UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of: February, 2024

Commission File No. 001-40381

NEW PACIFIC METALS CORP.

(Translation of registrant’s name into English)

Suite 1750 - 1066 W. Hastings Street

Vancouver BC, Canada V6E 3X1

(Address of principal executive office)

[Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F]

Form 20-F [ ] Form 40-F

[X]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1) [ ]

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is “submitting” the Form 6-K in paper as permitted by Regulation S-T “Rule” 101(b)(7) [ ]

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Dated: February 13, 2024 |

NEW PACIFIC METALS CORP. |

|

| |

|

|

| |

“Jalen Yuan” |

|

| |

Jalen Yuan |

|

| |

Chief Financial Officer |

|

EXHIBIT INDEX

Exhibit

99.1

UNAUDITED

CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

For

the three and six months ended December 31, 2023 and 2022

(Expressed

in United States Dollars)

New Pacific

Metals Corp.

Unaudited Condensed Consolidated Interim Statements of Financial Position

(Expressed in US dollars)

| | |

Notes | | |

December 31, 2023 | | |

June 30, 2023 | |

| ASSETS | |

| | |

| | |

| |

| Current Assets | |

| | |

| | |

| |

| Cash and cash equivalents | |

| | |

$ | 25,837,156 | | |

$ | 6,296,312 | |

| Short-term investments | |

| | |

| 198,010 | | |

| 198,375 | |

| Receivables | |

| | |

| 336,158 | | |

| 421,860 | |

| Deposits and prepayments | |

| | |

| 485,579 | | |

| 631,402 | |

| | |

| | |

| 26,856,903 | | |

| 7,547,949 | |

| Non-current Assets | |

| | |

| | | |

| | |

| Other tax receivable | |

3 | | |

| 5,634,888 | | |

| 5,530,422 | |

| Equity investments | |

| | |

| 278,126 | | |

| 283,081 | |

| Plant and equipment | |

5 | | |

| 1,352,361 | | |

| 1,339,839 | |

| Mineral property interests | |

6 | | |

| 106,036,909 | | |

| 103,606,250 | |

| TOTAL ASSETS | |

| | |

$ | 140,159,187 | | |

$ | 118,307,541 | |

| | |

| | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | |

| | | |

| | |

| Current Liabilities | |

| | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

| | |

$ | 1,031,637 | | |

$ | 2,280,553 | |

| Due to a related party | |

7 | | |

| 125,234 | | |

| 56,102 | |

| | |

| | |

| 1,156,871 | | |

| 2,336,655 | |

| Total Liabilities | |

| | |

| 1,156,871 | | |

| 2,336,655 | |

| | |

| | |

| | | |

| | |

| Equity | |

| | |

| | | |

| | |

| Share capital | |

8 | | |

| 181,229,877 | | |

| 155,840,052 | |

| Share-based payment reserve | |

| | |

| 19,023,207 | | |

| 18,636,297 | |

| Accumulated other comprehensive income | |

| | |

| 10,794,208 | | |

| 10,227,980 | |

| Deficit | |

| | |

| (71,893,430 | ) | |

| (68,623,306 | ) |

| Total equity attributable to the equity holders of the Company | |

| | |

| 139,153,862 | | |

| 116,081,023 | |

| Non-controlling interests | |

9 | | |

| (151,546 | ) | |

| (110,137 | ) |

| Total Equity | |

| | |

| 139,002,316 | | |

| 115,970,886 | |

| | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND EQUITY | |

| | |

$ | 140,159,187 | | |

$ | 118,307,541 | |

Approved

on behalf of the Board:

| (signed) Maria Tang |

|

| Director |

|

| |

|

| (signed) Andrew Williams |

|

| Director |

|

See

accompanying notes to the unaudited condensed consolidated interim financial statements

New

Pacific Metals Corp.

Unaudited Condensed Consolidated Interim Statements of Loss

(Expressed in US dollars)

| | |

| | |

Three months ended

December 31, | | |

Six months ended

December 31, | |

| | |

Notes | | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Operating expense | |

| | |

| | |

| | |

| | |

| |

| Project evaluation and corporate development | |

| | |

$ | (76,553 | ) | |

$ | (77,561 | ) | |

$ | (189,537 | ) | |

$ | (186,097 | ) |

| Depreciation | |

5 | | |

| (54,345 | ) | |

| (51,181 | ) | |

| (104,958 | ) | |

| (106,192 | ) |

| Filing and listing | |

| | |

| (85,109 | ) | |

| (85,108 | ) | |

| (167,031 | ) | |

| (205,226 | ) |

| Investor relations | |

| | |

| (53,340 | ) | |

| (128,832 | ) | |

| (144,103 | ) | |

| (268,349 | ) |

| Professional fees | |

| | |

| (106,685 | ) | |

| (61,730 | ) | |

| (193,091 | ) | |

| (170,526 | ) |

| Salaries and benefits | |

| | |

| (650,973 | ) | |

| (430,404 | ) | |

| (1,101,112 | ) | |

| (759,574 | ) |

| Office and administration | |

| | |

| (379,675 | ) | |

| (352,921 | ) | |

| (712,461 | ) | |

| (719,797 | ) |

| Share-based compensation | |

8(b) | | |

| (412,077 | ) | |

| (739,971 | ) | |

| (1,075,099 | ) | |

| (1,570,829 | ) |

| | |

| | |

| (1,818,757 | ) | |

| (1,927,708 | ) | |

| (3,687,392 | ) | |

| (3,986,590 | ) |

| Other

income (expense) | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income from investments | |

4 | | |

$ | 275,020 | | |

$ | 83,455 | | |

$ | 295,294 | | |

$ | 41,781 | |

| Gain on disposal of plant and equipment | |

5 | | |

| - | | |

| - | | |

| 51,418 | | |

| - | |

| Foreign exchange gain (loss) | |

| | |

| 16,666 | | |

| (28,750 | ) | |

| 66,995 | | |

| (13,857 | ) |

| | |

| | |

| 291,686 | | |

| 54,705 | | |

| 413,707 | | |

| 27,924 | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Net

loss | |

| | |

$ | (1,527,071 | ) | |

$ | (1,873,003 | ) | |

$ | (3,273,685 | ) | |

$ | (3,958,666 | ) |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Attributable

to: | |

| | |

| | | |

| | | |

| | | |

| | |

| Equity holders of the Company | |

| | |

$ | (1,524,108 | ) | |

$ | (1,870,718 | ) | |

$ | (3,270,124 | ) | |

$ | (3,955,901 | ) |

| Non-controlling interests | |

9 | | |

| (2,963 | ) | |

| (2,285 | ) | |

| (3,561 | ) | |

| (2,765 | ) |

| Net loss | |

| | |

$ | (1,527,071 | ) | |

$ | (1,873,003 | ) | |

$ | (3,273,685 | ) | |

$ | (3,958,666 | ) |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss

per share attributable to the equity holders of the Company | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per share - basic and diluted | |

| | |

$ | (0.01 | ) | |

$ | (0.01 | ) | |

$ | (0.02 | ) | |

$ | (0.03 | ) |

| Weighted average number of common shares - basic and diluted | |

| | |

| 170,936,494 | | |

| 156,864,738 | | |

| 164,334,249 | | |

| 156,774,814 | |

See

accompanying notes to the unaudited condensed consolidated interim financial statements

New

Pacific Metals Corp.

