Biocept, Inc. (Nasdaq: BIOC), a leading provider of molecular

diagnostic assays, products and services, reports financial results

for the three and six months ended June 30, 2023 and provides a

business update.

“Biocept’s primary focus is establishing our proprietary

cerebrospinal fluid assay CNSide™ as standard of care. We continue

to diligently work towards submission to the National Comprehensive

Cancer Network® (NCCN®) for consideration to include CNSide in

their standard-of-care guidelines. We believe securing this status

will broaden physician adoption and support reimbursement that

reflects our test’s value in clinical decision-making,” said

Antonino Morales, Biocept President and CEO. “Our ongoing FORESEE

clinical trial is powered to generate data in support of this goal

by assessing CNSide’s impact on physicians’ treatment decisions.

I’m exceptionally pleased that patient enrollment in FORESEE has

passed the midpoint, with four clinical sites open around the

country for patient recruitment and several additional medical

centers expected to join in the coming weeks.

“We plan to provide further evidence of CNSide’s clinical

utility through publication in peer-reviewed medical journals. We

have submitted a manuscript with a description of our assay and its

features, validation from pilot studies and compelling case studies

showing actual use in patient management. Four additional

manuscripts are being prepared in collaboration with leading

neuro-oncologists for submission to scientific journals, including

several documenting their clinical experiences with CNSide in their

practices,” Mr. Morales continued.

“We right sized our business to align with our primary focus,

which is helping to extend our cash runway. Progressing towards

standard of care, completing the FORESEE clinical trial, and

reducing expenses are key to Biocept becoming a self-sustaining

business,” Mr. Morales added.

Earlier today Biocept announced that Priya U. Kumthekar, MD, a

United Counsel for Neurologic Subspecialties (UCNS)-certified

neuro-oncologist at Northwestern University, and David Piccioni,

MD, PhD, Director of Neuro-Oncology at University of California,

San Diego, discussed the use of CNSide in presentations at the 2023

SNO/ASCO CNS Cancer Conference, which was held last week.

Biocept intends to host a business update call later in August

to present a progress report on the FORESEE trial and discuss other

recent developments. Details of the call will be announced in a

press release.

Second Quarter Financial Results

Net revenues for the second quarter of 2023 were $0.6 million,

compared with $5.8 million for the second quarter of 2022, with the

decline due to lower RT-PCR COVID-19 testing volume. As previously

reported, the Company ceased providing COVID-19 testing services in

February 2023. The number of commercial accessions delivered for

the second quarters of 2023 and 2022 were 322 and 77,779,

respectively.

Cost of revenues for the second quarter of 2023 was $2.6

million, compared with $8.0 million for the second quarter of 2022,

with the decrease primarily due to the cessation of COVID-19

testing services and reduced headcount.

Research and development (R&D) expenses for the second

quarter of 2023 were $0.4 million, compared with $1.7 million for

the second quarter of 2022, with the decrease primarily due to a

reduction in headcount and lower purchases of materials and

supplies.

General and administrative (G&A) expenses for the second

quarter of 2023 were $3.5 million, compared with $4.3 million for

the second quarter of 2022. The decrease was primarily due to lower

headcount and consulting fees.

Sales and marketing expenses for the second quarter of 2023 were

$0.3 million, compared with $1.7 million for the second quarter of

2022, with the decrease primarily due to a reduction in headcount,

and lower consulting, promotion and outside service-related

expenses.

Non-cash change in the fair value of warrant liability for the

second quarter of 2023 was $2.4 million. There was no comparable

item for the second quarter of 2022.

Net loss attributable to common stockholders for the second

quarter of 2023 was $3.6 million, or $3.50 per share, compared with

a net loss attributable to common stockholders for the second

quarter of 2022 of $10.0 million, or $17.82 per share.

Six Month Financial Results

Net revenues for the first half of 2023 were $1.3 million,

compared with $25.8 million for the first half of 2022.

Operating expenses for the first half of 2023 were $14.5

million, and included cost of revenues of $5.6 million, R&D

expenses of $1.4 million, G&A expenses of $6.5 million and

sales and marketing expenses of $1.0 million.

