GSF Suez Board Moves To Ease Financing International Power Bid

April 02 2012 - 1:41PM

Dow Jones News

Power operator GDF Suez SA's (GSZ.FR) preparations for a

potential bid for the remaining shares in International Power PLC

(IPN.LN) it doesn't own were gathering pace as its board moved

Monday to ease any financing issue for the proposed offer.

GDF Suez admitted Thursday it is considering formally bidding

for the remaining 30% stake in International Power it doesn't own

at 390 pence ($62.47) a share.

The potential move has been approved by the group's two largest

shareholders--the French state which owns 36%, and Belgian

businessman Albert Frere's holding Groupe Bruxelles Lambert

(GBLB.BT) which owns 5.2%--as well as by its board, "unanimously,"

it said.

GDF Suez's directors also decided to offer shareholders the

possibility to receive the final dividend for 2011, representing 67

euro cents (89 U.S. cents) per share, in GDF Suez shares and not in

cash, the group said.

"This resolution is intended to supplement the financing of the

proposed offer for the remaining International Power shares not

already held by GDF Suez in complement to the upward revision of

the disposal plans previously announced," it explained, adding that

the French state and Groupe Bruxelles Lambert went for that

option.

The directors also agreed to offer the same possibility for the

interim dividend for 2012.

Asked if this move was designed to help GDF Suez to increase its

offer or to maintain its A credit rating, a spokesman for GDF Suez

declined to comment.

Thursday, International Power said that it had received the

proposal but didn't elaborate on the reaction of its management nor

its board and has remained mute on the potential offer since.

The price mentioned by GDF Suez--a "fair price" according to the

group's Chairman and Chief Executive Gerard Mestrallet Thursday--is

seen by analysts as probably too low to appeal to International

Power's remaining shareholders and Monday, shareholder Neptune

Investment Management actually said that GDF Suez SA should raise

it.

Robin Geffen, who runs Neptune, told Dow Jones Newswires the bid

was "slightly light." "The stock has traded above GBP4 so that does

indicate there are more buyers than sellers at 390 pence," he said.

"There are quite a few institutions who feel that the bid should

begin with a four, not a three."

GDF Suez's potential offer would value the remaining stake at

around GBP6 billion.

Thursday, Mestrallet insisted that the group was committed to

maintaining its A credit rating and would be therefore ready to

increase the amount of disposals it has already planned to dispose

of EUR10 billion of assets between 2011 and 2013. Earlier this

year, it said that in 2011, it completed two thirds of the assets

sales that were planned over the period.

-By Geraldine Amiel, Dow Jones Newswires; +33 1 40171767;

geraldine.amiel@dowjones.com

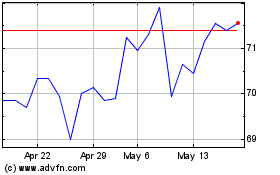

Groupe Bruxelles Lambert (EU:GBLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Groupe Bruxelles Lambert (EU:GBLB)

Historical Stock Chart

From Apr 2023 to Apr 2024