Unaudited Condensed Consolidated Interim

Statements of Comprehensive (Loss) Income

(Expressed in US dollars)

| | |

| | |

Three months ended

December 31, | | |

Six months ended

December 31, | |

| | |

Notes | | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net loss | |

| | |

$ | (1,527,071 | ) | |

$ | (1,873,003 | ) | |

$ | (3,273,685 | ) | |

$ | (3,958,666 | ) |

| Other comprehensive loss, net of taxes: | |

| | |

| | | |

| | | |

| | | |

| | |

| Items that may subsequently be reclassified to net income or loss: | |

| | |

| | | |

| | | |

| | | |

| | |

| Currency translation adjustment, net of tax of $nil | |

| | |

| 858,251 | | |

| 422,167 | | |

| 528,380 | | |

| (1,811,328 | ) |

| Other comprehensive loss, net of taxes | |

| | |

$ | 858,251 | | |

$ | 422,167 | | |

$ | 528,380 | | |

$ | (1,811,328 | ) |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Attributable to: | |

| | |

| | | |

| | | |

| | | |

| | |

| Equity holders of the Company | |

| | |

$ | 855,030 | | |

$ | 408,240 | | |

$ | 566,228 | | |

$ | (1,797,713 | ) |

| Non-controlling interests | |

9 | | |

| 3,221 | | |

| 13,927 | | |

| (37,848 | ) | |

| (13,615 | ) |

| Other comprehensive loss, net of taxes | |

| | |

$ | 858,251 | | |

$ | 422,167 | | |

$ | 528,380 | | |

$ | (1,811,328 | ) |

| Total comprehensive loss, net of taxes | |

| | |

$ | (668,820 | ) | |

$ | (1,450,836 | ) | |

$ | (2,745,305 | ) | |

$ | (5,769,994 | ) |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Attributable to: | |

| | |

| | | |

| | | |

| | | |

| | |

| Equity holders of the Company | |

| | |

$ | (669,078 | ) | |

$ | (1,462,478 | ) | |

$ | (2,703,896 | ) | |

$ | (5,753,614 | ) |

| Non-controlling interests | |

9 | | |

| 258 | | |

| 11,642 | | |

| (41,409 | ) | |

| (16,380 | ) |

| Total comprehensive loss, net of taxes | |

| | |

$ | (668,820 | ) | |

$ | (1,450,836 | ) | |

$ | (2,745,305 | ) | |

$ | (5,769,994 | ) |

See

accompanying notes to the unaudited condensed consolidated interim financial statements

New Pacific

Metals Corp.

Unaudited Condensed Consolidated Interim Statements of Cash Flows

(Expressed in US dollars)

| | |

| | |

Three months ended

December 31, | | |

Six months ended

December 31, | |

| | |

Notes | | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Operating activities | |

| | |

| | |

| | |

| | |

| |

| Net loss | |

| | |

$ | (1,527,071 | ) | |

$ | (1,873,003 | ) | |

$ | (3,273,685 | ) | |

$ | (3,958,666 | ) |

| Add (deduct) items not affecting cash: | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income from investments | |

4 | | |

| (275,020 | ) | |

| (83,455 | ) | |

| (295,294 | ) | |

| (41,781 | ) |

| Depreciation | |

5 | | |

| 54,345 | | |

| 51,181 | | |

| 104,958 | | |

| 106,192 | |

| Gain on disposal of plant and equipment | |

5 | | |

| - | | |

| - | | |

| (51,418 | ) | |

| - | |

| Share-based compensation | |

8(b) | | |

| 358,359 | | |

| 760,520 | | |

| 1,034,498 | | |

| 1,614,858 | |

| Unrealized foreign exchange (gain) loss | |

| | |

| (16,666 | ) | |

| 28,750 | | |

| (66,995 | ) | |

| 13,857 | |

| Changes in non-cash operating working capital | |

13 | | |

| (886,642 | ) | |

| (552,609 | ) | |

| (287,429 | ) | |

| (1,094,264 | ) |

| Interest received | |

4 | | |

| 276,590 | | |

| 116,582 | | |

| 300,721 | | |

| 250,224 | |

| Net cash used in operating activities | |

| | |

| (2,016,105 | ) | |

| (1,552,034 | ) | |

| (2,534,644 | ) | |

| (3,109,580 | ) |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Investing activities | |

| | |

| | | |

| | | |

| | | |

| | |

| Mineral property interest | |

| | |

| | | |

| | | |

| | | |

| | |

| Capital expenditures | |

| | |

| (736,260 | ) | |

| (5,413,239 | ) | |

| (2,878,749 | ) | |

| (9,502,583 | ) |

| Proceeds on disposals | |

| | |

| - | | |

| - | | |

| - | | |

| 2,986,188 | |

| Plant and equipment | |

| | |

| | | |

| | | |

| | | |

| | |

| Additions | |

5 | | |

| (1,788 | ) | |

| (60,437 | ) | |

| (135,706 | ) | |

| (80,143 | ) |

| Proceeds on disposals | |

5 | | |

| - | | |

| - | | |

| 58,776 | | |

| - | |

| Changes in other tax receivable | |

| | |

| (50,170 | ) | |

| (671,427 | ) | |

| (104,466 | ) | |

| (1,257,611 | ) |

| Net cash used in investing activities | |

| | |

| (788,218 | ) | |

| (6,145,103 | ) | |

| (3,060,145 | ) | |

| (7,854,149 | ) |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Financing activities | |

| | |

| | | |

| | | |

| | | |

| | |

| Proceeds from issuance of common shares | |

| | |

| 71,629 | | |

| 233,614 | | |

| 24,581,770 | | |

| 260,517 | |

| Net cash provided by financing activities | |

| | |

| 71,629 | | |

| 233,614 | | |

| 24,581,770 | | |

| 260,517 | |

| Effect of exchange rate changes on cash | |

| | |

| 552,164 | | |

| 274,126 | | |

| 553,863 | | |

| (1,306,409 | ) |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Decrease in cash | |

| | |

| (2,180,530 | ) | |

| (7,189,397 | ) | |

| 19,540,844 | | |

| (12,009,621 | ) |

| Cash and cash equivalent, beginning of the period | |

| | |

| 28,017,686 | | |

| 24,502,280 | | |

| 6,296,312 | | |

| 29,322,504 | |

| Cash and cash equivalent, end of the period | |

| | |

$ | 25,837,156 | | |

$ | 17,312,883 | | |

$ | 25,837,156 | | |

$ | 17,312,883 | |

| Supplementary cash flow information | |

13 | | |

| | | |

| | | |

| | | |

| | |

See

accompanying notes to the unaudited condensed consolidated interim financial statements

New Pacific

Metals Corp.

Unaudited Condensed Consolidated Interim Statements of Change in Equity

(Expressed in US dollars)

| |

|

|

Share

capital | | |

| | |

| | |

| | |

| | |

| | |

| |

| |

Notes |

|

Number

of

common

shares

issued | | |

Amount | | |

Share-based

payment

reserve | | |

Accumulated

other

comprehensive

income | | |

Deficit | | |

Total

equity

attributable to the

equity holders of

the Company | | |

Non-

controlling

interests | | |

Total

equity | |

| Balance,

July 1, 2022 |

| |

|

| 156,631,827 | | |

$ | 153,707,576 | | |

$ | 15,395,486 | | |

$ | 11,704,949 | | |

$ | (60,527,857 | ) | |

$ | 120,280,154 | | |

$ | (71,199 | ) | |

$ | 120,208,955 | |

| Options exercised |

| |

|

| 230,000 | | |

| 403,961 | | |

| (143,444 | ) | |

| - | | |

| - | | |

| 260,517 | | |

| - | | |

| 260,517 | |

| Restricted share units distributed |

| |

|

| 169,115 | | |

| 534,050 | | |

| (534,050 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Share-based compensation |

| |

|

| - | | |

| - | | |

| 2,294,568 | | |

| - | | |

| - | | |

| 2,294,568 | | |

| - | | |

| 2,294,568 | |

| Net loss |

| |

|

| - | | |

| - | | |

| - | | |

| - | | |

| (3,955,901 | ) | |

| (3,955,901 | ) | |

| (2,765 | ) | |

| (3,958,666 | ) |

| Currency translation adjustment |

| |

|

| - | | |

| - | | |

| - | | |

| (1,797,713 | ) | |

| - | | |

| (1,797,713 | ) | |

| (13,615 | ) | |

| (1,811,328 | ) |

| Balance,

December 31, 2022 |

| |

|

| 157,030,942 | | |

$ | 154,645,587 | | |

$ | 17,012,560 | | |

$ | 9,907,236 | | |

$ | (64,483,758 | ) | |

$ | 117,081,625 | | |

$ | (87,579 | ) | |

$ | 116,994,046 | |

| Options exercised |

| |

|

| 215,000 | | |

| 489,005 | | |

| (144,848 | ) | |

| - | | |

| - | | |

| 344,157 | | |

| - | | |

| 344,157 | |

| Restricted share units distributed |

| |

|

| 155,140 | | |

| 485,018 | | |

| (485,018 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Private placement |

