Comera Life Sciences Holdings, Inc. (Nasdaq: CMRA), a life

sciences company developing a new generation of bio-innovative

biologic medicines to improve patient access, safety, and

convenience, today reported financial results for the first quarter

ended March 31, 2023, and provided a business update.

“Comera continued to execute on its core value

drivers, including significant advancement of its ongoing

pharmaceutical partnerships, including our collaboration with

Regeneron, and sustained progression of our proprietary programs,

led by CLS-001, a subcutaneous formulation of vedolizumab,” said

Jeffrey Hackman, Chairman and Chief Executive Officer of Comera.

“As we strive to drive value for both shareholders and patients, we

remain focused on our mission to transform the patient experience

by enabling the delivery of biologics from intravenous to

subcutaneous form allowing patients to self-medicate at home and

ultimately reduce healthcare costs, improving quality of life.”

Recent Business Highlights

- Significant

progress in its ongoing research collaboration with Regeneron, a

leading U.S. biotechnology company. The partnership includes a

right to negotiate a license after technical evaluation is

complete.

- Further

development of its lead pipeline candidate CLS-001 (SQ

vedolizumab), highlighted by identification of a lead formulation

for a once-monthly SQ dose. Vedolizumab, currently marketed as

Entyvio in the United States as an IV formulation and an IV and

biweekly SQ formulation outside of the United States, is used for

the treatment of IBD including Crohn’s disease and ulcerative

colitis. Comera believes that a once-monthly SQ form could have

significant advantages for patients and the healthcare system.

- Joined the

Subcutaneous Drug Development & Delivery Consortium (SC

Consortium) to advance the science, technology, and best practices

for SQ drug development and delivery.

- In April 2023,

announced the expansion of its patent portfolio with one new patent

granted in South Korea and two Notices of Allowance in the United

States and Japan covering expansion of claims, geographic coverage,

and exclusive rights pertaining to certain excipients in its

proprietary SQore™ platform.

- In January

2023, announced the completion of a private placement of 2,406,242

units, at a purchase price of $1.48 per unit, resulting in gross

proceeds of approximately $3.6 million and with each unit

consisting of one share of the Company’s common stock and one

five-year warrant to purchase two shares of the Company’s common

stock at an exercise price of $1.23 per share.

First Quarter 2023 Financial Results

Comera reported revenues of $393 thousand for

the three months ended March 31, 2023, compared to $95 thousand for

the same period in 2022, with the increase primarily related to the

expansion of its ongoing research collaboration with Regeneron.

Cost of revenue totaled $117 thousand for the

three months ended March 31, 2023, compared to $45 thousand for the

same period in 2022. The increase is primarily related to higher

direct labor costs due to an increase in research activities

performed under customer contracts.

R&D expenses totaled $344 thousand for the three months

ended March 31, 2023, compared to $487 thousand for the same period

in 2022. The overall decrease of approximately $143 thousand is

primarily related to lower lab supply expenses and a greater

allocation of resources to cost of revenue in the three months

ended March 31, 2023.

General and administrative expenses totaled $2.4

million for the three months ended March 31, 2023, compared to $2.0

million for the same period in 2022, due primarily to an increase

in expenses in connection with the Company’s growth and costs

associated with operating a public company, including an

incremental $256 thousand of non-cash stock compensation

expense.

Comera reported a net loss of $2.6 million, or

$0.13 loss per share for the three months ended March 31, 2023,

compared to a net loss of $2.9 million, or $4.01 loss per share,

for the same period in 2022. The decrease was primarily due to

higher non-operating expense in the prior year.

Comera had $1.6 million in cash, cash

equivalents and restricted cash at March 31, 2023.

About Comera Life Sciences

Leading a compassionate new era in medicine,

Comera Life Sciences is applying a deep knowledge of formulation

science and technology to transform essential biologic medicines

from intravenous (IV) to subcutaneous (SQ) forms. The goal of this

approach is to provide patients with the freedom of self-injectable

care, reduce institutional dependency and to put patients at the

center of their treatment regimen.

To learn more about the Comera Life Sciences

mission, as well as the proprietary SQore™ platform, visit

https://comeralifesciences.com/.

