TIDMARK

RNS Number : 0533B

Arkle Resources PLC

29 September 2022

29 September 2022

Arkle Resources PLC

("Arkle" or the "Company")

Interim Statement for the period ended 30 June 2022

Chairman's Statement

The principal activities of Arkle in recent months have been on

our Irish zinc holdings, where drilling is ongoing and on our

Wicklow / Wexford gold licences. Action on our gold licences has

been mainly focused on a review of recent drilling results. After

an extended delay the licence covering our main gold prospect in

Donegal was renewed.

The Environmental Targets for 2030 and 2050 cannot be reached

without massive and substantial investment in both mineral and

hydrocarbon resources. That is reality. Every EV, every windmill

requires metals. In the case of windmills, an offshore windmill

needs 1,650 tons of metals. Every EV requires metals for the body

and scarce Battery Group Metals for propulsion. There are huge and

growing gaps on projected demand against supplies. Since most mines

have short lives finding new sources of metals is a condition

precedent for Environmental Targets. This means exploration. This

in turn requires investors willing to put up risk capital. Without

discoveries there can be no new mines. That is a blinding glimpse

at the obvious but is not recognised. Private investors have

deserted explorers and institutions have backed off funding

development.

Lithium, copper graphite and nickel are vital to the green

economy, yet exploration is hard to fund.

Gold, as you would expect in an uncertain world, remains in

demand, but here again there is a dearth of early-stage exploration

funding.

The lack of London investor interest in Irish exploration assets

led the board to examine potential projects overseas. We focused on

geographic areas where we have experience, Africa, and on minerals

where we have knowledge, gold, base metals and, importantly,

Battery Group Metals, in particular lithium. On our board and in

the wider shareholder group there is a substantial body of

knowledge relating to lithium. We made a tentative entrance into

this area with the acquisition of three small areas in Zimbabwe,

one of the largest lithium producers in the world. We continue to

evaluate other opportunities.

Zinc

Recent months have seen the start of a six hole drilling

programme on our Stonepark licence block (owned 23.44% by Arkle and

76.56% by Group Eleven Resources Corp.). A seventh, deeper hole has

been added to the programme. The northern most licence of the six

blocks holding contains 5.1 million tonnes of 11.3% combined lead

and zinc. Most of the block remains unexplored. The six hole

programme is designed to test new areas. The first three holes have

been completed. One G-11-2531-01 was a 642 metre hole which

discovered a 150 metre vertical displacement of the fault. Hole

G-11-450-03, 3.7km away intersected a thick package of extensive

brecciation and pyrite. The results may point to a large and

compelling zinc target to the North of this hole. An additional

hole to test this target will be drilled following the completion

of the current three hole programme.

The third hole drilled to the West of the Stonepark discovery

encountered a number of low grade zinc intervals. Drilling has

commenced on the remaining three shallow holes which will test

targets close to the existing discovery.

The six hole programme is paid for. The additional hole which

could be as deep as 1,100 metres will cost in excess of EUR120,000.

Arkle has indicated that it will participate in this hole.

Gold

Arkle holds five prospecting licences in Wicklow / Wexford and

two in Donegal.

In 2021 extensive surveys were followed by a 12 hole drilling

programme on our Wicklow / Wexford ground. Some high grade results

were found but the extreme "nuggety" nature of the gold made

detailed analyses difficult. The conclusion was that the Tombreen

target was larger than previously anticipated with visible gold

identified along a 1.5km strike and 7km width. It is likely that

this gold extends from the Tombeen licence into the adjacent

Knocknalour licence.

It was decided to do a full review and modelling exercise of all

current and historic data and drillcore on the five licences. The

organisation due to undertake this exercise has not been in a

position to complete it due to equipment issues.

Arkle holds two licences in Donegal. Significant gold

indications have been discovered on the Meeneragh licence. It was

planned to begin a drilling programme in summer 2022 but a long

delay in renewing the licence meant that the weather window had

shortened and this is now deferred until 2023.

