UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K/A

(Amendment No. 6)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 13, 2009

AMERICA’S CAR-MART, INC.

(Exact name of registrant as specified in

its charter)

| Texas |

0-14939 |

63-0851141 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

802 SE Plaza Avenue, Suite 200, Bentonville,

Arkansas 72712

(Address of principal

executive offices, including zip code)

(479) 464-9944

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant

to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Explanatory Note

This Amendment No. 6 to Form 8-K (this

“Amendment No. 5”), which amends the Current Report on Form 8-K of America’s Car-Mart, Inc. (the “Company”)

originally filed with the Securities and Exchange Commission (the “Commission”) on November 17, 2009 and previously

amended on Forms 8-K/A filed with the Commission on August 27, 2010, August 26, 2011, July 27, 2012, July 2, 2013, and June 11,

2014, respectively, is being filed to disclose certain information in the exhibits to the Form 8-K that was previously redacted

pursuant to requests for confidential treatment filed with the Commission and Orders Granting Confidential Treatment issued by

the Commission.

The employment agreement between the Company

and Eddie L. Hight, as amended by the amendment attached as Exhibit 10.2 to this Amendment No. 6, was terminated upon Mr. Hight’s

retirement from the position of Chief Operating Officer effective November 30, 2013, and as of such date, is no longer in effect.

The amendments to the employment agreements attached as exhibits to this Amendment No. 6 are being filed solely for the purpose

of disclosing certain information previously redacted as described above. No other changes have been made to the information reported

in the Form 8-K, as previously amended by Amendment No. 5 to Form 8-K filed with the Commission on June 11, 2014 (“Amendment

No. 5”). This Amendment No. 6 does not otherwise modify or update in any way the disclosures made in Amendment No. 5. Accordingly,

the text of the original Form 8-K, as previously amended, is omitted from this Amendment No. 6.

Item

9.01. Financial Statements and Exhibits

(d) Exhibits.

| | Exhibit No. | Description of Exhibit |

| | | |

| 10.1 | Amendment No. 1 to Employment Agreement Between America’s Car-Mart, Inc. and William H. Henderson. |

| 10.2 | Amendment No. 1 to Employment Agreement Between America’s Car-Mart, Inc. and Eddie L. Hight. |

| 10.3 | Amendment No. 1 to Employment Agreement Between America’s Car-Mart, Inc. and Jeffrey A. Williams. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

AMERICA’S CAR-MART, INC. |

|

| |

|

|

|

| Date: June 23, 2015 |

|

/s/ Jeffrey A. Williams |

|

| |

|

Jeffrey A. Williams |

| |

|

Chief Financial Officer and Secretary |

| |

|

(Principal Financial and Accounting Officer) |

EXHIBIT INDEX

| | Exhibit No. | Description of Exhibit |

| | | |

| 10.1 | Amendment No. 1 to Employment Agreement Between America’s Car-Mart, Inc. and William H. Henderson. |

| 10.2 | Amendment No. 1 to Employment Agreement Between America’s Car-Mart, Inc. and Eddie L. Hight. |

| 10.3 | Amendment No. 1 to Employment Agreement Between America’s Car-Mart, Inc. and Jeffrey A. Williams. |

Exhibit 10.1

AMENDMENT NO. 1

TO

EMPLOYMENT AGREEMENT

BETWEEN AMERICA’S CAR-MART, INC.

AND WILLIAM H. HENDERSON

This Amendment No.

1 to the Employment Agreement (the “Amendment”) between America’s Car-Mart, Inc., an Arkansas corporation

(the “Company”) and William H. Henderson (the “Associate”) is entered into and effective

as of November 13, 2009.

RECITALS

WHEREAS, the

Company and the Associate have agreed to certain amendments to the Employment Agreement dated on or as of May 1, 2007 between the

Company and the Associate (the “Employment Agreement”) as set forth below;

WHEREAS, all

capitalized terms not defined herein shall have the same meaning given to such terms in the Employment Agreement.

