Australian Companies Play Down Indonesia Mining Law Change

March 09 2012 - 5:20AM

Dow Jones News

Australian mining companies were Friday playing down the

implications of a change in Indonesian law capping foreign

ownership in mines at no more than 49%, despite some uncertainty

over how the new regulation would be implemented.

Companies with existing "contracts of work," a system dating

back to 1967, contend the agreements remain valid until the agreed

expiry. Privately, many said they believe the target of the new law

are mining licenses known as IUP concessions.

Under the "contracts of work" system which governed investment

in Indonesia's coal, copper, gold and other resources, foreign

investors had been allowed to hold up to 80% of mining companies,

but the Energy and Mineral Resources Ministry Wednesday said

foreign investors would now be required to gradually reduce their

stake to 49% after 10 years of operation from the start of

production.

Many details remain unclear, but a senior Indonesian official

told Dow Jones Newswires that the rule change will only affect new

contracts or the renewal of existing contracts.

"We understand the changes do not apply to [our] existing

contract of work, which expires in 2029," said Kerrina Watson, a

spokeswoman for Newcrest Mining Ltd. (NCM.AU), Australia's largest

producer of gold.

Newcrest owns 82.5% of Gosowong, which produced 107,500 ounces

of gold in the three months through December. PT Aneka Tambang owns

the remainder.

Mining giant BHP Billiton Ltd. (BHP) was still reviewing the

presidential decree, spokesman Antonios Papaspiropoulos said. BHP

owns 75% of the IndoMet Coal operation in East Kalimantan.

Indonesian company, Adaro energy TBK owns the other 25% and holds a

coal contract of work.

A spokesman for Anglo-Australian miner Rio Tinto PLC (RIO)

wasn't immediately able to respond to questions about the new

law.

Robust Resources Ltd. (ROL.AU) said it would seek advise, but

didn't expect it would have to make any divestments after having

already taken on an Indonesian investor that has a 22.5% stake in

its local subsidiary and 9.4% holding in Robust itself. Robust has

two projects on Romang Island.

A number of existing contracts of work already contain

obligations to sell stakes in mining assets to an Indonesian

government body or an Indonesian national.

Kingrose Mining Ltd. (KRM.AU) said it isn't directly affected by

the new law as its 85% Indonesian subsidiary holds a contract of

work over a gold and silver project in Sumatra that is valid until

2034. The government has twice deferred an obligation to begin the

process of cutting its ownership in the subsidiary to 49%, and it

said it has been advised it has strong ground to continuing

deferring to March 2016.

Straits Resources Ltd. (SRQ.AU) on its website said the contract

of work for its Mt Muro mine in the province of Central Kalimantan

requires it to offer 51% of the operation, and while it complies

with this requirement each year, it has so far not received any

proposal.

One company with an IUP mining concession, Intrepid Mines Ltd.

(IAU.AU), said it was studying the regulation and considering its

best course of action for its Tujuh Bukit gold-silver-copper

project on the island of Java. It said the effect of and time frame

for the amended regulation was still subject to interpretation.

-By Robb M. Stewart, Dow Jones Newswires; +61 3 9292 2094;

robb.stewart@dowjones.com

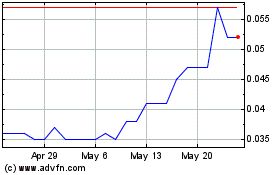

Kingsrose Mining (ASX:KRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

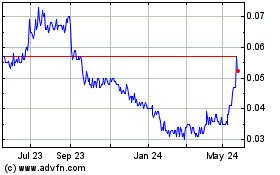

Kingsrose Mining (ASX:KRM)

Historical Stock Chart

From Apr 2023 to Apr 2024