Inuvo, Inc. (NYSE American: INUV), a leading provider of marketing

technology, powered by artificial intelligence (AI) that serves

brands and agencies, today provided a business update, and

announced its financial results for the second quarter ended June

30, 2022.

Richard Howe, CEO of Inuvo, stated, “We had another

exceptionally strong quarter as demonstrated by a 79.3%

year-over-year increase in revenue to $22.7 million for the three

months ended June 30, 2022. We also achieved a 77.4% year-over-year

increase in revenue to $41.3 million for the six months ended June

30, 2022. Importantly, we have realized approximately 15%

compounded quarterly growth rate over the two-year period between

Q2 of 2020 and Q2 of 2022. Both the Search and Social ValidClick

and Programmatic IntentKey platforms experienced significant growth

in the three and six months ended June 30, 2022.”

Mr. Howe added, “We believe the industry we serve is not

prepared for the implications of a consumer privacy led future

where consumer data is no longer available to facilitate behavioral

targeting of advertising. Most of an advertisers’ return on

advertising spend is related to the use of 3rd party cookies and

consumer data. The industry we serve is rapidly changing, and

within the next two years, we anticipate cookies will be eliminated

on all major platforms including Apple and Google. This poses an

immediate threat to existing incumbent advertising technology and

data companies. Currently, we estimate that 75% of the media

purchase opportunities within the open web either do not have a

consumer cookie ID, or that cookie ID does not persist the next

day. This disruptive change, already well underway within the

industry provides Inuvo a unique opportunity to rapidly capture

market share, while incumbents continue to develop and deploy

variations on outdated technologies poorly aligned with the

future.”

Financial Results for the Three and Six Month Ended June

30, 2022Net revenue for the second quarter ended June 30,

2022 totaled $22.7 million, an increase of 79.3% as compared to

$12.6 million for the same period last year. Net revenue for the

six months ended June 30, 2022 totaled $41.3 million, an increase

of 77.4% compared to $23.3 million for the same period last

year.

IntentKey programmatic platform revenue for the three months and

six months ended June 30, 2022 exceeded the same period last year

by 197% and 232%, respectively. ValidClick search and social

platform revenue for the three and six months ended June 30, 2022

exceeded the same period last year by 44% and 35%, respectively.

Revenue split between IntentKey and ValidClick was roughly 38%

versus 62% for the three months ended June 30, 2022, which compares

to 23% and 77%, respectively, for the same period last year.

Cost of revenue for the second quarter ended June 30, 2022,

totaled $9.3 million as compared to $2.3 million for the same

period last year. Cost of revenue for the six months ended June 30,

2022, totaled $18.0 million as compared to $3.7 million for the

same period last year. The increase in the cost of revenue for the

three months and six months ended June 30, 2022 as compared to the

same period last year was related to the acquisition of new

customers and growth of IntentKey as a percentage of revenue.

Gross profit for the three and six months ended June 30, 2022

totaled $13.4 million and $23.3 million, respectively as compared

to $10.4 million and $19.5 million, respectively, for the same

period last year. Gross profit margin for the three and six months

ended June 30, 2022 was 59.1% and 56.5%, respectively as compared

to 82.1% and 84.1%, respectively, for the same period last year.

The IntentKey platform has a lower gross margin than the ValidClick

platform but has a greater overall net margin than the ValidClick

platform. The gross margin decreased as IntentKey revenue became a

greater percentage of net revenue.

Operating expenses for the three months ended June 30, 2022

totaled $16.2 million, an increase of 27.0% as compared to $12.8

million for the same period last year. Operating expenses for the

six months ended June 30, 2022 totaled $28.3 million, an increase

of 15.2% as compared to $24.5 million for the same period last

year. Operating expenses for the three and six months ended June

30, 2022 included a one-time marketing expense of $1.4 million

related to fraudulent media purchased from a prominent advertising

platform, from whom the Company expects reimbursement. The company

has withheld payment of an equivalent amount of payables due to

this advertising platform.

Other expense/income for the three and six months ended June 30,

2022 included an expense of approximately $395 thousand and $377

thousand, respectively, from unrealized losses on trading

securities. Other expense/income for the three months ended June

30, 2021 included approximately $25 thousand from unrealized gains

on trading securities, and for the six month period ended June 30,

2021, other expense/income included income of approximately $495

thousand due to the reversal of deferred revenue from a one-time

contract cancellation.