NOW, THEREFORE,

in consideration of the mutual covenants and promises contained herein, the parties hereto, each intending to be legally bound

hereby, agree as follows:

1. Amendment

of Section 3. Section 3 of the Employment Agreement is hereby deleted in its entirety and replaced with the following:

Term. Unless otherwise terminated

in accordance with Sections 8, 9, 10 or 11, the Employment Term shall be for a term ending April 30, 2015. This Agreement shall

be automatically renewed for successive additional Employment Terms of one (1) year each unless notice of termination is given

in writing by either party to the other party at least thirty (30) days prior to the expiration of the initial Employment Term

or any renewal Employment Term.

2. Amendment

of Section 4(a). Section 4(a) of the Employment Agreement is hereby deleted in its entirety and replaced with the following:

(a) Base Salary and Benefits. The

base annual salary of the Associate for his employment services hereunder shall be $300,000 or such higher annual salary, if any,

as shall be approved by the Board of Directors of the Parent Company from time to time (the “Base Salary”), which shall

be payable in accordance with the Company’s payroll policy. Effective as of May 1, 2010, the Base Salary for the Associate

shall be $350,000 or such higher annual salary, if any, as shall be approved by the Board of Directors of the Parent Company from

time to time. Nothing contained herein shall affect or in any way limit the Associate’s rights as an Associate of the Company

to participate in any Company 401(k) profit sharing plan or medical and life insurance programs offered by the Company to its employees,

or affect or in any way limit any other benefits provided to the Associate as of the date hereof or as may be approved by the Board

of Directors of the Parent Company from time to time, all of which shall be available to the Associate to the same extent as if

this Agreement had not existed, and compensation received by the Associate hereunder shall be in addition to the foregoing.

3. Amendment

to Section 4(b). Section 4(b) of the Employment Agreement is hereby deleted in its entirety and replaced with the following:

(b) Bonus.

(i) In addition to the Base Salary

and fringe benefits described above, the Associate shall be eligible to earn an annual cash bonus (the “Bonus”) during

the term beginning May 1, 2007 and ending April 30, 2010. The Bonus range shall be $40,000 to $60,000 per fiscal year, and shall

be based upon Parent Company’s Economic Profit Per Share as defined and described below. The Bonus will depend on the Parent

Company attaining a minimum of 85% of its projected economic profit per share (in which case a $40,000 bonus would be paid) and

will increase ratably up to 115% of its projected economic profit per share (in which case a $60,000 bonus would be paid), as set

forth in Appendix A to this Agreement; provided however, Associate expressly acknowledges and agrees that the projected

Parent Company Economic Profit Per Share for fiscal 2009 and fiscal 2010 shall be subject to adjustment by the Compensation Committee

of the Board of Directors of the Parent Company, in its sole discretion.

(ii) In addition to the Base Salary

and fringe benefits described above and the Bonus described above, the Associate shall be eligible to earn an additional cash bonus

of $60,000 for the period beginning May 1, 2009 and ending April 30, 2010 if for such period Parent Company’s GAAP Earnings

Per Share (as defined below) is $2.20 or more; provided, however, that for purposes of this Section 4(b)(ii), the Parent Company’s

GAAP Earnings Per Share shall exclude any and all compensation expense or charges associated with the amendments dated as of November

13, 2009 to the Employment Agreements dated as of May 1, 2007, between the Company and its “named executive officers”

(as listed in the Parent Company’s annual definitive proxy statement filed with the Securities and Exchange Commission).

(iii) In addition to the Base Salary

and fringe benefits described above, the Associate shall be eligible to earn a Bonus for each of the fiscal years during the term

beginning May 1, 2010 and ending April 30, 2015. The Bonus shall be based upon Parent Company’s projected fully diluted earnings

per share calculated in accordance with GAAP for each fiscal year (“GAAP Earnings Per Share”). The Bonus will depend

on the Parent Company attaining a minimum of 95% of its projected GAAP Earnings Per Share, as set forth in Appendix C to

this Agreement.

