Global Stocks Drop on Renewed Concerns About China

March 08 2016 - 5:10AM

Dow Jones News

Global stocks fell Tuesday after fresh data sparked renewed

concerns about slowing growth in China and commodity prices cooled

after a recent rally.

The Stoxx Europe 600 was down 1% in early trade as lower oil and

metals prices prompted the mining sector to pull back from seven

consecutive sessions of gains. Shares in BHP Billiton PLC were down

nearly 6%, while Rio Tinto PLC and Glencore PLC both fell around

4%.

The moves came after data Tuesday showed China's exports

registered their biggest drop in more than five years as weak

global demand continued to undercut growth in the world's

second-largest economy.

"February trade data confirmed the disappointing start to 2016,"

economists at HSBC Global Research said in a note. "We believe a

more decisive policy stimulus package, including more aggressive

monetary policy and fiscal expansion, are warranted," they

added.

Hong Kong's Hang Seng Index fell 0.7%, while Japan's Nikkei

Stock Average fell 0.8% and Australia's S&P ASX 200 fell 0.7%.

China's Shanghai Composite Index ended 0.1% higher, pulling back

slightly from a five-day winning streak.

Also weighing on stocks, Brent crude oil fell 1% to $40.43 a

barrel. The fall came after a rise in oil prices on Monday helped

send Wall Street to its fifth consecutive session of gains.

U.S. stocks closed at their highest level since early January on

Monday after their longest winning streak since October. But many

investors remain cautious.

"There are a lot of things uncertain about the world right now,"

said Seth Masters, chief investment officer at AllianceBernstein's

wealth management arm, pointing to questions among investors about

China's economy, slow European growth, volatile oil prices, and

global central bank policy.

The European Central Bank meets Thursday and investors expect it

to announced additional stimulus measures, which could weigh on the

euro. The euro was last up 0.2% against the dollar at $1.1039 after

German industrial production came in above expectations in

January.

In other currencies, the dollar was down 0.2% against the yen at

¥ 112.8740.

In metals, gold was up 0.7% at $1273 an ounce.

Mark Magnier and Chao Deng contributed to this article

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

March 08, 2016 04:55 ET (09:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

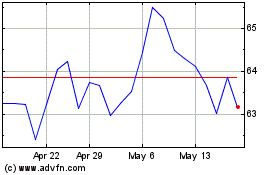

ASX (ASX:ASX)

Historical Stock Chart

From May 2024 to Jun 2024

ASX (ASX:ASX)

Historical Stock Chart

From Jun 2023 to Jun 2024