EssilorLuxottica: Full year 2019 results / Uplift in Sales and Net

Profit growth / Strong foundation to accelerate synergy delivery

Full year 2019 results

Uplift in Sales and Net Profit

growth Strong foundation to accelerate synergy

delivery

- Revenue growth at constant exchange rates2 of 4.4%,

compared to 3.2% in 2018 pro forma1

- Adjusted6 operating profit: Euro 2,812 million, 16.2%

of revenue

- Adjusted6 net profit attributable to owners of the

parent: Euro 1,938 million, 11.1% of revenue and growth of 4.8%1 at

constant exchange rates2

- Free cash flow7: Euro 1,825 million

- Adjusted6 EPS: Euro 4.46

- Dividend recommendation: Euro 2.23 per share, scrip

dividend proposed

Charenton-le-Pont, France (March 6, 2020

– 7:00am) - The Board of

Directors of EssilorLuxottica met on March 5, 2020 to approve the

consolidated financial statements for the year ended December 31,

2019. These financial statements were audited by the Statutory

Auditors whose certification report is in the process of being

issued. The Board of Directors has also approved the Restated

Unaudited Pro Forma1 Consolidated Financial Information for the

year ended December 31, 2018, which has been prepared for

illustrative purposes only.

“In its first full year, EssilorLuxottica

delivered a solid performance. It advanced on its Mission and

delivered innovative products at every price point to customers and

consumers worldwide while generating profitable growth. This

translated into strong revenue, free cash flow and net profit

growth, in line with guidance. The Company also implemented a range

of structural decisions in order to start the integration process

and the delivery of the expected synergies presented at its Capital

Markets Day. Essilor, for its part, performed strongly. It

continued to leverage its unique innovation capabilities in vision

care and eyewear, its digital platforms and the flexibility

provided by its global network of interconnected plants and

prescription laboratories”, said Laurent Vacherot, CEO of

Essilor.

"When we look at Luxottica’s performance over

the past year, there is so much to be proud of, both in terms of

our solid results and many notable achievements - our continued

digital transformation in particular proved that the work we’ve

done over the past five years is paying off. Along with growing and

improving our profits, we set a new standard for the way technology

can elevate an entire organization, from online sales growth to our

deep connections with consumers across every channel. These

successes, along with our outstanding cash flow generation of 1.2

billion Euro, were key contributors to EssilorLuxottica’s overall

results for the year”, commented Francesco Milleri, Deputy Chairman

and CEO of Luxottica.

Full year 2019 adjusted6 results

2019 is the first year in which

EssilorLuxottica’s consolidated statement of profit or loss shows

the full year performance of both Essilor’s and Luxottica’s

businesses. However, since the 2018 information presented in the

statement of profit or loss is affected by the accounting of the

combination between Essilor and Luxottica, the financial

information deemed relevant to compare 2019 performance is based on

the restated pro forma1 information for the year ended December 31,

2018.

|

In millions of Euros |

2019 |

2018* pro

forma1 |

Reported Change |

| Revenue |

17,390 |

16,194 |

+7.4% |

| Adjusted6

gross profit |

10,887 |

10,209 |

+6.6% |

| % of revenue |

62.6% |

63.0% |

|

| Adjusted6

operating profit |

2,812 |

2,618 |

+7.4% |

| % of revenue |

16.2% |

16.2% |

|

| Adjusted6

net profit attributable to owners of the parent |

1,938 |

1,774 |

+9.2% |

| % of revenue |

11.1% |

11.0% |

|

* The 2018 comparative information has been

restated following the application of IFRS 16 Leases, as well as to

reflect the finalization of the purchase price allocation (“PPA”)

related to the EssilorLuxottica Combination.

In 2019, EssilorLuxottica’s full year revenues

grew by 7.4% compared to prior-year pro forma1 revenue (4.4% at

constant exchange rates2). The Company’s adjusted6 gross profit as

a percent of sales came in at 62.6% while adjusted6 operating

profit was stable at 16.2% of sales. Adjusted6 net profit

attributable to the owners of the parent of Euro 1,938 million

represents an increase of 9.2%1 compared to the prior year (4.8%1

at constant exchange rates2).

Full year 2019 highlights

- Strong revenue growth at constant exchange rates2 across all

divisions with the best performance from Sunglasses & Readers

up 8.9%, Lenses & Optical Instruments up 5.5%, and Retail up

4.0%;

- Direct e-commerce, which represented around 5% of consolidated

revenue, grew by 16% at constant exchange rates2, with positive

trends across all major platforms and regions;

- On a geographical basis at constant exchange rates2, Fast

Growing Markets4 expanded by 8.5% and represented close to 20% of

revenue, Europe grew by 5.1% and North America was in line with

global market growth at 3.1%;

- Adjusted6 operating profit as a percent of sales remained

stable reflecting underlying margin improvement offset by

investments behind key brands and growth initiatives

worldwide;

- Free cash flow7 amounted to Euro 1.8 billion, the same level as

last year despite the impact of fraudulent financial activity at

one of Essilor’s plants in Thailand;

- Key investment fueled new product launches (notably

Transitions® Signature® GEN 8TM and Vision-RTM 800), further

digitalization of the business, stronger offerings on proprietary

e-commerce sites, refurbishment of key retail stores and expansion

of operating structures in Fast Growing Markets4 among others;

- Activation of synergies in line with Company’s expectations,

with structural decisions creating a strong foundation for an

increase in synergy delivery in 2020 and 2021;

- Continued strong momentum in external growth with the proposed

acquisition of GrandVision and several bolt-on transactions such as

Barberini in Italy and Brille24 in Germany.

Fourth quarter 2019

highlights

- Lenses & Optical Instruments grew by 5.2% at constant

exchange rates2 thanks to Fast Growing Markets4, the Transitions®

Signature® GEN 8TM launch in the United States and double

digit-growth in e-commerce;

- Sunglasses & Readers grew by 10.1% at constant exchange

rates2 with a strong performance by Xiamen Yarui Optical in China,

fueled by its expansion into optical frames and online sales;

- Wholesale rose by 2.4% at constant exchange rates2 thanks to

stronger performance in North America (including independents), key

markets in Europe, steadily sound trends in Brazil with Óticas

Carol and rebuilt Mainland China;

- Retail continued on its solid path, up 4.6% at constant

exchange rates2, thanks to the optical networks in North America

(including positive trends at LensCrafters) as well as the entire

business in Australia, Europe and Brazil;

- Fraudulent financial activity was discovered at one of Essilor

International’s plants in Thailand. The financial impact has been

fully recorded in the 2019 consolidated statement of profit or

loss for an amount of Euro 185 million after taking into

account foreign exchanges impacts;

- The Company launched a bond issuance for a total amount of Euro

5 billion, notably to (re)finance a portion of the consideration to

be paid in relation to the proposed acquisition of GrandVision, to

(re)finance the existing debt of the Company and to fund general

corporate purposes. Group net debt amounted to Euro 4,046 million

at the end of December 2019, compared to Euro 3,849 at the end of

December 2018 (restated following the implementation of IFRS 16

Leases).

Synergies and integration The

Company has started to drive integration and deliver revenue and

cost synergies. It confirms that the net impact of those synergies

on adjusted6 operating profit is expected to be in the range

of:

- Euro 300 to Euro 350 million in the period

2019-2021;

- Euro 420 to Euro 600 million by

2022-2023.

In 2019, the first synergies generated as part

of this plan were in line with internal expectations. This included

the development of Essilor lenses, including the most innovative

and technologically advanced categories, within the Company’s own

retail networks as well as key initiatives in R&D, procurement,

prescription laboratories and insourcing.

In addition, structural decisions were made

during the year to create a strong foundation for further

integration and accelerate synergy delivery in 2020 and 2021, in

line with the plan. These decisions include:

- Defining one single IT platform to be rolled out across the

Company, after the ongoing pilot project in Italy;

- Creating one single network of prescription laboratories, as

part of an integrated supply chain;

- Establishing a unified platform for the provision of complete

pairs of branded glasses, starting with the availability of full

prescription products under the Ray-Ban brand both in the clear and

sun segments;

- The full integration of Costa into the brand portfolio of

Luxottica;

- A common employee shareholding plan, which was extended to

Luxottica employees in Italy in 2019 with a subscription rate of

over 67%.