(iv) “Parent Company’s

Economic Profit Per Share” shall be defined as net operating profit after tax, less a capital charge (after tax) applied

to the “Economic Capital” required to generate said profits, divided by fully diluted shares outstanding. “Economic

Capital” is defined as net assets plus debt plus cumulative after tax interest expense at the end of the fiscal year. The

Parent Company Economic Profit Per Share shall exclude any and all compensation associated with the Employment Agreements dated

as of May 1, 2007, between the Company and its “named executive officers” (as listed in the Parent Company’s

annual definitive proxy statement filed with the Securities and Exchange Commission).

(v) The Bonus, if any, shall be paid

each fiscal year, within fifteen (15) days following the Parent Company’s filing of its annual report on Form 10-K for such

fiscal year, based upon the Parent Company’s Economic Profit Per Share or GAAP Earnings Per Share for that fiscal year. Any

Bonus shall be deemed to be earned by the Associate if the Associate was an employee of the Company as of the last day of the fiscal

year in question.

4. Addition

of Section 4(e). A new Section 4(e) is hereby inserted into the Employment Agreement after Section 4(d) but before Section

5:

(e) Additional Equity

Awards. On November 27, 2009, the Parent Company will grant to the Associate the following equity awards: (i) a non-qualified stock

option to purchase 240,000 shares of Parent Company common stock pursuant to the Parent Company’s 2007 Stock Option Plan,

which options shall vest in equal installments (48,000 options) on each of April 30, 2011, April 30, 2012, April 30, 2013, April

30, 2014 and April 30, 2015; and (ii) 10,000 shares of restricted stock pursuant to the Parent Company’s Stock Incentive

Plan, which shares of restricted stock shall vest on April 30, 2015 if the Parent Company attains at least 70% of its cumulative

projected GAAP Earnings Per Share for the period commencing on May 1, 2010 and ending on April 30, 2015.

5. Addition

of Appendix C. A new Appendix C, as attached to this Amendment, is hereby appended to the Employment Agreement after Appendix

B.

6. Reaffirmation.

Except to the extent the provisions of the Employment Agreement are specifically amended, modified or superseded by this Amendment,

the Employment Agreement is in full force and effect and is hereby ratified and confirmed.

7. Amendment.

This Amendment and the Employment Agreement may only be amended by a writing signed by each party hereto.

8. Counterparts.

This Amendment may be executed in counterpart signature pages, each of which shall constitute an original but all taken together

to constitute one instrument.

[SIGNATURE PAGE FOLLOWS.]

IN WITNESS WHEREOF,

the parties have executed this Amendment on and effective as of the date first written above.

COMPANY:

AMERICA’S CAR-MART, INC.

By: /s/ Jeffrey A. Williams

Name: Jeffrey A. Williams

Title: Vice President Finance,

Secretary and Chief Financial Officer

ASSOCIATE:

/s/ William H. Henderson

William H. Henderson

APPENDIX C

Applicable to the Bonus pursuant to

Section 4(b)(iii)

of the

Employment Agreement

Fiscal 2011-2015

| |

Fiscal Year |

| |

2011 |

2012 |

2013 |

2014 |

2015 |

| Projected GAAP Earnings Per Share |

2010 Actual GAAP Earnings Per Share multiplied by 1.15 |

2011 Projected GAAP Earnings Per Share multiplied by 1.15 |

2012 Projected GAAP Earnings Per Share multiplied by 1.15 |

2013 Projected GAAP Earnings Per Share multiplied by 1.15 |

2014 Projected GAAP Earnings Per Share multiplied by 1.15 |

| Bonus Potential: |

$125,000 |

$137,500 |

$151,250 |

$166,375 |

$183,013 |

If Parent Company’s actual GAAP Earnings

Per Share equals 95-99% of Parent Company’s projected GAAP Earnings Per Share (rounded to the nearest whole percentage point),

the Bonus for such fiscal year shall be the Bonus Potential for such fiscal year multiplied by 0.67.

