Progen Concedes Shareholder Requisitioned Meeting

February 19 2009 - 1:37AM

PR Newswire (US)

-- Progen board; MELBOURNE, Australia, Feb. 19

/PRNewswire-FirstCall/ -- A general meeting of Progen

Pharmaceuticals Ltd (ASX:PGL) shareholders was validly

requisitioned on January 28, 2009 by Cytopia Ltd (ASX:CYT) and 14

other Progen shareholders. The resolutions sought to achieve two

outcomes: -- A full share buyback accessible to all Progen

shareholders -- Removal of the current board and appointment of

three new independent directors The Progen board has announced that

shareholders will be provided the opportunity to elect a new board

but has refused to put forward the first resolution proposing the

full share buyback. The shareholder meeting has now been called for

March 27, 2009. The director candidates for the Progen board are

well qualified to act for shareholders and their biographies are

summarized in the request for general meeting announcement on

January 28, 2009 (ref:

http://www.cytopia.com.au/announcements09.html). Importantly, they

will be committed to fully advancing the strategic goals announced

by Progen on November 13, 2008. As well as being independent, they

will focus on the best interests of the company and all of its

shareholders and be receptive to their wishes. The current Progen

board has continued to deny shareholders the choice being actively

sought since the abrupt termination of the PI88 trial over seven

months ago. The shareholder resolutions proposed on January 28,

2008 allowed all shareholders the option of remaining as investors

in a cancer focused biotechnology company, having their shares

bought back by the company at $1.10 per share or some combination

of the two. The merger proposal with Avexa Limited (ASX:AVX) only

allows for up to a $20 million capital return to shareholders. We

believe a large number of shareholders would choose the full share

buyback, possibly in excess of 50% of Progen's shares. In this

case, they would face a significant scale back. The full buy back

resolution proposed by the shareholders in the meeting requisition

was responsibly conditioned, considered a buyback in the context of

a going concern rather than winding up the company and was capable

of execution had the Progen board so desired. A new board will

obviously be able to reconsider the wishes of shareholders. The

current Progen board has denied shareholders the opportunity to

vote on all resolutions at the one meeting, as requested. Although

it clearly would be in the best interests of shareholders to delay

by two weeks the meeting scheduled for March 11, 2009, shareholders

will now have to endure the avoidable inconvenience and cost of two

shareholder meetings. The resolutions put forward to the current

Progen board did not ask shareholders to vote on any merger with

Cytopia and suggestions otherwise are misleading. The independent

director candidates have a stated platform of exploring a merger

with Cytopia but any such discussions would only occur after

shareholders have been given the initial choice they seek. The

members' statement announced on January 28, 2008 provides clarity

regarding the intent of the members requisitioning the meeting. All

shareholders should be given the choice of a share buyback or

staying as investors. A new board is needed to make this possible.

As a result of the current Progen board being unwilling to fully

cooperate with the shareholder resolutions, the notice of meeting

issued by Progen does not include any statement from shareholders.

Instead, appropriate documentation addressing matters being put to

shareholders at both meetings will be distributed shortly to Progen

shareholders. It is important that all shareholders vote and fully

understand all the choices being presented at each meeting.

Proposed Progen and Avexa merger The material submitted by the

Progen board on February 5, 2009 (Progen-Avexa Merger Notice of

Meeting) details the high risk, high funding strategy that is being

proposed under the merger with Avexa. This strategy is in stark

contrast to the strategic recommendations arising from the

company-commissioned Beerworth report and presented to Progen

shareholders on November 13, 2008? -- Adopt a policy of licensing

an appropriate partner before commencing any future Phase III trial

-- Progen shareholders were advised of partnering interest in PI88

over a number of years, yet the company elected to take the

compound into Phase III trials and no partnering deal eventuated.

The Avexa merger proposes to focus investment in the Phase III

trials of Apricitabine (ATC). -- ATC has also not been partnered

and the total estimated cost of completion of Phase III trials is

$155 million. In the absence of either substantial new capital or

partnering and assuming trial success, a further $95 million is

likely to be needed to achieve product registration. -- Change

emphasis from pursuing the registration and commercialisation of a

single compound to a business model that involves the development

of a balanced portfolio of compounds and projects -- Despite the

eventual failure of PI88 development, the current Progen board

proposes a continuation of the same high risk business model under

an Avexa merger. -- Focus on acquiring complementary assets in

oncology discovery, research and development -- The Avexa merger

proposal concentrates on HIV, not oncology. The Avexa assets are

not complementary with the Progen assets. Recommendation A focus on

a single compound development strategy is inappropriate for Progen

shareholders and inconsistent with the recommendations the company

received last year from its own advisors. It is Cytopia's view that

all Progen shareholders should vote against the proposed merger

with Avexa on March 11, 2009 and vote for the appointment of a new

board willing to represent the interests of all shareholders on

March 27, 2009. About Cytopia Cytopia Ltd is an Australian

biotechnology company focused on the discovery and development of

new drugs to treat cancer and other diseases. Cytopia conducts its

research and drug development through subsidiaries based in

Melbourne, Australia and San Francisco, USA and specializes in

developing new small molecule compounds with an improved

therapeutic profile for the treatment of cancer. The company's lead

drug candidate is CYT997, a vascular disrupting agent (VDA) for the

treatment of various cancers, which is currently being trialled in

Phase I and Phase II clinical studies. Cytopia is continuing to

build on its range of JAK inhibitors and kinase expertise, with

CYT387, a novel oral JAK2 inhibitor focused on the treatment of

myeloproliferative disorders, expected to enter Phase I clinical

studies in 2009. DATASOURCE: Cytopia Ltd CONTACT: Mr. Andrew

Macdonald, Chief Executive Officer of Cytopia Ltd, +61 3 9208 4232,

; or Mr. Rudi Michelson of Monsoon Communications, +61 3 9620 3333,

Web Site: http://www.cytopia.com.au/announcements09.html

Copyright

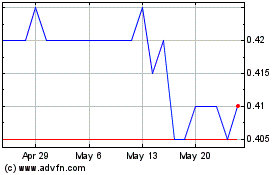

Prospa (ASX:PGL)

Historical Stock Chart

From Apr 2024 to May 2024

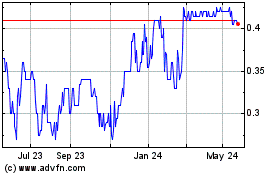

Prospa (ASX:PGL)

Historical Stock Chart

From May 2023 to May 2024