Eliminating poor vision around the world

Essilor has created more than 15,000 inclusive

businesses worldwide since 2013, which have the potential to give

more than 300 million people access to vision health. These access

points delivered vision solutions to 10.7 million new eyeglass

wearers in 2019 alone, bringing the total for the past seven years

to 33.5 million.These efforts earned EssilorLuxottica the 17th spot

in Fortune Magazine’s annual Change the World list in 2019. In this

same spirit of raising awareness on good vision, Essilor made

presentations in different parts of the world to leverage the

report it published on the sidelines of the last United Nations

General Assembly session, entitled “Eliminating Poor Vision in a

Generation: What will it take to eliminate uncorrected refractive

errors by 2050?”. The report quantifies the scale of uncorrected

poor vision in the world and recommends a cumulative investment of

$14 billion over the next 30 years to eliminate it.In 2019, Essilor

worked toward this goal through partnerships to eliminate poor

vision in many regions. In Bhutan, 30,000 pairs of glasses have

been delivered to date to make this country the first in the world

to eliminate poor vision. In India, more than 143,000 people were

screened to put the Doddaballapura region on track to be the first

in the country to also eliminate poor vision by 2021. In Nepal, the

company signed a letter of intent to provide access to eye care to

the 350,000 residents of the Bhaktapur district. And in China,

Essilor worked with the Huoqiu County to eliminate poor vision in

the county within three years. Partnerships were also launched with

governmental ministries in France, Kenya and India to promote eye

exams and raise awareness about the importance of visual health in

schools or among underprivileged children (see page 15 for more

details).

Subsequent events

COVID-19The current COVID-19

epidemic has a negative impact on the Company’s business in Greater

China, which represents approximately 5% of consolidated revenue.

So far, the virus has also slightly impacted the Company’s revenue

performance in other regions. At the current level, inventory is

sufficient to meet several weeks of demand.In terms of production,

EssilorLuxottica plants in China are currently operating at

slightly reduced capacity, which is quickly normalizing, while the

plants in Italy and all other locations are currently running at

full capacity. Contingency plans can be activated in case of a

protracted pandemic. They would aim at optimizing the Company’s

global infrastructure. EssilorLuxottica can rely on a worldwide

network of plants and laboratories, which allow flexibility and

continuity.

GrandVisionThe European

Commission has initiated a Phase II review of the proposed

acquisition of GrandVision. The transaction has been

unconditionally cleared so far in the United States, Russia and

Colombia, and it is currently under review also in Brazil, Chile,

Mexico and Turkey (see page 28 for more details).

FraudThe Company announced on

December 30, 2019 that it had discovered fraudulent financial

activity at an Essilor plant in Thailand. Since then, Essilor

International has implemented a wide range of corrective measures

under the supervision of the EssilorLuxottica Board of Directors

(see page 28 for more details).

Management Changes

EssilorLuxottica confirms that the search for a

new CEO is ongoing. It is now also considering internal

candidates. The final appointment is expected to be made by the end

of 2020.

David Wielemans is appointed co-CFO of

EssilorLuxottica alongside Stefano Grassi, in replacement of Hilary

Halper.

Ariel Bauer is appointed co-Head of Investor

Relations of EssilorLuxottica alongside Giorgio Iannella, in

replacement of Véronique Gillet.

DividendThe Board of Directors

will recommend that shareholders at the Annual Meeting to be held

on May 15, 2020 approve the payment of a dividend of Euro 2.23 per

share. Shareholders will be offered the option of receiving their

dividend in cash or in newly issued shares. The dividend will be

paid – or the shares issued – as from June 15, 2020.

OutlookThe Company’s financial

objectives for 2020 assume that the COVID-19 outbreak will subside

in the next few months.

Based on this assumption, and excluding any

contribution from GrandVision, EssilorLuxottica expects to grow in

sales and profits. Including synergies and at constant exchange

rates2, it is projecting the following:

- Sales growth: +3.0%-5.0%

- Adjusted6 operating profit growth: 0.7-1.2x sales growth

- Adjusted6 net profit growth: 0.7-1.2x sales growth

In addition, due to the COVID-19 outbreak, the

Company’s current expectation is for revenue growth to be below the

annual trend in the first half of the year, followed by a recovery

in the second half.

Conference callA conference

call in English will be held today at 11 am CET.The meeting will be

available live and on a replay mode

at:https://channel.royalcast.com/webcast/essilorluxotticaen/20200306_1/

Upcoming investor events

- Q1 2020 Sales: May 5, 2020;

- Annual Shareholders Meeting: May 15, 2020;

- H1 2020 Results: July 31, 2020.

Notes

1 Pro forma: the Restated

Unaudited Pro Forma Consolidated Financial Information has been

produced for illustrative purposes only, with the aim of providing

comparative information for the year ended December 31, 2018 as if

the combination between Essilor and Luxottica had occurred on

January 1, 2018. For further details, please refer to the table in

the Appendix.2 Constant exchange rates: figures at

constant exchange rates have been calculated using the average

exchange rates in effect for the corresponding period in the

previous year.3 Like-for-like: growth at constant

scope and exchange rates.4 Fast-growing countries or

markets: include China, India, ASEAN, South Korea, Hong

Kong, Taiwan, Africa, the Middle East, Russia, Eastern Europe and

Latin America.5 Comparable store sales or comps:

reflect, for comparison purposes, the change in sales from one

period to another by taking into account in the more recent period

only those stores already open during the comparable prior period.

For each geographic area, the calculation applies the average

exchange rate of the prior period to both periods.6

Adjusted measures or figures: adjusted from the expenses

or income related to the combination between Essilor and Luxottica

and other transactions that are unusual, infrequent or unrelated to

the normal course of business as the impact of these events might

affect the understanding of the Group’s performance.7 Free

Cash Flow: Net cash flow provided by operating activities

less the sum of Purchase of property, plant and equipment and

intangible assets and Cash payments for the principal portion of

lease liabilities according to the IFRS consolidated statement of

cash flow.

EssilorLuxottica is a global leader in the

design, manufacture and distribution of ophthalmic lenses, frames

and sunglasses. Formed in 2018, its mission is to help people

around the world to see more, be more and live life to its fullest

by addressing their evolving vision needs and personal style

aspirations. The Company brings together the complementary

expertise of two industry pioneers, one in advanced lens technology

and the other in the craftsmanship of iconic eyewear, to set new

industry standards for vision care and the consumer experience

around it. Influential eyewear brands including Ray-Ban and Oakley,

lens technology brands including Varilux® and Transitions®, and

world-class retail brands including Sunglass Hut and LensCrafters

are part of the EssilorLuxottica family. In 2019, EssilorLuxottica

had over 150,000 employees and consolidated revenues of Euro 17.4

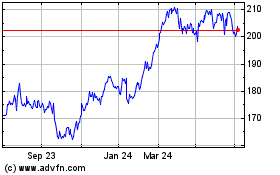

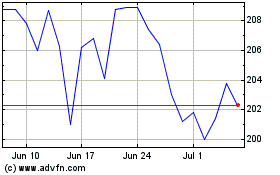

billion. The EssilorLuxottica share trades on the Euronext Paris

market and is included in the Euro Stoxx 50 and CAC 40 indices.

Codes and symbols: ISIN: FR0000121667; Reuters: ESLX.PA; Bloomberg:

EL:FP.

