Italy Poised to Help Monte dei Paschi if Capital Raising Fails

December 12 2016 - 6:50AM

Dow Jones News

ROME—The Italian government would intervene to recapitalize

troubled lender Banca Monte dei Paschi di Siena SpA should the bank

fail to get the capital it needs to stay afloat from private

investors, a Treasury official said on Monday.

Late Sunday, the bank said it would reopen a debt-to-equity swap

offer, as part of a last resort attempt to complete a €5 billion

($5.3 billion) recapitalization and avoid being bailed out by the

Italian government.

The bank is racing to raise the capital by the end of the year,

after the European Central Bank, which supervises large eurozone

lenders, rejected its request for more time to complete its

plan.

The ECB had granted Monte dei Paschi until the end of the year

to raise the additional capital it needs as part of a major

overhaul at the bank, which includes the sale of €28 billion worth

of bad loans.

The bank had already offered its bondholders to swap €4.3

billion worth of subordinated, or riskier bonds, into shares.

However, the bank raked in only €1 billion in fresh capital from

the previous conversion offer.

It then planned to raise the remaining amount from one or more

large cornerstone investors and with a capital increase offered in

the market.

"If the transaction weren't successful the precautionary

recapitalization by the state would kick in under article 32 of the

Bank Recovery and Resolution Directive," the official said. "The

continuity of the bank and clients' savings would be preserved

under any scenario."

Under such European law, the government's financial support for

ailing banks may take several forms, such as a direct injection of

capital or a guarantee on the sale of financial instruments by the

bank.

It would be allowed if the failure of the bank would cause "a

serious disturbance in the economy" of the country where the bank

is based and to preserve financial stability.

Experts agree that such measures couldn't be taken without

imposing some losses on shareholders and bondholders of the

bank.

Monte dei Paschi's plans have been complicated by a government

crisis and resulting uncertainty prompted by Italy's rejection of

constitutional reforms in a referendum a week ago.

On Sunday, Italy's President Sergio Mattarella asked departing

Foreign Affairs Minister Paolo Gentiloni to form a new government

in a bid to quickly end the political crisis triggered by the

result of referendum.

The swift action on the government crisis has infused some

optimism at Monte dei Paschi as it makes its last-ditch attempt to

raise capital. The bank's shares rose more than 7% in early trading

in Milan on Monday.

However, people familiar with the matter have warned that it is

very unlikely that the bank will complete the transaction by

year-end.

Write to Giovanni Legorano at giovanni.legorano@wsj.com

(END) Dow Jones Newswires

December 12, 2016 06:35 ET (11:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

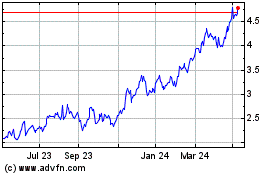

Banca Monte Dei Paschi D... (BIT:BMPS)

Historical Stock Chart

From May 2024 to Jun 2024

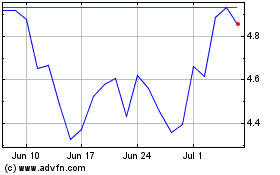

Banca Monte Dei Paschi D... (BIT:BMPS)

Historical Stock Chart

From Jun 2023 to Jun 2024