| |

|

| 90,090 | | |

| 220,442 | | |

| - | | |

| - | | |

| - | | |

| 220,442 | | |

| - | | |

| 220,442 | |

| Share-based compensation |

| |

|

| - | | |

| - | | |

| 2,253,603 | | |

| - | | |

| - | | |

| 2,253,603 | | |

| - | | |

| 2,253,603 | |

| Net loss |

| |

|

| - | | |

| - | | |

| - | | |

| - | | |

| (4,139,548 | ) | |

| (4,139,548 | ) | |

| (1,918 | ) | |

| (4,141,466 | ) |

| Currency translation adjustment |

| |

|

| - | | |

| - | | |

| - | | |

| 320,744 | | |

| - | | |

| 320,744 | | |

| (20,640 | ) | |

| 300,104 | |

| Balance,

June 30, 2023 |

| |

|

| 157,491,172 | | |

$ | 155,840,052 | | |

$ | 18,636,297 | | |

$ | 10,227,980 | | |

$ | (68,623,306 | ) | |

$ | 116,081,023 | | |

$ | (110,137 | ) | |

$ | 115,970,886 | |

| Options exercised |

| 8(b)(i) |

|

| 85,000 | | |

| 197,213 | | |

| (61,529 | ) | |

| - | | |

| - | | |

| 135,684 | | |

| - | | |

| 135,684 | |

| Restricted share units distributed |

| 8(b)(ii) |

|

| 259,210 | | |

| 746,526 | | |

| (746,526 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Common shares issued through

bought deal financing |

| 8(c) |

|

| 13,208,000 | | |

| 24,446,086 | | |

| - | | |

| - | | |

| - | | |

| 24,446,086 | | |

| - | | |

| 24,446,086 | |

| Share-based compensation |

| 8(b) |

|

| - | | |

| - | | |

| 1,194,965 | | |

| - | | |

| - | | |

| 1,194,965 | | |

| - | | |

| 1,194,965 | |

| Net loss |

| |

|

| - | | |

| - | | |

| - | | |

| - | | |

| (3,270,124 | ) | |

| (3,270,124 | ) | |

| (3,561 | ) | |

| (3,273,685 | ) |

| Currency

translation adjustment |

| |

|

| - | | |

| - | | |

| - | | |

| 566,228 | | |

| - | | |

| 566,228 | | |

| (37,848 | ) | |

| 528,380 | |

| Balance,

December 31, 2023 |

| |

|

| 171,043,382 | | |

$ | 181,229,877 | | |

$ | 19,023,207 | | |

$ | 10,794,208 | | |

$ | (71,893,430 | ) | |

$ | 139,153,862 | | |

$ | (151,546 | ) | |

$ | 139,002,316 | |

See

accompanying notes to the unaudited condensed consolidated interim financial statements

New

Pacific Metals Corp.

Notes to Unaudited Condensed Consolidated Interim Financial Statements for the three and six months ended December 31, 2023 and 2022

(Expressed in US dollars)

New

Pacific Metals Corp. along with its subsidiaries (collectively, the “Company” or “New Pacific”) is a Canadian

mining issuer engaged in exploring and developing mineral properties in Bolivia. The Company is in the stage of exploring and advancing

the development of its mineral properties and has not yet determined if they contain economically recoverable mineral reserves. The underlying

value and the recoverability of the amounts shown for mineral property interests are entirely dependent upon the existence of recoverable

mineral reserves, the ability of the Company to obtain the necessary financing to complete the exploration and development of the mineral

properties, and future profitable production or proceeds from the disposition of the mineral property interests.

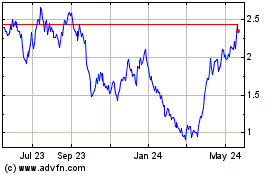

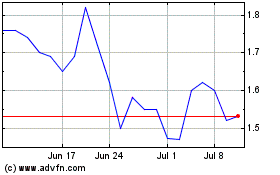

The

Company is publicly listed on the Toronto Stock Exchange (“TSX”) under the symbol “NUAG” and on the NYSE American

stock exchange (“NYSE-A”) under the symbol “NEWP”. The head office, registered address and records office of

the Company are located at 1066 Hastings Street, Suite 1750, Vancouver, British Columbia, Canada, V6E 3X1.

| 2. | MATERIAL

ACCOUNTING POLICY INFORMATION |

| (a) | Statement

of Compliance and Basis of Preparation |

These

unaudited condensed consolidated interim financial statements have been prepared in accordance with International Accounting Standard

34 – Interim Financial Reporting (“IAS 34”) as issued by the International Accounting Standards Board (“IASB”).

These unaudited condensed consolidated interim financial statements should be read in conjunction with the Company’s audited consolidated

financial statements for the year ended June 30, 2023. These unaudited condensed consolidated interim financial statements follow the

same accounting policies, estimates and judgements set out in Note 2 to the audited consolidated financial statements for the year ended

June 30, 2023, except as set out in Note 2(c) below.

These

unaudited condensed consolidated interim financial statements have been prepared on a going concern basis.

The

unaudited condensed consolidated interim financial statements of the Company as at and for the three and six months ended December 31,

2023 were approved and authorized for issuance in accordance with a resolution of the Board of Directors (the “Board”) dated

on February 12, 2024.

| (b) | Basis

of Consolidation |

These

unaudited condensed consolidated interim financial statements include the accounts of the Company and its wholly or partially owned subsidiaries.

Subsidiaries

are consolidated from the date on which the Company obtains control up to the date of the disposition of control. Control is achieved

when the Company has power over the subsidiary, is exposed or has rights to variable returns from its involvement with the subsidiary;

and has the ability to use its power to affect its returns. For non-wholly-owned subsidiaries over which the Company has control, the

net assets attributable to outside equity shareholders are presented as “non-controlling interests” in the equity section

of the consolidated statements of financial position. Net income or loss for the period that is attributable to the non-controlling interests

is calculated based on the ownership of the non-controlling interest shareholders in the subsidiary.

New

Pacific Metals Corp.

Notes to Unaudited Condensed Consolidated Interim Financial Statements for the three and six months ended December 31, 2023 and 2022

(Expressed in US dollars)

Balances,

transactions, income and expenses between the Company and its subsidiaries are eliminated on consolidation.

Details

of the Company’s significant subsidiaries which are consolidated are as follows:

| | |

| |

| |

Proportion of ownership interest held | | |

|

| Name of subsidiaries | |

Principal activity | |

Country of

incorporation | |

December 31,

2023 | | |

June 30,

2023 | | |

Mineral

properties |

| New Pacific Offshore Inc. | |

Holding company | |

BVI (i) | |

| 100 | % | |

| 100 | % | |

|

| SKN Nickel & Platinum Ltd. | |

Holding company | |

BVI | |

| 100 | % | |

| 100 | % | |

|

| Glory Metals Investment Corp. Limited | |

Holding company | |

Hong Kong | |

| 100 | % | |

| 100 | % | |

|

| New Pacific Investment Corp. Limited | |

Holding company | |

Hong Kong | |

| 100 | % | |

| 100 | % | |

|

New Pacific Andes Corp. Limited

| |

Holding company | |

Hong Kong | |

| 100 | % | |

| 100 | % | |

|

| Fortress Mining Inc. | |

Holding company | |

BVI | |

| 100 | % | |

| 100 | % | |

|

| New Pacific Success Inc. | |

Holding company | |

BVI | |

| 100 | % | |

| 100 | % | |

|

| New Pacific Forward Inc. | |

Holding company | |

BVI | |

| 100 | % | |

| 100 | % | |

|

| Minera Alcira S.A. | |

Mining company | |

Bolivia | |

| 100 | % | |

| 100 | % | |

Silver Sand |

| NPM Minerales S.A. | |

Mining company | |

Bolivia | |

| 100 | % | |

| 100 | % | |

|

| Colquehuasi S.R.L. | |

Mining company | |

Bolivia | |

| 100 | % | |

| 100 | % | |

Silverstrike |

| Minera Hastings S.R.L. | |

Mining company | |

Bolivia | |

| 100 | % | |

| 100 | % | |

Carangas |

| Qinghai Found Mining Co., Ltd. | |

Mining company | |

China | |

| 82 | % | |

| 82 | % | |

|

(i) British Virgin Islands (“BVI”)

| (c) | Changes

in Accounting Policies |

The

accounting policies applied in the preparation of these unaudited condensed consolidated interim financial statements are consistent

with those applied and disclosed in the Company’s audited consolidated financial statements for the year ended June 30, 2023 with

the exception of the mandatory adoption of certain amendments noted below:

| i. | Amendments

to IAS 1 - Presentation of Financial Statements and IFRS Practice Statement 2 - Making

Materiality Judgments - Disclosure of Accounting Policies |

The

amendments change the requirements in IAS 1 with regard to disclosure of accounting policies. The amendments replace all instances of

the term “significant accounting policies” with “material accounting policy information.” Accounting policy information

is material if, when considered together with other information included in an entity’s financial statements, it can reasonably

be expected to influence decisions that the primary users of general purpose financial statements make on the basis of those financial

statements.