CONTACTS

|

EssilorLuxottica Investor

Relations(Charenton-le-Pont) Tel: + 33 1 49 77 42

16(Milan) Tel: + 39 (02) 8633 4870E-mail:

ir@essilorluxottica.com |

EssilorLuxottica Corporate

Communications(Charenton-le-Pont) Tel: + 33 1 49 77 45

02(Milan) Tel: + 39 (02) 8633 4470E-mail:

media@essilorluxottica.com |

Excerpts from the full year 2019

management report

Full year 2019 revenue by operating

segment

|

In millions of Euros |

2019 |

2018 Restated*

Pro forma1 |

Change at constant rates2 |

Currency effect |

Change (reported) |

| Lenses &

Optical Instruments |

6,791 |

6,283 |

+5.5% |

+2.6% |

+8.1% |

| Sunglasses &

Readers |

885 |

787 |

+8.9% |

+3.6% |

+12.5% |

| Equipment |

221 |

210 |

+2.0% |

+3.3% |

+5.3% |

|

Essilor revenue |

7,897 |

7,280 |

+5.8% |

+2.7% |

+8.5% |

| Wholesale |

3,260 |

3,145 |

+1.8% |

+1.9% |

+3.7% |

| Retail |

6,232 |

5,769 |

+4.0% |

+4.0% |

+8.0% |

|

Luxottica revenue |

9,493 |

8,914 |

+3.2% |

+3.3% |

+6.5% |

|

Total |

17,390 |

16,194 |

+4.4% |

+3.0% |

+7.4% |

* 2018 information has been restated following

the application of IFRS 16 Leases.

EssilorLuxottica’s revenue amounted to Euro

17,390 million and increased by 4.4% at constant exchange rates2 in

2019, in the upper half of the Group’s 3.5% to 5% outlook.

Lenses & Optical

Instruments

The Lenses & Optical Instruments division

grew by 5.5% at constant exchange rates2 in 2019, for total sales

of Euro 6,791 million. The division showed strength across all

regions through a continued focus on innovation, fast growing

markets4 and e-commerce. Key milestones in 2019 included the launch

of Transitions® Signature® GEN 8TM in the US market, the success of

the Vision-R™ 800 phoropter in Europe, double-digit growth both in

China, thanks to branded lenses (notably EyezenTM, Crizal® and

Varilux®), and Latin America owing to market expansion activities

and a new partnership with a key player in the region.

Sunglasses & Readers

The Sunglasses & Readers division performed

well in 2019, with revenue rising 12.5% to Euro 885 million (+8.9%

at constant exchange rates2). This reflected robust results in

China, especially for Xiamen Yarui Optical (Bolon™) and strong

market demand for readers and sunglasses at Costa and FGX

International in the United States. Furthermore, e-commerce sales

were once again buoyant for the division, with revenue ending the

period up by more than 20% on a like-for-like3 basis.Lastly, in

keeping with the commitments made to Turkish antitrust authorities

at the time of the combination with Luxottica, Essilor divested its

subsidiary Merve, which markets sunglasses to consumers in

Turkey.

Equipment

The Equipment division grew by 2% at constant

exchange rates2 with a mix of solid market trends in Europe, Latin

America and Asia offset by a slowdown in the capital investment

cycle in other developed markets, partly due to industry

consolidation. On a consolidated financial basis, Europe and Asia

contributed to growth while North America and Latin America were

headwinds. With respect to products, performance was driven by

digitalization, new generation surfacing machines and coating

machines. The order book ended the year slightly up. The business

contributed to group profitability, which enabled continued R&D

investment to support innovation in production methods and lab

efficiency across the global ophthalmic lens industry.

Wholesale

The Wholesale division closed the year with

revenue up by 3.7% to Euro 3,260 million, or +1.8% at constant

exchange rates2, the strongest pace since 2015 thus proving the

effectiveness of the set of strategic initiatives undertaken. All

regions were on the rise, with a remarkable acceleration

experienced by North America over the second part of the year

supported by positive trends at independents, department stores and

third-party e-commerce. The steady growth posted by Europe was

driven by volumes and benefited from the relentless evolution of

STARS. On a global basis, the program is now comprised of

approximately 16,600 doors, representing over 13% of sales for the

Wholesale division. As for Asia, Oceania and Africa and Latin

America, both the regions experienced a deceleration in the second

half of 2019, mainly attributable to poor trends in Hong Kong and

travel retail and a weakening performance in Mexico respectively.

Conversely, Brazil was among the top performers and recorded a

sustained growth, at high single digit pace during the twelve

months, boosted by STARS and Óticas Carol (both meaningfully

increasing the number of doors). Mainland China continued to

leverage the success of the strategic repositioning of the business

undertaken two years ago.

Retail

The Retail division was up 8.0% in revenue to

Euro 6,232 million in the full year, or +4.0% at constant exchange

rates2, with accelerating momentum in the fourth quarter. Revenue

was positive throughout the entire year, with comparable store

sales5 slightly above the parity in the twelve months. In North

America all the networks contributed to the division growth, in

particular the Optical Retail Business led the growth with

LensCrafters posting the strongest quarter of the year (thanks to a

healthy insurance week and a strong price-mix), a solid

contribution from the insurance business unit Eye Med as well as

Target Optical and Pearle Vision. During the fourth quarter the

sales drop was amplified at Sears Optical. In Europe Sunglass Hut

and Salmoiraghi & Viganò kept nicely growing, like both optical

and sun business did in Australia and sun in Brazil. Hong Kong

confirmed to be a drag, with no signs of improvement, while GMO was

impacted by protests in Chile and Ecuador in the last quarter of

the year. Direct e-commerce grew double digit across all the

platforms in the full year, mostly driven by North America that

posted in the fourth the best quarter of the year.

Full Year 2019 revenue by geographical area

|

In millions of Euros |

2019 |

2018 Restated*

Pro forma1 |

Change at constant rates2 |

Currency effect |

Change (reported) |

| North

America |

9,154 |

8,433 |

+3.1% |

+5.4% |

+8.5% |

| Europe |

4,236 |

4,038 |

+5.1% |

-0.2% |

+4.9% |

| Asia, Oceania and

Africa |

2,892 |

2,694 |

+5.4% |

+2.0% |

+7.4% |

| Latin

America |

1,108 |

1,028 |

+9.5% |

-1.8% |

+7.7% |

|

Total |

17,390 |

16,194 |

+4.4% |

+3.0% |

+7.4% |

* 2018 information has been restated following

the application of IFRS 16 Leases.

North America

In North America revenue increased by 8.5% to

Euro 9,154 million (+3.1% at constant exchange rates2).

The Lenses & Optical instruments division

posted another strong full year through a continued focus on its go

to market strategy in the core United States lens business along

with strong e-commerce growth. The lens strategy in the United

States, led by key brands and innovation, partnerships with

Independent Eyecare Professionals (ECP) and key accounts, continued

to deliver results. Performance was stronger in the second half

owing to the launch of Transitions® Signature® GEN 8™. Full year

2019 growth was further boosted by robust engagement with Luxottica

both for select key accounts and sales of value added lenses though

the Group’s retail channels. Canada and sales of Transitions to

other lens casters were headwinds while contact lens distribution

activities added to growth. Trends were strong in Sunglasses &

Readers. Costa made further inroads with Eyecare professionals as

well as in sporting goods stores and online channels, while

increasing its presence in the United States. The brand notably

solidified its leadership in fishing stores, selling to fishing

enthusiasts and those living near beaches, lakes and rivers. Late

in 2019, Costa started being integrated into the Luxottica

portfolio, which should help this young brand expand its global

footprint more quickly and benefit from significant synergies,

given Luxottica’s expertise in sunwear. In addition, strong market

demand for readers and sunglasses allowed FGX International to make

up in the second half for the impact of a demanding comparison

basis in the first six months. It continued to diversify its

distribution network in the United States and to expand its

international and online operations.The Equipment division posted a

modest decline for the year, owing mainly to softer fourth quarter

dynamics, as key customers work to absorb capacity from recent

investment programs.