Forward-Looking Statements

This press release includes “forward-looking

statements” within the meaning of the federal securities laws.

These forward-looking statements generally are identified by the

words “believe,” “project,” “expect,” “anticipate,” “estimate,”

“intend,” “strategy,” “future,” “opportunity,” “plan,” “may,”

“should,” “will,” “would,” “will be,” “will continue,” “will likely

result,” and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. Many factors could

cause actual future events to differ materially from the

forward-looking statements in this document, including, but not

limited to: the Company’s ability to maintain the listing of its

securities on the Nasdaq Capital Market; the price of the Company’s

securities may be volatile due to a variety of factors, including

changes in the competitive and highly regulated industries in which

the Company plans to operate, variations in performance across

competitors, changes in laws and regulations affecting the

Company’s business and changes in the capital structure; the

Company’s ability to execute on its business plans, forecasts, and

other expectations and identify and realize additional

opportunities; the risk of economic downturns and the possibility

of rapid change in the highly competitive industry in which the

Company operates; the risk that the Company and its current and

future collaborators are unable to successfully develop and

commercialize the Company’s products or services, or experience

significant delays in doing so; the risk that we will be unable to

continue to attract and retain third-party collaborators, including

collaboration partners and licensors; the risk that the Company may

never achieve or sustain profitability; the risk that the Company

will need to raise additional capital to execute its business plan,

which may not be available on acceptable terms or at all; the risk

that the Company experiences difficulties in managing its growth

and expanding operations; the risk that third-party suppliers and

manufacturers are not able to fully and timely meet their

obligations; the risk that the Company is unable to secure or

protect its intellectual property; the risk that the Company is

unable to secure regulatory approval for its product candidates;

the effect of any resurgence of the COVID-19 pandemic or other

public health emergencies on the Company’s business; general

economic conditions; and other risks and uncertainties described in

Item 1A of Part I of the Company’s Annual Report on Form 10-K filed

with the SEC on March 17, 2023 under “Risk Factors” and in other

filings that have been made or will be made with the SEC. The

foregoing list of factors is not exhaustive. Forward-looking

statements speak only as of the date they are made. Readers are

cautioned not to put undue reliance on forward-looking statements,

and Comera assumes no obligation and does not intend to update or

revise these forward-looking statements, whether as a result of new

information, future events, or otherwise. Comera can give no

assurance that it will achieve its expectations.

Contacts

Comera Investor

John Woolford ICR Westwicke John.Woolford@westwicke.com

Comera Press

Jon Yu ICR WestwickeComeraPR@westwicke.com

| COMERA LIFE

SCIENCES HOLDINGS, INC. |

| CONSOLIDATED

BALANCE SHEETS |

|

(unaudited) |

| |

|

|

|

March 31, |

|

December

31, |

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

|

Assets |

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,538,653 |

|

|

$ |

446,607 |

|

|

|

Restricted cash - current |

|

|

— |

|

|

|

1,505,625 |

|

|

|

Accounts receivable |

|

|

— |

|

|

|

34,320 |

|

|

|

Deferred issuance costs |

|

|

— |

|

|

|

90,047 |

|

|

|

Prepaid expenses and other current assets |

|

|

868,784 |

|

|

|

986,499 |

|

|

|

Total current assets |

|

|

2,407,437 |

|

|

|

3,063,098 |

|

|

| Restricted

cash - non-current |

|

|

50,000 |

|

|

|

50,000 |

|

|

| Property and

equipment, net |

|

|

234,576 |

|

|

|

257,186 |

|

|

| Right-of-use

asset |

|

|

263,904 |

|

|

|

313,629 |

|

|

| Security

deposit |

|

|

43,200 |

|

|

|

43,200 |

|

|

|

Total assets |

|

$ |

2,999,117 |

|

|

$ |

3,727,113 |

|

|

|

Liabilities, Convertible Preferred Stock and Stockholders’