Net loss for the second quarter of 2022 totaled $3.2 million, or

$0.03 per basic and diluted share, as compared to net loss of $2.4

million, or $0.02 per basic and diluted share, for the same period

last year. Net loss for the six months ended June 30, 2022 totaled

$5.3 million, or $0.04 per basic and diluted share, as compared to

net loss of $4.5 million, or $0.04 per basic and diluted share, for

the same period last year.

Net loss in the second quarter included $1.3 million non-cash

depreciation, amortization, and stock compensation and for the

six-month period those same items were $2.7 million. The net loss

also includes $1.4 million dollars of expense related to the

fraudulent media described above and $395 thousand of marked to

market losses of which, by August 12th, had regained approximately

$300 thousand.

Adjusted EBITDA was a loss of approximately $142 thousand in the

second quarter of 2022, compared to a loss of approximately $965

thousand for the same period last year. Adjusted EBITDA was a loss

of approximately $859 thousand for the six months ended June 30,

2022, compared to a loss of approximately $1.8 million for the same

period last year.

Liquidity and Capital Resources:On June 30,

2022, Inuvo had $8.4 million in cash, cash equivalents and

marketable securities, $8.9 million of working capital, an unused

working capital facility of $5 million and no debt.

As of June 30, 2022, Inuvo had 119,873,869 common shares issued

and outstanding.

Conference Call Details: Date: Monday,

August 15, 2022 Time: 10:00 a.m. Eastern Time Toll-free

Dial-in Number: 1-888-394-8218International Dial-in Number:

1-323-701-0225Conference ID: 3117716Webcast Link: HERE

A telephone replay will be available through Monday, August 29,

2022. To access the replay, please dial 1-844-512-2921 (domestic)

or 1-412-317-6671 (international). At the system prompt, please

enter the code 3117716 followed by the # sign. You will then be

prompted for your name, company, and phone number. Playback will

then automatically begin.

About InuvoInuvo®, Inc. (NYSE American: INUV)

is a market leader in Artificial Intelligence built for

advertising. Its IntentKey AI solution is a first-of-its-kind

proprietary and patented technology capable of identifying and

actioning to the reasons why consumers are interested in products,

services, or brands, not who those consumers are. To learn more,

visit www.inuvo.com.

Safe Harbor / Forward-Looking StatementsThis

press release contains “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements are subject to risks and

uncertainties that may cause actual results to differ materially,

including, without limitation risks detailed from time to time in

our filings with the Securities and Exchange Commission (the

“SEC”), and represent our views only as of the date they are made

and should not be relied upon as representing our views as of any

subsequent date. You are urged to carefully review and consider any

cautionary statements and other disclosures, including the

statements made under the heading "Risk Factors" in Inuvo, Inc.'s

Annual Report on Form 10-K for the fiscal year ended December 31,

2021 as filed on March 17, 2022, our Quarterly Reports on Form

10-Q, and our other filings with the SEC. Additionally,

forward looking statements are subject to certain risks, trends,

and uncertainties including the continued impact of Covid-19 on

Inuvo’s business and operations. Inuvo cannot provide assurances

that the assumptions upon which these forward-looking statements

are based will prove to have been correct. Should one of these

risks materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those expressed

or implied in any forward-looking statements, and investors are

cautioned not to place undue reliance on these forward-looking

statements, which are current only as of this date. Inuvo does not

intend to update or revise any forward-looking statements made

herein or any other forward-looking statements as a result of new

information, future events or otherwise. Inuvo further expressly

disclaims any written or oral statements made by a third party

regarding the subject matter of this press release. The

information, which appears on our websites and our social media

platforms is not part of this press release.

Inuvo Company Contact: Wally Ruiz Chief

Financial Officer Tel (501) 205-8397 wallace.ruiz@inuvo.com

Investor Relations:David Waldman / Natalya

RudmanCrescendo Communications, LLCTel: (212)

671-1020inuv@crescendo-ir.com

(Tables follow)