In North America, Luxottica posted its best year

since 2015 in terms of sales growth with Wholesale and Retail both

accelerating in the fourth quarter. The growth in Wholesale was

reinforced by the solid performance in the independent, department

store and the third-party e-commerce channels. The Retail business

had a strong year with Target Optical and EyeMed leading the way at

double-digit sales growth. Sunglass Hut posted positive performance

building on a winning omnichannel proposition, further articulated

and resonating well with its customers. LensCrafters closed the

year on a positive note benefitting from an expanding store

remodeling program and a favorable price-mix boosted by a higher

penetration of value-added lenses. The crisis of Sears had a

significant impact on the overall performance of the Retail

business leading to the decision to exit the banner by the end

January 2020. The proprietary e-commerce platforms delivered

exceptional growth, with a further acceleration in the fourth

quarter. Oakley eyewear experienced a relevant uplift from the

partnership with the NFL (with its testimonial Patrick Mahomes

winning the Superbowl and the related MVP trophy), posting

mid-single digit growth in the second half of the year.

Europe

In Europe, revenue increased by 4.9% to Euro

4,236 million (+5.1% at constant exchange rates2).

Operating in a fiercely competitive environment,

the Lenses & Optical Instruments division demonstrated

resilience in France, the largest market in the region, and in all

Eastern European countries, particularly Poland and Russia. Gains

were driven by value-added lenses, especially progressive lenses.

Elsewhere in Europe, revenue was either flat or slightly lower.

Growth in E-commerce sales was satisfactory, especially for contact

lenses distributed through the VisionDirect website. The

Instruments business saw strong growth in 2019, fueled by the

launch and marketing of two major new products during the year:

Visioffice® X, a tool for personalizing lenses in optical stores,

and the Vision-R™ 800 phoropter. A world first, the latter

radically changes the eye exam process and customer experience,

allowing measurement up to 0.01 diopter versus 0.25 diopter with

other machines on the market. In addition to revolutionizing

optometry, the Vision-R™ 800 paves the way for ophthalmic lenses

with much greater accuracy.Within the Sunglasses & Readers

division, FGX International delivered robust sales, notably in the

United Kingdom and Germany.The Equipment division had a strong

finish to the year in the fourth quarter, following an exceptional

third quarter performance.

In 2019, Europe continued to contribute to the

overall Luxottica growth, with a positive evolution at both

Wholesale and Retail divisions, supported by best-selling

proprietary brands (also online) as well as main luxury licenses.

The Wholesale channel showed steadily growth over the year,

supported by volumes expansion. Among major countries, Italy,

Germany, Turkey and Eastern Europe outperformed other markets. The

successful development of the STARS program remains a key pillar of

Luxottica’s strategy, and currently represents over 20% of

Wholesale revenue in the region, showing a nice acceleration in the

last part of the year. Sales in Europe were also supported by the

growth around double-digit of the Retail division, on the back of

effective in-store execution empowering positive results in all

countries. Sunglass Hut confirmed its healthy growth trajectory,

growing at mid-single digit in comparable sales5 in Continental

Europe and with 21 successful new openings during the year. In

Italy, Salmoiraghi & Viganò, the leading multi-brand retailer

in the country, consolidated further its position, growing nicely

in both comparable sales5 and total revenues, also thanks to a

successful store renovation plan that will be carried forward in

2020 as well. Finally, Persol opened its first store in Europe (in

Milan).

Asia, Oceania and Africa

In Asia, Oceania and Africa, revenue increased

by 7.4% to Euro 2,892 million (+5.4% at constant exchange

rates2).

The Lenses & Optical Instruments division

was a major contributor to the regional performance. It delivered

double-digit growth in China, thanks to branded lenses (notably

EyezenTM, Crizal® and Varilux®), instruments, myopia control

solutions and innovation in the midrange. Good performances from

progressive and photochromic lenses have accelerated gains in South

Korea quarter after quarter, and kept momentum strong in Southeast

Asia. In India, promotional campaigns, online sales and innovative

business models for Base-of-Pyramid consumers only partially offset

the decline in sales through traditional distribution channels.

Revenue in Japan got a lift from value-added lenses and a series of

commercial successes with optical chains.The Sunglasses &

Readers division also saw double-digit revenue growth in the region

with excellent results at Xiamen Yarui Optical (BolonTM and

MolsionTM) in optical frames and robust online sales. The division

strengthened its positions in the Chinese sunwear market, its main

market in the region.The Equipment division posted solid growth as

market conditions in fast growing markets remained favorable.

2019 was positive for Luxottica in the region as

a whole, with growing sales at constant exchange rates2 in both

Wholesale and Retail divisions. The second half of the year

decelerated versus the first, particularly due to weaker Wholesale

in the third quarter (mostly reflecting political turmoil in Hong

Kong, dropping travel retail business and unfavorable weather

conditions in Japan), but turning positive in the fourth quarter.

Australia, Mainland China, South East Asia and Middle-East drove

the group’s performance in the area, more than balancing the

decline in Hong Kong and travel retail business, while Japan and

Korea closed the year at around the par. Wholesale growth was

basically driven by Mainland China, where the business restarted on

much cleaner basis. In Retail, Australia and New Zealand kept on a

nice growing trajectory in both optical at OPSM, posting the 14th

consecutive quarter of positive comps5/sales, and sun business at

SGH, consistently in terms of sales and comparable store sales5

growth, reaping the fruits of the store refurbishment program

carried out last year. Hong Kong retail remained negative, for the

fourth consecutive year.

Latin America

In Latin America, revenue increased by 7.7% to

Euro 1,108 million (+9.5% at constant exchange rates2).

The Lenses & Optical Instruments division

generated significantly improved growth at constant exchange rates2

for the full year 2019 when compared to 2018 consisting of balanced

growth in Brazil and Spanish speaking markets through most of the

year. 2019 was marked by several key initiatives including

marketing programs such as “Varilux® em Dobro” in Brazil, “Cambia

tu cara” in Colombia, and enhanced client marketing at Grupo Vision

in Costa Rica. The division also rolled out new technological

advances and product ranges to independent laboratories to further

support growth. After having bought the assets of the laboratory of

Devlyn Holdings, Essilor signed a supply contract with Opticas

Devlyn, the leading optical chain in Mexico, which boosted growth

in constant currency terms. In e-commerce, online sales in Brazil

continue to develop rapidly. Major strides were also made in

digital marketing with consumers in Mexico and Colombia now able to

access the Spanish-language edition of the eye care information

website “AllAboutVision.com”.The Sun & Readers division

contributed modestly to regional growth.The Equipment division was

a slight headwind to regional growth on a consolidated basis

despite solid underlying activity as market conditions in fast

growing markets remained favorable.

Luxottica continued to grow in Latin America

last year, expanding sales at constant exchange rates2 in both

Wholesale and Retail divisions. The second half of the year

slightly slowed down compared to the first, mostly due to a

weakening performance in the fourth quarter in Mexico. The key

market of Brazil kept the positive momentum it showed throughout

the entire year, made of high-single digit growth in Wholesale,

boosted by STARS and Óticas Carol (reaching 1,335 franchise

locations), as well as double-digit growth in Retail, primarily

sustained by SGH. GMO closed the year positive in sales and

comparable store sales5, absorbing the negative impact of the

protests in Chile and Ecuador in the last quarter.

Fourth-quarter 2019 revenue by operating

segment

|

In millions of Euros |

Q4 2019 |

Q4 2018

Restated* |

Change at constant rates2 |

Currency effect |

Change (reported) |

| Lenses &

Optical Instruments |

1,701 |

1,589 |

+5.2% |

+1.8% |

+7.0% |

| Sunglasses &

Readers |

242 |

214 |

+10.1% |

+2.8% |

+12.9% |

| Equipment |

70 |

73 |

-6.8% |

+2.1% |

-4.7% |

|

Essilor revenue |

2,012 |

1,876 |

+5.3% |

+2.0% |

+7.3% |

| Wholesale |

753 |

725 |

+2.4% |

+1.4% |

+3.8% |

| Retail |

1,539 |

1,439 |

+4.6% |

+2.3% |

+6.9% |

|

Luxottica revenue |

2,291 |

2,164 |

+3.9% |

+2.0% |

+5.9% |

|

Total |

4,304 |

4,040 |

+4.5% |

+2.0% |

+6.5% |

* 2018 information has been restated following

the application of IFRS 16 Leases.