The

supporting paragraphs in IAS 1 are also amended to clarify that accounting policy information that relates to immaterial transactions,

other events or conditions is immaterial and need not be disclosed. Accounting policy information may be material because of the nature

of the related transactions, other events or conditions, even if the amounts are immaterial. However, not all accounting policy information

relating to material transactions, other events or conditions is itself material. The IASB has also developed guidance and examples to

explain and demonstrate the application of the ‘four-step materiality process’ described in IFRS Practice Statement 2.

The

amendments were applied effective July 1, 2023 and did not have a material impact on the Company’s unaudited condensed consolidated interim

financial statements.

New

Pacific Metals Corp.

Notes to Unaudited Condensed Consolidated Interim Financial Statements for the three and six months ended December 31, 2023 and 2022

(Expressed in US dollars)

| ii. | Amendments

to IAS 8 - Accounting Policies, Changes in Accounting Estimates and Errors— Definition

of Accounting Estimates |

The

amendments replace the definition of a change in accounting estimates with a definition of accounting estimates. Under the new definition,

accounting estimates are “monetary amounts in financial statements that are subject to measurement uncertainty.” The definition

of a change in accounting estimates was deleted. However, the IASB retained the concept of changes in accounting estimates in the Standard

with the following clarifications:

| § | A

change in accounting estimate that results from new information or new developments is not

the correction of an error; and |

| | |

| § | The

effects of a change in an input or a measurement technique used to develop an accounting

estimate are changes in accounting estimates if they do not result from the correction of

prior period errors. |

The

amendments were applied effective July 1, 2023 and did not have a material impact on the Company’s unaudited condensed consolidated interim

financial statements.

Other

tax receivable is composed of value-added tax (“VAT”) imposed by the Bolivian government. The Company had VAT outputs through

its exploration costs and general expenses incurred in Bolivia. These VAT outputs are deductible against future VAT inputs that will

be generated through sales.

| 4. | INCOME

FROM INVESTMENTS |

Income

from investments consist of:

| | |

Three Months Ended

December 31, | | |

Six Months Ended

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Fair value change on equity investments | |

$ | (11,626 | ) | |

$ | (3,569 | ) | |

$ | (5,141 | ) | |

$ | (175,291 | ) |

| Fair value change on bonds | |

| 10,056 | | |

| (29,552 | ) | |

| (286 | ) | |

| (33,152 | ) |

| Interest income | |

| 276,590 | | |

| 116,576 | | |

| 300,721 | | |

| 250,224 | |

| Net income from investments | |

$ | 275,020 | | |

$ | 83,455 | | |

$ | 295,294 | | |

$ | 41,781 | |

New

Pacific Metals Corp.

Notes to Unaudited Condensed Consolidated Interim Financial Statements for the three and six months ended December 31, 2023 and 2022

(Expressed in US dollars)

| Cost | |

Land

and

building | | |

Machinery | | |

Motor

vehicles | | |

Office

equipment

and furniture | | |

Computer

software | | |

Total | |

| Balance,

July 1, 2022 | |

$ | 630,000 | | |

$ | 408,358 | | |

$ | 579,032 | | |

$ | 266,364 | | |

$ | 193,774 | | |

$ | 2,077,528 | |

| Additions | |

| - | | |

| 77,259 | | |

| - | | |

| 15,576 | | |

| - | | |

| 92,835 | |

| Disposals | |

| - | | |

| - | | |

| - | | |

| (12,259 | ) | |

| (99,442 | ) | |

| (111,701 | ) |

| Foreign

currency translation impact | |

| - | | |

| - | | |

| - | | |

| (2,406 | ) | |

| (817 | ) | |

| (3,223 | ) |

| Balance,

June 30, 2023 | |

$ | 630,000 | | |

$ | 485,617 | | |

$ | 579,032 | | |

$ | 267,275 | | |

$ | 93,515 | | |

$ | 2,055,439 | |

| Additions | |

| 115,237 | | |

| - | | |

| - | | |

| 20,469 | | |

| - | | |

| 135,706 | |

| Disposals | |

| - | | |

| - | | |

| (110,838 | ) | |

| (30,709 | ) | |

| - | | |

| (141,547 | ) |

| Reclassifed

among asset groups | |

| - | | |

| (18,296 | ) | |

| 18,296 | | |

| - | | |

| - | | |

| - | |

| Reclassifed

to mineral property interest | |

| - | | |

| (10,685 | ) | |

| - | | |

| - | | |

| - | | |

| (10,685 | ) |

| Foreign

currency translation impact | |

| - | | |

| - | | |

| - | | |

| 103 | | |

| 99 | | |

| 202 | |

| Balance,

December 31, 2023 | |

$ | 745,237 | | |

$ | 456,636 | | |

$ | 486,490 | | |

$ | 257,138 | | |

$ | 93,614 | | |

$ | 2,039,115 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Accumulated

depreciation and amortization | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance,

July 1, 2022 | |

$ | - | | |

$ | (113,640 | ) | |

$ | (198,572 | ) | |

$ | (156,000 | ) | |

$ | (146,468 | ) | |

$ | (614,680 | ) |

| Depreciation | |

| - | | |

| (57,272 | ) | |

| (98,338 | ) | |

| (35,170 | ) | |

| (22,751 | ) | |

| (213,531 | ) |

| Disposals | |

| - | | |

| - | | |

| - | | |

| 12,259 | | |

| 99,442 | | |

| 111,701 | |

| Foreign

currency translation impact | |

| - | | |

| - | | |

| - | | |

| 1,627 | | |

| (717 | ) | |

| 910 | |

| Balance,

June 30, 2023 | |

$ | - | | |

$ | (170,912 | ) | |

$ | (296,910 | ) | |

$ | (177,284 | ) | |

$ | (70,494 | ) | |

$ | (715,600 | ) |

| Depreciation | |

| - | | |

| (30,479 | ) | |

| (51,185 | ) | |

| (17,423 | ) | |

| (5,871 | ) | |

| (104,958 | ) |

| Disposals | |

| - | | |

| - | | |

| 110,837 | | |

| 23,352 | | |

| - | | |

| 134,189 | |

| Foreign

currency translation impact | |

| - | | |

| - | | |

| - | | |

| (181 | ) | |

| (204 | ) | |

| (385 | ) |

| Balance,

December 31, 2023 | |

$ | - | | |

$ | (201,391 | ) | |

$ | (237,258 | ) | |

$ | (171,536 | ) | |

$ | (76,569 | ) | |

$ | (686,754 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Carrying

amount | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance,

June 30, 2023 | |

$ | 630,000 | | |

$ | 314,705 | | |

$ | 282,122 | | |

$ | 89,991 | | |

$ | 23,021 | | |

$ | 1,339,839 | |

| Balance,

December 31, 2023 | |

$ | 745,237 | | |

$ | 255,245 | | |

$ | 249,232 | | |

$ | 85,602 | | |

$ | 17,045 | | |

$ | 1,352,361 | |

For the three and six months ended December 31, 2023, certain plant and equipment were disposed for proceeds of $nil and $58,776, respectively

(three and six months ended December 31, 2022 - $nil and $nil, respectively) and gain of $nil and $51,418, respectively (three and six

months ended December 31, 2022 - $nil and $nil, respectively).

New Pacific

Metals Corp.