If Parent Company’s actual GAAP Earnings

Per Share equals 100-104% of Parent Company’s projected GAAP Earnings Per Share (rounded to the nearest whole percentage

point), the Bonus for such fiscal year shall be the Bonus Potential for such fiscal year multiplied by 1.00.

If Parent Company’s actual GAAP Earnings

Per Share equals 105% or more of Parent Company’s projected GAAP Earnings Per Share (rounded to the nearest whole percentage

point), the Bonus for such fiscal year shall be the Bonus Potential for such fiscal year multiplied by 1.33.

C-1

Exhibit 10.2

AMENDMENT NO. 1

TO

EMPLOYMENT AGREEMENT

BETWEEN AMERICA’S CAR-MART, INC.

AND EDDIE L. HIGHT

This Amendment No.

1 to the Employment Agreement (the “Amendment”) between America’s Car-Mart, Inc., an Arkansas corporation

(the “Company”) and Eddie L. Hight (the “Associate”) is entered into and effective as of

November 13, 2009.

RECITALS

WHEREAS, the

Company and the Associate have agreed to certain amendments to the Employment Agreement dated on or as of May 1, 2007 between the

Company and the Associate (the “Employment Agreement”) as set forth below;

WHEREAS, all

capitalized terms not defined herein shall have the same meaning given to such terms in the Employment Agreement.

NOW, THEREFORE,

in consideration of the mutual covenants and promises contained herein, the parties hereto, each intending to be legally bound

hereby, agree as follows:

1. Amendment

of Section 3. Section 3 of the Employment Agreement is hereby deleted in its entirety and replaced with the following:

Term. Unless otherwise terminated

in accordance with Sections 8, 9, 10 or 11, the Employment Term shall be for a term ending April 30, 2015. This Agreement shall

be automatically renewed for successive additional Employment Terms of one (1) year each unless notice of termination is given

in writing by either party to the other party at least thirty (30) days prior to the expiration of the initial Employment Term

or any renewal Employment Term.

2. Amendment

of Section 4(a). Section 4(a) of the Employment Agreement is hereby deleted in its entirety and replaced with the following:

(a) Base Salary and Benefits. The

base annual salary of the Associate for his employment services hereunder shall be $185,000 or such higher annual salary, if any,

as shall be approved by the Board of Directors of the Parent Company from time to time (the “Base Salary”), which shall

be payable in accordance with the Company’s payroll policy. Effective as of May 1, 2010, the Base Salary for the Associate

shall be $250,000 or such higher annual salary, if any, as shall be approved by the Board of Directors of the Parent Company from

time to time. Nothing contained herein shall affect or in any way limit the Associate’s rights as an Associate of the Company

to participate in any Company 401(k) profit sharing plan or medical and life insurance programs offered by the Company to its employees,

or affect or in any way limit any other benefits provided to the Associate as of the date hereof or as may be approved by the Board

of Directors of the Parent Company from time to time, all of which shall be available to the Associate to the same extent as if

this Agreement had not existed, and compensation received by the Associate hereunder shall be in addition to the foregoing.

3. Amendment

to Section 4(b). Section 4(b) of the Employment Agreement is hereby deleted in its entirety and replaced with the following:

(b) Bonus.

(i) In addition to the Base Salary

and fringe benefits described above, the Associate shall be eligible to earn an annual cash bonus (the “Bonus”) during

the term beginning May 1, 2007 and ending April 30, 2010. The Bonus range shall be $24,000 to $36,000 per fiscal year, and shall

be based upon Parent Company’s Economic Profit Per Share as defined and described below. The Bonus will depend on the Parent

Company attaining a minimum of 85% of its projected economic profit per share (in which case a $24,000 bonus would be paid) and

will increase ratably up to 115% of its projected economic profit per share (in which case a $36,000 bonus would be paid), as set

forth in Appendix A to this Agreement; provided however, Associate expressly acknowledges and agrees that the projected

Parent Company Economic Profit Per Share for fiscal 2009 and fiscal 2010 shall be subject to adjustment by the Compensation Committee

of the Board of Directors of the Parent Company, in its sole discretion.