EssilorLuxottica’s revenue increased by 4.5% at

constant exchange rates2 during the fourth quarter of 2019.

Fourth-quarter 2019 revenue by geographical

area

|

In millions of Euros |

Q4 2019 |

Q4 2018

Restated* |

Change at constant rates2 |

Currency effect |

Change (reported) |

| North America |

2,273 |

2,113 |

+4.3% |

+3.3% |

+7.6% |

| Europe |

971 |

918 |

+4.9% |

+0.8% |

+5.7% |

| Asia, Oceania and

Africa |

756 |

707 |

+5.0% |

+1.8% |

+6.8% |

| Latin America |

304 |

301 |

+3.8% |

-2.9% |

+0.9% |

|

Total |

4,304 |

4,040 |

+4.5% |

+2.0% |

+6.5% |

* 2018 information has been restated following

the application of IFRS 16 Leases.

North America

In North America, revenue increased by 7.6% to

Euro 2,273 million (+4.3% at constant exchange rates2).

The Lenses & Optical Instruments Division

benefitted from the continued momentum from the Transitions®

Signature® GEN 8™ launch, both with Independent Eyecare

Professionals and through the Company’s retail channels.

Robust growth continued with Alliance members and Essilor Experts

while key accounts expanded at a modest pace. Similar to the full

year trend, contact lens distribution activities contributed to

growth.Sunglasses & Readers performance in the United States

was driven primarily by FGX during the fourth quarter.Trends in the

Equipment division moderated after a particularly strong third

quarter and an elevated prior year comparison

base.

Both Luxottica divisions posted the best quarter of the year.

Wholesale grew high-single digit thanks to the sound execution

across all channels. The benefit from the consolidation of

Barberini weighted to a smaller extent. On the Retail side, sales

were up mid-single digit, led by LensCrafters delivering strong

results especially during the ramp up towards the end of the

insurance year. The performance at Sunglass Hut was mixed. The

brick and mortar stores were impacted by an unfavorable timeframe

of the holiday season and lower traffic in the touristic locations,

but the shortfall was made up online. Target Optical and EyeMed

confirmed their sound growth path, while Sears continued to be a

heavy drag. The direct e-commerce business had another exceptional

quarter growing at 27% at constant exchange rates2 and all major

websites contributed to the success.

Europe

In Europe revenue increased by 5.7% to Euro 971

million (+4.9% at constant exchange rates2).

The performance of the Lenses & Optical

Instruments in the quarter was driven by robust gains in Russia,

Turkey, Instruments and online sales of contact lens through

VisionDirect.The Equipment division continued its strong

performance in the fourth quarter, ending the year sharply

higher.

Luxottica’s turnover in Europe kept expanding in

the last quarter of the year. The Wholesale division saw robust

trends in particular in Spain, Portugal, Greece, UK, Turkey and

Eastern Europe. Performance of the sun category stood out in the

fourth quarter. The company continued to develop its STARS program,

thanks to top key accounts, and related turnover experiencing a

further acceleration, up by more than 50% compared to the fourth

quarter of last year. Retail sales increased soundly in the quarter

in high-single digit area, posting its 24th consecutive quarter of

turnover expansion. All major countries showed a positive evolution

in the division, led by Sunglass Hut in Continental Europe and

Salmoiraghi & Viganò in Italy.

Asia, Oceania and Africa

In Asia, Oceania and Africa revenue increased by

6.8% to Euro 756 million (+5.0% at constant exchange rates2).

The Lenses & Optical Instruments division

delivered strong in the region, with business up sharply in China,

South Korea, Southeast Asia and Japan. Growth was fueled by

value-added lenses in all countries.The Sunglasses & Readers

division continued to benefit from its expansion in optical frames

and online sales, primarily in China.Following an exceptional

performance through the first nine months of the year, the

Equipment division slowed down during the fourth quarter.

Luxottica’s regional sales accelerated in the

fourth versus the third quarter, driven by Australia, Mainland

China and South East Asia. Australia and New Zealand retail gained

further momentum, even amid wildfires emergency, with the optical

business recording the 14th consecutive quarter of positive sales,

also helped by refurbishments, and the sun business contributing as

well, both positive in comparable store sales5. Mainland China

speeded up at double-digit pace, fueled by both revamped Wholesale

and positive Retail in sales and comparable store sales5. On the

opposite, Hong Kong did not improve, deteriorating further in

Retail sales and comparable store sales5. Ray-Ban mono-brand store

roll-out made further progress last year in the region, focused on

Mainland China which reached 141 locations at the end of December,

out of a total 171 in the whole Asia-Pacific area.

Latin America

In Latin America, revenue increased by 0.9% to

Euro 304 million (+3.8% at constant exchange rates2).

Growth in the Lenses & Optical Instruments

division remained in double digits at constant exchange rates2

through a mix of strong underlying trends and new partnerships. In

Brazil, the solid dynamics through the first nine months eased as

the focus shifted to the Transitions® Signature® GEN 8™ launch

anticipated in the earlier part of 2020. E-commerce activity in

Brazil supported regional growth. Elsewhere in the region growth

was supported by continued market development and improved product

mix, which more than offset economic headwinds in select markets,

notably Chile and Colombia. Recently formed partnerships

contributed to growth at constant exchange rates2, particularly in

Mexico where sales expanded at a double-digit rate during the

fourth quarter. The Sunglasses & Readers division contributed

modestly to regional growth during the quarter.

For Luxottica, in the fourth quarter the still

sound performance of Brazil was counterbalanced by weakening result

of Mexico, all in all ending up in flattish sales at constant

exchange rates2 in the region. Brazil confirmed sound performance

in the fourth quarter, even accelerating in retail sales at

constant exchange rates2, essentially boosted by SGH comparable

store sales5. On the opposite, after a positive first half of the

year, the Mexican wholesale business started deteriorating in the

third quarter and failed to recover in the final three months,

mostly due to the poor performance of independents and key

accounts. The abovementioned political unrests in Chile and Ecuador

affected the sales performance of GMO in the last quarter of the

year, negative in sales and comparable store sales5.

Eliminating poor vision around the world

Essilor has created more than 15,000 inclusive

businesses worldwide since 2013, which have the potential to give

more than 300 million people access to vision health. These access

points delivered vision solutions to 10.7 million new eyeglass

wearers in 2019 alone, bringing the total for the past seven years

to 33.5 million.These efforts earned EssilorLuxottica the 17th spot

in Fortune Magazine’s annual Change the World list in 2019. The

ranking was recognition of the company’s commitment to bring good

vision to everyone everywhere and eliminate poor vision around the

world as part of its mission to “see more, be more and live life to

its fullest”. In this same spirit of raising awareness on good

vision, Essilor made presentations in different parts of the world

to leverage the report it published on the sidelines of the last

United Nations General Assembly session, entitled “Eliminating Poor

Vision in a Generation: What will it take to eliminate uncorrected

refractive errors by 2050?”. The report quantifies the scale of

uncorrected poor vision in the world and recommends a cumulative

investment of $14 billion over the next 30 years to eliminate

it.

Over the course of 2019, Essilor worked toward

this goal through partnerships to eliminate poor vision in many

regions. In Bhutan, 30,000 pairs of glasses have been delivered to

date to make this country the first in the world to eliminate poor

vision. In India, more than 143,000 people were screened to put the

Doddaballapura region on track to be the first in the country to

also eliminate poor vision by 2021. In Nepal, the company signed a

letter of intent to provide access to eye care to the 350,000

residents of the Bhaktapur district. And in China, Essilor worked

with the Huoqiu County to eliminate poor vision in the county

within three years. Partnerships were also launched with

governmental ministries in France, Kenya and India to promote eye

exams and raise awareness about the importance of visual health in

schools or among underprivileged children. Lastly, Essilor put its

culture of innovation to work for Base of Pyramid consumers in

2019: it developed new refraction technologies to make eye

screening available to all, and launched the new “Ready2Clip

Generation II” prescription glasses that can be dispensed on the

spot.This strong dynamic continued in the first few months of 2020.

