Coinbase Revenue Dips By Nearly 50% Amid Crypto Winter

November 05 2022 - 9:01PM

NEWSBTC

The crypto market continues to express more decline in the value of

most assets, especially Coinbase. Also, the intense bearish trend

is creating tighter conditions for almost all firms. The overall

effect results in adverse reports on the performance of the

companies. Related Reading: Dogecoin Shows Bullish Bias As $0.12

Support Holds; Will $0.15 Be Breached? Recently, Coinbase, the most

prominent American crypto exchange, released its report for the

third quarter of 2022. However, the data about its revenue are not

impressive. In addition, the exchange published its 3Q report

recently, which did not meet most analysts’ expectations. According

to the data, Coinbase’s revenue dipped by 50% from its last year’s

value due to fluctuations in trading activity. Hence, the firm lost

about $545 million compared with the gain of $406 million for its

Q3 2021. Adverse Macroeconomic Conditions Contribute To Revenue

Decline Coinbase wrote to its shareholders regarding the drop in

its revenue. It pointed out that the unfavorable macroeconomic

conditions and the dwindling crypto market created a negative

stance for the firm. Hence, the company’s trading volume dropped

drastically, leading to a fall in its revenue. Usually, the

exchange gets about 90% of its profits from its transaction fees,

which is higher than the industry average. But, the bearish crypto

market is not helping its activity. The detail of the company’s

report has its Q3 transaction revenue at $366 million. This

indicates a drop of about 44% from the second quarter. But it noted

a surge of 43% in subscription and service revenue as the value

hits $211 million. As a result, the overall revenue for the third

quarter dipped by 28% from Q2 2021. The company recorded a loss of

$116 million for its earnings before interest, taxes, depreciation,

and amortization (EBITDA). The value plummeted from the $618

million it gained during the same quarter in 2021. Related Reading:

Polygon Sees Large Volume Of MATIC Whale Transactions In Last 24

Hours Trading volume dipped by 27% to $159 billion against its $217

billion in the last quarter. Ethereum showed higher performance

than Bitcoin. It contributes 33% of the firm’s total trading volume

for the period, while Bitcoin accounts for 31%. Also, the firm

mentioned that its trading volume shifted considerably from

the US due to more concerns about regulations and some uncertainty.

Coinbase explained that the macroeconomic conditions caused retail

investors to go to holding, leading to reduced trading volume.

Coinbase Witnessed Drop In Users And Stock Additionally, Coinbase’s

user base is dropping. During the quarter, the firm noted about 8.5

million monthly transacting users (MTUs) against 9 million and 9.2

in Q2 and Q1, respectively. The firm said that 2023 could bring

more uncertainty. It stated that their preparation for next year is

with conservative bias with the assumption of more extreme

macroeconomic conditions. This year has been a dwindling one, even

on Coinbase stock. Due to the persisting bear market and the firm’s

shift from risk-on assets, its stock has dropped by three-quarters

of its value since January 2022. Featured Image From Pixabay,

Charts From Tradingview

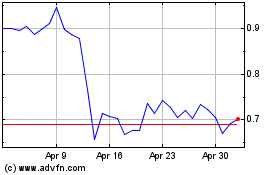

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

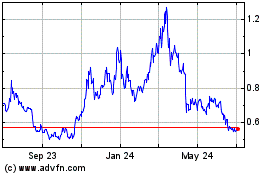

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024