Nissan and Renault Plan Post-Merger Integration Without a Merger -- Heard on the Street

May 28 2020 - 9:29AM

Dow Jones News

By Stephen Wilmot

Can companies cut their way out of a crisis? And has this crisis

become so bad that radical cultural change is possible? In the case

of Nissan Motor Co. and its global car-making alliance with Renault

SA and Mitsubishi Motors Corp., it is easier to be optimistic about

the first question than the second.

As part of a much-anticipated transformation plan, Nissan said

Thursday it would revive profits by shrinking its production

capacity by 20%, particularly in areas like Europe and Southeast

Asia that it no longer considers "core." On Friday, Renault will

announce its own plan, with the need for factory closures awkwardly

set against the backdrop of a $5 billion rescue loan package backed

by the French government, its anchor shareholder.

The cuts will be made possible by a much deeper level of

cooperation. According to a high-level strategy unveiled Wednesday,

each alliance member will focus on its strengths according to a

"leader-follower" principle, whether in terms of vehicle type,

technology or region. So Nissan will take the lead on larger cars

and the U.S., Chinese and Japanese markets; Renault on smaller cars

in Europe and South America; and Mitsubishi on big plug-in hybrids

and South East Asia.

Reducing costs is a tried and tested strategy for reviving car

makers, though not a quick one. Better cash flows can then be

plowed into new products, stimulating a sales revival and even

better cash flows. Nissan went through something like this virtuous

cycle in the early 2000s under former boss Carlos Ghosn, whom it

now blames for its current problems. Renault's French peer Peugeot

is a more recent example: Having made massive layoffs in 2012

following the euro crisis, it is now one of the most profitable

mass-market car makers in the world.

What has no precedent is the kind of industrial collaboration

with which Nissan and Renault hope to achieve their cuts. They want

to share not just vehicle "platforms" or underpinnings -- as almost

40% of their cars already do -- but also much of its upper body

too. They even intend to share factories where necessary to improve

capacity utilization. Mitsubishi, which only joined the alliance in

2016, is along for part of the ride.

It feels like a postmerger integration plan without the merger.

Alliance chairman Jean-Dominique Senard again ruled out a

full-blown tie-up Wednesday. But keeping their assets and profits

separate means the leadership teams will be left constantly

balancing interests to make sure the benefits of integration are

spread equally. The risk is that the plan's strictly rational

approach to capital allocation degenerates, as it has before, into

horse-trading or recriminations.

This risk is heightened by the nationalist tone of contemporary

geopolitics. Late Tuesday, France's President Emmanuel Macron

announced an EUR8 billion ($8.79 billion) package of post-Covid

measures to support the country's auto industry, including

Renault's loan guarantee and extra subsidies for electric vehicles.

In exchange, he wants France to be a center for their production,

and for Renault to invest in a European battery company.

Electric vehicle technology, which Nissan and Renault both

pioneered and see as strategic, is a potential flashpoint for

political tensions within the alliance. Each claimed some form of

leadership on the electric powertrain on Wednesday. In this, as in

so many other elements of the alliance, keeping everyone happy will

be anything but easy.

Write to Stephen Wilmot at stephen.wilmot@wsj.com

(END) Dow Jones Newswires

May 28, 2020 09:14 ET (13:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

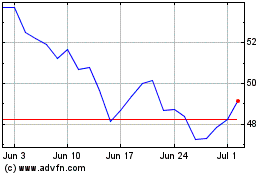

Renault (EU:RNO)

Historical Stock Chart

From Mar 2024 to Apr 2024

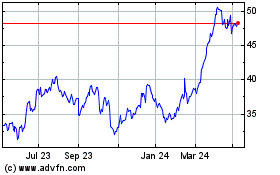

Renault (EU:RNO)

Historical Stock Chart

From Apr 2023 to Apr 2024