Notes to Unaudited Condensed Consolidated Interim Financial Statements for the three and six months ended December 31, 2023 and 2022

(Expressed in US dollars)

| 6. | MINERAL

PROPERTY INTERESTS |

The

continuity schedule of mineral property acquisition costs and deferred exploration and development costs is summarized as follows:

| Cost | |

Silver

Sand | | |

Carangas | | |

Silverstrike | | |

Total | |

| Balance,

July 1, 2022 | |

| | |

| | |

| | |

| |

| Capitalized

exploration expenditures | |

$ | 76,568,598 | | |

$ | 5,460,946 | | |

$ | 3,269,232 | | |

$ | 85,298,776 | |

| Reporting

and assessment | |

| 1,008,174 | | |

| 88,558 | | |

| - | | |

| 1,096,732 | |

| Drilling

and assaying | |

| 1,925,695 | | |

| 8,289,678 | | |

| 977,881 | | |

| 11,193,254 | |

| Project

management and support | |

| 2,719,120 | | |

| 1,424,573 | | |

| 256,569 | | |

| 4,400,262 | |

| Camp

service | |

| 467,690 | | |

| 1,005,158 | | |

| 174,651 | | |

| 1,647,499 | |

| Permit

and license | |

| 195,821 | | |

| 9,389 | | |

| - | | |

| 205,210 | |

| Foreign

currency impact | |

| (201,972 | ) | |

| (8,831 | ) | |

| (24,680 | ) | |

| (235,483 | ) |

| Balance, June 30, 2023 | |

$ | 82,683,126 | | |

$ | 16,269,471 | | |

$ | 4,653,653 | | |

$ | 103,606,250 | |

| Capitalized

exploration expenditures | |

| | | |

| | | |

| | | |

| | |

| Reporting

and assessment | |

| 258,404 | | |

| 112,700 | | |

| - | | |

| 371,104 | |

| Drilling

and assaying | |

| 47,217 | | |

| 23,894 | | |

| - | | |

| 71,111 | |

| Project

management and support | |

| 821,846 | | |

| 557,248 | | |

| 51,047 | | |

| 1,430,141 | |

| Camp

service | |

| 218,747 | | |

| 233,584 | | |

| 26,394 | | |

| 478,725 | |

| Permit

and license | |

| 33,047 | | |

| 9,308 | | |

| - | | |

| 42,355 | |

| Foreign

currency impact | |

| 23,199 | | |

| 13,053 | | |

| 971 | | |

| 37,223 | |

| Balance,

December 31, 2023 | |

$ | 84,085,586 | | |

$ | 17,219,258 | | |

$ | 4,732,065 | | |

$ | 106,036,909 | |

On

July 20, 2017, the Company acquired the Silver Sand Project. The Project is located in the Colavi District of the Potosí Department,

in Southwestern Bolivia, 33 kilometres (“km”) northeast of Potosí City, the department capital. The project covers

an area of approximately 5.42 km2 at an elevation of 4,072 metres (“m”) above sea level.

For

the three and six months ended December 31, 2023, total expenditures of $413,362 and $1,379,261, respectively (three and six months ended

December 31, 2022 - $1,700,593 and $4,197,529, respectively) were capitalized under the project.

In

April 2021, the Company signed an agreement with a private Bolivian company to acquire a 98% interest in the Carangas Project. The project

is located approximately 180 km southwest of the city of Oruro and within 50 km from Bolivia’s border with Chile. The private Bolivian

company is 100% owned by Bolivian nationals and holds title to the three exploration licenses that cover an area of 40.75 km2.

Under

the agreement, the Company is required to cover 100% of the future expenditures on exploration, mining, development, and production activities

for the project.

For

the three and six months ended December 31, 2023, total expenditures of $321,877 and $936,734, respectively (three and six months ended

December 31, 2022 - $2,871,725 and $5,848,633, respectively) were capitalized under the project.

New

Pacific Metals Corp.

Notes

to Unaudited Condensed Consolidated Interim Financial Statements for the three and six months ended December 31, 2023 and

2022

(Expressed in US dollars)

In December 2019, the Company acquired

a 98% interest in the Silverstrike Project from a private Bolivian corporation. The project covers an area of approximately 13 km2

and is located approximately 140 km southwest of the city of La Paz, Bolivia.

For the three and six months ended

December 31, 2023, total expenditures of $10,125 and $77,441, respectively (three and six months ended December 31, 2022 - $702,839 and

$1,145,490, respectively) were capitalized under the project.

| 7. | RELATED PARTY TRANSACTIONS |

Related party transactions are made

on terms agreed upon by the related parties. The balances with related parties are unsecured, non-interest bearing, and due on demand.

Related party transactions not disclosed elsewhere in the consolidated financial statements are as follows:

| Due to a related party | |

December 31,

2023 | | |

June 30,

2023 | |

| Silvercorp Metals Inc. | |

$ | 125,234 | | |

$ | 56,102 | |

(a)

Silvercorp Metals Inc. (“Silvercorp”) has one director (June 30, 2023 – one director and one officer) in common

with the Company. Silvercorp and the Company share office space and Silvercorp provides various general and administrative services

to the Company. The Company expects to continue making payments to Silvercorp in the normal course of business. Office and

administrative expenses rendered and incurred by Silvercorp on behalf of the Company for the three and six months ended December 31,

2023 were $193,296 and 409,487, respectively (three and six months ended December 31, 2022 - $239,345 and

$481,598, respectively).

| (b) | Compensation of key management personnel |

The remuneration of directors and

other members of key management personnel for the three and six months ended December 31, 2023 and 2022 are as follows:

| | |

Three months ended

December 31, | | |

Six months ended

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Director’s cash compensation | |

$ | 26,892 | | |

$ | 14,722 | | |

$ | 42,112 | | |

$ | 30,041 | |

| Director’s share-based compensation | |

| 118,698 | | |

| 196,148 | | |

$ | 258,275 | | |

| 430,760 | |

| Key management’s cash compensation | |

| 289,507 | | |

| 220,847 | | |

$ | 585,871 | | |

| 350,268 | |

| Key management’s share-based compensation | |

| 402,154 | | |

| 481,755 | | |

$ | 884,777 | | |

| 1,048,026 | |

| | |

$ | 837,251 | | |

$ | 913,472 | | |

$ | 1,771,035 | | |

$ | 1,859,095 | |

Other than as disclosed above, the Company does not have

any ongoing contractual or other commitments resulting from transactions with related parties.

| (a) | Share Capital - authorized share capital |

The Company’s authorized share capital consists of

an unlimited number of common shares without par value.

New

Pacific Metals Corp.

Notes

to Unaudited Condensed Consolidated Interim Financial Statements for the three and six months ended December 31, 2023 and

2022

(Expressed

in US dollars)

| (b) | Share-based compensation |

The Company has a share-based compensation

plan (the “Plan”) under which the Company may issue stock options and restricted share units (“RSUs”). The maximum

number of common shares to be reserved for issuance on any share-based compensation under the Plan is a rolling 10% of the issued and

outstanding common shares from time to time.

For the three and six months ended

December 31, 2023, a total of $412,077 and $1,075,099, respectively (three and six months ended December 31, 2022 - $739,971 and $1,570,829,

respectively) was recorded as share-based compensation expense.

For the

three and six months ended December 31, 2023, a total reduction of $(53,718) and $(40,601) due to forfeitures of stock options and RSUs

(three and six months ended December 31, 2022 – addition of $20,549 and $44,029, respectively) were included in the project evaluation

and corporate development expense.

For the three and six months

ended December 31, 2023, a reduction of $(56,606) and an addition of $160,467, respectively (three and six months ended December 31,

2022 – addition of $315,571 and $679,710, respectively) was capitalized under mineral property interests.

The continuity schedule of stock options, as at December

31, 2023, is as follows:

| | |

Number of options | | |

Weighted average

exercise price (CAD$) | |

| Balance, July 1, 2022 | |

| 3,662,167 | | |

| 3.18 | |

| Options Granted | |

| 1,186,000 | | |

| 3.47 | |

| Options exercised | |

| (445,000 | ) | |

| 1.82 | |

| Options forfeited | |

| (446,000 | ) | |

| 3.66 | |

| Balance, June 30, 2023 | |

| 3,957,167 | | |

| 3.37 | |

| Options exercised | |

| (85,000 | ) | |

| 2.15 | |

| Options forfeited | |

| (506,000 | ) | |

| 3.79 | |

| Balance, December 31, 2023 | |

| 3,366,167 | | |

| 3.34 | |

New

Pacific Metals Corp.

Notes

to Unaudited Condensed Consolidated Interim Financial Statements for the three and six months ended December 31, 2023 and

2022

(Expressed

in US dollars)

The following table summarizes information

about stock options outstanding as at December 31, 2023:

| Exercise | | |

Number of options

outstanding as at | | |

Weighted

average remaining

contractual life | | |

Number of options

exercisable as at | | |

Weighted

average

exercise price | |

| prices (CAD$) | | |

2023-12-31 | | |

(years) | | |

2023-12-31 | | |

(CAD$) | |

| $ | 2.15 | | |

| 689,167 | | |

| 0.15 | | |

| 689,167 | | |

$ | 2.15 | |

| $ | 3.33 | | |

| 658,000 | | |

| 3.10 | | |

| 329,000 | | |

$ | 3.33 | |

| $ | 3.42 | | |

| 818,000 | | |

| 4.05 | | |

| 136,335 | | |

$ | 3.42 | |

| $ | 3.67 | | |

| 120,000 | | |

| 4.07 | | |

| 20,000 | | |

$ | 3.67 | |

| $ | 3.89 | | |

| 10,000 | | |

| 3.15 | | |

| 5,000 | | |

$ | 3.89 | |

| $ | 3.92 | | |

| 50,000 | | |

| 4.29 | | |

| 8,333 | | |

$ | 3.92 | |

| $ | 4.00 | | |

| 1,021,000 | | |

| 3.43 | | |

| 510,500 | | |

$ | 4.00 | |

| $ | 2.15 - $4.00 | | |

| 3,366,167 | | |

| 2.88 | | |

| 1,698,335 | | |

$ | 3.07 | |

Subsequent to December 31, 2023, a

total of 1,335,000 stock options with a life of five years were granted to directors, officers, and employees at an exercise price of

CAD$2.10 per share subject to a vesting schedule over a three-year term with 1/6 of the options vesting every 6 months after the date

of grant until fully vested.