In January, Essilor’s flagship inclusive business program Eye

MitraTM – the world’s largest rural optical network – was featured

at the World Economic Forum in Davos in a newly launched report

called “Business as Unusual”. And in February, Essilor pledged to

donate 1 million eyeglasses and sunglasses to the United Nations

Road Safety Fund (UNSRF). This partnership promotes global action

on good vision for road users while contributing to the United

Nations’ Sustainable Development Goals.

EssilorLuxottica consolidated statement

of profit or loss

|

In millions of Euros |

2019 |

2018 Restated* |

Change |

|

Revenue |

17,390 |

10,833 |

60.5% |

| Cost of

sales |

(6,573) |

(3,961) |

65.9% |

|

Gross profit |

10,817 |

6,872 |

57.4% |

| % of

revenue |

62.2% |

63.4% |

|

|

Total operating expenses |

(9,138) |

(5,473) |

67.0% |

|

Operating profit |

1,678 |

1,399 |

20.0% |

| % of

revenue |

9.7% |

12.9% |

|

|

Profit before taxes |

1,534 |

1,289 |

19.0% |

| % of

revenue |

8.8% |

11.9% |

|

| Income

taxes |

(350) |

(139) |

150.9% |

|

Effective tax rate |

22.8% |

10.8% |

|

|

Net Profit |

1,185 |

1,150 |

3.0% |

|

Net profit attributable to owners of the

parent |

1,077 |

1,083 |

-0.6% |

* 2018 information has been restated following

the application of IFRS 16 Leases, as well as to reflect the

finalization of the purchase price allocation (“PPA”) related to

the EL Combination.

The comparability in 2019 consolidated financial

statements is still affected by the EL Combination which occurred

on October 1, 2018. Since this transaction has been considered a

reverse acquisition according to the requirements of IFRS 3

Business Combinations, the consolidated financial statements

reflect the following structure:

|

Statements |

Year endedDecember 31, 2019 |

Year endedDecember 31, 2018 |

|

Profit or loss |

EssilorLuxottica’s12 months(Jan-Dec) |

Luxottica’s12 months(Jan-Dec) * |

Essilor’s3 months(Oct-Dec) * |

|

Financial position |

EssilorLuxottica’shistorical cost |

EssilorLuxottica’shistorical cost * |

* 2018 information has been restated following

the application of IFRS 16 Leases, as well as to reflect the

finalization of the purchase price allocation (“PPA”) related to

the EL Combination.

- Revenue showed a 60.5% growth mainly due to the

contribution of Essilor revenue amounting to Euro 5,885 million for

the first nine months of 2019;

- Operating profit grew by 20.0% primarily because of the

contribution of Essilor which, however, is affected by the

depreciation and amortization resulting from the recognition of

tangible and intangible assets following the purchase price

allocation related to the EL Combination (Euro 747 million).

Moreover, 2019 performance is also affected by the impact of the

fraudulent financial activities discovered at an Essilor plant in

Thailand recorded for an amount of Euro 185 million including

foreign exchanges effects.

- Net profit grew by 3% essentially due to the contribution

of Essilor, as described above. 2019 Net profit has also been

affected by the recognition of deferred tax assets (approx. Euro 30

million), following the merger of the Group’s Canadian entities as

part of the integration activities, and by a tax reimbursement

resulting from a positive pronouncement of the Italian tax

authority (Euro 29 million).

EssilorLuxottica consolidated statement

of profit or loss: reconciliation with adjusted6

figures

Year ended December 31, 2019

|

In millions of Euros |

2019 |

Adjustments related to PPA impacts |

Other non-GAAP adjustments |

2019Adjusted6 |

|

Revenue |

17,390 |

- |

- |

17,390 |

| Cost of

sales |

(6,573) |

61 |

8 |

(6,503) |

|

Gross profit |

10,817 |

61 |

8 |

10,887 |

| % of

revenue |

62.2% |

|

|

62.6% |

|

Total operating expenses |

(9,138) |

669 |

395 |

(8,074) |

|

Operating profit |

1,678 |

730 |

404 |

2,812 |

|

% of revenue |

9.7% |

|

|

16.2% |

| Cost of

net debt |

(117) |

(7) |

9 |

(115) |

| Other

financial income / (expenses)* |

(27) |

- |

1 |

(26) |

|

Profit before taxes |

1,534 |

723 |

414 |

2,672 |

| % of

revenue |

8.8% |

|

|

15.4% |

| Income

taxes |

(350) |

(142) |

(126) |

(618) |

|

Net Profit |

1,185 |

581 |

288 |

2,054 |

|

Net profit attributable to owners of the

parent |

1,077 |

|

|

1,938 |

* Including Share of profit of associates.

Year ended December 31, 2018

|

In millions of Euros |

2018 Restated*Pro

forma1

information** |

Adjustments related to PPA impacts |

Other non-GAAP adjustments |

2018 Restated*Pro

forma1Adjusted6 |

|

Revenue |

16,194 |

- |

- |

16,194 |

| Cost of

sales |

(6,131) |

119 |

27 |

(5,985) |

|

Gross profit |

10,063 |

119 |

27 |

10,209 |

| % of

revenue |

62.1% |

|

|

63.0% |

|

Total operating expenses |

(8,552) |

639 |

322 |

(7,591) |

|

Operating profit |

1,511 |

758 |

349 |

2,618 |

|

% of revenue |

9.3% |

|

|

16.2% |

| Cost of

net debt |

(148) |

(6) |

5 |

(149) |

| Other

financial income / (expenses)*** |

(11) |

- |

- |

(11) |

|

Profit before taxes |

1,352 |

752 |

354 |

2,458 |

| % of

revenue |

8.3% |

|

|

15.2% |

| Income

taxes |

(221) |

(297) |

(74) |

(593) |

|

Net Profit |

1,131 |

455 |

279 |

1,866 |

|

Net profit attributable to owners of the

parent |

n.a. |

|

|

1,774 |

* 2018 information has been restated following

the application of IFRS 16 Leases, as well as to reflect the

finalization of the purchase price allocation (“PPA”) related to

the EL Combination.** Reconciliation from Reported to Pro forma1

2018 statement of profit or loss is available in the Appendix.***

Including Share of profit of associates.

Adjusted6 measures

In this document, management presented certain

performance indicators that are not envisioned by the International

Financial Reporting Standards (“IFRS”) as issued by the

International Accounting Standards Board and endorsed by the

European Union. Such measures are not meant to be considered in

isolation or as a substitute for items appearing in

EssilorLuxottica consolidated financial statements prepared in

accordance with IFRS. Rather, these non-IFRS measures should be

used as a supplement to IFRS results to assist the reader in better

understanding the operating performance of the Group and should be

read in conjunction with EssilorLuxottica consolidated financial

statements. Such measures are not defined terms under IFRS and

their definitions should be carefully reviewed and understood by

investors.

The combination of Essilor and Luxottica (the

“EL Combination”), as well as events that are unusual, infrequent

or unrelated to normal operations, have a significant impact on the

consolidated results. Accordingly, in order to provide additional

comparative information on the results for the period under review

compared to previous periods, to reflect the EssilorLuxottica

actual economic performance and enable it to be monitored and

benchmarked against competitors, some measures have been adjusted

(“adjusted measures”). In particular, management adjusted the

following measures: Gross profit, Operating expenses, Operating

profit, Profit before taxes and Net profit. Such adjusted measures

are reconciled to their most comparable pro forma1 measures in the

Restated Unaudited Pro Forma Consolidated Financial Information for

the year ended December 31, 2018, and to the most comparable

reported measures in the consolidated statement of profit or loss

for the year ended December 31, 2019.

