Polar Capital Holdings PLC AuM Update (8517P)

October 12 2023 - 2:00AM

UK Regulatory

TIDMPOLR

RNS Number : 8517P

Polar Capital Holdings PLC

12 October 2023

12 October 2023

Polar Capital Holdings plc

AuM Update

Polar Capital Holdings plc ("Polar Capital" or the "Group"), the

specialist active asset management group, today provides a

quarterly update of its unaudited statement of Assets under

Management ("AuM").

Group AuM (unaudited)

Polar Capital reports that as at 30 September 2023 its AuM were

GBP19.1bn compared to GBP19.2bn at the end of March 2023. During

the six-month period, AuM decreased by net redemptions of GBP0.6bn,

outflows from fund closures of GBP50m offset by a GBP0.5bn increase

related to market movement and fund performance.

AuM movement in six months to 30 September 2023

Open ended Investment Segregated Total

funds Trusts mandates

----------- ----------- ----------- -----------

AuM at 1 April 2023 GBP14,281m GBP3,910m GBP1,029m GBP19,220m

----------- ----------- ----------- -----------

Net flows GBP(475)m GBP(78)m GBP(28)m GBP(581)m

----------- ----------- ----------- -----------

Fund closures(1) GBP(7)m - GBP(43)m GBP(50)m

----------- ----------- ----------- -----------

Market movement GBP306m GBP271m GBP(31)m GBP546m

and performance

----------- ----------- ----------- -----------

Total AuM at GBP14,105m GBP4,103m GBP927m GBP19,135m

30 September 2023

----------- ----------- ----------- -----------

(1) Return of funds to investors on closure of the Melchior

European Absolute Return fund (Q1) and related segregated mandate

(Q2).

Net performance fees (unaudited)

The table below sets out the position relating to net

performance fee profits due to the Group (after the deduction of

staff interests) as a product of accrued performance fees in funds

managed by the Group three months before the strike point of such

performance fee receipts. The majority of the Group's performance

fees crystallise in the second half of the financial year. There is

no certainty that the fees will be sustained over the next quarter,

as performance fees can be volatile.

Performance fees Six months Year to Six months

to to

net of staff allocations 30 Sept 22 31 Mar 23 30 Sept 23

(year-end)

Received - GBP1.7m -

------------ ------------ ------------

Accrued but not yet earned in GBP4.8m n/a GBP1.3m*

funds with year ends on or before

the financial year end

------------ ------------ ------------

Total net performance fee profits GBP4.8m GBP1.7m GBP1.3m*

------------ ------------ ------------

*The figures have been reduced by GBP0.8m of net performance fee

distributions that relate to prior accounting periods that IFRS

require to be deducted from this year's receipts.

Gavin Rochussen, Chief Executive, commented:

"There has been continued demand and inflows into the Artificial

Intelligence, Japan Value, Emerging Market Stars, Asia Stars and

Smart Energy Funds, with combined net inflows of GBP225m across

these funds in the quarter.

"A combination of the continued challenging environment for

equity markets, net outflows, fund closures and fund performance

meant that our AuM at the end of the six-month period were

GBP19.1bn compared to GBP19.7bn at the end of the previous quarter

and GBP19.2bn at the end of March 2023. Total net outflows for the

quarter were GBP423m.

"During the quarter, the rate of outflows from the open-ended

Technology funds continued to decline, with GBP74m of net outflows

compared to GBP103m in the previous quarter and GBP199m in the

first quarter of this calendar year.

"Despite the challenging back drop, we are pleased with the

continuing progress in diversifying the business. The Smart funds

managed by the Sustainable Thematic team have now collectively

reached AuM of GBP280m. The Emerging Market and Asia Stars team now

collectively manages GBP1.5bn of AuM and continues its progress in

the US with US domiciled vehicles now surpassing GBP125m.

"Later this month the Global Insurance Fund celebrates its

25-year anniversary. Since launch it has delivered strong and

consistent annualised returns to shareholders of circa 10% pa, by

investing for the long-term in a concentrated portfolio of

best-in-class non-life insurers. Insurance sector performance is

typically counter-cyclical, offering investors genuine

diversification with unique drivers and we look forward to

continuing to generate steady returns for our investors for many

years to come.

"We remain confident that with our diverse range of

differentiated, active specialist fund strategies we are

well-positioned to perform for our clients and shareholders over

the long term."

For further information please contact:

Polar Capital

Gavin Rochussen (Chief Executive) +44 (0)20 7227

Samir Ayub (Finance Director) 2700

Numis Securities Limited - Nomad and Joint

Broker

Giles Rolls

Charles Farquhar +44 (0)20 7260

Stephen Westgate 1000

Peel Hunt LLP - Joint Broker

Andrew Buchanan

John Welch +44 (0)20 3597

Sam Milford 8680

Camarco

Ed Gascoigne-Pees

Jennifer Renwick +44 (0)20 3757

Phoebe Pugh 4995

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCNKDBQCBDDKKD

(END) Dow Jones Newswires

October 12, 2023 02:00 ET (06:00 GMT)

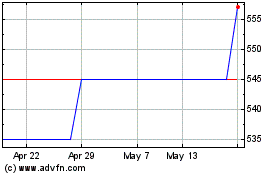

Polar Capital (AQSE:POLR.GB)

Historical Stock Chart

From Mar 2024 to Apr 2024

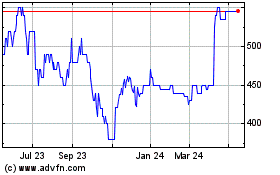

Polar Capital (AQSE:POLR.GB)

Historical Stock Chart

From Apr 2023 to Apr 2024