Current Report Filing (8-k)

March 03 2023 - 5:25PM

Edgar (US Regulatory)

00-0000000 Units, each consisting of one Class A ordinary share and one-half of one redeemable warrant 0001868573 false 0001868573 2023-03-03 2023-03-03 0001868573 us-gaap:CapitalUnitsMember 2023-03-03 2023-03-03 0001868573 us-gaap:CommonClassAMember 2023-03-03 2023-03-03 0001868573 us-gaap:WarrantMember 2023-03-03 2023-03-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 3, 2023

APX ACQUISITION CORP. I

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Cayman Islands |

|

001-41125 |

|

N/A |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

Juan Salvador Agraz 65 Contadero, Cuajimalpa de Morelos Mexico City, Mexico |

|

05370 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: +52 (55) 4744 1100

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one Class A ordinary share, par value $0.0001, and one-half of one redeemable warrant |

|

APXIU |

|

The NASDAQ Stock Market LLC |

| Class A ordinary shares, par value $0.0001 per share |

|

APXI |

|

The NASDAQ Stock Market LLC |

| Warrants, each whole warrant exercisable for one share of Class A ordinary share for $11.50 per share |

|

APXIW |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On February 28, 2023, the Company issued an unsecured promissory note (the “Note”) in the amount of $875,000. The proceeds of the Note may be drawn in a single instance within five (5) business days after the date thereof.

The Note is payable in full on the earlier of (a) the Company’s consummation of a Business Combination (as defined in the Amended and Restated Memorandum and Articles of Association, as it may be amended from time to time) and (b) December 31, 2023 (the earlier of such dates, the “Due Date”). On the Due Date, the Company shall (i) pay to the Payee (as defined in the Note) the outstanding principal amount of the Note in immediately available funds (the “Principal Balance”) and (ii) deliver to the Payee, as interest-in-kind, a number of newly issued Warrants (as defined below) equal to the Principal Balance divided by (y) $1.00, rounded up to the nearest whole number of warrants (the “Warrants”). The terms of the Warrants would be identical to the warrants issued by the Company in a private placement that was consummated in connection with the Company’s initial public offering (“IPO”). The Payee shall be entitled to certain registration rights with respect to the Warrants and the shares issuable upon exercise of the Warrants.

The issuance of the Note was made pursuant to the exemption from registration contained in Section 4(a)(2) of the Securities Act of 1933, as amended.

A copy of the Note is attached as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference. The foregoing description is a summary only and qualified in its entirety by reference to the full text of the Note, a copy of which is attached as Exhibit 10.1 hereto and is incorporated by reference herein.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The disclosure contained in Item 1.01 of this Current Report on Form 8-K is incorporated by reference herein.

| Item 7.01. |

Regulation FD Disclosure. |

On March 3, 2023, the Company issued a press release, a copy of which is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein, announcing that the Company deposited $750,000 into the trust account established in connection with the Company’s IPO (the “Trust Account”) in order to effect the extension of the termination date, from March 9, 2023 to June 9, 2023, and may deposit an additional $750,000 into the Trust Account for a subsequent extension that may be needed by the Company to complete a Business Combination.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as shall be expressly set forth by reference in such a filing. Furthermore, the furnishing of information under Item 7.01 of this Current Report on Form 8-K is not intended to constitute a determination by the Company that the information contained herein, including the exhibits hereto, is material or that the dissemination of such information is required by Regulation FD.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits:

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 3, 2023

|

|

|

| APX ACQUISITION CORP. I |

|

|

| By: |

|

/s/ Xavier Martinez |

| Name: |

|

Xavier Martinez |

| Title: |

|

Chief Financial Officer |

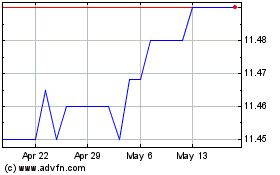

APx Acquisition Corporat... (NASDAQ:APXI)

Historical Stock Chart

From Apr 2024 to May 2024

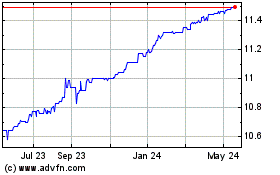

APx Acquisition Corporat... (NASDAQ:APXI)

Historical Stock Chart

From May 2023 to May 2024