Regulatory News:

In the first half of 2021, Carmila (Paris:CARM) illustrated

the effectiveness of its platform with very dynamic leasing

activity and stepped-up growth drivers, while taking advantage of

its geographical footprint, omnichannel strategy and solid

financial position, despite the impact of the prolonged health

crisis (cumulative closure of 2.2 months).

- Firm recovery in retailer sales as stores reopened (retailer

sales in France up 5% in June 2021 versus June 2019)

- Dynamic leasing activity (541 leased signed, up 40% on

first-half 2019 and 140% on first-half 2020)

- Positive reversion for new leasings (+3.9% vs rental values)

and for renewals (+3.0%)

- Financial occupancy rate stable at 95.7%

- Stable and solid rental base (-0.6% on a like for like basis

versus end-December 2020)

- Stable portfolio value at €6,135 million including transfer

taxes (-0.2% like for like on end-December 2020)

- EPRA Net Tangible Assets at €23.69 per share, down

4%

- Recurring earnings of €76.2 million (excluding IFRS 16 Covid

impacts), down 18.9% versus first-half 2020, and recurring earnings

per share of €0.53 (excluding IFRS 16 Covid impacts)

- Collection rate at 69.3% for the first half of 2021

- Loan-to-value ratio of 39.4% including transfer taxes at 30

June 2021, temporarily impacted by first-half 2021 rent

collection

- Liquidity in excess of €950 million; no major refinancing

expected before 2023

Marie Cheval, Chair and Chief Executive Officer of Carmila

commented: “The first half of 2021 was once again shaped by the

health crisis, with 2.2 months of closures for Carmila’s centres.

In this intensely demanding environment, Carmila has demonstrated

the effectiveness of its platform, underscored by exceptionally

dynamic leasing activity, with 541 leases signed in the first half

of the year. Carmila is stepping up the rollout of its growth

drivers with the opening of the Nice Lingostière extension on 19

May 2021, the expansion of Carmila Retail Development and the

successful openings of our Healthcare projects. Capitalisation

rates are stable for the first time since 2017, illustrating the

quality of Carmila’s assets. In light of these results, we are

confident in the strength of Carmila’s business model and our

ability to drive our development prospects.”

1. Key financial information

First-half 2021

Change vs. First-half

2020

LfL change vs. First-half

2020

First-half 2020

Gross rental income (€m)

172.9

+5.7%

163.6

Net rental income (€m)

127.9

-13.2%

-1.7%

147.5

Recurring earnings (€m)

74.1

-21.1%

93.9

Recurring earnings (€m, excl. IFRS 16

Covid impact)

76.2

-18.9%

93.9

Recurring earnings per share (€m, excl.

IFRS 16 Covid impact)

0.53

-22.4%

0.69

First-half 2021

Change vs. Full-year

2020

LfL change vs. Full-year

2020

Full-year 2020

Portfolio valuation (€m, including

transfer taxes)

6,135

-0.2%

-0.2%

6,150

Net Potential Yield

6.20%

+0 bps

6.20%

Loan-to-value ratio (including transfer

taxes)

39.4%

+240 bps

37.0%

EPRA NTA (€/share)

23.69

-4.2%

24.72

2. Operating performance

The first half of 2021 was shaped by continued health

restrictions, imposed at a national level in France and at a

regional level in Spain and Italy, which evolved over time

depending on the geography and size of shopping centres. Over the

first half of the year 2021, stores in Carmila shopping centres

were closed for an average of 2.2 months compared to two months of

closure in first-half 2020.

Dynamic reopening periods In the Group’s three countries,

cumulative footfall was down by an average of 22% on first-half

2019 (down 20.4% in France, 23.8% in Spain and 25.7% in Italy).

Reopening periods were characterised by solid rebounds, with

footfall in June 2021 close to June 2019 levels (90% in France, 80%

in Spain and 85% in Italy). During the periods when stores reopened

in France, retailer sales outperformed 2020 and 2019 levels, with

sales up 5% in June 2021 versus June 2019.

