Eni to Merge Renewables, Retail Businesses; Sets New Dividend Floor

February 19 2021 - 9:16AM

Dow Jones News

By Giulia Petroni

Eni SpA on Friday unveiled its strategic plan for 2021-24

period, including the merger of its renewable and retail businesses

and a rebased dividend policy.

The Italian oil-and-gas major said it would combine its

renewable and retail business, planning to reach a customer base of

15 million clients and a renewable installed capacity of 15

gigawatts by 2030. The overall investment for the business will be

four billion euros ($4.83 billion) during the 2021-2024 period.

The new segment is expected to increase adjusted earnings before

interest, taxes, depreciation and amortization to almost EUR1

billion in 2024 from EUR600 million in 2021.

Eni said it has committed to becoming carbon neutral by 2050 and

sees its renewables capacity increasing to 60 gigawatts in the next

three decades. It added that gas will represent more than 90% of

its production in the long term, supporting its transition away

from fossil fuels.

Eni set a dividend floor of EUR0.36 a share with oil prices at

$43 a barrel, from the previous level of $45 a barrel. It added it

will restart a share buyback of EUR300 million a year in a Brent

crude environment of $56 a barrel, EUR400 million from $61 a barrel

and EUR800 million from $66 a barrel.

The company said production will grow at an average of about 4%

a year during the plan, while upstream capex will amount to about

EUR4.5 billion per year on average. Annual average capital

expenditure for the group will be around EUR7 billion.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

February 19, 2021 09:01 ET (14:01 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

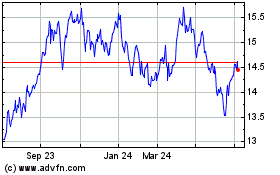

Eni (BIT:ENI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eni (BIT:ENI)

Historical Stock Chart

From Apr 2023 to Apr 2024