Global Stocks Muted Ahead of Fed Announcement

March 16 2016 - 5:20AM

Dow Jones News

Global stocks were steady while the dollar strengthened

Wednesday as investors prepared to parse the Federal Reserve's

latest views on the U.S. economy and the course of interest

rates.

Moves were muted ahead of the Fed announcement, with the Stoxx

Europe 600 inching up 0.2% in early trade. Energy companies gained

as oil prices recovered, while shares of auto makers were up as the

euro weakened against the dollar. A weaker currency tends to boost

shares of exporters.

The U.S. central bank concludes its two-day monetary policy

meeting later Wednesday. While no change to interest rates is

expected, investors will assess the bank's policy statement and

economic projections as well as Chairwoman Janet Yellen's news

conference for guidance on what Fed officials will do next.

Recent U.S. economic data, including a strong jobs report, have

helped boost expectations among investors that the Fed will raise

rates later in the year.

In currencies, the euro was last down 0.3% against the dollar at

$1.1079. The dollar was up 0.5% against the yen at ¥ 113.7080 after

Bank of Japan Gov. Haruhiko Kuroda said the bank is prepared to

launch additional easing measures.

The British pound fell 0.4% against the dollar to $1.4100. The

U.K.'s FTSE 100 was up 0.4% as investors prepared for Chancellor

George Osborne to unveil fresh budget measures for the U.K. economy

later in the day.

Earlier, shares in China edged up after Premier Li Keqiang said

it is "impossible" for China not to realize its economic targets.

Japan's Nikkei Stock Average fell 0.8%, while Australia's S&P

ASX 200 edged higher following an uneventful session on Wall

Street.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

March 16, 2016 05:05 ET (09:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

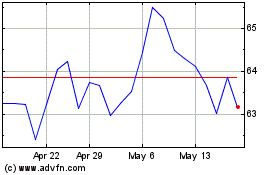

ASX (ASX:ASX)

Historical Stock Chart

From May 2024 to Jun 2024

ASX (ASX:ASX)

Historical Stock Chart

From Jun 2023 to Jun 2024