Very dynamic leasing activity 541 leases were signed in

the first half of the year (9.0% of the rental base) for a total

minimum guaranteed rent of €27.6 million and rents 3.9% above

appraisal rental values. In terms of number of leases, this

represented a 40% increase on first-half 2019 and 140% on

first-half 2020. The 541 signed leases comprise 266 vacant premises

and 275 renewals. Carmila recorded a positive 3.0% average

reversion on renewals over the first half of the year. Carmila is

continuing to develop the merchandise mix in its centres by signing

up leading and up-and-coming retail brands in a range of segments.

In France, for example, Carmila is preparing to welcome a number of

stores including two New Yorker, two Action, eight Hubside Store,

and two Normal, while three Popeye’s restaurants are scheduled to

open in Spain. Leveraging the strength of its regional presence and

its retail know-how, Carmila is constantly searching for new

concepts, such as Miniso, Happy Cash Eco (specialised in

purchasing, selling and repairing products) and wine specialist Les

Canons, as well as local retailers. In the first half of 2021,

revenues derived from Specialty Leasing and Pop-up Stores were up

3% compared with the same period last year in the three countries.

Specialty Leasing recovered well in June 2021 with revenues up 38%

compared to June 2020. The good leasing performance is continuing

into the second half of 2021, as illustrated by the high number of

pre-contracts signed with retailers.

Solid rental base The rental base was stable at 30 June

2021, down slightly by 0.6% on a like for like basis versus

2020.

The number of administration proceedings and lease terminations

was flat. In first-half 2021, administration proceedings

represented a negative 0.5% impact on Carmila’s rental base and

lease terminations a negative 1.3%.

Successful omnichannel initiatives Carmila is developing

an omnichannel strategy, the priority of which is to support

retailers through the digital transition, in particular the 40% of

independent retailers and local partner franchisees. Carmila is

helping retailers make the most of the store reopening period

through a range of initiatives, including strengthening their

omnichannel presence via the Carrefour marketplace in Spain,

offering online payment solutions with ShoppingPay, and broadening

drive-to-store solutions with live shopping events. Carmila is

continuing to develop interactions with its customer community by

partnering with a network of local influencers whose subscribers

surged by 300% year on year in the first half of 2021. Focused on

drive-to-store initiatives, Carmila also bolstered its online

presence through a geo-localised customer database of 3.6 million

opt-in contacts in France, Spain and Italy, and by pushing its

presence on Google and Facebook. In the first half of 2021, Carmila

centres were searched nearly 41 million times on Google (up 12%

year on year) and generated 130 million views on their Facebook

posts (up 29% year on year).

Successful opening of the restructured Cité Europe and the

Nice Lingostière extension In the first half of 2021, Carmila

delivered two major extension and restructuring projects:

- Cité Europe (Calais-Coquelles) restructuring: since 29 January

2021, the centre has hosted a new Primark store, as well as a fully

refitted Cité Gourmande leisure and restaurant complex. The centre

has recorded 31 new store openings since 2018, including seven in

the first half of 2021. From 19 May to 30 June 2021, the centre

recorded a 65% surge in footfall versus the same year-ago

period.

- On 19 May 2021, Carmila opened the fully-leased Nice

Lingostière extension. As part of the project devised together with

local stakeholders, the centre is welcoming 50 new stores across

12,000 sq.m. of additional gross leasable area, including leading

retail brands such as H&M, Kiabi, Cultura, Mango and new

concepts like Le Repaire des Sorciers, La Barbe de Papa, Even and

Bambino. Investments in the project amounted to €90 million. The

opening was a success and generated a 30% increase in footfall from

19 May to 30 June 2021 versus the same period in 2020.

Carmila also reached a new milestone on the Montesson shopping

centre extension project after receiving the requisite

authorisation from the regional commercial development authority

(CNAC) in May 2021. This extension, which is adjacent to

Carrefour’s leading French hypermarket, aims to host 60 new stores

and restaurants by 2025 as part of an urban development project

designed to boost the local economy.