(ii) In addition to the Base Salary

and fringe benefits described above and the Bonus described above, the Associate shall be eligible to earn an additional cash bonus

of $36,000 for the period beginning May 1, 2009 and ending April 30, 2010 if for such period Parent Company’s GAAP Earnings

Per Share (as defined below) is $2.20 or more; provided, however, that for purposes of this Section 4(b)(ii), the Parent Company’s

GAAP Earnings Per Share shall exclude any and all compensation expense or charges associated with the amendments dated as of November

13, 2009 to the Employment Agreements dated as of May 1, 2007, between the Company and its “named executive officers”

(as listed in the Parent Company’s annual definitive proxy statement filed with the Securities and Exchange Commission).

(iii) In addition to the Base Salary

and fringe benefits described above, the Associate shall be eligible to earn a Bonus for each of the fiscal years during the term

beginning May 1, 2010 and ending April 30, 2015. The Bonus shall be based upon Parent Company’s projected fully diluted earnings

per share calculated in accordance with GAAP for each fiscal year (“GAAP Earnings Per Share”). The Bonus will depend

on the Parent Company attaining a minimum of 95% of its projected GAAP Earnings Per Share, as set forth in Appendix C to

this Agreement.

(iv) “Parent Company’s

Economic Profit Per Share” shall be defined as net operating profit after tax, less a capital charge (after tax) applied

to the “Economic Capital” required to generate said profits, divided by fully diluted shares outstanding. “Economic

Capital” is defined as net assets plus debt plus cumulative after tax interest expense at the end of the fiscal year. The

Parent Company Economic Profit Per Share shall exclude any and all compensation associated with the Employment Agreements dated

as of May 1, 2007, between the Company and its “named executive officers” (as listed in the Parent Company’s

annual definitive proxy statement filed with the Securities and Exchange Commission).

(v) The Bonus, if any, shall be paid

each fiscal year, within fifteen (15) days following the Parent Company’s filing of its annual report on Form 10-K for such

fiscal year, based upon the Parent Company’s Economic Profit Per Share or GAAP Earnings Per Share for that fiscal year. Any

Bonus shall be deemed to be earned by the Associate if the Associate was an employee of the Company as of the last day of the fiscal

year in question.

4. Addition

of Section 4(e). A new Section 4(e) is hereby inserted into the Employment Agreement after Section 4(d) but before Section

5:

(e) Additional Equity

Awards. On November 27, 2009, the Parent Company will grant to the Associate the following equity awards: (i) a non-qualified stock

option to purchase 120,000 shares of Parent Company common stock pursuant to the Parent Company’s 2007 Stock Option Plan,

which options shall vest in equal installments (24,000 options) on each of April 30, 2011, April 30, 2012, April 30, 2013, April

30, 2014 and April 30, 2015; and (ii) 5,000 shares of restricted stock pursuant to the Parent Company’s Stock Incentive Plan,

which shares of restricted stock shall vest on April 30, 2015 if the Parent Company attains at least 70% of its cumulative projected

GAAP Earnings Per Share for the period commencing on May 1, 2010 and ending on April 30, 2015.

5. Addition

of Appendix C. A new Appendix C, as attached to this Amendment, is hereby appended to the Employment Agreement after Appendix

B.

6. Reaffirmation.

Except to the extent the provisions of the Employment Agreement are specifically amended, modified or superseded by this Amendment,

the Employment Agreement is in full force and effect and is hereby ratified and confirmed.

7. Amendment.

This Amendment and the Employment Agreement may only be amended by a writing signed by each party hereto.

8. Counterparts.

This Amendment may be executed in counterpart signature pages, each of which shall constitute an original but all taken together

to constitute one instrument.

[SIGNATURE PAGE FOLLOWS.]