Net loss attributable to common stockholders for the first half

of 2023 was $10.8 million, or $13.25 per share, compared with net

loss attributable to common stockholders for the first half of 2022

of $12.3 million, or $21.78 per share.

Biocept reported cash of $6.6 million as of June 30, 2023,

compared with $12.9 million as of December 31, 2022. In May 2023,

the Company received net cash proceeds of approximately $3.6

million from an underwritten public offering, after deducting

underwriting discounts and other expenses payable by the

Company.

About the FORESEE Clinical Trial

The multi-center, prospective FORESEE clinical trial is a

longitudinal therapy response monitoring study in subjects with

leptomeningeal metastases (LM) using CNSide™ (CSF Tumor Cells)

compared to standard of care (CSF cytology, clinical evaluation,

and imaging). The goal of the FORESEE trial is to evaluate the

performance of CNSide in monitoring the response of LM to treatment

and to assess the impact of CNSide on treatment decisions made by

physicians. The trial is enrolling up to 40 patients with breast or

non-small cell lung cancer (NSCLC) who have suspected or confirmed

LM. Standard of care methods to diagnose or assess the treatment

response of LM have limited sensitivity and specificity. This

creates challenges for physicians to manage LM or determine the

best course of treatment. CNSide is a Laboratory Developed Test

(LDT) that is used commercially at the physician’s discretion in

Biocept’s CLIA-certified, CAP-accredited laboratory.

About Biocept

Biocept is a molecular diagnostics company with commercialized

assays for patients with carcinomas or melanomas. Our experts have

spent years working to change the way physicians look at

cerebrospinal fluid in cancer patients. Biocept has developed a

unique, patented methodology to isolate cancer material that is

shed from the primary tumor, such as CSF tumor cells (CSF-TCs) and

cell-free DNA (cfDNA). As such, Biocept is a leading commercial

provider of testing services designed to enable clinicians to

rapidly detect and monitor cancer biomarkers from a cerebrospinal

fluid sample.

Forward-Looking Statements Disclaimer Statement

This news release contains forward-looking statements that are

based upon current expectations or beliefs, as well as a number of

assumptions about future events. Although we believe that the

expectations reflected in the forward-looking statements and the

assumptions upon which they are based are reasonable, we can give

no assurance that such expectations and assumptions will prove to

be correct. Forward-looking statements are generally identifiable

by the use of words like "will," "expect," “goal,” “objective,”

"believe" or "intend" or the negative of these words or other

variations on these words or comparable terminology. To the extent

that statements in this news release are not strictly historical,

including, without limitation, statements regarding FORESEE’s

potential to generate evidence of CNSide’s clinical utility to

support adoption into clinical care guidelines and broaden

physician adoption and support reimbursements, our expectation that

several additional medical centers will join the FORESEE clinical

trial in the coming weeks, our plan to provide further evidence of

CNSide’s clinical utility through publication in peer-reviewed

medical journals, additional manuscripts to be submitted for peer

review, our cash runway, and other statements that are not

historical fact, are forward-looking, and are made pursuant to the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. The reader is cautioned not to put undue reliance on

these forward-looking statements, as these statements are subject

to numerous risks and uncertainties, including that the results of

the FORESEE clinical trial may not support the inclusion of CNSide

in clinical care guidelines; Medicare and private payors may not

provide coverage and reimbursement or may breach, rescind or modify

their contracts or reimbursement policies or delay payments; risks

related to our need for additional capital; and the risk that our

products and services may not perform as expected. These and other

factors are described in greater detail under the "Risk Factors"

heading in our Quarterly Report on Form 10-Q for the quarter ended

March 31, 2023, filed with the Securities and Exchange Commission

(SEC) on May 10, 2023, and in our Quarterly Report on Form 10-Q for

the quarter ended June 30, 2023, being filed with the SEC today.

The effects of such risks and uncertainties could cause actual

results to differ materially from the forward-looking statements

contained in this news release. We do not plan to update any such

forward-looking statements and expressly disclaim any duty to

update the information contained in this press release except as

required by law. Readers are advised to review our filings with the

SEC at http://www.sec.gov/.

