2020.

On

June 15, 2020, the Company commenced distributing to its stockholders a Notice of Annual Meeting of Stockholders and a Definitive

Proxy Statement (the “Proxy Statement”) for the Annual Meeting. This supplement describes a recent change in the manner

in which the Annual Meeting will be held and the proposed nominees for election to the board of directors of the Company (the

“Board”) and should be read in conjunction with the Proxy Statement.

Change

in Annual Meeting Location; Virtual-Only Meeting to be Held

On

or around July 10, 2020, the Company issued a press release announcing that, due to the continuing public health impact

of the coronavirus pandemic and to prioritize the health and well-being of meeting participants, the Annual Meeting on July 30,

2020 at 2 p.m. Pacific Time, will be held in a virtual format only. Stockholders will not be able to attend the Annual Meeting

in person.

As

described in the Proxy Statement, stockholders at the close of business on the record date, June 5, 2020 (the “Record Date”),

or their duly appointed proxies, are entitled to attend the Annual Meeting. If you were a stockholder of record as of the Record

Date, you may access the virtual meeting by going to https://www.issuerdirect.com/virtual-event/east and following the instructions

on the website to enter the first 13 digits of your control number printed on your proxy card or notice of internet availability

of proxy materials.

If

you were a beneficial owner as of the Record Date of shares held in “street name” through a broker, bank or other

nominee and you wish to attend the meeting and/or vote your shares during the meeting or submit questions during the meeting,

you will need to provide proof of your authority to vote (legal proxy), which you must obtain from such nominee reflecting your

holdings. You may forward an e-mail from your nominee or attach an image of your legal proxy and transmit it via e-mail to Issuer

Direct at proxy@issuerdirect.com and you should label the e-mail “Legal Proxy” in the subject line. Requests for registration

must be received by Issuer Direct no later than 12:00 a.m., Pacific Time, on July 28, 2020. You will then receive confirmation

of your registration, with a control number by e-mail from Issuer Direct. At the time of the meeting, go to www.issuerdirect.com/virtual-event/east

and enter the first 13 digits of your control number.

Online

access to the Annual Meeting will open at 1:45 p.m. Pacific Time to allow time for stockholders to log-in prior to the start of

the Annual Meeting. You may vote or ask questions during the Annual Meeting by following the instructions available on the meeting

website during the meeting.

Whether

or not stockholders plan to participate in the virtual-only Annual Meeting, the Company urges stockholders to vote and submit

their proxies in advance of the meeting by one of the methods described in the proxy materials for the Annual Meeting. The proxy

card included with the Proxy Statement previously distributed will not be updated to reflect the change to a virtual-only meeting

and may continue to be used to vote shares in connection with the Annual Meeting.

Withdrawal

of Nominee for Election as Director and Chief Executive Officer Change

On

June 25, 2020, Lawrence Firestone, our current Chief Executive Officer (“CEO”), resigned from the Board, effective

July 30, 2020, the date of the Annual Meeting, and as CEO, effective upon the appointment of his successor Paul Block. In light

of Mr. Firestone’s resignation as a director, Mr. Firestone will not stand for re-election to our Board at the Annual Meeting.

The

Board approved the appointment of Paul Block as CEO, effective July 1, 2020. At the time of his appointment, Mr. Block was the

chair of the Nominating & Corporate Governance Committee and was a member of the Audit Committee and the Compensation Committee.

Mr. Block resigned from all committees of the Board effective upon his appointment as CEO, and director Robert Grammen became

the lead independent director and was appointed chair of the Nominating & Corporate Governance Committee. Mr. Block remains

chair of the Board and a non-independent member of the Board.

Compensation

Arrangements

Mr.

Firestone and the Company have entered into an executive separation agreement dated June 25, 2020 (the “Separation Agreement”).

Pursuant to the terms of the Separation Agreement, Mr. Firestone resigned as CEO on July 1, 2020. He will assist and cooperate

with the Company, as needed, with any transfer of duties and further assist and act as a consultant or advisor to the Company

with any ongoing questions or issues or matters which may arise through December 31, 2020.

The

Separation Agreement provides that Mr. Firestone will (a) continue to receive his annual cash base salary of $250,000 in installments

in accordance and under the regular payroll schedule of the Company until December 31, 2020, (b) continue to receive his existing

health benefits until June 25, 2021 and (c) continue to vest the restricted stock units (the “RSUs”) that were granted

or to be granted under his Executive Employment Agreement, dated November 12, 2019, between the Company and Mr. Firestone, until

December 31, 2020 as follows: the equivalent of $25,000 of RSUs for the quarter ending June 30, $25,000 of RSUs for the quarter

ending September 30 and $25,000 of RSUs for the quarter ending December 31, all to vest on the date of grant. The Separation Agreement

also contains releases of claims and non-solicitation, non-competition, and confidentiality provisions.