New Opportunities

Lack of investor interest in Irish zinc and gold exploration

combined with a growing anti-mining sentiment in certain parts of

the Irish government led the board to consider opportunities

outside of Ireland.

We focused on minerals and areas where we have some competence

in particular gold, base metals and lithium in Africa. The search

has been slow to gather momentum but is now making progress.

We put our toe into the water with the acquisition of three

licences containing lithium type rocks in Zimbabwe. We have

identified more ground but we are moving slowly. A number of gold

projects have been and are being examined but as yet, we have seen

none we deem worth pursuing. Base metals in sub-Saharan Africa

offer interesting possibilities but the main focus is lithium,

cobalt and platinum group minerals.

Future

Ireland has been the sole focus of Arkle activities. For two

generations the Irish structure for exploration has been the envy

of the world, certainty of title, a clear and quick path to

obtaining and renewing of licences, fair taxation, no state equity

involvement and good infrastructure. However, there is concern that

changing Irish State attitudes will hamper and dampen the efforts

of a small and declining group of explorers in Ireland.

What is absolutely certain is a growing shortage of critical

metals. This can only mean higher prices. Investors willing to take

the risks involved may be handsomely rewarded if prospects can be

turned into mines.

John Teeling

Chairman

28 September 2022

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Enquiries:

Arkle Resources PLC

John Teeling, Chairman +353 (0) 1 833 2833

Jim Finn, Finance Director +353 (0) 1 833 2833

SP Angel Corporate Finance LLP

Nominated Advisor & Joint Broker

Matthew Johnson/Adam Cowl +44 (0) 203 470 0470

First Equity Limited

Joint Broker

Jason Robertson +44 (0) 207 374 2212

BlytheRay +44 (0) 207 138 3204

Megan Ray

Rachael Brooks

Teneo

Luke Hogg +353 (0) 1 661 4055

Arkle Resources plc

Financial Information (Unaudited)

Six Months Ended Year Ended

30 Jun 22 30 Jun 21 31 Dec 21

unaudited unaudited audited

Condensed Consolidated Statement of Comprehensive Income EUR'000 EUR'000 EUR'000

Administrative expenses (139) (148) (320)

- - -

---------- ---------- -----------

OPERATING LOSS (139) (148) (320)

Profit/(Loss) due to fair value volatility of warrants 160 185 746

---------- ---------- -----------

PROFIT BEFORE TAXATION 21 37 426

Income tax expense - - -

PROFIT FOR THE PERIOD AND TOTAL COMPREHENSIVE INCOME 21 37 426

========== ========== ===========

PROFIT PER SHARE - basic and diluted 0.01c 0.01c 0.14c

========== ========== ===========

Condensed Consolidated Statement of Financial Position

30 Jun 22 30 Jun 21 31 Dec 21

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

NON-CURRENT ASSETS

Intangible Assets 3,949 3,514 3,831

---------- ---------- -----------

CURRENT ASSETS

Other receivables 24 61 32

Cash and cash equivalents 120 571 80

---------- ---------- -----------

144 632 112

---------- ---------- -----------

TOTAL ASSETS 4,093 4,146 3,943

---------- ---------- -----------

LIABILITIES

CURRENT LIABILITIES

Trade and other payables (287) (294) (234)

Warrants - (653) (160)

---------- ---------- -----------

(287) (947) (394)

---------- ---------- -----------

NET CURRENT LIABILITIES (143) (315) (282)

NET ASSETS 3,806 3,199 3,549

========== ========== ===========

EQUITY

Share Capital - Deferred Shares 992 992 992

Share Capital - Ordinary Shares 864 765 765

Share Premium 6,817 6,680 6,680

Share based payments reserve 156 127 156

Retained deficit (5,023) (5,365) (5,044)

