TIDMARK

RNS Number : 5823N

Arkle Resources PLC

26 September 2023

26(th) September 2023

Arkle Resources PLC

("Arkle" or the "Company")

Interim Statement for the period ended 30 June 2023

Chairman's Statement

Arkle continues to make progress on the main business of the

Company, mineral exploration. Our partner in the Stonepark zinc

project in Ireland has confirmed their intention to drill a deep

hole on a good zinc target discovered in 2022. We will shortly

undertake a short drilling programme on our Donegal gold licence.

Finally, we continue to review a number of overseas investment

opportunities, particularly in lithium.

Zinc

For the first time since 1965 there is no zinc production in

Ireland due, I hope, to the temporary closure of the Tara Mine in

Navan. For almost 60 years, Ireland was a world ranking zinc

producer. Known as a zinc province, Ireland was, and still is,

highly prospective for zinc.

The Glencore discovery at Pallas Green and the Tara Deep

discovery are each world class undeveloped discoveries. We believe

the three discoveries at Stonepark, Carrickittle and Ballywire

close to the Pallas Green deposit certainly have the makings of

another large discovery. The demand for zinc from emerging markets

is strong. The zinc price is also strong. But ever-growing capital

costs, more and more regulations and the huge rise in recent energy

prices have made new projects less economical. As someone actively

involved in Irish zinc since the late 1960s, I hope that the Tara

closure is temporary.

Our partner, Group Eleven, is the operator on our Stonepark

group of five licences. They keep the licences in good standing.

They have a number of good drill targets in the Stonepark -

Carrickittle - Ballywire corridor. Stonepark is not their top

priority. We have maintained our 23.44% interest and have informed

Group Eleven that we will participate in the deep hole on Stonepark

- when they decide to drill it.

Gold

We hold five licences in the Wicklow / Wexford area in Ireland

and one prospective licence in Donegal. We have drill ready targets

on the Donegal ground which we will shortly drill. Let me remind

shareholders that the Donegal geology is similar to that in the

multimillion ounce Dalradian gold discovery in Tyrone. The

Dalradian discovery is privately owned.

Over the years, repeated exploration programmes have identified

high grade gold in the Wicklow hills. The gold is in veins, often

very narrow and nuggety so one hole can hit a nugget giving very

high grades whilst the next hole either misses the narrow vein or

finds no nuggets and so delivers a low or non-existent grade.

The area needs an intensive drilling programme and Arkle needs a

farm out partner to carry most of the cost. The present difficult

fundraising environment on the AIM market for explorers makes this

difficult.

Lithium

There is lithium in the Wicklow granites. This has been known

for decades but until recently lithium in spodumene / pegmatite

rocks was not viable. The race to electrify cars and increase

battery storage to assist wind and solar projects has greatly

increased the demand for lithium. Arkle has undertaken two

prospecting programmes in the southern part of the block. Lithium

was found but the results were spotty. It needs further work.

We have applied for additional licences in the area.

Other Activities

Given the poor market perception of Irish zinc and gold

interests it was decided to look at opportunities outside

Ireland.

In the first instance we are looking at lithium projects. In

June 2022, we announced the award of licences in Zimbabwe. However,

there are difficulties there with title, so the work is paused at

present.

In another jurisdiction, we are progressing the acquisition of

two licence blocks which may contain lithium, although no previous

exploration for this mineral has been carried out on these

blocks.

The board has also examined a number of proposals in gold, base

metals and rare earths. None have progressed passed due diligence.

The programme to find new opportunities is ongoing.

John Teeling

Chairman

25(th) September 2023

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Enquiries:

Arkle Resources PLC

John Teeling, Chairman +353 (0) 1 833 2833

Jim Finn, Finance Director +353 (0) 1 833 2833

SP Angel Corporate Finance LLP

Nominated Advisor & Joint Broker

Matthew Johnson/Adam Cowl +44 (0) 203 470 0470

First Equity Limited

Joint Broker

Jason Robertson +44 (0) 207 374 2212

BlytheRay

Megan Ray +44 (0) 207 138 3204

Teneo

Luke Hogg +353 (0) 1 661 4055

Alan Tyrrell

Arkle Resources plc

Financial Information (Unaudited)

Condensed Consolidated Statement of Comprehensive Income Six Months Ended Year Ended

30 June 23 30 June 22 31 Dec 22

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

Administrative expenses (150) (139) (303)

