Regulatory News:

Tikehau Capital (Paris:TKO) is hosting today its second

Capital Markets Day, in London, during which its founders and

executive team will outline the Group’s next growth chapter.

Powered by its strong balance sheet and unique corporate culture,

the Group will materially accelerate its expansion and profit

generation with the ambition to:

- Reach more than €65bn of AuM for its asset management

business by 2026, thus doubling the size of its AuM.

- Generate more than €250m of fee-related earnings

by 2026, a 2.6x progression vs 2021.

- Drive its return on equity to mid-teens level by

2026.

In addition to this strong outlook, Tikehau Capital announces

the following milestones recorded during the first months of

2022:

- The launch of an innovative impact fund focused on green

assets within its private equity business;

- The completion of a landmark $500m transaction in the credit

secondaries space;

- The opening of an office in Israel, the firm’s 13th

office worldwide;

- The gain of two large mandates with (i) a €100m impact

lending mandate in the Netherlands and (ii) Tikehau Capital’s

first ever corporate co-investment mandate in real estate

for €250m.

Finally, on 21 March 2022, Tikehau Capital has been assigned an

investment grade credit rating by Standard & Poor’s at BBB-

with stable outlook, a further act of acknowledgement of the

strength of both its business model and financial structure. In

January 2022, Fitch Ratings had re-affirmed Tikehau Capital’s

credit rating at BBB-, outlook stable.

A virtuous compounding model, fuelling a strong outlook for

2026

Scalability

>€65bn

x2

Asset Management AuM

vs. 2021 AM AuM

Operating leverage

>€250m

x2.6

Fee-related earnings (FRE)

vs. 2021 FRE

Value creation

Mid-teens

vs. 10%

Return on Equity by 2026

In 2021

Antoine Flamarion and Mathieu Chabran, co-founders of

Tikehau Capital, said: “Since its IPO in 2017, Tikehau Capital

has delivered significant growth, more than tripling its assets

under management and consistently outperforming its targets. This

amazing journey is first and foremost a credit to our talented and

dedicated teams. Today we embark on a new chapter of accelerated

growth and profitability, setting ambitious new targets for 2026.

We aim to double the size of our AuM, scaling up our platform and

pursuing the expansion of our geographical footprint, while

maintaining our performance and generating value for our investors

and shareholders. Tikehau Capital builds its future success on its

unique entrepreneurial culture and strong balance sheet, which

serves as a powerful growth compounder. Thanks to our diverse

talent base, constant ability to innovate and strong commitment to

sustainability, Tikehau Capital will continue to stand out as a

strong value-creation generator for all its stakeholders.”

The Group’s Capital Markets Day will start at

13:00 pm GMT (14:00 pm CET) and will be broadcasted live. To watch

the presentation, please connect to our website:

https://www.tikehaucapital.com/en/finance/capital-markets-day. A

replay will be available after the live presentation.

A second to none European track

record of profitable growth

- Tikehau Capital has built a solid track record of profitable

growth since IPO. The firm’s differentiating business model,

powered by its strong growth-compounding balance sheet, has powered

an outstanding 31% AuM CAGR since 2016, coupled with a 104% FRE1

CAGR over the same period.

- In addition, the firm has demonstrated consistent

over-achievement of targets set since IPO, delivering 2 years

ahead the 2020 AuM target communicated in March 2017 and achieving

in 2021 over 95% of each of its 2022 guidance, which had been

communicated in 2019.

- The Group’s outstanding growth since IPO has been supported by

its entrepreneurial culture, placing alignment of interests,

innovation and performance at its core. The firm has also built a

unique and differentiating platform with:

- A robust balance sheet, allowing Tikehau Capital to fuel

its asset management business growth, maintaining a high level of

alignment of interests with its shareholders and investor-clients

as well as carrying out accretive acquisitions, and

- Top talents across the firm, with complementary

expertise and backgrounds, a key asset to source investment

opportunities and drive investment performance.