In 2018 and 2019, adjusted measures exclude: (i)

the incremental impacts of the purchase price allocations related

to the EL Combination; and (ii) other adjustments related to

transactions that are unusual, infrequent or unrelated to normal

operations, as the impact of these events might affect the

understanding of the Group’s performance. These adjustments are

described below.

Year ended December 31, 2019

- Non-recurring Cost of sales for Euro 8 million mainly

associated with restructuring and reorganization expenses incurred

with respect to projects aimed at the optimization of the central

warehouses of the Group and the costs of Luxottica’s restricted

shares plan (LTI) for employees working for operations

activities.

- Non-recurring Selling expenses for Euro 30 million mainly

associated with the closing of the US retail chain Sears Optical,

announced by the Group in December 2019.

- Non-recurring General and administrative expenses for Euro 199

million associated with the following impacts:

- non-recurring costs related to restructuring and reorganization

projects aiming at increasing the Group’s operational and

organizational efficiency for Euro 71 million; the non-recurring

costs mainly refer to severance, accelerated depreciation and

write-off;

- non-recurring expenses related to M&A projects for Euro 21

million mainly linked to the transactions costs incurred in

connection with GrandVision N. V. proposed acquisition announced on

July 31, 2019, and to the acquisition of Barberini completed in

August 2019;

- one-off costs incurred by the Group for Euro 36 million,

including transaction costs linked to the finalization of the MTO

and delisting of Luxottica shares and other one-off integration

costs;

- expenses related to share-based payments for about Euro 65

million linked to the removal of the performance conditions from

the 2015 and 2016 Essilor’s share-based plans, the international

employee shareholding plan extended to Luxottica employees in late

2019 and to Luxottica’s restricted shares plan (LTI);

- non-recurring expenses for Euro 6 million incurred in

connection with the settlement of a commercial litigation.

- Non-recurring Other income / (expenses) are adjusted for Euro

166 million corresponding to the following impacts:

- non-recurring loss related to the fraudulent financial

activities in a plant in Thailand for an amount of Euro 185 million

(including foreign exchanges impacts);

- non-recurring costs related to M&A and divestment

transactions for Euro 22 million mainly related the loss resulting

from the sale of Merve as a condition required by the Turkish

anti-trust authorities to approve the combination of Essilor and

Luxottica for Euro 14 million, as well as a non-recurring impact on

final deferred payments paid on various past acquisitions;

- net negative impact of Euro 5 million related to other

non-recurring transactions linked to significant claims and

litigations; and

- the elimination of a non-recurring net gain for Euro 46 million

mainly related to the profit recorded from the sale of the Group’s

25% ownership in a US based entity and the sale of another

investment.

- Cost of net debt is adjusted for Euro 9 million corresponding

mainly to non-recurring financial expenses linked to early

repayment of debt at Luxottica level in the context of the

restructuring and centralization of financial debt at

EssilorLuxottica level.

- Income taxes are adjusted for an amount of Euro (126) million

corresponding to the tax effects of the above-mentioned adjustments

for Euro (56) million and to the elimination of non-recurring net

tax gains for Euro (70) million mainly due to i) the one-off

recognition of deferred tax assets on tax losses carry forward in a

Canadian entity following the merger of the Essilor and Luxottica

entities in Canada into one tax group and to ii) the reimbursement

granted from the Italian tax authorities on IRAP tax related to

fiscal years 2014 to 2016.

Year

ended December 31, 2018

- Non-recurring Cost of sales for Euro 27 million associated with

restructuring and reorganization projects mainly linked to

initiatives aimed at transforming the Group’s distributive network

(i.e. centralization of the Group warehouses removing stock in

store; closing down some local warehouses) as well as those related

to a change in the Group business model (e.g. removal of lenses

laboratories from the stores). In particular, the expenses adjusted

in 2018 consist of write-off of the equipment and stock affected by

those restructuring and reorganization projects, as well as the

related logistic costs incurred.

- Non-recurring Selling expenses for a net cost of Euro 7 million

resulting from an impairment loss recorded on specific brands, as

well as from some projects aimed at transforming significantly the

Group’s sales force organization.

- Non-recurring General and administrative expenses for Euro 278

million associated with the following impacts:

- total transaction costs related to the combination of Essilor

and Luxottica for Euro 158 million (of which Euro 128 million

incurred in 2017, Euro 22 million incurred in 2018 and Euro 8

million in 2019);

- non-recurring costs of Euro 77 million mainly linked to the

removal of the performance conditions from the 2015 and 2016

share-based plans authorized by the Essilor Annual General Meeting

of May 2017, less Euro 5 million adjustment related to the

valuation of Essilor’s share-based payments;

- restructuring and reorganization expenses for Euro 48

million.

- Non-recurring expenses for Euro 36 million accounted for in

Other income / (expenses) including:

- loss on assets disposal for Euro 5 million following the

request from the Turkish Antitrust authorities to divest Merve as a

condition precedent to approve the combination of Essilor and

Luxottica;

- net loss impact of the change in consolidation scope of one

entity for Euro 24 million;

- net negative impact of Euro 5 million related to other

non-recurring transactions mainly linked to significant claims and

litigations; and

- distribution of exceptional bonuses to French employees for

Euro 2 million.

- Cost of net debt is adjusted for Euro 5 million corresponding

to a non-recurring financial expense linked to early repayment of

debt.

- Income taxes are adjusted for an amount of Euro (74) million

corresponding to the tax effect of the above-mentioned adjustments

for Euro (27) million and to a non-recurring tax income of Euro

(47) million.

Other non-GAAP measures

Other non-GAAP measures such as EBITDA, Free

Cash Flows, Net Debt and the ratio Net Debt to EBITDA are also

included in this document in order to:

- improve transparency for investors;

- assist investors in their assessment of the Group’s operating

performance and its ability to refinance its debt as it matures and

incur additional indebtedness to invest in new business

opportunities;

- assist investors in their assessment of the Group’s cost of

debt;

- ensure that these measures are fully understood in light of how

the Group evaluates its operating results and leverage;

- properly define the metrics used and confirm their calculation;

and

- share these measures with all investors at the same time.

Those other non-GAAP measures are not meant to

be considered in isolation or as a substitute for items appearing

in EssilorLuxottica’s consolidated financial statements prepared in

accordance with IFRS. Rather, these other non-GAAP measures should

be used as a supplement to IFRS results to assist the reader in

better understanding the operating performance of the Group.

Moreover, investors should be aware that the Group's method of

calculating those non-GAAP measures may differ from that used by

other companies.

The following table provides a reconciliation of

those non-GAAP measures to the most directly comparable IFRS

financial measures.

|

|

2019 |

|

|

|

|

Net cash flow provided by operating activities (a) |

3,299 |

|

Purchase of property, plant and equipment and intangible

assets (a) |

(903) |

|

Cash payments for the principal portion of lease liabilities

(a) |

(571) |

|

Free Cash Flow |

1,825 |

|

|

|

|

Operating profit (b) |

1,678 |

|

Depreciation and amortization (a) |

2,121 |

|

EBITDA |

3,800 |

|

|

|

|

Net Debt (c) |

4,046 |

|

|

|

|

Net Debt / EBITDA |

1.1 |

(a) As presented in the consolidated statement of cash flows.(b)

As presented in the consolidated statement of profit or loss.(c)

Net Debt is presented in the Note 22 - Financial debt, including

lease liabilities to the consolidated financial statements; its

components are also reported in the paragraph Consolidated

statement of financial position, Net Debt and cash flow.

