GE Posts Revenue, Core Earnings Growth

April 22 2016 - 7:30AM

Dow Jones News

General Electric Co. on Friday reported growth in revenue and

core earnings, though profit in its industrials business slid.

Shares, up 16% in the past year, slipped 0.7% in light trading

premarket as the company posted an overall loss.

Chief Executive Jeff Immelt said the company continues to

deliver "in a volatile environment."

He said the oil and gas environment is challenging "and the

value of GE is that we are able to offset this with better

performance across the portfolio."

GE is in the midst of a transformation to refocus on its core

industrial businesses like aviation and power.

Meanwhile, the conglomerate continues to make strides to exit

the financial business by shedding assets of GE Capital, which has

long been a distraction for investors who believed it dragged on

the company's share price. Since announcing its dismantling plan

last April, GE has signed some $166 billion in deals. GE filed a

request with federal regulators on March 31 to remove its

designation as a systemically important financial institution,

which would end its supervision by the Federal Reserve.

"Today our portfolio is simpler and stronger," said Mr. Immelt,

adding the company is ahead in its GE Capital exit plan, with $166

billion in deals signed.

Over all for the period ended March 31, GE reported a loss of

$98 million, or a penny a share, compared with a loss of $13.57

billion, or $1.35 a share, a year earlier. Revenue rose 6.1% to

$27.85 billion.

Excluding the finance businesses being wound down, GE reported a

profit of 21 cents a share, while revenue came in at $27.6 billion.

GE said those earnings were dented 2 cents a share by the

industrial segments.

Analysts polled by Thomson Reuters had forecast earnings of 19

cents a share on revenue of $27.62 billion excluding those

businesses.

GE said its industrial operating profit fell 3% to $2.9 billion

in the quarter. Orders slid 7% on an organic basis.

In the previous quarter, GE closed its acquisition of Alstom

SA's energy assets, bulking up its core power equipment business.

GE also split out its renewable energy businesses, including new

acquisitions from Alstom, into a stand-alone business unit.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

April 22, 2016 07:15 ET (11:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

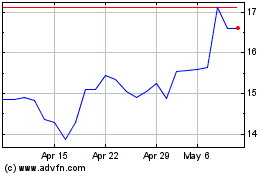

Alstom (EU:ALO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alstom (EU:ALO)

Historical Stock Chart

From Apr 2023 to Apr 2024