TOTAL EQUITY 3,806 3,199 3,549

========== ========== ===========

Condensed Consolidated Statement of Changes in Shareholders Equity

Called-up Called-up

Share Share Share

Capital Capital Share Based Retained

Deferred Ordinary Premium Reserves Deficit Total

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

As at 1 January 2021 992 742 6,606 127 (5,470) 2,997

Shares issued - 23 74 - - 97

Fair value of warrants exercised - - - - 68 68

Profit for the period - - - - 37 37

As at 30 June 2021 992 765 6,680 127 (5,365) 3,199

----------- ----------- -------- --------- --------- --------

Share options granted - - - 29 - 29

Profit for the period - - - - 321 321

As at 31 December 2021 992 765 6,680 156 (5,044) 3,549

----------- ----------- -------- --------- --------- --------

Shares issued - 99 137 - - 236

Profit for the period - - - - 21 21

As at 30 June 2022 992 864 6,817 156 (5,023) 3,806

=========== =========== ======== ========= ========= ========

Condensed Consolidated Cash Flow Six Months Ended Year Ended

30 Jun 22 30 Jun 21 31 Dec 21

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

CASH FLOW FROM OPERATING ACTIVITIES

Profit for the year 21 37 426

Share based payments charge - - 29

Fair value movement of warrants (160) (185) (746)

Foreign exchange 7 (27) (25)

---------- ---------- -----------

(132) (175) (316)

Movements in working capital 61 78 47

---------- ---------- -----------

NET CASH USED IN OPERATING ACTIVITIES (71) (97) (269)

CASH FLOW FROM INVESTING ACTIVITIES

Payments for exploration and evaluation (118) (141) (458)

---------- ---------- -----------

NET CASH USED IN INVESTING ACTIVITIES (118) (141) (458)

---------- ---------- -----------

CASH FLOW FROM FINANCING ACTIVITIES

Proceeds from issue of equity shares 236 97 97

---------- ---------- -----------

NET CASH FROM FINANCING ACTIVITIES 236 97 97

---------- ---------- -----------

NET INCREASE/(DECREASE) IN CASH AND CASH EQUIVALENTS 47 (141) (630)

Cash and Cash Equivalents at beginning of the period 80 685 685

Effects of exchange rate changes on cash held in foreign currencies (7) 27 25

CASH AND CASH EQUIVALENTS AT OF THE PERIOD 120 571 80

========== ========== ===========

Notes:

1. INFORMATION

The financial information for the six months ended 30 June 2022

and the comparative amounts for the six months ended 30 June 2021

are unaudited.

The interim financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the European Union. The interim financial statements have been

prepared applying the accounting policies and methods of

computation used in the preparation of the published consolidated

financial statements for the year ended 31 December 2021.

The interim financial statements do not include all of the

information required for full annual financial statements and

should be read in conjunction with the audited consolidated

financial statements of the Group for the year ended 31 December

2021, which are available on the Company's website

www.arkleresources.com

The interim financial statements have not been audited or

reviewed by the auditors of the Group pursuant to the Auditing

Practices board guidance on Review of Interim Financial

Information.

2. No dividend is proposed in respect of the period.

3. EARNINGS PER SHARE

Basic earnings per share is computed by dividing the profit

after taxation for the year attributable to ordinary shareholders

by the weighted average number of ordinary shares in issue and

ranking for dividend during the year. Diluted earnings per share is

computed by dividing the profit after taxation for the year by the

weighted average number of ordinary shares in issue, adjusted for

the effect of all dilutive potential ordinary shares that were

outstanding during the year.

The following table sets out the computation for basic and

diluted earnings per share (EPS):

30 June 30 June 31 Dec

22 21 21

EUR EUR EUR

Profit per share - Basic and Diluted 0.01c 0.01c 0.14c

============== ============== ==============

Basic profit per share

The earnings and weighted average number of ordinary shares used

in the calculation of basic loss per share are as follows:

EUR'000 EUR'000 EUR'000

Profit for the year attributable

to equity holders 21 37 426

============== ============== ==============

Denominator Number Number Number

For basic and diluted EPS 330,296,947 305,051,947 220,039,097

============== ============== ==============

Basic and diluted loss per share are the same as the effect of

the outstanding share options is anti-dilutive.

