Amended Current Report Filing (8-k/a)

November 07 2019 - 4:58PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date of

Report (Date of earliest event reported): November 1,

2019

AYTU BIOSCIENCE, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

001-38247

|

47-0883144

|

|

(State

or other jurisdiction of incorporation)

|

(Commission

File Number)

|

(IRS

Employer Identification No.)

|

373 Inverness Parkway, Suite 206

Englewood, CO 80112

(Address

of principal executive offices, including Zip Code)

Registrant’s

telephone number, including area code: (720) 437-6580

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

☐

Written

communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

☐

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

☐

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b))

☐

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common

Stock, par value $0.0001 per share

|

|

AYTU

|

|

The

NASDAQ Stock Market LLC

|

Indicate

by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of

1934 (§240.12b-2 of this chapter).

Emerging growth

company ☐

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

On November 4,

2019, Aytu BioScience, Inc. (the “Company”), filed a

Current Report on Form 8-K (the “Original Form 8-K”)

that included Exhibit 10.6. In addition, on November 4, 2019, the

Company filed an Amended Current Report on Form 8-K (the

“First Amendment”) to refile Exhibit 10.6 to include

certain exhibits that were inadvertently omitted. The purpose of

this Amended Form 8-K (the “Second Amendment”) is to

refile Exhibit 10.6. The Second Amendment includes an appendix that

was inadvertently omitted. Exhibit 10.6 to the Second Amendment

supersedes the previous Exhibits 10.6 filed with both the Original

Form 8-K and the First Amendment. The exhibit filed with this

Second Amendment otherwise remains unchanged from the Exhibits 10.6

filed with the Original Form 8-K and First

Amendment.

This Second

Amendment should be read in conjunction with the Original Form 8-K,

the First Amendment and the Company’s other filings with the

SEC. Except as stated herein, this Amendment does not reflect

events occurring after the filing of the Original Form 8-K and

First Amendment with the SEC on November 4, 2019, and no attempt

has been made in this Amendment to modify or update other

disclosures as presented in the Original Form

8-K.

Item

1.01 Entry into a Material Definitive

Agreement.

Consent and Limited Waiver Agreement

Under the Purchase

Agreement, the Company has assumed from Seller a fixed payment

obligation to Deerfield CSF, LLC (“Deerfield”) of approximately $16.6

million (the “Deerfield

Obligation”). The Deerfield Obligation requires fixed

monthly payments equal to $86,840 from November 2019 through

January 2021 plus $15 million due in January 2021. Additionally,

monthly variable payments are due to Deerfield equal to 15% of net

revenue generated from a subset of the Product Portfolio, subject

to an aggregate monthly minimum of $100,000, except for January

2020, when a one-time minimum payment of $150,000 is due. The

variable payment obligation continues through February 2026 or

until aggregate variable payments of approximately $9.3 million

have been made. The Deerfield Obligation was previously assigned to

Seller pursuant to an asset purchase agreement between Seller and

Avadel U.S. Holdings, Inc. (“Avadel”) dated February 12, 2018.

In order to assign the Deerfield Obligation to the Company, each of

Deerfield and certain of its affiliates (collectively, the

“Deerfield

Parties”) and Avadel must consent to the assignment of

the Deerfield Obligation to the Company.

Accordingly, the

Company has entered into a Consent and Limited Waiver Agreement

among the Deerfield Parties, Avadel, Armistice Capital Master Fund,

Ltd. (“Armistice”), and Seller, dated

October 31, 2019 (the “Waiver”), pursuant to which: (i)

Armistice has agreed to enter into a guarantee of the Deerfield

Obligation (the “Armistice

Guarantee”); (ii) Seller has agreed to enter into a

guarantee of the Deerfield Obligation (the “Seller Guarantee” together with

the Armistice Guarantee, the “Guarantees”); and (iii) Armistice

has agreed to enter into an escrow agreement with the Deerfield

Parties (the “Escrow

Agreement”), pursuant to which Armistice will deposit

approximately $15 million into an escrow account. In consideration

for the Company assuming the Deerfield Obligation, the Guarantees,

and the Escrow Agreement, each of the Deerfield Parties and Avadel

have agreed to execute the Waiver and provide for assignment of the

Deerfield Obligation. Steven Boyd, a member of the Company’s

board of directors, is the founder and chief investment officer of

Armistice.

The foregoing

description of the Waiver, the Armistice Guarantee, the Seller

Guarantee, and the Escrow Agreement is qualified in its entirety by

the full text of: (i) the Waiver, a copy of which is attached

hereto as Exhibit 10.6; (ii) the Armistice Guarantee, a copy of

which is attached as Exhibit A-1 to the Waiver; (iii) the Seller

Guarantee, a copy of which is attached as Exhibit A-2 to the

Waiver; and (iv) the Escrow Agreement, a copy of which is attached

as Exhibit B to the Waiver.

Item 9.01 Financial Statements and

Exhibits.

(d)

The following exhibit is being filed herewith:

|

Exhibit

|

|

Description

|

|

|

|

Consent

and Limited Waiver Agreement, dated November 1,

2019

|

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

AYTU

BIOSCIENCE, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

November 7, 2019

|

|

By:

|

/s/ Joshua R. Disbrow

|

|

|

|

|

|

Joshua

R. Disbrow

|

|

|

|

|

|

Chief

Executive Officer

|

|

|

|

|

|

|

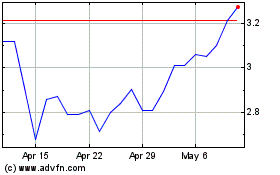

AYTU BioPharma (NASDAQ:AYTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

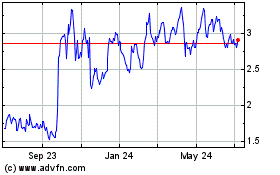

AYTU BioPharma (NASDAQ:AYTU)

Historical Stock Chart

From Apr 2023 to Apr 2024