- - -

----------- ----------- -----------

OPERATING LOSS (150) (139) (303)

Profit/(Loss) due to fair value volatility of warrants 117 160 4

----------- ----------- -----------

PROFIT/(LOSS) BEFORE TAXATION (33) 21 (299)

Income tax expense - - -

PROFIT/(LOSS) FOR THE PERIOD AND TOTAL COMPREHENSIVE INCOME (33) 21 (299)

=========== =========== ===========

PROFIT/(LOSS) PER SHARE - basic and diluted (0.01) c 0.01c (0.09) c

=========== =========== ===========

Condensed Consolidated Statement of Financial Position 30 June 23 30 June 22 31 Dec 22

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

NON-CURRENT ASSETS

Intangible Assets 4,026 3,949 3,991

----------- ----------- -----------

CURRENT ASSETS

Other receivables 16 24 7

Cash and cash equivalents 63 120 200

----------- ----------- -----------

79 144 207

----------- ----------- -----------

TOTAL ASSETS 4,105 4,093 4,198

----------- ----------- -----------

LIABILITIES

CURRENT LIABILITIES

Trade and other payables (383) (287) (326)

Warrants (39) - (156)

----------- ----------- -----------

(422) (287) (482)

----------- ----------- -----------

NET CURRENT LIABILITIES (343) (143) (275)

NET ASSETS 3,683 3,806 3,716

=========== =========== ===========

EQUITY

Share Capital - Deferred Shares 992 992 992

Share Capital - Ordinary Shares 988 864 988

Share Premium 6,923 6,817 6,923

Share based payments reserve 156 156 156

Retained deficit (5,376) (5,023) (5,343)

TOTAL EQUITY 3,683 3,806 3,716

=========== =========== ===========

Condensed Consolidated Statement of Changes in Shareholders Equity

Called-up Called-up

Share Share Share

Capital Capital Share Based Retained

Deferred Ordinary Premium Reserves Deficit Total

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

As at 1 January 2022 992 765 6,680 156 (5,044) 3,549

Shares issued - 99 137 - - 236

Profit for the period - - - - 21 21

As at 30 June 2022 992 864 6,817 156 (5,023) 3,806

------------- ------------- ---------- --------- --------- --------

Shares issued - 124 106 - 230

Loss for the period - - - - (320) (320)

As at 31 December 2022 992 988 6,923 156 (5,343) 3,716

------------- ------------- ---------- --------- --------- --------

Loss for the period - - - - (33) (33)

As at 30 June 2023 992 988 6,923 156 (5,376) 3,683

============= ============= ========== ========= ========= ========

Six Months Ended Year Ended

30 June 23 30 June 22 31 Dec 22

Condensed Consolidated Cash Flow unaudited unaudited audited

EUR'000 EUR'000 EUR'000

CASH FLOW FROM OPERATING ACTIVITIES

Loss for the year (33) 21 (299)

Share based payments charge - - 0

Fair value movement of warrants (117) (160) (4)

Foreign exchange (4) 7 12

----------- ----------- -----------

(154) (132) (291)

Movements in working capital 48 61 117

----------- ----------- -----------

NET CASH USED IN OPERATING ACTIVITIES (106) (71) (174)

CASH FLOW FROM INVESTING ACTIVITIES

Payments for exploration and evaluation (35) (118) (160)

----------- ----------- -----------

NET CASH USED IN INVESTING ACTIVITIES (35) (118) (160)

----------- ----------- -----------

CASH FLOW FROM FINANCING ACTIVITIES

Proceeds from issue of equity shares 0 236 466

----------- ----------- -----------

NET CASH FROM FINANCING ACTIVITIES 0 236 466

----------- ----------- -----------

NET INCREASE/(DECREASE) IN CASH AND CASH EQUIVALENTS (141) 47 132

Cash and Cash Equivalents at beginning of the period 200 80 80

Effects of exchange rate changes on cash held in foreign currencies 4 (7) (12)

CASH AND CASH EQUIVALENTS AT OF THE PERIOD 63 120 200

=========== =========== ===========

Notes:

1. INFORMATION

The financial information for the six months ended 30 June 2023

and the comparative amounts for the six months ended 30 June 2022

are unaudited.

The interim financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the European Union. The interim financial statements have been

prepared applying the accounting policies and methods of

computation used in the preparation of the published consolidated

financial statements for the year ended 31 December 2022.