IN WITNESS WHEREOF,

the parties have executed this Amendment on and effective as of the date first written above.

COMPANY:

AMERICA’S CAR-MART, INC.

By: /s/ Jeffrey A. Williams

Name: Jeffrey A. Williams

Title: Vice President Finance,

Secretary and Chief Financial Officer

ASSOCIATE:

/s/ Eddie L. Hight

Eddie L. Hight

APPENDIX C

Applicable to the Bonus pursuant to

Section 4(b)(iii)

of the

Employment Agreement

Fiscal 2011-2015

| |

Fiscal Year |

| |

2011 |

2012 |

2013 |

2014 |

2015 |

| Projected GAAP Earnings Per Share |

2010 Actual GAAP Earnings Per Share multiplied by 1.15 |

2011 Projected GAAP Earnings Per Share multiplied by 1.15 |

2012 Projected GAAP Earnings Per Share multiplied by 1.15 |

2013 Projected GAAP Earnings Per Share multiplied by 1.15 |

2014 Projected GAAP Earnings Per Share multiplied by 1.15 |

| Bonus Potential: |

$70,000 |

$77,000 |

$84,700 |

$93,170 |

$102,487 |

If Parent Company’s actual GAAP Earnings

Per Share equals 95-99% of Parent Company’s projected GAAP Earnings Per Share (rounded to the nearest whole percentage point),

the Bonus for such fiscal year shall be the Bonus Potential for such fiscal year multiplied by 0.67.

If Parent Company’s actual GAAP Earnings

Per Share equals 100-104% of Parent Company’s projected GAAP Earnings Per Share (rounded to the nearest whole percentage

point), the Bonus for such fiscal year shall be the Bonus Potential for such fiscal year multiplied by 1.00.

If Parent Company’s actual GAAP Earnings

Per Share equals 105% or more of Parent Company’s projected GAAP Earnings Per Share (rounded to the nearest whole percentage

point), the Bonus for such fiscal year shall be the Bonus Potential for such fiscal year multiplied by 1.33.

C-1

Exhibit 10.3

AMENDMENT NO. 1

TO

EMPLOYMENT AGREEMENT

BETWEEN AMERICA’S CAR-MART, INC.

AND JEFFREY A. WILLIAMS

This Amendment No.

1 to the Employment Agreement (the “Amendment”) between America’s Car-Mart, Inc., an Arkansas corporation

(the “Company”) and Jeffrey A. Williams (the “Associate”) is entered into and effective as

of November 13, 2009.

RECITALS

WHEREAS, the

Company and the Associate have agreed to certain amendments to the Employment Agreement dated on or as of May 1, 2007 between the

Company and the Associate (the “Employment Agreement”) as set forth below;

WHEREAS, all

capitalized terms not defined herein shall have the same meaning given to such terms in the Employment Agreement.

NOW, THEREFORE,

in consideration of the mutual covenants and promises contained herein, the parties hereto, each intending to be legally bound

hereby, agree as follows:

1. Amendment

of Section 3. Section 3 of the Employment Agreement is hereby deleted in its entirety and replaced with the following:

Term. Unless otherwise terminated

in accordance with Sections 8, 9, 10 or 11, the Employment Term shall be for a term ending April 30, 2015. This Agreement shall

be automatically renewed for successive additional Employment Terms of one (1) year each unless notice of termination is given

in writing by either party to the other party at least thirty (30) days prior to the expiration of the initial Employment Term

or any renewal Employment Term.