Deficit |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

1,772,187 |

|

|

$ |

1,458,267 |

|

|

|

Accrued expenses and other current liabilities |

|

|

1,365,334 |

|

|

|

1,295,764 |

|

|

|

Insurance premium financing |

|

|

— |

|

|

|

455,562 |

|

|

|

Deposit liability |

|

|

— |

|

|

|

1,505,625 |

|

|

|

Deferred revenue |

|

|

— |

|

|

|

144,280 |

|

|

|

Lease liability - current |

|

|

217,500 |

|

|

|

199,184 |

|

|

|

Total current liabilities |

|

|

3,355,021 |

|

|

|

5,058,682 |

|

|

| Derivative

warrant liabilities |

|

|

250,745 |

|

|

|

277,507 |

|

|

| Lease

liability - noncurrent |

|

|

53,669 |

|

|

|

120,302 |

|

|

|

Total liabilities |

|

|

3,659,435 |

|

|

|

5,456,491 |

|

|

| Commitments

and contingencies (Note 15) |

|

|

|

|

|

| Series A

convertible preferred stock |

|

|

4,604,526 |

|

|

|

4,517,710 |

|

|

|

Stockholders’ equity (deficit): |

|

|

|

|

|

|

Common stock, $0.0001 par value; 150,000,000 shares authorized;

19,152,693 and 16,709,221 shares issued and outstanding at March

31, 2023 and December 31, 2022, respectively |

|

|

1,915 |

|

|

|

1,671 |

|

|

|

Additional paid-in capital |

|

|

32,118,476 |

|

|

|

28,655,164 |

|

|

|

Accumulated deficit |

|

|

(37,385,235 |

) |

|

|

(34,903,923 |

) |

|

|

Total stockholders’ deficit |

|

|

(5,264,844 |

) |

|

|

(6,247,088 |

) |

|

|

Total liabilities, convertible preferred stock and stockholders’

deficit |

|

$ |

2,999,117 |

|

|

$ |

3,727,113 |

|

|

| |

|

|

|

|

|

| COMERA LIFE

SCIENCES HOLDINGS, INC. |

|

CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS |

|

(unaudited) |

| |

|

|

|

Three Months Ended March 31, |

|

|

|

|

|

2023 |

|

|

|

2022 |

|

|

| Revenue |

|

$ |

392,915 |

|

|

$ |

95,334 |

|

|

| Cost of

revenue |

|

|

116,519 |

|

|

|

44,524 |

|

|

| Operating

expenses: |

|

|

|

|

|

|

Research and development |

|

|

343,705 |

|

|

|

487,217 |

|

|

|

General and administrative |

|

|

2,433,147 |

|

|

|

2,016,245 |

|

|

|

Total operating expenses |

|

|

2,776,852 |

|

|

|

2,503,462 |

|

|

| Loss from

operations |

|

|

(2,500,456 |

) |

|

|

(2,452,652 |

) |

|

| Other income

(expense), net: |

|

|

|

|

|

|

Change in fair value of derivative warrant liabilities |

|

|

26,762 |

|

|

|

— |

|

|

|

Interest expense |

|

|

(7,618 |

) |

|

|

(77 |

) |

|

|

Other expense, net |

|

|

— |

|

|

|

(426,666 |

) |

|

|

Total other income (expense), net |

|

|

19,144 |

|

|

|

(426,743 |

) |

|

| Net loss and

comprehensive loss |

|

|

(2,481,312 |

) |

|

|

(2,879,395 |

) |

|

| Less:

accretion of convertible preferred stock to redemption value |

|

|

(86,816 |

) |

|

|

— |

|

|

| Net loss

attributable to common stockholders |

|

$ |

(2,568,128 |

) |

|

$ |

(2,879,395 |

) |

|

| Net loss per

share attributable to common stockholders — basic and diluted |

|

$ |

(0.13 |

) |

|

$ |

(4.01 |

) |

|

|

Weighted-average number of common shares used in computing net loss

per share attributable to common stockholders — basic and

diluted |

|

|

19,033,436 |

|

|

|

718,419 |

|

|

| |

|

|

|

|

|

Comera Life Sciences (NASDAQ:CMRA)

Historical Stock Chart

From Mar 2024 to Apr 2024

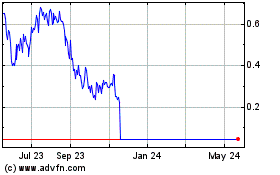

Comera Life Sciences (NASDAQ:CMRA)

Historical Stock Chart

From Apr 2023 to Apr 2024