The interim financial statements do not include all of the

information required for full annual financial statements and

should be read in conjunction with the audited consolidated

financial statements of the Group for the year ended 31 December

2022, which are available on the Company's website

www.arkleresources.com

The interim financial statements have not been audited or

reviewed by the auditors of the Group pursuant to the Auditing

Practices board guidance on Review of Interim Financial

Information.

2. No dividend is proposed in respect of the period.

3. EARNINGS PER SHARE

Basic earnings per share is computed by dividing the profit

after taxation for the year attributable to ordinary shareholders

by the weighted average number of ordinary shares in issue and

ranking for dividend during the year. Diluted earnings per share is

computed by dividing the profit after taxation for the year by the

weighted average number of ordinary shares in issue, adjusted for

the effect of all dilutive potential ordinary shares that were

outstanding during the year.

The following table sets out the computation for basic and

diluted earnings per share (EPS):

30 June 23 30 June 22 31 Dec 22

Profit/(loss) per share - Basic and Diluted (0.01) c 0.01c (0.09) c

=============== =============== ================

Basic profit/(loss) per share

The earnings and weighted average number of ordinary shares used in the calculation of basic

loss per share are as follows:

EUR'000 EUR'000 EUR'000

Profit for the year attributable to equity holders (33) 21 (299)

=============== =============== ================

Denominator Number Number Number

For basic and diluted EPS 395,382,426 330,296,947 343,481,056

=============== =============== ================

Basic and diluted loss per share are the same as the effect of

the outstanding share options is anti-dilutive.

4. INTANGIBLE ASSETS

30 June 23 30 June 22 31 Dec 22

Exploration and evaluation assets: EUR'000 EUR'000 EUR'000

Cost at 1 January 3,991 3,831 3,831

Additions 35 118 160

Closing Balance 4,026 3,949 3,991

=========== =========== ==========

In 2007 the Group entered into an agreement with Teck Cominco

which gave Teck Cominco the option to earn a 75% interest in a

number of other licences held by the Group. Teck Cominco had to

spend CAD$3m to earn the interest. During 2012 the relevant

licences were transferred to a new company, TILZ Minerals Limited,

which at 30 June 2022 was owned 23.44% (2021: 23.44%) by Limerick

Zinc Limited (subsidiary of Arkle Resources plc) and 76.56% (2021:

76.56%) by Group Eleven Resources Corp (third party).

On 13 September 2017 t he board of Arkle Resources plc were

informed that Group Eleven Resources Corp. a private company, has

acquired the 76.56% interest held by Teck Ireland in TILZ Minerals.

Arkle Resources plc owns the remaining 23.44%.

The Group's share of expenditure on the licences continues to be

capitalised as an exploration and evaluation asset. The Group is

subject to cash calls from Group Eleven Resources Corp. in respect

of the financing of the ongoing exploration an d evaluation of

these licences. In the event that the Group decides not to meet

these cash calls its interest in TILZ Minerals Limited may be

diluted accordingly.

On 23 June 2022 the Company was granted three licences covering

163 hectres to prospect for Lithium in the Insiza District of the

Matabeleland South Province of Zimbabwe. The directors believe that

these licences, which cover a small area, represent a low-cost

entry into one of the largest lithium producing countries in the

world.

The realisation of the intangible assets is dependent on the

discovery and successful development of economic reserves which is

subject to a number of risks as outlined below. Should this prove

unsuccessful the carrying value included in the balance sheet would

be written off to the statement of comprehensive income.

The group's activities are subject to a number of significant

potential risks including;

- Uncertainties over development and operational risks;

- Compliance with licence obligations;

- Ability to raise finance to develop assets;

- Liquidity risks; and

- Going concern risks.

The directors are aware that by its nature there is an inherent

uncertainty in such exploration and evaluation expenditure as to

the value of the asset. Having reviewed the carrying value of

exploration and evaluation of assets at 30 June 2023, the directors

are satisfied that the value of the intangible asset is not less

than carrying value.