Biocept, Inc.

Condensed Balance

Sheets

(In thousands, except share

and per share data)

June 30,

December 31,

2023

2022

Assets

(unaudited)

Current assets:

Cash

$

6,633

$

12,897

Accounts receivable

800

2,151

Inventories, net

551

757

Prepaid expenses and other current

assets

876

538

Total current assets

8,860

16,343

Fixed assets, net

2,395

2,572

Lease right-of-use asset - operating

8,190

8,486

Lease right-of-use assets - finance

2,272

3,086

Other non-current assets

386

386

Total assets

$

22,103

$

30,873

Liabilities and

Stockholders' Equity

Current liabilities:

Accounts payable

$

1,467

$

1,523

Accrued liabilities

1,529

2,249

Current portion of lease liability -

operating

565

518

Current portion of lease liabilities -

finance

815

1,099

Financed insurance premiums

526

117

Total current liabilities

4,902

5,506

Non-current portion of lease liability -

operating

8,849

9,175

Non-current portion of lease liabilities -

finance

836

1,200

Payor liability

6,149

6,132

Warrant liability

1,077

—

Total liabilities

21,813

22,013

Commitments and contingencies

Stockholders’ equity:

Preferred stock, $0.0001 par value,

5,000,000 shares authorized; 2,090 shares issued and outstanding at

June 30, 2023 and December 31, 2022

—

—

Common stock, $0.0001 par value,

150,000,000 shares authorized; 2,407,381 shares and 568,994 shares

issued and outstanding at June 30, 2023 and December 31, 2022,

respectively.

—

—

Additional paid-in capital

309,503

307,298

Accumulated deficit

(309,213

)

(298,438

)

Total stockholders’ equity

290

8,860

Total liabilities and stockholders’

equity

$

22,103

$

30,873

Biocept, Inc.

Condensed Statements of

Operations

(In thousands, except shares

and per share data)

(Unaudited)

For the Three Months Ended

June 30,

For the Six Months Ended June

30,

2023

2022

2023

2022

Net revenues

$

589

$

5,819

$

1,262

$

25,763

Costs and expenses:

Cost of revenues

2,550

8,023

5,578

18,357

Research and development expenses

409

1,729

1,449

3,574

General and administrative expenses

3,494

4,300

6,482

10,556

Sales and marketing expenses

250

1,656

965

5,314

Total costs and expenses

6,703

15,708

14,474

37,801

Loss from operations

(6,114

)

(9,889

)

(13,212

)

(12,038

)

Other income (expense):

Interest expense, net

(50

)

(155

)

(96

)

(217

)

Other income, net

91

—

91

—

Change in fair value of warrant

liability

2,442

—

2,442

—

Total other income (expense):

2,483

(155

)

2,437

(217

)

Loss before income taxes

(3,631

)

(10,044

)

(10,775

)

(12,255

)

Income tax expense

—

—

—

—

Net loss

(3,631

)

(10,044

)

(10,775

)

(12,255

)

Net loss attributable to common

stockholders

$

(3,631

)

$

(10,044

)

$

(10,775

)

$

(12,255

)

Weighted-average shares outstanding used

in computing net loss per share attributable to common

stockholders:

Basic

1,036,529

563,528

813,180

562,561

Diluted

1,036,529

563,528

813,180

562,561

Net loss per common share:

Basic

$

(3.50

)

$

(17.82

)

$

(13.25

)

$

(21.78

)

Diluted

$

(3.50

)

$

(17.82

)

$

(13.25

)

$

(21.78

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230814999814/en/

Investor & Media

Contact: LHA Investor Relations Jody Cain Jcain@lhai.com

(310) 691-7100

Biocept (NASDAQ:BIOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

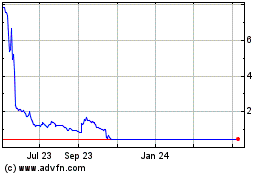

Biocept (NASDAQ:BIOC)

Historical Stock Chart

From Apr 2023 to Apr 2024