Stepping up expansion of Carmila Retail Development

Carmila Retail Development, the Company’s subsidiary that aims to

invest alongside innovative retailers, experienced a sharp rise in

performance in first-half 2021. Carmila’s four main partners –

barbers La Barbe de Papa, footwear and accessory specialist

Indémodable, and e-cigarette retailer Cigusto in France, as well as

Centros Ideal beauty clinics in Spain – opened a total of 37

premises in the first half of the year, with a further 44 scheduled

to open in the second half.

Carmila Retail Development has entered into new partnerships

such as with wine specialist Les Canons and restaurant chain

Dicapo. Several partnerships are currently under development.

Carmila Retail Development’s dynamic partnerships are also

exemplified by the development of Digital Native Vertical Brands

(DNVB). Carmila is continuing to grow the Marquette retail brand,

devised together with Digital Native Group, which distributes

online brands through its concept store. In June 2021, Carmila

launched the “Prix DNVB Ready” aiming to identify innovative

concepts with a mostly-online presence, and develop them in its

centres.

Successful first Healthcare openings In the first half of

2021, Carmila opened its first dental practices under the Vertuo

brand in Athis-Mons, Sartrouville, Perpignan Claira and Nantes

Beaujoire. Five more centres are scheduled to open by the end of

the year. Over the same period in Spain, Carmila opened two

DentalStar centres in Montigala (Barcelona) and Cabrera del

Mar.

At the end of 2021, Carmila Retail Development partnerships will

account for around 248 premises in France and Spain, including 118

in Carmila centres representing €5 million in rent.

Stepping up new real estate activities Carmila is

accelerating its urban mixed-use projects launched in partnership

with Carrefour and Altarea. Three projects are under way at

Flins-Aubergenville, Nantes Beaujoire and Sartrouville, and 20 more

are currently under consideration. Carmila is also continuing to

invest in Lou5G, its TowerCo business, for the construction and

installation of new towers. Lou5G is set to raise recurring rental

income to €1.1 million by the end of the year, representing 101

leases.

Optimising capital allocation During the first half of

the year, Carmila initiated an asset rotation programme that began

with the sale of a retail park in Nanteuil-lès-Meaux at its

end-December 2020 appraisal value. The proceeds from the disposal

will be used to launch a share buyback programme for around €8

million.

Continuing an ambitious CSR strategy Carmila is

accelerating its CSR strategy, rooted in the Here we act

initiatives programme. A number of projects have been deployed

focusing on the programme’s three pillars of the Planet, Local

Regions and Employees.

During the first half of 2021, Carmila initiated BREEAM In-Use

certification at 40 new sites, including 21 sites in France, 16 in

Spain and 3 in Italy. The goal is to have all of the Carmila sites

certified by 2025.

Carmila was also recognised by the Science Based Targets

initiative (SBTi) for its commitment to fighting climate change in

line with the 1.5°C objective, pursuant to the Paris Agreement.

3. Financial results

Net rental income Net rental income amounted to €127.9

million in the first half of the year, down 13.2%. The decrease was

mainly attributable to the temporary effects of the health crisis,

with a 12.2% negative impact on net rental income. The organic

decrease was linked to the 1.0% contraction in the rental base,

including positive 0.2% indexation, which underscores the solidity

of Carmila’s assets. The Nice Lingostière extension had a positive

1.2% impact while other impacts reduced net rental income by 1.2%,

including the sale of the Nanteuil-lès-Meaux retail park and

strategic vacancies in view of restructuring operations.

Impact of the health crisis in first-half 2021 Stores

were closed for an average of 2.2 months in first-half 2021 (2.8

months in France). The negative impact of the health crisis in the

first half of 2021 amounted to €33.5 million, representing 0.9

months of invoicing. Carmila prudently allocated a €17.2 million

provision for rent waivers for the period during which businesses

were closed in France in the first half of the year, as well as

€6.5 million for Spain and Italy. This will enable Carmila to

provide targeted rent waivers for the closure period, speed up

collection of 2021 rents and re-establish systematic due-date

rental payments. All the estimated impacts of closures in the first

half of 2021 have been recognised in the financial statements.