30 June 23 30 June 22 31 Dec 22

Segmental Analysis EUR'000 EUR'000 EUR'000

Limerick 1,705 1,698 1,705

Rest of Ireland 2,297 2,243 2,274

Zimbabwe 24 8 12

----------- ----------- ----------

Closing Balance 4,026 3,949 3,991

=========== =========== ==========

5. SHARE CAPITAL AND SHARE PREMIUM

2022 2021

EUR'000 EUR'000

Authorised

1,000,000,000 Ordinary shares of 0.25c each 2,500 2,500

500,000,000 Deferred shares of 0.75c each 3,750 3,750

-------------- --------------

6,250 6,250

============== ==============

Share Capital Share Premium

EUR'000 EUR'000

Number

Deferred Shares - nominal value of 0.75c 132,311,593 992 -

============ ============== ==============

Share Capital Share Premium

Ordinary Shares - nominal value of 0.25c EUR'000 EUR'000

Number

Allotted, Called Up and Fully Paid:

Balance at 1 January 2022 305,982,426 765 6,680

Issued during the period 39,400,000 99 137

Balance at 30 June 2022 345,382,426 864 6,817

Issued during the period 50,000,000 124 106

------------ -------------- --------------

Balance at 31 December 2022 395,382,426 988 6,923

Issued during the period - - -

Balance at 30 June 2023 395,382,426 988 6,923

============ ============== ==============

Movement in shares

There was no movement in shares in the current period.

6. SHARE BASED PAYMENTS - OPTIONS

Equity-settled share-based payments are measured at fair value

at the date of grant.

The Group plan provides for a grant price equal to the average

quoted market price of the ordinary shares on the date of

grant.

30 Jun 23 Weighted average 30 Jun22 Weighted average 31 Dec 22 Weighted average

exercise price in exercise price in exercise price in

pence pence pence

'000 '000 '000

Outstanding at

beginning of

period 16,100 1.32 16,100 1.32 16,100 1.32

Granted during the - - - - -

period

Expired during the - - - - -

period

---------- ------------------- --------- ------------------- ---------- -------------------

Outstanding at end

of period 16,100 1.32 16,100 1.32 16,100 1.32

========== =================== ========= =================== ========== ===================

Exercisable at end

of period 16,100 1.32 16,100 1.32 16,100 1.32

========== =================== ========= =================== ========== ===================

7. SHARE BASED PAYMENTS - WARRANTS

Fair Value

30 June 23 30 June 22 31 Dec 22

EUR'000 EUR'000 EUR'000

At beginning of period 156 160 -

Issued during the period - - 156

Expired during the period - (4) -

Exercised during the period - (72) -

Movement in fair value (117) (84) -

----------- ----------- ----------

Closing Balance 39 - 156

=========== =========== ==========

30 June 23 30 June 22 31 Dec 22

EUR'000 EUR'000 EUR'000

Profit/(Loss) due to Fair Value Volatility of Warrants

Fair Value at 1 January 156 160 160

Less Fair Value at end of period 39 - 156

Movement for the period 117 160 4

=========== =========== ==========

Number

30 June 23 30 June 22 31 Dec 22

'000 '000 '000

Outstanding at beginning of period 50,000 110,463 69,063

Granted during the period - - 50,000

Exercised during the period - (39,400) -

Expired during the period - (2,000) (69,063)

----------- ----------- ----------

Closing Balance 50,000 69,063 50,000

=========== =========== ==========

On 1 January 2023 a total of 50,000,000 warrants with an

exercise price of 0.5p per warrant and a fair value of EUR155,690

were outstanding. These warrants have an expiry date of 24 November

2024. The movement in fair value for the period to 30 June 2033 of

EUR117,330 was expensed to the Consolidated Statement of

Comprehensive Income. The fair value was calculated using the

Black-Scholes valuation model.

8. POST BALANCE SHEET EVENTS

There are no material post balance sheet events affecting the

Company.

9. The Interim Report for the six months to 30 June 2023 was

approved by the Directors on 25(th) September 2023.

10. The Interim Report will be available on Arkle Resources

PLC's website www.arkleresources.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR MZGZLVKKGFZM

(END) Dow Jones Newswires

September 26, 2023 02:00 ET (06:00 GMT)

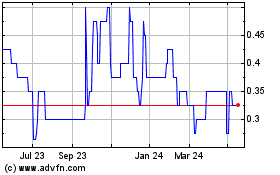

Arkle Resources (AQSE:ARK.GB)

Historical Stock Chart

From Mar 2024 to Apr 2024

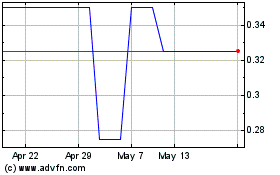

Arkle Resources (AQSE:ARK.GB)

Historical Stock Chart

From Apr 2023 to Apr 2024