In

connection with Mr. Block’s appointment as Chief Executive Officer, Mr. Block entered into an executive employment agreement

with the Company effective July 1, 2020 (the “Employment Agreement”). Under the Employment Agreement, Mr. Block will

be paid in all stock of 31,250 shares per month from July 1, 2020 through December 31, 2020, which includes a 2020 bonus equal

to 50% of his salary during the six-month period. Beginning January 1, 2021, the Company will pay Mr. Block an annual base salary

of $350,000, which will increase to $375,000 on January 1, 2022 if Company revenue exceeds $20 million in 2021, and increase to

$400,000 on January 1, 2023 if Company revenue exceeds $30 million in 2022.

The

Company will also request that the Compensation Committee of the Board approve the following grants of restricted stock units

(“RSUs”) to Mr. Block: (i) on or after July 1, 2020, the equivalent of $100,000 in RSUs, one-half (1/2) of which will

vest on each of March 31, 2021 and June 30, 2021; (ii) on or after January 1, 2021, the equivalent of $200,000 of RSUs, one-twelfth

(1/12) of which will be earned and vested on each of March 31, June 30, September 30 and December 31, beginning March 31, 2021

and ending December 31, 2023; (iii) on or after January 1, 2022, the equivalent of $200,000 of RSUs, one-twelfth (1/12) of which

will be earned and vested on each of March 31, June 30, September 30 and December 31, beginning March 31, 2022 and ending December

31, 2024; and (iv) on or after January 1, 2023, the equivalent of $100,000 of RSUs, one-twelfth (1/12) of which will be earned

and vested on each of March 31, June 30, September 30 and December 31, beginning March 31, 2023 and ending December 31, 2025.

Further,

Mr. Block will be eligible to receive a target incentive payment of 100% of his annual base salary beginning in 2021. Actual payments

will be determined based on a combination of the Company’s results and individual performance against the applicable performance

goals established by the Compensation Committee of the Board. Mr. Block will also receive other benefits that are generally available

to other executive officers of the Company and will be entitled to certain severance benefits if he is terminated without cause,

or resigns for good reason (in each case, as defined in the Employment Agreement), including, among other things, twelve (12)

months of the Executive’s then-current annual base salary (which will be deemed $350,000 during 2020) and the continued

vesting of RSUs for a period of 12 months after the date of termination.

The

foregoing is a summary only and does not purport to be a complete description of all of the terms, provisions, covenants and agreements

contained in the Separation Agreement and the Employment Agreement and is subject to and qualified in its entirety by reference

to the complete text of the Separation Agreement, which has been filed as an exhibit to our Current Report on Form 8-K dated June

30, 2020, and the complete text of the Employment Agreement, which has been filed as an exhibit to our Current Report on Form

8-K dated July 10, 2020.

Proposed

Change to Elect the 4 Remaining Director Nominees in Proposal 1

In

light of Mr. Firestone’s resignation from the Board and his not standing for re-election to the Board at the Annual Meeting,

Item 1 in the Proxy Statement now proposes to elect the 4 remaining director nominees named in the Proxy Statement to hold office

for a one-year term ending on the earlier of: (a) the annual meeting of stockholders to be held in 2021; or (b) her or his successor

is duly elected and qualified.

The

Board recommends that you vote FOR each of the 4 remaining director nominees.

Voting

Matters

If

you have already voted, you do not need to take any action unless you wish to change your vote. Proxy voting forms already returned

by stockholders will remain valid and will be voted at the Annual Meeting unless revoked.

Shares

represented by proxy voting forms before the Annual Meeting will be voted for the directors nominated by the Board as instructed

on the form, except that votes will not be cast for Mr. Firestone because he has resigned from the Board and is no longer standing

for re-election. If you have not yet voted, please complete the proxy voting form or submit your voting instructions, disregarding

Mr. Firestone’s name as a nominee for election as director.

None

of the other agenda items presented in the Proxy Statement are affected by this supplement, and shares represented by proxy voting

forms returned before the Annual Meeting will be voted with respect to all other matters properly brought before the Annual Meeting

as instructed on the form.

Information

regarding how to vote your shares, or revoke your proxy or voting instructions, is available on pages 2-3 of the Proxy Statement.

By

Order of the Board of Directors

Paul Block

Chairman

of the Board of Directors

Portland,

Oregon

July

10, 2020

Important

Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on July 30, 2020: The Proxy

Statement and our 2019 Annual Report are available at www.proxyvote.com.

Eastside Distilling Announces Change to

a Virtual-Only

Meeting Format for the 2020 Annual Meeting of the

Stockholders

PORTLAND, Ore., July 10, 2020—Eastside

Distilling, Inc. (NASDAQ: EAST) announced today a change in the format of its 2020 Annual Meeting of Stockholders (the “Annual

Meeting”) from in-person to a virtual-only meeting format due to the continuing public health impact of COVID-19 and to

support the health and safety of the Company’s stockholders and attendees. As previously announced, the Annual Meeting will

be held on Thursday, July 30 at 2:00 p.m. Pacific Time (“PT”).