Collection rate The collection rate for first-half rents

stood at 69.3% as of 19 July 2021 (5.5 percentage points higher

than at end-June 2021), the delay being due to the impact of

tenants anticipating a financial support package in France. This

support package represents excellent news that are expected to

accelerate collection.

Operating expenses Overhead costs for the period totalled

€24.4 million, down €0.9 million.

Net financial expense Net financial expense amounted to

€29.5 million, up €2.3 million. The increase in interest expense on

bonds (€3.8 million) was partially offset by the decrease in

interest expense on bank borrowings (€1.6 million).

Recurring earnings Recurring earnings (excluding the

impact of IFRS 16 Covid-related rent-free periods) stood at €76.2

million, down €17.8 million or 18.9% compared with the first half

of 2020. Recurring earnings per share for first-half 2021 amounted

to €0.53 (excluding the IFRS 16 Covid impact), a decrease of €0.16

per share or 22.4%.

4. Portfolio valuation

At 30 June 2021, the gross asset value of the portfolio,

including transfer taxes, stood at €6,135.2 million, down €12.7

million or 0.2% compared with the figure reported at 31 December

2020. On a like-for-like basis, the decrease was €9.7 million (down

0.2%). First-half 2021 was the first period during which

capitalisation rates were stable since 2017: the average

capitalisation rate for the portfolio was 6.20% at 30 June 2021,

flat compared with the 31 December 2020 figure. The solid rental

base, dynamic leasing activity and the limited, flat vacancy rate

all demonstrate the stability of Carmila’s assets in the first half

of the year.

5. Debt and financial structure

The financial position was strengthened in first-half 2021.

Carmila issued a €300 million bond on 25 March 2021, maturing in

April 2029 and paying a coupon of 1.625%. With the proceeds,

Carmila partially reimbursed a bank loan falling due in June 2024

in the amount of €300 million, extending the average maturity of

debt (4.6 years at 30 June 2021 versus 4.5 years at end-December

2020) while maintaining a stable average interest rate (2.0% at 30

June 2021 versus 1.9% at 31 December 2020). Net debt was

temporarily impacted by the collection situation in the first half

of the year, and stood at €2,379 million as of 20 July 2021, a

marked improvement compared to the €2,419 million recorded at 30

June 2021. The loan-to-value ratio including transfer taxes stood

at 39.4% at 30 June 2021, up 240 basis points, due to the temporary

change in net debt. At 20 July 2021, the loan-to-value ratio stood

at 38.9%, down by 40 basis points compared to 30 June 2021.

6. Conclusions and outlook: Carmila, the platform helping

transform the retail sector

The health crisis has accelerated the transformation of retail

concerning issues such as purchasing power, omnichannel,

convenience and corporate social responsibility. Carmila’s centres

help preserve purchasing power, combine the benefits of physical

and online retail; they are safe and accessible, fully adapted and

embedded in the local economy and community.

Carmila is rolling out with agility an efficient platform to

help transform the retail sector.

This platform draws on Carmila’s solid fundamentals: a unique

regional footprint − more than one-third of French and Spanish

citizens can reach a Carmila centre within 20 minutes; leading

local shopping centres registering 650 million visits per year; and

assets adjoined to powerful hypermarkets, which proved their worth

during the health crisis.

This platform is built on four key pillars:

- Retail places in motion

- Preferred partner for retailers

- 100%-omnichannel strategy

- Solid growth drivers fuelled by innovation

In these very demanding times, Carmila has been able to adapt to

the consequences of the health crisis, deploying changes to its

platform in record time and keeping pace with retail industry

trends. Carmila aims to improve customer and visitor satisfaction,

innovating to become a privileged partner, particularly by

supporting retailers in their development and omnichannel

transformation.