The continuity schedule of RSUs, as

at December 31, 2023, is as follows:

| | |

Number

of shares | | |

Weighted

average

grant date closing

price per share (CAD$) | |

| Balance, July 1, 2022 | |

| 1,477,216 | | |

$ | 4.11 | |

| Granted | |

| 967,000 | | |

| 3.48 | |

| Forfeited | |

| (222,801 | ) | |

| 4.01 | |

| Distributed | |

| (324,255 | ) | |

| 4.20 | |

| Balance, June 30, 2023 | |

| 1,897,160 | | |

$ | 3.79 | |

| Forfeited | |

| (203,624 | ) | |

| 3.80 | |

| Distributed | |

| (259,210 | ) | |

| 3.87 | |

| Balance, December 31, 2023 | |

| 1,434,326 | | |

| 3.77 | |

Subsequent to December 31, 2023, a

total of 164,003 RSUs were vested and distributed.

Subsequent to December 31, 2023, a

total of 1,024,000 RSUs were granted to directors, officers, and employees at a grant date closing price of CAD$2.10 per share subject

to a vesting schedule over a three- year term with 1/6 of the RSUs vesting every 6 months after the date of grant until fully vested.

On

September 29, 2023, the Company successfully closed a bought deal financing to issue a total of 13,208,000 common shares at a price

of $1.96 (CAD $2.65) per common share for gross proceeds of $25,888,462. The underwriter’s fee and other issuance costs for

the transaction were $1,442,376.

New

Pacific Metals Corp.

Notes

to Unaudited Condensed Consolidated Interim Financial Statements for the three and six months ended December 31, 2023 and 2022

(Expressed in US dollars)

| 9. | NON-CONTROLLING INTEREST |

| | |

Qinghai

Found | |

| Balance, July 1, 2022 | |

$ | (71,199 | ) |

| Share of net loss | |

| (4,683 | ) |

| Share of other comprehensive loss | |

| (34,255 | ) |

| Balance, June 30, 2023 | |

$ | (110,137 | ) |

| Share of net loss | |

| (3,561 | ) |

| Share of other comprehensive loss | |

| (37,848 | ) |

| Balance, December 31, 2023 | |

$ | (151,546 | ) |

As at December 31, 2023 and June 30,

2023, the non-controlling interest in the Company’s subsidiary Qinghai Found was 18%.

The Company manages its exposure to

financial risks, including liquidity risk, foreign exchange rate risk, interest rate risk, credit risk, and equity price risk in accordance

with its risk management framework. The Board of Directors has overall responsibility for the establishment and oversight of the Company’s

risk management framework and reviews the Company’s policies on an ongoing basis.

The Company classifies

its fair value measurements within a fair value hierarchy, which reflects the significance of inputs used in making the measurements as

defined in IFRS 13 – Fair Value Measurement (“IFRS 13”).

Level 1 –

Unadjusted quoted prices at the measurement date for identical assets or liabilities in active markets.

Level 2 –

Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar assets and liabilities in active markets;

quoted prices for identical or similar assets and liabilities in markets that are not active; or other inputs that are observable or can

be corroborated by observable market data.

Level 3 – Unobservable inputs

which are supported by little or no market activity.

The following table sets forth the

Company’s financial assets that are measured at fair value on a recurring basis by level within the fair value hierarchy as at December

31, 2023 and June 30, 2023 that are not otherwise disclosed. As required by IFRS 13, financial assets are classified in their entirety

based on the lowest level of input that is significant to the fair value measurement.

New

Pacific Metals Corp.

Notes

to Unaudited Condensed Consolidated Interim Financial Statements for the three and six months ended December 31, 2023 and 2022

(Expressed in US dollars)

| | |

Fair value as at December 31, 2023 | |

| Recurring measurements | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Financial Assets | |

| | |

| | |

| | |

| |

| Cash and cash equivalent | |

$ | 25,837,156 | | |

$ | - | | |

$ | - | | |

$ | 25,837,156 | |

| Short-term investments | |

| 198,010 | | |

| - | | |

| - | | |

| 198,010 | |

| Equity investments | |

| 278,126 | | |

| - | | |

| - | | |

| 278,126 | |

| | |

Fair value as at June 30, 2023 | |

| Recurring measurements | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Financial Assets | |

| | |

| | |

| | |

| |

| Cash and cash equivalent | |

$ | 6,296,312 | | |

$ | - | | |

$ | - | | |

$ | 6,296,312 | |

| Short-term investments | |

| 198,375 | | |

| - | | |

| - | | |

| 198,375 | |

| Equity investments | |

| 283,081 | | |

| - | | |

| - | | |

| 283,081 | |

Fair value of other financial instruments

excluded from the table above approximates their carrying amount as of December 31, 2023, and June 30, 2023, respectively, due to the

short-term nature of these instruments.

There were no transfers into or out

of Level 1, 2, or 3 during the three and six months ended December 31, 2023.

The Company has a history of losses

and no operating revenues from its operations. Liquidity risk is the risk that the Company will not be able to meet its short term business

requirements. As at December 31, 2023, the Company had a working capital position of $25,700,032 and sufficient cash resources to meet

the Company’s short-term financial liabilities and its planned exploration and development expenditures on various projects in Bolivia

for, but not limited to, the next 12 months.

In the normal course of business,

the Company enters into contracts that give rise to commitments for future minimum payments. The following summarizes the remaining contractual

maturities of the Company’s financial liabilities:

| | |

December 31, 2023 | | |

June 30,

2023 | |

| | |

Due within a year | | |

Total | | |

Total | |

| Accounts payable and accrued liabilities | |

$ | 1,031,637 | | |

$ | 1,031,637 | | |

$ | 2,280,553 | |

| Due to a related party | |

| 125,234 | | |

| 125,234 | | |

| 56,102 | |

| | |

$ | 1,156,871 | | |

$ | 1,156,871 | | |

$ | 2,336,655 | |

New

Pacific Metals Corp.

Notes

to Unaudited Condensed Consolidated Interim Financial Statements for the three and six months ended December 31, 2023 and 2022

(Expressed in US dollars)

The Company is exposed to foreign

exchange risk when it undertakes transactions and holds assets and liabilities denominated in foreign currencies other than its functional

currencies. The functional currency of the head office, Canadian subsidiaries and all intermediate holding companies is CAD. The functional

currency of all Bolivian subsidiaries is USD. The functional currency of the Chinese subsidiary is RMB. The Company currently does not

engage in foreign exchange currency hedging. The Company’s exposure to foreign exchange risk that could affect net income is summarized

as follows:

| Financial assets denominated in foreign currencies other than relevant functional currency | |

December 31,

2023 | | |

June 30,

2023 | |

| United States dollars | |

$ | 346,868 | | |

$ | 320,994 | |

| Bolivianos | |

| 1,038,268 | | |

| 869,869 | |

| Total | |

$ | 1,385,136 | | |

$ | 1,190,863 | |

| | |

| | | |

| | |

| Financial liabilities denominated in foreign currencies other than relevant functional currency | |

| | | |

| | |

| United States dollars | |

$ | 73,995 | | |

$ | 73,970 | |

| Bolivianos | |

| 484,179 | | |

| 1,543,889 | |

| Total | |

$ | 558,174 | | |

$ | 1,617,859 | |

As at December 31, 2023, with other

variables unchanged, a 1% strengthening (weakening) of the USD against the CAD would have increased (decreased) net income by approximately

$2,700.

As at December 31, 2023, with other

variables unchanged, a 1% strengthening (weakening) of the Bolivianos against the USD would have increased (decreased) net income by approximately

$5,500.