2. Amendment

of Section 4(a). Section 4(a) of the Employment Agreement is hereby deleted in its entirety and replaced with the following:

(a) Base Salary and Benefits. The

base annual salary of the Associate for his employment services hereunder shall be $180,000 or such higher annual salary, if any,

as shall be approved by the Board of Directors of the Parent Company from time to time (the “Base Salary”), which shall

be payable in accordance with the Company’s payroll policy. Effective as of May 1, 2010, the Base Salary for the Associate

shall be $250,000 or such higher annual salary, if any, as shall be approved by the Board of Directors of the Parent Company from

time to time. Nothing contained herein shall affect or in any way limit the Associate’s rights as an Associate of the Company

to participate in any Company 401(k) profit sharing plan or medical and life insurance programs offered by the Company to its employees,

or affect or in any way limit any other benefits provided to the Associate as of the date hereof or as may be approved by the Board

of Directors of the Parent Company from time to time, all of which shall be available to the Associate to the same extent as if

this Agreement had not existed, and compensation received by the Associate hereunder shall be in addition to the foregoing.

3. Amendment

to Section 4(b). Section 4(b) of the Employment Agreement is hereby deleted in its entirety and replaced with the following:

(b) Bonus.

(i) In addition to the Base Salary

and fringe benefits described above, the Associate shall be eligible to earn an annual cash bonus (the “Bonus”) during

the term beginning May 1, 2007 and ending April 30, 2010. The Bonus range shall be $20,000 to $30,000 per fiscal year, and shall

be based upon Parent Company’s Economic Profit Per Share as defined and described below. The Bonus will depend on the Parent

Company attaining a minimum of 85% of its projected economic profit per share (in which case a $20,000 bonus would be paid) and

will increase ratably up to 115% of its projected economic profit per share (in which case a $30,000 bonus would be paid), as set

forth in Appendix A to this Agreement; provided however, Associate expressly acknowledges and agrees that the projected

Parent Company Economic Profit Per Share for fiscal 2009 and fiscal 2010 shall be subject to adjustment by the Compensation Committee

of the Board of Directors of the Parent Company, in its sole discretion.

(ii) In addition to the Base Salary

and fringe benefits described above and the Bonus described above, the Associate shall be eligible to earn an additional cash bonus

of $30,000 for the period beginning May 1, 2009 and ending April 30, 2010 if for such period Parent Company’s GAAP Earnings

Per Share (as defined below) is $2.20 or more; provided, however, that for purposes of this Section 4(b)(ii), the Parent Company’s

GAAP Earnings Per Share shall exclude any and all compensation expense or charges associated with the amendments dated as of November

13, 2009 to the Employment Agreements dated as of May 1, 2007, between the Company and its “named executive officers”

(as listed in the Parent Company’s annual definitive proxy statement filed with the Securities and Exchange Commission).

(iii) In addition to the Base Salary

and fringe benefits described above, the Associate shall be eligible to earn a Bonus for each of the fiscal years during the term

beginning May 1, 2010 and ending April 30, 2015. The Bonus shall be based upon Parent Company’s projected fully diluted earnings

per share calculated in accordance with GAAP for each fiscal year (“GAAP Earnings Per Share”). The Bonus will depend

on the Parent Company attaining a minimum of 95% of its projected GAAP Earnings Per Share, as set forth in Appendix C to

this Agreement.

(iv) “Parent Company’s

Economic Profit Per Share” shall be defined as net operating profit after tax, less a capital charge (after tax) applied

to the “Economic Capital” required to generate said profits, divided by fully diluted shares outstanding. “Economic

Capital” is defined as net assets plus debt plus cumulative after tax interest expense at the end of the fiscal year. The

Parent Company Economic Profit Per Share shall exclude any and all compensation associated with the Employment Agreements dated

as of May 1, 2007, between the Company and its “named executive officers” (as listed in the Parent Company’s

annual definitive proxy statement filed with the Securities and Exchange Commission).

(v) The Bonus, if any, shall be paid

each fiscal year, within fifteen (15) days following the Parent Company’s filing of its annual report on Form 10-K for such

fiscal year, based upon the Parent Company’s Economic Profit Per Share or GAAP Earnings Per Share for that fiscal year. Any

Bonus shall be deemed to be earned by the Associate if the Associate was an employee of the Company as of the last day of the fiscal

year in question.