- Growth drivers will help boost business in the coming months

and years, particularly:

- portfolio enhancement projects: renovations, creation of food

courts and extensions

- Carmila Retail Development: new projects are under way

following the successful development of four partner brands and the

first Healthcare openings

- new real estate activities: around 20 urban mixed-use projects

are under consideration and Carmila is continuing to roll out its

TowerCo, Lou5G

Carmila will be staging an Investor Day in the autumn to present

in detail its growth drivers and strategy. In view of the

uncertainty linked to the health situation, the impact of a fourth

wave of the pandemic, particularly in Spain, the prolonged state of

emergency in France and arrangements for the health pass, Carmila

is proceeding cautiously with its full-year financial projections,

and accordingly, will not be providing guidance for its full-year

2021 earnings. Carmila is highly resilient and the Group has solid

growth prospects. While the current context remains concerning, in

view of Carmila’s capacity to rebound and the sustainability of its

development, management is confident in the Group’s model.

INVESTOR AGENDA 21 October 2021 (after trading): Third

quarter 2021 Financial Information

ABOUT CARMILA As the third largest listed owner of

commercial property in continental Europe, Carmila was founded by

Carrefour and large institutional investors in order to transform

and enhance the value of shopping centres adjoining Carrefour

hypermarkets in France, Spain and Italy. At 31 December 2020, its

portfolio was valued at €6.15 billion, comprising 215 shopping

centres, all leaders in their catchment areas. Driven by an

ambition to simplify and enhance the daily lives of retailers and

customers across the regions, the local touch is at the heart of

everything Carmila does. Carmila’s teams have a deeply-anchored

retail culture, comprising experts in all aspects of retail

attractiveness: operations, shopping centre management, leasing,

local digital marketing, business set-ups and CSR. Carmila is

listed on Euronext-Paris Compartment A under the symbol CARM. It

benefits from the tax regime for French real estate investment

trusts (“SIIC”). Carmila became part of the FTSE EPRA/NAREIT Global

Real Estate (EMEA Region) indices on 18 September 2017. Carmila

became part of the Euronext CAC Small, CAC Mid & Small and CAC

All-tradable indices on 24 September 2018. On 18 November 2020,

Carmila joined the SBF 120 and CAC Mid 60 indices.

IMPORTANT NOTICE Some of the statements contained in this

document are not historical facts but rather statements of future

expectations, estimates and other forward-looking statements based

on management's beliefs. These statements reflect such views and

assumptions prevailing as of the date of the statements and involve

known and unknown risks and uncertainties that could cause future

results, performance or events to differ materially from those

expressed or implied in such statements. Please refer to the most

recent Universal Registration Document filed in French by Carmila

with the Autorité des marchés financiers for additional information

in relation to such factors, risks and uncertainties. Carmila has

no intention and is under no obligation to update or review the

forward-looking statements referred to above. Consequently, Carmila

accepts no liability for any consequences arising from the use of

any of the above statements.

This press release and its appendices together

with the 2021 Half-Year Results presentation slideshow are

available in the “Financial Press Release” of Carmila’s Finance

webpage:

https://www.carmila.com/en/finance/financial-press-releases/

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210728005760/en/

INVESTOR AND ANALYST CONTACT Pierre-Yves Thirion – Chief

Financial Officer pierre_yves_thirion@carmila.com +33 6 47 21 60

49

PRESS CONTACT Morgan Lavielle - Communications Director

morgan_lavielle@carmila.com +33 6 87

77 48 80

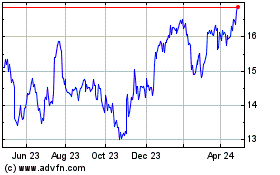

Carrefour Property Devel... (EU:CARM)

Historical Stock Chart

From Mar 2024 to Apr 2024

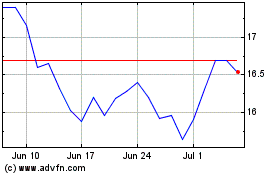

Carrefour Property Devel... (EU:CARM)

Historical Stock Chart

From Apr 2023 to Apr 2024