- Those two strategic enablers will continue to be at the

heart of the Group’s growth trajectory by 2026.

Powerful secular trends underpinning the alternative industry

growth

- Tikehau Capital is positioned on a fast-growing market

benefiting from strong structural tailwinds. The alternative

asset management space has indeed grown by a 11% CAGR over

2015-20202 and is expected to keep growing at a fast pace by 2025.

Investors in search for diversification and high

risk-adjusted returns are set to keep allocating to the private

markets.

- While the alternative assets will represent 16% of global AuM

by 2025, they will account for the largest pool of revenues (46%).

The Group is therefore positioned on the most profitable

segment of the asset management market.

- In addition to these strong secular trends, Tikehau Capital

will leverage its differentiating investment approach to

seize attractive growth opportunities, especially in a world

currently in transition. The investment areas on which the Group

has built a growing exposure over the recent years, such as energy

transition, digitalization, cybersecurity or real estate asset

reconversion have proven to be resilient through cycles. The Group

is convinced that these investment focus will keep driving

long-term value creation.

An increasingly profitable growth momentum in asset

management

- Tikehau Capital is on track to accelerate its asset management

business growth based on two main pillars:

- Keep growing and scaling its “Yield” strategies, which

offer predictable, inflation-hedged regular returns as well as high

operating leverage and strong potential for adjacencies. Those

strategies include the firm’s private debt, European Core / Core+

Real Estate and fixed income strategies.

- Accelerate the transition of its “Value-Add” strategies to

the next level. Tikehau Capital’s Value-Add strategies, which

are less mature, generate higher returns derived from asset

transformation, higher management fees and offer strong potential

for scalability ahead. Those strategies include the firm’s private

equity, value-add real estate and infrastructure as well as equity

and flexible strategies.

- Scalability will be a powerful growth driver for all

Tikehau Capital strategies. The different phases of maturity for

the firm’s strategies offer multiple scalability drivers across the

platform, be it by launching large successor vintages poised to

scale thanks to strong performance, by maintaining a regular flow

of funds in market to capture client demand, by expanding LP base

globally in existing and new geographies or by leveraging existing

core expertise to launch adjacent initiatives, among others.

- Tikehau Capital’s financial model within its asset management

business is increasingly profitable. On the one hand, platform

scalability will drive strong operating leverage going

forward for both Yield and Value-Add strategies and, on the other

hand, performance fees are poised to represent a growing part of

the Group’s profits as its funds approach their respective

maturities.

- Building on strong scalability and operating leverage

prospects, Tikehau Capital targets to:

- Reach over €65bn of Asset Management AuM by 20263, i.e 2

times the level of AM AuM at 31 December 2021. While the Group has

grown its AM AuM by +€24bn over the past 5 years, this new guidance

implies a +€32bn growth of that metric over the next 5 years

- Generate over €250m of Fee-related earnings (FRE) by

20263, representing a +21% CAGR over 2022-2026, and a FRE

margin in the mid-forties area, compared to 36% of FRE margin

at 31 December 2021

Object omitted.

A synergetic, profitable and

disciplined portfolio allocation

- At 31 December 2021, Tikehau Capital’s investment portfolio

reached €2.7bn, off which 75% invested in its own strategies. The

Group has therefore achieved, one year ahead, the upper-range of

its 2022 target. This compares to 33% of investment portfolio

exposed to own strategies at 31 December 2017.

- Going forward, Tikehau Capital will keep leveraging on its

strong balance sheet to continue to:

- Invest in priority in its own strategies, generating

significant skin in the game and therefore compounding third-party

fundraising. It will also allow the firm to provide sponsor capital

to new or existing strategies, helping to accelerate time to

market. Between 2017 and 2021, Tikehau Capital has committed

approximately €0.5bn per year in its own asset management

strategies, which are now on the way to scale up and increasingly

contribute to Group’s profits. Tikehau Capital expects to keep

committing on average an equivalent amount within its own

strategies annually from 2022 to 2026. Such commitments shall

be called and cashed out over a longer time horizon, in line with

funds deployment pace.

