Securities Registration (section 12(b)) (8-a12b)

June 03 2020 - 6:02AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-A

FOR

REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF

THE SECURITIES EXCHANGE ACT OF 1934

UBS AG

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

Switzerland

|

|

90-0186363

|

|

(State of Incorporation or Organization)

|

|

(I.R.S. Employer Identification no.)

|

|

|

|

|

Bahnhofstrasse 45, CH-8098 – Zurich, Switzerland

Aeschenvorstadt 1, CH-4051 – Basel, Switzerland

|

|

N/A

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Securities to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of Each Class

to be so Registered

|

|

Name of Each Exchange on Which

Each Class is to be Registered

|

|

ETRACS Monthly Pay 1.5x Leveraged Mortgage REIT ETN due June 10, 2050

|

|

NYSE Arca, Inc.

|

|

ETRACS Monthly Pay 1.5x Leveraged Closed-End Fund Index ETN due June 10, 2050

|

|

NYSE Arca, Inc.

|

|

ETRACS Quarterly Pay 1.5x Leveraged Wells Fargo BDC Index ETN due June 10, 2050

|

|

NYSE Arca, Inc.

|

|

ETRACS Quarterly Pay 1.5x Leveraged Alerian MLP Index ETN due June 10, 2050

|

|

NYSE Arca, Inc.

|

If this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General

Instruction A.(c) or (e), please check the following box: ☒

If this form relates to the registration of a class of securities pursuant

to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d) or (e), please check the following box: ☐

If this form relates to the registration of a class of securities concurrently with a Regulation A offering, check the following box: ☐

Securities Act registration statement or Regulation A offering statement file number to which this form relates: 333-225551 (if applicable)

Securities to be registered pursuant to

Section 12(g) of the Act:

None

(Title of Class)

|

Item 1.

|

Description of Registrant’s Securities to be Registered

|

The Registrant filed with the Securities and Exchange Commission (the “Commission”) a Registration Statement on Form F-3 (Registration Statement No. 333-225551) (the “Registration Statement”) containing a prospectus, dated October 31, 2018, relating to the

Registrant’s Debt Securities and Warrants (the “Prospectus”). The Registration Statement was declared effective on October 31, 2018. On the date hereof, the Registrant intends to file with the Commission pursuant to Rule 424(b)

under the Securities Act of 1933, four prospectus supplements, each dated June 2, 2020 (the “Prospectus Supplements”) relating to four series of the Registrant’s Exchange Traded Access Securities (“ETRACS”), entitled

(a) ETRACS Monthly Pay 1.5x Leveraged Mortgage REIT ETN due June 10, 2050; (b) ETRACS Monthly Pay 1.5x Leveraged Closed-End Fund Index ETN due June 10, 2050; (c) ETRACS Quarterly Pay 1.5x

Leveraged Wells Fargo BDC Index ETN due June 10, 2050; and (d) ETRACS Quarterly Pay 1.5x Leveraged Alerian MLP Index ETN due June 10, 2050, each of which is part of the Registrant’s Medium-Term Notes, Series B. The Prospectus

Supplements and the Prospectus are incorporated by reference to the extent set forth below.

The material set forth (i) under the

headings “Description of Debt Securities We May Offer” on pages 12 to 31, “Considerations Relating to Indexed Securities” on pages 52 to 54, “U.S. Tax Considerations” on pages 58 to 68 and “Tax Considerations Under

the Laws of Switzerland” on pages 69 to 70 in the Prospectus and (ii) in the respective Prospectus Supplements are each incorporated herein by reference, as applicable. The outstanding principal amount of the securities of each series

registered hereby may be increased from time to time in the future due to further issuances of securities having substantially the same terms. If any such additional securities are issued, a prospectus supplement relating to the additional

securities will be filed with the Securities and Exchange Commission and will be incorporated herein by reference. The securities of each series registered hereby are, and any additional securities of such series registered hereby in the future will

be, all part of a single series of the Registrant’s Medium-Term Notes, Series B, as described in the documents referenced above.

Pursuant to the Instructions as to Exhibits with respect to Form 8-A, the following exhibits are being

filed with the Commission in connection with this Registration Statement on Form 8-A:

|

|

1.

|

Debt Indenture, dated as of June 12, 2015, between the Company and U.S. Bank Trust National Association, as

debt trustee (incorporated by reference to Exhibit 4.22 of the Registrant’s registration statement no. 333-204908).

|

|

|

2.

|

Form of ETRACS Monthly Pay 1.5x Leveraged Mortgage REIT ETN due June 10, 2050.

|

|

|

3.

|

Form of ETRACS Monthly Pay 1.5x Leveraged Closed-End Fund Index ETN due

June 10, 2050.

|

|

|

4.

|

Form of ETRACS Quarterly Pay 1.5x Leveraged Wells Fargo BDC Index ETN due June 10, 2050.

|

|

|

5.

|

Form of ETRACS Quarterly Pay 1.5x Leveraged Alerian MLP Index ETN due June 10, 2050.

|

|

|

6.

|

Officers’ Certificate of the Registrant pursuant to Section 301 of the Debt Indenture setting forth

the terms of the Registrant’s Medium-Term Notes, Series B (incorporated by reference to Exhibit 3 of the Registrant’s registration statement on Form 8-A, filed with the Commission on July 14,

2015).

|

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this registration

statement to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

UBS AG

|

|

|

|

|

|

(Registrant)

|

|

Dated: June 2, 2020

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Timothy Geller

|

|

|

|

|

|

Name:

|

|

Timothy Geller

|

|

|

|

|

|

Title:

|

|

Executive Director

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Shruti Senapati

|

|

|

|

|

|

Name:

|

|

Shruti Senapati

|

|

|

|

|

|

Title:

|

|

Director

|

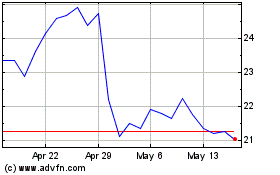

Microsectors Energy 3x L... (AMEX:WTIU)

Historical Stock Chart

From Mar 2024 to Apr 2024

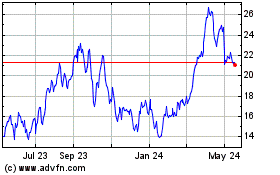

Microsectors Energy 3x L... (AMEX:WTIU)

Historical Stock Chart

From Apr 2023 to Apr 2024