Current Report Filing (8-k)

November 07 2022 - 5:16PM

Edgar (US Regulatory)

0001617669FALSE00016176692022-11-072022-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 7, 2022

UNIQUE FABRICATING, INC.

(Exact name of registrant as specified in its Charter)

| | | | | | | | |

| Delaware | 001-37480 | 46-1846791 |

(State or other jurisdiction

of Incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | |

| 800 Standard Parkway | | |

| Auburn Hills, | Michigan | | 48326 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (248) 853-2333

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $.001 per share | UFAB | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01. Entry Into a Material Definitive Agreement.

On November 7, 2022, Unique Fabricating NA, Inc. (the “US Borrower”) and Unique-Intasco Canada, Inc. (the “CA Borrower” and together with the US Borrower, the “Borrowers” or the “Company”) and their subsidiaries entered into the Waiver and Ninth Amendment to Credit Agreement (“Ninth Amendment”) with respect to the Amended and Restated Credit Agreement, as amended, among the Borrowers, their subsidiaries, the financial institutions signatory thereto (the “Lenders”) and Citizens Bank, National Association, a national banking association, as Administrative Agent for the lenders (the “Agent”), as amended, included by the Forbearance Agreement (the “Credit Agreement”). As previously reported, as of December 31, 2020, and March 31, 2021, the Company was in violation of certain of its financial covenants (the “Specified Defaults”), as defined in the Credit Agreement. As of September 30, 2021, the Company was also in violation of the required Minimum Consolidated EBITDA covenant, as amended by the Second Amendment to the Forbearance Agreement dated September 21, 2021 (the “Specified Forbearance Termination Event”). The Lenders entered into a Forbearance Agreement initially in April 2021, which subsequently has been extended, most recently through November 7, 2022, pursuant to which the Lenders agreed to forbear on a limited basis from exercising their rights because of the Specified Defaults and the Specified Forbearance Termination Event. The Lenders in the Ninth Amendment, among other things, agreed to grant a permanent waiver of the Specified Defaults and the Specified Forbearance Termination Event that have occurred prior to the effectiveness of the Ninth Amendment and of any right the Lenders may have to exercise any of their rights against the Company as a result.

The Ninth Amendment also requires that the Company repay the outstanding principal balance of the Loans under the Credit Agreement and all accrued and unpaid interest thereon on or before February 3, 2023 (subject to extension to not later than February 28, 2023 if the Company complies with certain conditions (the “Repayment Date” )). The Company also is required to deliver to the Lenders by December 9, 2022, non-binding indications of interest from one or more potential counterparties to one or more refinancing transactions which aggregate sufficient net proceeds to result in repayment in full of the Loans and other Indebtedness on or before the Repayment Date (the “Refinancing Transaction”). The Company is further required to deliver by January 16, 2023, at least one fully executed term sheet with respect to a Refinancing Transaction with a counterparty that satisfies certain qualifications specified in the Ninth Amendment. If the Company fails to meet these milestone dates or repay the Loans or other Indebtedness in full on or before the Repayment Date it will constitute an event of default under the Credit Agreement.

The Company also is required to cause its Mexican subsidiary to grant as security for repayment of the Loans, by December 8, 2022, a first priority lien, subject only to permitted liens, enforceable under Mexican law in such subsidiary’s accounts receivables.

Item 9.01. Exhibits.

(d) Exhibits. The following exhibits are filed herewith:

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (the Cover Page Interactive Data File is embedded with the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| UNIQUE FABRICATING, INC. |

| Date: November 7, 2022 | By: | /s/ Brian P. Loftus |

| | Brian P. Loftus |

| | Chief Financial Officer |

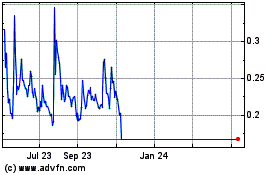

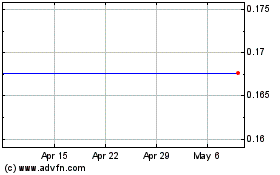

Unique Fabricating (AMEX:UFAB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unique Fabricating (AMEX:UFAB)

Historical Stock Chart

From Apr 2023 to Apr 2024