- Carry out ecosystem investments, aiming at serving

Tikehau Capital’s asset management franchise by complementing the

firm’s expertise and geography, generating ancillary business as

well as developing long-term strategic partnerships.

- The returns, capital gains and capital recycling from by the

Group’s portfolio investments represent sizeable financial

means to fund future organic and inorganic growth

opportunities.

Object omitted.

A financial model on the way to

deliver its full potential

Since its IPO in 2017, Tikehau Capital delivered compelling

profitable growth while consistently overachieving its targets from

top to bottom line. As such, between 2017 and 2021, the Group

has been doubling its fee-related earnings on average every year,

demonstrating the relevance of its profitable growth model in the

alternative asset management space.

Going forward, Tikehau Capital’s financial model is on track

to deliver its full capacity, since investments in the Group’s

platform and funds are yet to crystallize all their potential, on

top of the firm’s strong future growth prospects.

- The strong AuM growth journey on which Tikehau Capital is

embarking, coupled with a growing operating leverage resulting from

the platform’s scalability, is expected to allow the Group to

multiply its FRE by more than 2.6 times over the next 5

years, with the target to reach more than €250m by 2026.

- Furthermore, since Tikehau Capital has expanded rapidly in

strategies eligible to performance fees, and given that such

strategies are delivering compelling returns, the contribution of

performance-related revenues to the Group’s earnings is

expected to rise materially in the medium-term.

- Finally, Tikehau Capital’s balance sheet is a critical

asset in the Group’s model. This perpetual capital base, which

is invested with discipline in priority within the Group’s asset

management strategies, is on track to generate growing and

increasingly predictable returns.

Thanks to these powerful profit engines, Tikehau Capital is

targeting to generate a return on equity at mid-teens level by 2026

(vs 10% in 2021).

Tikehau Capital is committed to strong shareholder value

creation, as evidenced also by its guidance to distribute more

than 80% of its asset management EBIT4 to shareholders as

ordinary dividend.

At 31 December 2021, Tikehau Capital relied on €3.0bn of

shareholders’ equity and €1.1bn of consolidated cash position,

as well as an undrawn revolving credit facility of €725m.

Furthermore, the Group’s investment portfolio amounted to

€2.7bn at 31 December 2021, of which 75% was invested in the

Group’s asset management strategies. The Group therefore has

significant financial resources to fund its growth

trajectory over the medium term in order (i) to remain at forefront

in innovation through regular funds launches (ii) to continue to

support its scaling asset management strategies and (iii) seize

inorganic growth opportunities.

Tikehau Capital has been assigned an investment grade credit

rating (BBB-, stable outlook) by Fitch Ratings in 2019

(confirmed in January 2022), and by Standard & Poor’s in March

2022, thus acknowledging the strength of both Tikehau Capital’s

business model and financial structure.

Sustainability at the service of

resilience and value creation

- The uncertain geopolitical context that characterizes the

beginning of 2022 is set to undoubtedly accelerate some of the

megatrends on which the Group has built a growing exposure

over the recent years, in particular energy transition,

cybersecurity and the broad range of impact-dedicated strategies

which aim at providing sustainable growth and resilience.

- Acting as a pioneer, Tikehau Capital initiated thematic and

impact investing as early as 2018 as part of the creation of a

European Energy Transition fund in private equity. Since then, the

firm has been driven by a strong dedication to accelerate in that

field and has developed an innovative platform dedicated to impact

around four key themes: (i) climate and biodiversity, (ii)

innovation, (iii) economic development and social inclusion, and

(iv) health.