Voting Electronically and Attending the

Virtual Annual Meeting

The Company’s stockholders as of the

close of business on June 5, 2020 (the “Record Date”) or their duly appointed proxies can join the live virtual meeting.

Stockholders will be able to listen, vote and submit questions from any remote location with internet connectivity. If you were

a stockholder of record as of the Record Date, to be admitted to the Annual Meeting at www.issuerdirect.com/virtual-event/east,

and to vote your shares during the meeting or submit questions during the meeting, you must enter the control number found on

your proxy card, voting instruction form or notice you previously received. Online access to the Annual Meeting will open at 1:45

p.m. PT to allow time for stockholders to log-in prior to the start of the Annual Meeting. Stockholders of record may vote during

the Annual Meeting by following the instructions available on the meeting website during the meeting.

If you were a beneficial owner as of the Record

Date of shares held in “street name” through a broker, bank or other nominee and you wish to attend the meeting and/or

vote your shares during the meeting or submit questions during the meeting, you will need to provide proof of your authority to

vote (legal proxy), which you must obtain from such nominee reflecting your holdings. You may forward an e-mail from your nominee

or attach an image of your legal proxy and transmit it via e-mail to Issuer Direct at proxy@issuerdirect.com and you should

label the e-mail “Legal Proxy” in the subject line. Requests for registration must be received by Issuer Direct no

later than 12:00 a.m., PT, on July 28, 2020. You will then receive confirmation of your registration, with a control number by

e-mail from Issuer Direct. At the time of the meeting, go to www.issuerdirect.com/virtual-event/east and enter the first

13 digits of your control number.

Proxy Information

Whether or not you plan to attend the Annual

Meeting, we urge you to vote and submit your proxy in advance of the meeting by one of the methods described in the proxy materials

for the Annual Meeting. The proxy card included with the proxy materials previously distributed will not be updated to reflect

the change in location and may continue to be used to vote your shares in connection with the Annual Meeting. If you have previously

submitted a proxy by one of the methods described in the proxy materials, you do not need to vote again unless you would like

to change your vote.

The Company’s 2020 proxy statement contains

important information and this announcement should be read in conjunction with the 2020 proxy statement. The 2020 proxy statement

and other relevant materials are available for free at the U.S. Securities & Exchange Commission’s website (www.sec.gov)

and at the Company’s website under the investors tab (www.eastsidedistilling.com). Additionally, you may access the

Company’s proxy materials at www.proxyvote.com.

About Eastside Distilling

Eastside Distilling, Inc. (NASDAQ: EAST)

has been producing high-quality, award-winning craft spirits in Portland, Oregon, since 2008. The Company is distinguished by

its highly decorated product lineup that includes Redneck Riviera Whiskey with companion brands Granny Rich Reserve and Howdy

Dew!, newly acquired Azuñia Tequilas, Burnside Whiskeys, Hue-Hue Coffee Rum, and Portland Potato Vodkas. All Eastside

spirits are crafted from natural ingredients for quality and taste. Eastside’s Craft Canning + Bottling subsidiary is

one of the Northwest’s leading independent spirit bottlers and ready-to-drink canners. For more information visit: www.eastsidedistilling.com

or follow the company on Twitter and Facebook.

Important Cautions Regarding Forward-Looking

Statements

Certain matters discussed in this press release

may be forward-looking statements. Such matters involve risks and uncertainties that may cause actual results to differ materially,

including the following: changes in economic conditions; general competitive factors; acceptance of the Company’s products

in the market; the Company’s success in obtaining new customers; the Company’s success in product development; the

Company’s ability to execute its business model and strategic plans; the Company’s success in integrating acquired

entities and assets, and all the risks and related information described from time to time in the Company’s filings with

the Securities and Exchange Commission (“SEC”), including the financial statements and related information contained

in the Company’s Annual Report on Form 10-K and interim Quarterly Reports on Form 10-Q. Examples of forward-looking statements

in this release may include statements related to our strategic focus, product verticals, anticipated revenue, and profitability.

The Company assumes no obligation to update the cautionary information in this release.

Company Contact:

Eastside Distilling

971-888-4264

inquiries@eastsidedistilling.com

Investors:

Robert Blum

Lytham Partners, LLC

(602) 889-9700

east@lythampartners.com

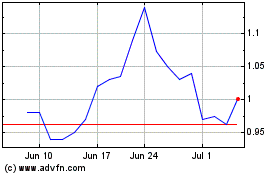

Eastside Distilling (NASDAQ:EAST)

Historical Stock Chart

From Mar 2024 to Apr 2024

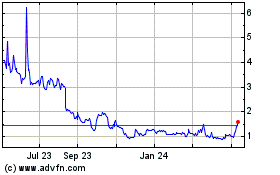

Eastside Distilling (NASDAQ:EAST)

Historical Stock Chart

From Apr 2023 to Apr 2024