4. INTANGIBLE ASSETS

30 June 22 30 June 21 31 Dec 21

Exploration and evaluation assets: EUR'000 EUR'000 EUR'000

Cost at 1 January 3,831 3,373 3,373

Additions 118 141 458

Closing Balance 3,949 3,514 3,831

=========== =========== ==========

In 2007 the Group entered into an agreement with Teck Cominco

which gave Teck Cominco the option to earn a 75% interest in a

number of other licences held by the Group. Teck Cominco had to

spend CAD$3m to earn the interest. During 2012 the relevant

licences were transferred to a new company, TILZ Minerals Limited,

which at 30 June 2022 was owned 23.44% (2021: 23.44%) by Limerick

Zinc Limited (subsidiary of Arkle Resources plc) and 76.56% (2021:

76.56%) by Group Eleven Resources Corp (third party).

On 13 September 2017 t he board of Arkle Resources plc were

informed that Group Eleven Resources Corp. a private company, has

acquired the 76.56% interest held by Teck Ireland in TILZ Minerals.

Arkle Resources plc owns the remaining 23.44%.

The Group's share of expenditure on the licences continues to be

capitalised as an exploration and evaluation asset. The Group is

subject to cash calls from Group Eleven Resources Corp. in respect

of the financing of the ongoing exploration an d evaluation of

these licences. In the event that the Group decides not to meet

these cash calls its interest in TILZ Minerals Limited may be

diluted accordingly.

On 23 June 2022 the Company announced that they been granted

three licences covering 163 hectres to prospect for Lithium in the

Insiza District of the Matabeleland South Province of Zimbabwe. The

directors believe that these licences, which cover a small area,

represent a low-cost entry into one of the largest lithium

producing countries in the world.

The realisation of the intangible assets is dependent on the

discovery and successful development of economic reserves which is

subject to a number of risks as outlined below. Should this prove

unsuccessful the carrying value included in the balance sheet would

be written off to the statement of comprehensive income.

The group's activities are subject to a number of significant

potential risks including;

- Uncertainties over development and operational risks;

- Compliance with licence obligations;

- Ability to raise finance to develop assets;

- Liquidity risks; and

- Going concern risks.

The directors are aware that by its nature there is an inherent

uncertainty in such exploration and evaluation expenditure as to

the value of the asset. Having reviewed the carrying value of

exploration and evaluation of assets at 30 June 2022, the directors

are satisfied that the value of the intangible asset is not less

than carrying value.

30 June 22 30 June 21 31 Dec 21

Segmental Analysis EUR'000 EUR'000 EUR'000

Limerick 1,698 1,600 1,600

Rest of Ireland 2,243 1,914 2,231

Zimbabwe 8 - -

----------- ----------- ----------

Closing Balance 3,949 3,514 3,831

=========== =========== ==========

5. SHARE CAPITAL AND SHARE PREMIUM

2022 2021

EUR'000 EUR'000

Authorised

1,000,000,000 Ordinary shares

of 0.25c each 2,500 2,500

500,000,000 Deferred shares of

0.75c each 3,750 3,750

--------- ---------

6,250 6,250

========= =========

Share Share

Capital Premium

Number EUR'000 EUR'000

Deferred Shares - nominal value

of 0.75c 132,311,593 992 -

============ ========= =========

Share Share

Ordinary Shares - nominal value Capital Premium

of 0.25c Number EUR'000 EUR'000

Allotted, Called Up and Fully

Paid:

Balance at 1 January 2021 297,044,926 742 6,606

Issued during the period 8,937,500 23 74

Balance at 30 June 2021 305,982,426 765 6,680

Issued during the period - - -

------------ --------- ---------

Balance at 31 December 2021 305,982,426 765 6,680

Issued during the period 39,400,000 99 137

Balance at 30 June 2022 345,382,426 864 6,817

============ ========= =========

Movement in shares

On 19 January 2021 a total of 8,937,500 shares were issued on

the exercise of 8,937,500 warrants at a price of 0.5p and 1.2p per

share to provide additional working capital and fund development

costs.