- The Group’s responsible investment policy covers the full

spectrum of responsible investing through four pillars ranging from

exclusions to the development of products dedicated to sustainable

themes. At end-December 2021, c.70% of AuM and over 80% of

Private Equity AuM were classified SFDR Article 8 & 9

funds5. Tikehau Capital intends to keep launching

impact-dedicated strategies going forward, as evidenced in 2022 for

example by the launch of a decarbonization private equity fund in

North America or a green assets private equity strategy.

Key achievements in 2022 to date

Over the first months of 2022, Tikehau Capital has been very

active in delivering further progress across its strategies and

launching new promising initiatives. In particular, the Group

announces the following achievements:

- Tikehau Capital launches a new impact fund within the

Group’s private equity business

Focused on green assets, this fund is an impact fund as defined

by Article 9 of the SFDR and follows the firm’s ambition to

accelerate in its contribution to address the climate urgency. This

fund supports companies promoting decarbonising solutions or

companies engaged in ambitious decarbonisation plans. This fund

buys, finances, builds, owns and operates small decentralised

assets that enable to reduce the carbon footprint of their

end-users.

As such, the fund contributes to the acceleration of adoption of

green assets in the real economy in order to meet the 2030

objectives of the European Union and will participate to accelerate

the adoption of the European Fit For 55 & REPowerEU packages

aiming respectively at reducing by 55% the CO2 by 2030 and ensuring

energy security in Europe. The fund focuses on energy efficiency of

building and industrial sites, low carbon mobility, sustainable

agriculture, circular economy and clean energy generation. Total

commitments of the first closing of the fund reached more than

€100m.

- Tikehau Capital completes a landmark $500m transaction in

the credit secondaries space

Tikehau Capital announces the acquisition of approximately $500

million of Limited Partnership interest from a leading Asian

financial institution via its Private Debt Secondaries business, in

a direct lending fund managed by a leading US alternative asset

manager.

The transaction, which has been sourced and negotiated

bilaterally, is an LP-led secondary transaction involving a single

private debt fund focusing on the upper mid-market. To date, this

transaction represents one of the largest private debt secondaries

deal in the market.

The underlying portfolio is comprised of 30+ performing,

high-quality borrowers, diversified across geographies and sectors,

and backed by blue-chip equity sponsors. This represents the 8th

private debt secondaries investment completed by Tikehau Capital’s

private debt secondaries team.

- Tikehau Capital opens an office in Israel, the firm’s 13th

office worldwide

The Israeli market has significant untapped growth potential for

Tikehau Capital. Its dynamic and high-growth OECD economy has

accelerated its position as a global innovation hub with

sophisticated institutional and business communities.

As an early mover among global alternative asset managers,

Tikehau Capital wants to build a strong local presence in Israel in

order to capture the growing demand for alternative assets from

local investors, driven by structural market shifts. With this new

permanent presence, the Group has the ambition to accelerate its

expansion in the region, drawing on its expertise, resources, and

global network across its various asset classes (private debt, real

assets, private equity, and capital markets strategies), and direct

investment activities.

- Tikehau Capital wins a €100m impact lending mandate in The

Netherlands

Tikehau Capital has been entrusted by Pensioenfonds

Detailhandel, the pension fund for the retail sector in The

Netherlands, to manage a €100m impact private debt mandate, through

its Impact Lending strategy.

The investment mandate issued follows Pensioenfonds

Detailhandel’s decision to allocate c.1% of their total assets to

three managers active in the impact investing space. Tikehau

Capital was selected for its pan-European capabilities combined

with its highly regarded impact investing platform and

expertise.

Launched in December 2020, Tikehau Capital’s Impact Lending

strategy seeks to contribute to a sustainable European economy

while providing investors with competitive returns. It primarily

invests in SMEs which contribute to the sustainable economic

transition through their product offering, resource management, or

processes.

