Tikehau Capital Appointed by the Belgian Federal Government to Manage the Belgian Recovery Fund

September 02 2021 - 2:45AM

Business Wire

The fund aims to support local companies

throughout post-Covid recovery

Regulatory News:

Tikehau Capital (Paris:TKO), the global alternative asset

management group, present in Belgium since 2015, has been appointed

by the Belgian federal authorities to manage the Belgian Recovery

Fund, which will allocate up to €350 million to finance Belgian

companies negatively impacted by the Covid-19 pandemic. This

mandate confirms Tikehau Capital's active role to finance Europe’s

economic recovery.

Following a broad international consultation, the Federal

Holding and Investment Company (“SFPI-FPIM”) appointed Tikehau

Investment Management, Tikehau Capital’s asset management

subsidiary, as manager of the Belgian Recovery Fund, to support the

Belgian economy and businesses across the country.

The fund will grant subordinated and/or convertible loans over

the next five years to companies active in Belgium. The SFPI-FPIM

will commit €100 million in the fund, and up to €250 million will

be raised from Belgian and international institutional

investors.

This success is a recognition of the expertise of Tikehau

Capital’s local investment teams, led by Edouard Chatenoud, Head of

Benelux, which have an established track record in financing

Belgian companies.

Tikehau Capital is already involved in several similar

initiatives in Europe and this success confirms its role as a key

player in financing the economy and the post-Covid recovery.

Antoine Flamarion and Mathieu Chabran, co-founders of Tikehau

Capital stated: "Tikehau Capital is committed to playing a

leading role in financing the economic recovery in Europe and we

recognise the importance of this project for the Belgian economy

and employment in the region. This initiative has a particular

resonance for Tikehau Capital as Belgium is one of the first

countries in which we established an on-the-ground presence, and we

are delighted to receive the support of the Belgian government and

the nation’s federal institutions. It is an honour to offer the

expertise of our pioneering private debt teams for this ambitious

programme and share our experience in managing public funds through

this public-private partnership to drive Belgium’s economic

recovery."

According to Koen Van Loo, CEO, and Céline Vaessen, Chief

Investment Officer, at SFPI-FPIM: "Since the beginning of the

pandemic, SFPI-FPIM has injected more than €400 million to support

several dozen Belgian companies in its historical investment

sectors such as aeronautics and life sciences, which were strongly

impacted by the health crisis. We have also continued to invest in

the recovery, with new participations such as Univercells and

ExeVir Bio, which are developing solutions related to vaccination

and anti-Covid treatments. Following a market consultation, we are

delighted to have chosen Tikehau Capital to manage the Belgian

Recovery Fund, given its solid track record in Belgium and the

expertise of their teams."

ABOUT TIKEHAU

CAPITAL

Tikehau Capital is a global alternative asset management group

with €30.9 billion of assets under management (as of 30 June 2021).

Tikehau Capital has developed a wide range of expertise across four

asset classes (private debt, real assets, private equity and

capital markets strategies) as well as multi-asset and special

opportunities strategies.

Tikehau Capital is a founder led team with a differentiated

business model, a strong balance sheet, proprietary global deal

flow and a track record of backing high quality companies and

executives.

Deeply rooted in the real economy, Tikehau Capital provides

bespoke and innovative alternative financing solutions to companies

it invests in and seeks to create long-term value for its

investors, while generating positive impacts on society. Leveraging

its strong equity base (€2.8 billion of shareholders’ equity as of

31 December 2020), the firm invests its own capital alongside its

investor-clients within each of its strategies.

Controlled by its managers alongside leading institutional

partners, Tikehau Capital is guided by a strong entrepreneurial

spirit and DNA, shared by its 629 employees (as of 30 June 2021)

across its 12 offices in Europe, Asia and North America. Tikehau

Capital is listed in compartment A of the regulated Euronext Paris

market (ISIN code: FR0013230612; Ticker: TKO.FP).

For more information, please visit: www.tikehaucapital.com

DISCLAIMER:

This document does not constitute an offer of securities for

sale or investment advisory services. It contains general

information only and is not intended to provide general or specific

investment advice. Past performance is not a reliable indicator of

future earnings and profit, and targets are not guaranteed.

Certain statements and forecasted data are based on current

forecasts, prevailing market and economic conditions, estimates,

projections and opinions of Tikehau Capital and/or its affiliates.

Due to various risks and uncertainties. actual results may differ

materially from those reflected or expected in such forward-looking

statements or in any of the case studies or forecasts. All

references to Tikehau Capital’s advisory activities in the US or

with respect to US persons relate to Tikehau Capital North

America.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210901006071/en/

PRESS CONTACTS: Tikehau Capital: Valérie Sueur – +33 1 40 06 39

30 UK – Prosek Partners: Henrietta Dehn – +44 7717 281 665 USA –

Prosek Partners: Trevor Gibbons – +1 646 818 9238

press@tikehaucapital.com

SHAREHOLDER AND INVESTOR CONTACT: Louis Igonet – +33 1 40 06 11

11 shareholders@tikehaucapital.com

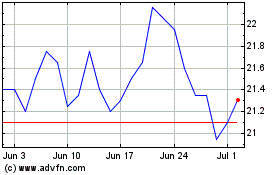

Tikehau Capital (EU:TKO)

Historical Stock Chart

From Mar 2024 to Apr 2024

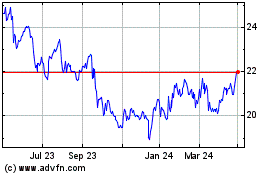

Tikehau Capital (EU:TKO)

Historical Stock Chart

From Apr 2023 to Apr 2024