Adjusted6 consolidated statement of profit or

loss

|

In millions of Euros |

2019 |

2018 Restated* Pro

forma1 |

Change |

Change at constantexchange

rates2 |

|

|

|

|

|

|

|

Revenue |

17,390 |

16,194 |

7.4% |

4.4% |

| Cost of

sales |

(6,503) |

(5,985) |

8.7% |

5.9% |

|

Gross profit |

10,887 |

10,209 |

6.6% |

3.5% |

| % of

revenue |

62.6% |

63.0% |

|

|

| Research

and development |

(291) |

(275) |

5.9% |

3.5% |

|

Selling |

(4,595) |

(4,308) |

6.7% |

3.6% |

|

Royalties |

(168) |

(163) |

2.7% |

-0.2% |

|

Advertising and marketing |

(1,236) |

(1,115) |

10.8% |

7.9% |

| General

and administrative |

(1,777) |

(1,719) |

3.4% |

1.1% |

| Other

income / (expenses) |

(8) |

(11) |

-22.5% |

-33.1% |

|

Total operating expenses |

(8,074) |

(7,591) |

6.4% |

3.5% |

|

Operating profit |

2,812 |

2,618 |

7.4% |

3.3% |

| % of

revenue |

16.2% |

16.2% |

|

|

| Cost of

net debt |

(115) |

(149) |

-23.1% |

-24.0% |

| Other

financial income / (expenses) |

(24) |

(11) |

|

|

| Share of

profits of associates |

(2) |

- |

|

|

|

Profit before taxes |

2,672 |

2,458 |

8.7% |

4.6% |

| % of

revenue |

15.4% |

15.2% |

|

|

| Income

taxes |

(618) |

(593) |

4.3% |

0.8% |

|

Effective tax rate |

23.1% |

24.1% |

|

|

|

Net Profit |

2,054 |

1,866 |

10.1% |

5.7% |

|

Net profit attributable to owners of the

parent |

1,938 |

1,774 |

9.2% |

4.8% |

* 2018 information has been restated following

the application of IFRS 16 Leases, as well as to reflect the

finalization of the purchase price allocation (“PPA”) related to

the EL Combination.

Revenue for the year totaled

Euro 17,390 million, an increase of 7.4% in current exchange rates

and 4.4% in constant exchange rates2 when compared to 2018.

Adjusted6 Gross

profit: +6.6% at current exchange rates and 3.5% at constant

exchange rates2

Adjusted6 Gross profit in 2019 ended at Euro

10,887 million, representing 62.6% of revenue versus 63.0% in 2018.

The gross margin at Luxottica was broadly stable, despite the

slight dilution generated by the fast-growing managed vision care

business. On the Essilor side, the positive effect from the

Transitions Generation 8 launch was more than offset by portfolio

mix effects stemming from faster growth in online contact lens

sales and Sunglasses & Readers as well as a negative impact

from the obsolescence of the Transitions Generation 7 product.

Adjusted6 Operating

expenses: +6.4% at current exchange rates and +3.5% at constant

exchange rates2Operating expenses

amounted to Euro 8,074 million in 2019, translating to 46.4% of

sales compared to 46.9% in the prior year and reflecting:

- Research and development costs of Euro 291 million, as the

Group continues to invest the same portion of its revenue behind

innovation.

- Selling costs of Euro 4,595 million to support

EssilorLuxottica’s top line growth, positively impacted by the

winding down of legacy operations at Sears Optical Retail.

- Royalties of Euro 168 million, related to the Group’s licensed

frame brands.

- Advertising and marketing costs of Euro 1,236 million included

the impact of investments to drive future growth. This included a

renewed effort in marketing campaigns on lens brands, e-commerce,

Sunglasses & Readers, the Transitions Generation 8 launch and

activities to develop the myopia segment. The Group also launched

new campaigns and partnerships for its top brands in frames and

retail banners (Sunglass Hut returning to television after three

years, Oakley becoming an official sponsor to the NFL and Ray-Ban

launching a successful Sun Campaign).

- General and administrative costs totaled Euro 1,777 million

reflecting EssilorLuxottica’s strong cost control measures,

particularly effective during the second half of the year.

Adjusted6 Operating profit: +7.4% at

current exchange rates and +3.3% at constant exchange

rates2The Group posted an adjusted6 Operating profit of

Euro 2,812 million, representing 16.2% of sales, in line compared

to 2018.

Adjusted6 Cost of net debt, Other

financial income / (expenses) and Share of profits of

associates

The adjusted6 Cost of net debt declined to Euro

115 million in 2019 from Euro 149 million due to a decrease in the

Company’s financing cost and despite an exceptional cash

disbursement to complete EssilorLuxottica’s Mandatory Tender Offer

for Luxottica shares. The issuance of the Euro 5 billion bond in

November did not have a material impact in 2019. Other financial

expenses amounted to Euro 24 million and Share of profits of

associates showed a loss of Euro 2 million.

Adjusted6 Income

taxes

EssilorLuxottica reported adjusted6 tax expense

of Euro 618 million, reflecting an adjusted6 tax rate of 23.1% for

2019 compared to an adjusted6 tax rate of 24.1% in the prior year

resulting from a more favorable geographical mix of earnings and

from a positive closing of certain tax audits.

Adjusted6 net profit

attributable to owners of the parent: +9.2% at current

exchange rates and 4.8% at constant exchange rates2.

Consolidated statement of financial

position, Net Debt and cash flow

Condensed consolidated statement of

financial position

|

In millions of Euros |

Dec. 31, 2019 |

Dec. 31, 2018* |

Change |

|

In millions of Euros |

Dec. 31, 2019 |

Dec. 31, 2018* |

Change |

| |

|

|

|

|

|

|

|

|

| Goodwill |

24,074 |

23,486 |

588 |

|

Equity |

35,332 |

33,403 |

1,929 |

| Intangible, Tangible and

Right-of-use |

16,934 |

17,143 |

(209) |

|

Non-current borrowings and lease

liabilities |

8,484 |

4,045 |

4,439 |

| Other

non-current assets |

825 |

762 |

63 |

|

Other

non-current liabilities |

3,150 |

3,477 |

(327) |

| Non-current

assets |

41,833 |

41,391 |

442 |

|

Equity and non-current

liabilities |

46,966 |

40,925 |

6,041 |

| |

|

|

|

|

|

|

|

|

| Inventories, Trade receivables |

4,578 |

4,382 |

196 |

|

Short-term borrowings and lease

liabilities |

932 |

1,657 |

(725) |

| Other current assets |

1,336 |

782 |

554 |

|

Trade payables |

1,770 |

1,744 |

26 |

| Cash

and cash equivalents |

4,836 |

1,829 |

3,007 |

|

Other

current liabilities |

2,915 |

4,072 |

(1,157) |

| Current assets |

10,750 |

6,993 |

3,757 |

|

Current

liabilities |

5,617 |

7,473 |

(1,856) |

| Assets held for sale |

0 |

14 |

(14) |

|

|

|

|

|

|

ASSETS |

52,583 |

48,398 |

4,185 |

|

EQUITY and LIABILITIES |

52,583 |

48,398 |

4,185 |

* 2018 information has been restated following

the application of IFRS 16 Leases, as well as to reflect the

finalization of the purchase price allocation (“PPA”) related to

the EL Combination.

Goodwill increased by Euro 588 million, of which

Euro 206 million resulting from acquisitions made in 2019, and Euro

382 million resulting from foreign currency fluctuations (including

foreign currency fluctuations on the goodwill arising from the

EssilorLuxottica Combination, amounting to Euro 333 million).

Intangible, Tangible and Right-of-use are mainly

related to intangible assets recognized as part of the purchase

price allocation finalized on the EssilorLuxottica Combination for

around Euro 11 billion and to the right-of-use assets recognized

following the implementation of the new accounting standard IFRS 16

Leases.

The overall increase in Cash and cash

equivalents and Other current assets are mainly linked to the

proceeds from the issuance of the 5 billion bonds occurred in

November 2019 (as described in paragraph 1.2.2).

Equity increased mainly for the result of the

year (Euro 1,670 million including other comprehensive income

items), the share capital increases related to the sell-out and

squeeze-out procedures on Luxottica shares, as described in

paragraph 1.2.2 – Significant Events (Euro 1,019 million) and the

share-based payments accounted for in 2019 (Euro 154 million),

while decreased by Euro 959 million following dividend

distribution.

Other current liabilities decreased by Euro

1,157 million, of which 1,667 million are link to the short-term

put option representing EssilorLuxottica’s obligation to purchase