Current Report Filing (8-k)

May 14 2020 - 4:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 13, 2020

YUNHONG CTI LTD.

(Exact name of registrant as specified in charter)

|

Illinois

|

|

000-23115

|

|

36-2848943

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

22160 N. Pepper Road, Lake Barrington, IL 60010

(Address of principal executive offices) (Zip Code)

(847) 382-1000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

CTIB

|

|

The Nasdaq Stock Market LLC

(The Nasdaq Capital Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mart if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 4.02 Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

On May 13, 2020, the Audit Committee (the “Audit Committee”) of Yunhong CTI Ltd. (the "Company"), following a discussion between the Audit Committee and the Company's independent registered public accounting firm, RBSM, LLP, concluded that the following previously-filed financial statements of the Company should not be relied upon:

|

|

●

|

The Company's unaudited financial statements for the quarterly period ended March 31, 2019, contained in the Company's Quarterly Report on Form 10-Q, originally filed with the Securities and Exchange Commission ("SEC") on May 21, 2019 (the “Q1 Report”);

|

|

|

●

|

The Company's unaudited financial statements for the quarterly period ended June 30, 2019, contained in the Company's Quarterly Report on Form 10-Q, originally filed with the Securities and Exchange Commission ("SEC") on August 19, 2019 (the “Q2 Report”); and

|

|

|

●

|

The Company's unaudited financial statements for the quarterly period ended September 30, 2019, contained in the Company's Quarterly Report on Form 10-Q, originally filed with the Securities and Exchange Commission ("SEC") on November 19, 2019 (the “Q3 Report”);

|

The Audit Committee determined that it was necessary to file an amendment to its Q1 Report because the Q1 Report i) was originally filed without review of the Company’s independent accountants, ii) did not contain disclosure of certain subsequent events which occurred between the end of the first quarter and the filing of the Q1 Report and iii) needed to be revised to adjust a lease accounting entry on the balance sheet. In addition, the Audit Committee determined that the its deferred tax asset (DTA) at March 31, 2019 should have been $135,094 and, therefore, the Company should have recorded a valuation allowance on the income tax benefit of $360,492 generated during the quarter.

The Audit Committee determined that it was necessary to file an amendment to its Q2 Report because the Q2 Report i) was originally filed without review of the Company’s independent accountants, ii) did not contain disclosure of certain subsequent events which occurred between the end of the second quarter and the filing of the Q2 Report and iii) needed to be revised to include an impairment charge due to the Company’s anticipated deconsolidation of one of the entities previously included in calculating the Company’s consolidated financials, as well as the Company’s anticipated liquidation of two of its subsidiaries.

The Audit Committee determined that it was necessary to file an amendment to its Q3 Report because the Q3 Report i) was originally filed without review of the Company’s independent accountants and ii) did not contain disclosure of certain subsequent events which occurred between the end of the third quarter and the filing of the Q3 Report. In addition, the Audit Committee determined that two of the Company’s subsidiaries, CTI Balloons (UK) and CTI Europe (Germany), were held for sale as of September 30, 2019. Accordingly, in the amendment to the Q3 Report, the Company reported the results of these operations as discontinued operations in the Consolidated Statements of Comprehensive Income and presented the related assets and liabilities as held-for-sale in the Consolidated Balance Sheets. Associated with the determination that these subsidiaries were held for sale; impairments were recorded to appropriately value the entities. Additionally, the impairment charges and deferred tax benefits previously reported were adjusted based on additional information. Effective July 1, 2019, the Audit Committee determined that the Company is no longer the primary beneficiary of certain variable interest entities. Therefore, effective July 1, 2019, the Company deconsolidated these entities and their results are not included in the Company’s Consolidated Statements of Comprehensive Income subsequent to June 30, 2019.

The Company intends to file an amendment to its Q1 Report, Q2 Report and Q3 Report, respectively, as soon as practicable.

Item 8.01 Other Events.

The Company is filing this Current Report on Form 8-K to avail itself of the relief provided by the Securities and Exchange Commission (SEC) Order under Section 36 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), granting exemptions from specified provisions of the Exchange Act, as set forth in SEC Release No. 34-88318 (the “Order”). By filing this Current Report on Form 8-K, the Company is relying on the Order to receive an additional 45 days to file its Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2020 (the “Quarterly Report”) due to the circumstances related to COVID-19. In particular, COVID-19 has caused our key internal accounting personnel responsible for assisting the Company in the preparation of its financial statements to work remotely, and, consequently, has delayed their ability to complete their detailed review of the Company’s financials. Notwithstanding the foregoing, the Company expects to file its Quarterly Report no later than June 29, 2020 (which is 45 days from the Report’s original filing deadline of May 15, 2020).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 14, 2020

|

|

YUNHONG CTI LTD.

|

|

|

|

|

|

By:

|

/s/ Frank Cesario

|

|

|

|

Frank Cesario

|

|

|

|

President, Chief Executive Officer and Chief Financial Officer

|

Yunhong CTI (NASDAQ:CTIB)

Historical Stock Chart

From Mar 2024 to Apr 2024

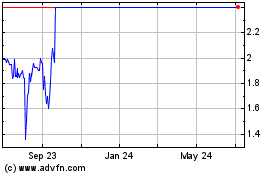

Yunhong CTI (NASDAQ:CTIB)

Historical Stock Chart

From Apr 2023 to Apr 2024