- Tikehau Capital wins its first ever corporate co-investment

mandate in real estate for €250m

In March 2022, Tikehau Capital was awarded a €250m real-estate

evergreen investment mandate by a leading global industrial company

for its German pension fund. Tikehau Capital has leveraged its

broad Real Estate platform, by proposing a fully dedicated fund

that would combine direct investments in Core / Core + assets as

well as indirect investments in Value-Add assets through the

Group’s real estate value-add strategy. This is a key milestone for

Tikehau Capital’s German footprint, following the opening of the

Group’s Frankfurt office in 2021.

CALENDAR

21 April 2022

Q1 2022 announcement (after market

close)

28 July 2022

2022 first half results (after market

close)

ABOUT TIKEHAU CAPITAL

Tikehau Capital is a global alternative asset management group

with €34.3 billion of assets under management (at 31 December

2021).

Tikehau Capital has developed a wide range of expertise across

four asset classes (private debt, real assets, private equity and

capital markets strategies) as well as multi-asset and special

opportunities strategies.

Tikehau Capital is a founder-led team with a differentiated

business model, a strong balance sheet, proprietary global deal

flow and a track record of backing high quality companies and

executives.

Deeply rooted in the real economy, Tikehau Capital provides

bespoke and innovative alternative financing solutions to companies

it invests in and seeks to create long-term value for its

investors, while generating positive impacts on society. Leveraging

its strong equity base (€3.0 billion of shareholders’ equity at 31

December 2021), the firm invests its own capital alongside its

investor-clients within each of its strategies.

Controlled by its managers alongside leading institutional

partners, Tikehau Capital is guided by a strong entrepreneurial

spirit and DNA, shared by its 683 employees (at 31 December 2021)

across its 13 offices in Europe, Asia and North America.

Tikehau Capital is listed in compartment A of the regulated

Euronext Paris market (ISIN code: FR0013230612; Ticker: TKO.FP).

For more information, please visit: www.tikehaucapital.com

DISCLAIMER:

This document does not constitute an offer of securities for

sale or investment advisory services. It contains general

information only and is not intended to provide general or specific

investment advice. Past performance is not a reliable indicator of

future earnings and profit, and targets are not guaranteed.

Certain statements and forecasted data are based on current

forecasts, prevailing market and economic conditions, estimates,

projections and opinions of Tikehau Capital and/or its affiliates.

Due to various risks and uncertainties. actual results may differ

materially from those reflected or expected in such forward-looking

statements or in any of the case studies or forecasts. All

references to Tikehau Capital’s advisory activities in the US or

with respect to US persons relate to Tikehau Capital North

America.

_____________________ 1 Fee-Related earnings 2 Source: BCG

Global Asset Management 2021. 3 Excluding potential acquisitions. 4

Defined as Fee-Related earnings + Performance-Related Earnings 5

Excluding Real Assets AuM - European Sustainable Finance Disclosure

Regulation (SFDR) is a set of EU rules which aim to make the

sustainability profile of funds more comparable and better

understood by end-investors

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220321005929/en/

PRESS: Tikehau Capital: Valérie Sueur – +33 1 40 06 39 30

UK – Prosek Partners: Henrietta Dehn – +44 7717 281 665 USA –

Prosek Partners: Trevor Gibbons – +1 646 818 9238

press@tikehaucapital.com

SHAREHOLDERS AND INVESTORS: Louis Igonet – +33 1 40 06 11

11 Théodora Xu – +33 1 40 06 18 56

shareholders@tikehaucapital.com

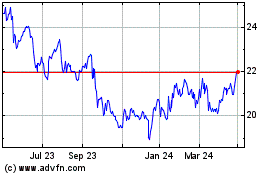

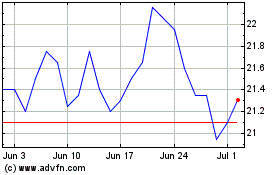

Tikehau Capital (EU:TKO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tikehau Capital (EU:TKO)

Historical Stock Chart

From Apr 2023 to Apr 2024