On 22 February 2022 a total of 30,080,000 shares were issued on

the exercise of 30,080,000 warrants at a price of 0.5p per share to

provide additional working capital and fund development costs.

On 28 April 2022 a total of 9,320,000 shares were issued on the

exercise of 9,320,000 warrants at a price of 0.5p per share to

provide additional working capital and fund development costs.

6. SHARE BASED PAYMENTS - OPTIONS

Equity-settled share-based payments are measured at fair value

at the date of grant.

The Group plan provides for a grant price equal to the average

quoted market price of the ordinary shares on the date of

grant.

30 Jun 22 Weighted average 30 Jun21 Weighted average 31 Dec 21 Weighted average

exercise price in exercise price in exercise price in

pence pence pence

'000 '000 '000

Outstanding at

beginning of

period 16,100 1.32 13,100 1.22 13,100 1.22

Granted during the

period - - - 3,000 1.80

Expired during the - - - - -

period

---------- ------------------- --------- ------------------- ---------- -------------------

Outstanding at end

of period 16,100 1.32 13,100 1.22 16,100 1.32

========== =================== ========= =================== ========== ===================

Exercisable at end

of period 16,100 1.32 13,100 1.22 16,100 1.32

========== =================== ========= =================== ========== ===================

7. SHARE BASED PAYMENTS - WARRANTS

Fair Value

30 June 22 30 June 21 31 Dec 21

EUR'000 EUR'000 EUR'000

At 1 January 160 906 906

Expired (4) - -

Exercised (72) (68) (68)

Movement in fair value (84) (185) (678)

----------- ----------- ----------

Closing Balance - 653 160

=========== =========== ==========

Number

30 June 22 30 June 21 31 Dec 21

'000 '000 '000

Outstanding at beginning of period 110,463 119,400 119,400

Granted during the period - - -

Exercised during the period (39,400) (8,937) (8,937)

Expired during the period (2,000) - -

----------- ----------- ----------

Closing Balance 69,063 110,463 110,463

=========== =========== ==========

On 1 January 2022 a total of 41,400,000 warrants with an

exercise price of 0.5p per warrant were outstanding. During the

period a total of 39,400,000 warrants with a fair value of

EUR72,193 were exercised. The balance of the 2,000,000 warrants

with a fair value of EUR3,664 expired in April 2022. The movement

in fair value of EUR75,857 was expensed to the Consolidated

Statement of Comprehensive Income.

On 1 January 2022 a total of 69,062,500 warrants with an

exercise price of 1.2p per warrant and a fair value of EUR83,814

were outstanding. These warrants have an expiry date of 7 September

2022. The movement in fair value of EUR83,814 was expensed to the

Consolidated Statement of Comprehensive Income.

8. POST BALANCE SHEET EVENTS

There are no material post balance sheet events affecting the

Company.

9. The Interim Report for the six months to 30 June 2022 was

approved by the Directors on 28 September 2022.

10. The Interim Report will be available on Arkle Resources

PLC's website www.arkleresources.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBUGDCRXDDGDI

(END) Dow Jones Newswires

September 29, 2022 02:00 ET (06:00 GMT)

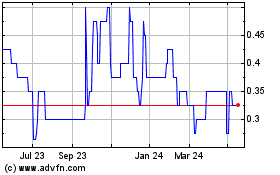

Arkle Resources (AQSE:ARK.GB)

Historical Stock Chart

From Apr 2024 to May 2024

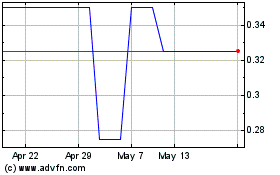

Arkle Resources (AQSE:ARK.GB)

Historical Stock Chart

From May 2023 to May 2024