Interest rate risk is the risk that

the fair value or future cash flows of a financial instrument will fluctuate due to changes in market interest rates. The Company holds

a portion of cash in bank accounts that earn variable interest rates. Due to the short-term nature of these financial instruments, fluctuations

in market rates do not have significant impact on the fair values of the financial instruments as of December 31, 2023. The Company, from

time to time, also owns cashable guaranteed investment certificates (“GICs”) and bonds that earn interest payments at fixed

rates to maturity. Fluctuation in market interest rates usually will have an impact on bond’s fair value. An increase in market

interest rates will generally reduce bond’s fair value while a decrease in market interest rates will generally increase it. The

Company monitors market interest rate fluctuations closely and adjusts the investment portfolio accordingly.

Credit risk is the risk of financial

loss to the Company if the counterparty to a financial instrument fails to meet its contractual obligations. The Company’s exposure

to credit risk is primarily associated with cash and cash equivalents, bonds, and receivables. The carrying amount of financial assets

included on the statement of financial position represents the maximum credit exposure.

The Company has deposits of cash and

cash equivalent that meet minimum requirements for quality and liquidity as stipulated by the Board. Management believes the risk of loss

to be remote, as the majority of its cash and cash equivalent is held with major financial institutions. Bonds by nature are exposed to

more credit risk than cash and cash equivalent. The Company manages its risk associated with bonds by only investing in large globally

recognized corporations from diversified industries. As at December 31, 2023, the Company had a receivables balance of $336,158 (June

30, 2023 - $421,860). There were no material amounts in receivables which were past due on December 31, 2023 (June 30, 2023 - $nil).

New

Pacific Metals Corp.

Notes

to Unaudited Condensed Consolidated Interim Financial Statements for the three and six months ended December 31, 2023 and 2022

(Expressed in US dollars)

The Company holds certain marketable

securities that will fluctuate in value as a result of trading on global financial markets. Based upon the Company’s portfolio at

December 31, 2023, a 10% increase (decrease) in the market price of the securities held, ignoring any foreign exchange effects would have

resulted in an increase (decrease) to net income of approximately $28,000.

The objectives of the capital management

policy are to safeguard the Company’s ability to support exploration and operating requirements on an ongoing basis, continue the

investment in high quality assets along with safeguarding the value of its mineral properties, and support any expansionary plans.

The capital of the Company consists

of the items included in equity less cash, cash equivalent and short term investments. Risk and capital management are primarily the responsibility

of the Company’s corporate finance function and is monitored by the Board. The Company manages the capital structure and makes adjustments

depending on economic conditions. Significant risks are monitored and actions are taken, when necessary, according to the Company’s

approved policies.

New

Pacific Metals Corp.

Notes

to Unaudited Condensed Consolidated Interim Financial Statements for the three and six months ended December 31, 2023 and 2022

(Expressed in US dollars)

As at and for the six months ended

December 31, 2023, the Company operates in four (as at and for the six months ended December 31, 2022 – four) reportable operating

segments, one being the corporate segment; the other three being the exploration and development segments based on mineral properties

in Bolivia. These reportable segments are components of the Company where separate financial information is available that is evaluated

regularly by the Company’s Chief Executive Officer, the chief operating decision maker (“CODM”).

| (a) | Segment information for assets and liabilities are as follows: |

| | |

December 31, 2023 | |

| | |

| | |

Exploration and Development | | |

| |

| | |

Corporate | | |

Silver Sand | | |

Carangas | | |

Silverstrike | | |

Total | |

| Cash | |

$ | 25,047,731 | | |

$ | 168,202 | | |

$ | 387,935 | | |

$ | 233,288 | | |

$ | 25,837,156 | |

| Short-term investments | |

| 198,010 | | |

| - | | |

| - | | |

| - | | |

| 198,010 | |

| Equity investments | |

| 278,126 | | |

| - | | |

| - | | |

| - | | |

| 278,126 | |

| Plant and equipment | |

| 220,615 | | |

| 440,684 | | |

| 37,082 | | |

| 653,980 | | |

| 1,352,361 | |

| Mineral property interests | |

| - | | |

| 84,085,586 | | |

| 17,219,258 | | |

| 4,732,065 | | |

| 106,036,909 | |

| Other assets | |

| 966,956 | | |

| 3,382,786 | | |

| 1,896,088 | | |

| 210,795 | | |

| 6,456,625 | |

| Total Assets | |

$ | 26,711,438 | | |

$ | 88,077,258 | | |

$ | 19,540,363 | | |

$ | 5,830,128 | | |

$ | 140,159,187 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Liabilities | |

$ | (975,052 | ) | |

$ | (168,231 | ) | |

$ | (11,687 | ) | |

$ | (1,901 | ) | |

$ | (1,156,871 | ) |

| | |

June 30, 2023 | |

| | |

| | |

Exploration and Development | | |

| |

| | |

Corporate | | |

Silver Sand | | |

Carangas | | |

Silverstrike | | |

Total | |

| Cash | |

$ | 6,232,985 | | |

$ | 58,497 | | |

$ | 260 | | |

$ | 4,570 | | |

$ | 6,296,312 | |

| Short-term investments | |

| 198,375 | | |

| - | | |

| - | | |

| - | | |

| 198,375 | |

| Equity investments | |

| 283,081 | | |

| - | | |

| - | | |

| - | | |

| 283,081 | |

| Plant and equipment | |

| 104,450 | | |

| 517,065 | | |

| 58,212 | | |

| 660,112 | | |

| 1,339,839 | |

| Mineral property interests | |

| - | | |

| 82,683,126 | | |

| 16,269,471 | | |

| 4,653,653 | | |

| 103,606,250 | |

| Other assets | |

| 908,823 | | |

| 3,563,256 | | |

| 1,888,293 | | |

| 223,312 | | |

| 6,583,684 | |

| Total Assets | |

$ | 7,727,714 | | |

$ | 86,821,944 | | |

$ | 18,216,236 | | |

$ | 5,541,647 | | |

$ | 118,307,541 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Liabilities | |

$ | (1,307,795 | ) | |

$ | (228,966 | ) | |

$ | (795,379 | ) | |

$ | (4,515 | ) | |

$ | (2,336,655 | ) |

New

Pacific Metals Corp.

Notes

to Unaudited Condensed Consolidated Interim Financial Statements for the three and six months ended December 31, 2023 and 2022

(Expressed in US dollars)

| (b) | Segment information for operating results are as follows: |

| | |

Three months ended December 31, 2023 | |

| | |

| | |

Exploration and Development | | |

| |

| | |

Corporate | | |

Silver Sand | | |

Carangas | | |

Silverstrike | | |

Total | |

| Project evaluation and corporate development | |

$ | (76,553 | ) | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | (76,553 | ) |

| Salaries and benefits | |

| (650,973 | ) | |

| - | | |

| - | | |

| - | | |

| (650,973 | ) |

| Share-based compensation | |

| (412,077 | ) | |

| - | | |

| - | | |

| - | | |

| (412,077 | ) |

| Other operating expenses | |

| (584,179 | ) | |

| (79,330 | ) | |

| (10,376 | ) | |

| (5,269 | ) | |

| (679,154 | ) |

| Total operating expense | |

| (1,723,782 | ) | |

| (79,330 | ) | |

| (10,376 | ) | |

| (5,269 | ) | |

| (1,818,757 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income from investments | |

| 275,020 | | |

| - | | |

| - | | |

| - | | |

| 275,020 | |

| Foreign exchange gain | |

| 16,666 | | |

| - | | |

| - | | |

| - | | |

| 16,666 | |

| Net loss | |

$ | (1,432,096 | ) | |

$ | (79,330 | ) | |

$ | (10,376 | ) | |

$ | (5,269 | ) | |

$ | (1,527,071 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Attributed to: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Equity holders of the Company | |