4. Addition

of Section 4(d). A new Section 4(d) is hereby inserted into the Employment Agreement after Section 4(c) but before Section

5:

(d) Additional Equity

Awards. On November 27, 2009, the Parent Company will grant to the Associate the following equity awards: (i) a non-qualified stock

option to purchase 120,000 shares of Parent Company common stock pursuant to the Parent Company’s 2007 Stock Option Plan,

which options shall vest in equal installments (24,000 options) on each of April 30, 2011, April 30, 2012, April 30, 2013, April

30, 2014 and April 30, 2015; and (ii) 5,000 shares of restricted stock pursuant to the Parent Company’s Stock Incentive Plan,

which shares of restricted stock shall vest on April 30, 2015 if the Parent Company attains at least 70% of its cumulative projected

GAAP Earnings Per Share for the period commencing on May 1, 2010 and ending on April 30, 2015.

5. Addition

of Appendix C. A new Appendix C, as attached to this Amendment, is hereby appended to the Employment Agreement after Appendix

B.

6. Reaffirmation.

Except to the extent the provisions of the Employment Agreement are specifically amended, modified or superseded by this Amendment,

the Employment Agreement is in full force and effect and is hereby ratified and confirmed.

7. Amendment.

This Amendment and the Employment Agreement may only be amended by a writing signed by each party hereto.

8. Counterparts.

This Amendment may be executed in counterpart signature pages, each of which shall constitute an original but all taken together

to constitute one instrument.

[SIGNATURE PAGE FOLLOWS.]

IN WITNESS WHEREOF,

the parties have executed this Amendment on and effective as of the date first written above.

COMPANY:

AMERICA’S CAR-MART, INC.

By: /s/ William H. Henderson

Name: William H. Henderson

Title: President and Chief Executive

Officer

ASSOCIATE:

/s/ Jeffrey A. Williams

Jeffrey A. Williams

APPENDIX C

Applicable to the Bonus pursuant to

Section 4(b)(iii)

of the

Employment Agreement

Fiscal 2011-2015

| |

Fiscal Year |

| |

2011 |

2012 |

2013 |

2014 |

2015 |

| Projected GAAP Earnings Per Share |

2010 Actual GAAP Earnings Per Share multiplied by 1.15 |

2011 Projected GAAP Earnings Per Share multiplied by 1.15 |

2012 Projected GAAP Earnings Per Share multiplied by 1.15 |

2013 Projected GAAP Earnings Per Share multiplied by 1.15 |

2014 Projected GAAP Earnings Per Share multiplied by 1.15 |

| Bonus Potential: |

$70,000 |

$77,000 |

$84,700 |

$93,170 |

$102,487 |

If Parent Company’s actual GAAP Earnings

Per Share equals 95-99% of Parent Company’s projected GAAP Earnings Per Share (rounded to the nearest whole percentage point),

the Bonus for such fiscal year shall be the Bonus Potential for such fiscal year multiplied by 0.67.

If Parent Company’s actual GAAP Earnings

Per Share equals 100-104% of Parent Company’s projected GAAP Earnings Per Share (rounded to the nearest whole percentage

point), the Bonus for such fiscal year shall be the Bonus Potential for such fiscal year multiplied by 1.00.

If Parent Company’s actual GAAP Earnings

Per Share equals 105% or more of Parent Company’s projected GAAP Earnings Per Share (rounded to the nearest whole percentage

point), the Bonus for such fiscal year shall be the Bonus Potential for such fiscal year multiplied by 1.33.

C-1

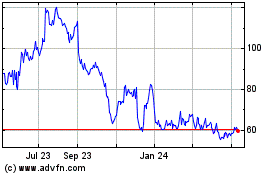

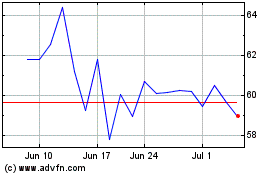

Americas Car Mart (NASDAQ:CRMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Americas Car Mart (NASDAQ:CRMT)

Historical Stock Chart

From Apr 2023 to Apr 2024