Diebold Secures Enough Shares to Complete Wincor Acquisition

March 29 2016 - 11:10AM

Dow Jones News

Diebold Inc. said Tuesday that it hit the required threshold in

its tender offer for German rival Wincor Nixdorf AG, moving the

cash-machine maker closer to sealing their merger.

North Canton, Ohio-based Diebold said it received 68.9% of

Wincor shares, an amount it said satisfies the minimum tender offer

condition of 67.6%. Excluding Treasury shares, Diebold secured

about 76.5% of Wincor, according to Diebold spokesman Michael

Jacobsen, meeting the 75% threshold required under German law.

Diebold and Wincor in November struck a $1.8 billion deal that

would create the world's largest maker of automated-teller machines

based on units sold. The Wall Street Journal reported earlier this

month that the deal was at risk of failing amid a lukewarm response

by investors. Some investors wait until the last minute to tender

shares, holding out for a higher price.

"With this milestone achieved, we look forward to completing

this transaction and integrating the two businesses," said Diebold

Chief Executive Andy Mattes. Diebold said its "additional

acceptance period" begins Wednesday and closes at midnight April

12, meaning the company could pick up more shares.

According to Gil Luria, managing director at Wedbush Securities,

executing the merger may be easier from this point forward, noting

the company may be able to avoid dealing with minority

shareholders.

The company said it expects to complete the merger, which needs

to win regulatory clearance, this summer.

Diebold shares rose 0.7% to $29.08 in morning trading in New

York.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

March 29, 2016 10:55 ET (14:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

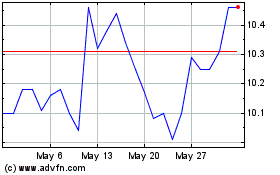

Pacific Current (ASX:PAC)

Historical Stock Chart

From May 2024 to Jun 2024

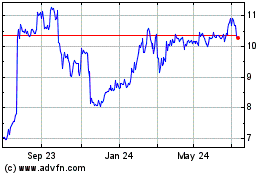

Pacific Current (ASX:PAC)

Historical Stock Chart

From Jun 2023 to Jun 2024