$ | (1,429,133 | ) | |

$ | (79,330 | ) | |

$ | (10,376 | ) | |

$ | (5,269 | ) | |

$ | (1,524,108 | ) |

| Non-controlling interests | |

| (2,963 | ) | |

| - | | |

| - | | |

| - | | |

| (2,963 | ) |

| Net loss | |

$ | (1,432,096 | ) | |

$ | (79,330 | ) | |

$ | (10,376 | ) | |

$ | (5,269 | ) | |

$ | (1,527,071 | ) |

| | |

Three months ended December 31, 2022 | |

| | |

| | |

Exploration and Development | | |

| |

| | |

Corporate | | |

Silver Sand | | |

Carangas | | |

Silverstrike | | |

Total | |

| Project evaluation and corporate development | |

$ | (77,561 | ) | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | (77,561 | ) |

| Salaries and benefits | |

| (430,404 | ) | |

| - | | |

| - | | |

| - | | |

| (430,404 | ) |

| Share-based compensation | |

| (739,971 | ) | |

| - | | |

| - | | |

| - | | |

| (739,971 | ) |

| Other operating expenses | |

| (576,913 | ) | |

| (66,958 | ) | |

| (28,277 | ) | |

| (7,624 | ) | |

| (679,772 | ) |

| Total operating expense | |

| (1,824,849 | ) | |

| (66,958 | ) | |

| (28,277 | ) | |

| (7,624 | ) | |

| (1,927,708 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income from investments | |

| 83,455 | | |

| - | | |

| - | | |

| - | | |

| 83,455 | |

| Foreign exchange loss | |

| (28,750 | ) | |

| - | | |

| - | | |

| - | | |

| (28,750 | ) |

| Net loss | |

$ | (1,770,144 | ) | |

$ | (66,958 | ) | |

$ | (28,277 | ) | |

$ | (7,624 | ) | |

$ | (1,873,003 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Attributed to: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Equity holders of the Company | |

$ | (1,767,859 | ) | |

$ | (66,958 | ) | |

$ | (28,277 | ) | |

$ | (7,624 | ) | |

$ | (1,870,718 | ) |

| Non-controlling interests | |

| (2,285 | ) | |

| - | | |

| - | | |

| - | | |

| (2,285 | ) |

| Net loss | |

$ | (1,770,144 | ) | |

$ | (66,958 | ) | |

$ | (28,277 | ) | |

$ | (7,624 | ) | |

$ | (1,873,003 | ) |

New

Pacific Metals Corp.

Notes

to Unaudited Condensed Consolidated Interim Financial Statements for the three and six months ended December 31, 2023 and 2022

(Expressed in US dollars)

| | |

Six months ended December 31, 2023 | |

| | |

| | |

Exploration and Development | | |

| |

| | |

Corporate | | |

Silver Sand | | |

Carangas | | |

Silverstrike | | |

Total | |

| Project evaluation and corporate development | |

$ | (189,537 | ) | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | (189,537 | ) |

| Salaries and benefits | |

| (1,101,112 | ) | |

| - | | |

| - | | |

| - | | |

| (1,101,112 | ) |

| Share-based compensation | |

| (1,075,099 | ) | |

| - | | |

| - | | |

| - | | |

| (1,075,099 | ) |

| Other operating expenses | |

| (1,154,182 | ) | |

| (136,112 | ) | |

| (22,633 | ) | |

| (8,717 | ) | |

| (1,321,644 | ) |

| Total operating expense | |

| (3,519,930 | ) | |

| (136,112 | ) | |

| (22,633 | ) | |

| (8,717 | ) | |

| (3,687,392 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Income from investments | |

| 295,294 | | |

| - | | |

| - | | |

| - | | |

| 295,294 | |

| (Loss) gain on disposal of plant and equipment | |

| (488 | ) | |

| 51,906 | | |

| - | | |

| - | | |

| 51,418 | |

| Foreign exchange gain | |

| 56,678 | | |

| - | | |

| 10,317 | | |

| - | | |

| 66,995 | |

| Net loss | |

$ | (3,168,446 | ) | |

$ | (84,206 | ) | |

$ | (12,316 | ) | |

$ | (8,717 | ) | |

$ | (3,273,685 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Attributed to: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Equity holders of the Company | |

$ | (3,164,885 | ) | |

$ | (84,206 | ) | |

$ | (12,316 | ) | |

$ | (8,717 | ) | |

$ | (3,270,124 | ) |

| Non-controlling interests | |

| (3,561 | ) | |

| - | | |

| - | | |

| - | | |

| (3,561 | ) |

| Net loss | |

$ | (3,168,446 | ) | |

$ | (84,206 | ) | |

$ | (12,316 | ) | |

$ | (8,717 | ) | |

$ | (3,273,685 | ) |

| | |

Six months ended December 31, 2022 | |

| | |

| | |

Exploration and Development | | |

| |

| | |

Corporate | | |

Silver Sand | | |

Carangas | | |

Silverstrike | | |

Total | |

| Project evaluation and corporate development | |

$ | (186,097 | ) | |

| - | | |

$ | - | | |

$ | - | | |

$ | (186,097 | ) |

| Salaries and benefits | |

| (759,574 | ) | |

| - | | |

| - | | |

| - | | |

| (759,574 | ) |

| Share-based compensation | |

| (1,570,829 | ) | |

| - | | |

| - | | |

| - | | |

| (1,570,829 | ) |

| Other operating expenses | |

| (1,272,189 | ) | |

| (143,027 | ) | |

| (42,606 | ) | |

| (12,268 | ) | |

| (1,470,090 | ) |

| Total operating expense | |

| (3,788,689 | ) | |

| (143,027 | ) | |

| (42,606 | ) | |

| (12,268 | ) | |

| (3,986,590 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss from investments | |

| 41,781 | | |

| - | | |

| - | | |

| - | | |

| 41,781 | |

| Foreign exchange loss | |

| (13,857 | ) | |

| - | | |

| - | | |

| - | | |

| (13,857 | ) |

| Net loss | |

$ | (3,760,765 | ) | |

$ | (143,027 | ) | |

$ | (42,606 | ) | |

$ | (12,268 | ) | |

$ | (3,958,666 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Attributed to: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Equity holders of the Company | |

$ | (3,758,000 | ) | |

$ | (143,027 | ) | |

$ | (42,606 | ) | |

$ | (12,268 | ) | |

$ | (3,955,901 | ) |

| Non-controlling interests | |

| (2,765 | ) | |

| - | | |

| - | | |

| - | | |

| (2,765 | ) |

| Net loss | |

$ | (3,760,765 | ) | |

$ | (143,027 | ) | |

$ | (42,606 | ) | |

$ | (12,268 | ) | |

$ | (3,958,666 | ) |

New

Pacific Metals Corp.

Notes

to Unaudited Condensed Consolidated Interim Financial Statements for the three and six months ended December 31, 2023 and 2022

(Expressed in US dollars)

| 13. | SUPPLEMENTARY CASH FLOW INFORMATION |

| Changes in non-cash operating working capital: | |

Three months ended

December 31, | | |

Six months ended

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Receivables | |

$ | 64,428 | | |

$ | 98,671 | | |

$ | 85,645 | | |

$ | (6,152 | ) |

| Deposits and prepayments | |

| (14,494 | ) | |

| (323,131 | ) | |

| (33,798 | ) | |

| (394,089 | ) |

| Accounts payable and accrued liabilities | |

| (844,135 | ) | |

| (357,690 | ) | |

| (406,861 | ) | |

| (424,924 | ) |

| Due to a related party | |

| (92,441 | ) | |

| 29,541 | | |

| 67,585 | | |

| (269,099 | ) |

| | |

$ | (886,642 | ) | |

$ | (552,609 | ) | |

$ | (287,429 | ) | |

$ | (1,094,264 | ) |

| Non-cash capital transactions: | |

Three months ended

December 31, | | |

Six months ended

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Addition (reduction) of capital expenditures of mineral property interest in accounts payable and accrued liabilities | |

$ | (117,008 | ) | |

$ | (474,469 | ) | |

$ | (839,183 | ) | |

$ | 1,009,359 | |

| Addition of capital expenditures of mineral property interest from deposits and prepayments | |

| 182,718 | | |

$ | - | | |

$ | 182,718 | | |

$ | - | |

| Cash and cash equivalents: | |

December 31,

2023 | | |

June 30,

2023 | |

| Cash on hand and at bank | |

$ | 18,201,303 | | |

$ | 6,296,312 | |

| Cash equivalents | |

| 7,635,853 | | |

| - | |

| | |

$ | 25,837,156 | | |

$ | 6,296,312 | |

Exhibit 99.2

MANAGEMENT’S

DISCUSSION AND ANALYSIS

For the three and six months ended December 31,

2023

(Expressed in United States Dollars)

| NEW PACIFIC METALS CORP. |

| Management’s Discussion and Analysis |

| For the three and six months ended December 31, 2023 |

| (Expressed in United States

dollars, unless otherwise stated) |

Date

of Report: February 12, 2024

This management’s discussion and analysis

(“MD&A”) for New Pacific Metals Corp. and its subsidiaries (collectively, “New Pacific” or the “Company”)

should be read in conjunction with the Company’s unaudited condensed consolidated interim financial statements for the three and

six months ended December 31, 2023 and the related notes contained therein. The Company prepares its financial statements in accordance

with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

The Company’s significant accounting policies are set out in Note 2 of the audited consolidated financial statements for the year