|

|

|

|

|

|

|

|

|

|

INUVO, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30 |

|

June 30 |

|

June 30 |

|

June 30 |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| Net

revenue |

|

$ |

22,651,305 |

|

|

$ |

12,635,583 |

|

|

$ |

41,260,672 |

|

|

$ |

23,253,392 |

|

| Cost

of revenue |

|

|

9,273,589 |

|

|

|

2,264,020 |

|

|

|

17,935,095 |

|

|

|

3,708,079 |

|

| Gross

profit |

|

|

13,377,716 |

|

|

|

10,371,563 |

|

|

|

23,325,577 |

|

|

|

19,545,313 |

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketing costs |

|

|

10,988,409 |

|

|

|

8,213,140 |

|

|

|

18,157,858 |

|

|

|

15,518,924 |

|

|

Compensation |

|

|

3,215,890 |

|

|

|

2,880,217 |

|

|

|

6,373,596 |

|

|

|

5,618,084 |

|

|

General and administrative |

|

|

2,011,237 |

|

|

|

1,676,890 |

|

|

|

3,737,909 |

|

|

|

3,401,868 |

|

| Total

operating expenses |

|

|

16,215,536 |

|

|

|

12,770,247 |

|

|

|

28,269,363 |

|

|

|

24,538,876 |

|

|

Operating loss |

|

|

(2,837,820 |

) |

|

|

(2,398,684 |

) |

|

|

(4,943,786 |

) |

|

|

(4,993,563 |

) |

|

Interest expense (income), net |

|

|

3,070 |

|

|

|

(7,991 |

) |

|

|

2,071 |

|

|

|

(30,380 |

) |

| Other

income (loss), net |

|

|

(395,177 |

) |

|

|

24,548 |

|

|

|

(377,475 |

) |

|

|

494,548 |

|

| Net

loss |

|

|

(3,229,927 |

) |

|

|

(2,382,127 |

) |

|

|

(5,319,190 |

) |

|

|

(4,529,395 |

) |

| Other

comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized loss on marketable securities |

|

|

(124,253 |

) |

|

|

- |

|

|

|

(222,409 |

) |

|

|

- |

|

|

Comprehensive loss |

|

|

(3,354,180 |

) |

|

|

(2,382,127 |

) |

|

|

(5,541,599 |

) |

|

|

(4,529,395 |

) |

|

|

|

|

|

|

|

|

|

|

Earnings per share, basic and diluted |

|

|

|

|

|

|

|

| Net

loss income |

|

|

(0.03 |

) |

|

|

(0.02 |

) |

|

|

(0.04 |

) |

|

|

(0.04 |

) |

|

Weighted average shares outstanding |

|

|

|

|

|

|

|

|

Basic |

|

|

119,827,944 |

|

|

|

116,497,035 |

|

|

|

118,788,819 |

|

|

|

116,497,035 |

|

|

Diluted |

|

|

119,827,944 |

|

|

|

116,497,035 |

|

|

|

118,788,819 |

|

|

|

116,497,035 |

|

|

INUVO, INC. |

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

June 30 |

|

|

December 31 |

|

| |

|

|

2022 |

|

|

2021 |

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash

and cash equivalent |

|

$ |

6,373,070 |

|

$ |

10,475,964 |

|

|

Marketable securities-short term |

|

|

2,044,601 |

|

|

1,927,979 |

|

|

Accounts receivable, net |

|

|

13,094,811 |

|

|

9,265,813 |

|

|

Prepaid expenses and other current assets |

|

|

1,074,366 |

|

|

1,408,186 |

|

| Total

current assets |

|

|

22,586,848 |

|

|

23,077,942 |

|

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

1,688,478 |

|

|

1,506,766 |

|

|

|

|

|

|

|

|

| Intangible

assets, net of accumulated amortization |

|

6,141,541 |

|

|

6,720,585 |

|

|

Goodwill |

|

|

9,853,342 |

|

|

9,853,342 |

|

| Other

assets |

|

|

2,209,980 |

|

|

2,838,439 |

|

|

|

|

|

|

|

|

| Total

assets |

|

$ |

42,480,189 |

|

$ |

43,997,074 |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

| |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

$ |

6,246,536 |

|

$ |

4,844,716 |

|

|

Accrued expenses and other current liabilities |

|

|

7,422,403 |

|

|

5,817,823 |

|

| Total

current liabilities |

|

|

13,668,939 |

|

|

10,662,539 |

|

|

|

|

|

|

|

|

|

Long-term liabilities |

|

|

304,895 |

|

|

526,540 |

|

|

|

|

|

|

|

|

| Total

stockholders' equity |

|

|

28,506,355 |

|

|

32,807,995 |

|

| Total

liabilities and stockholders' equity |

|

$ |

42,480,189 |

|

$ |

43,997,074 |

|

|

RECONCILIATION OF NET LOSS TO ADJUSTED EBITDA |

|

(unaudited) |

| |

| |

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

June 30 |

|

June 30 |

|

June 30 |

|

|

June 30 |

|

|

|

2022 |

|

2021 |

|

2022 |

|

|

2021 |

|

Net loss |

|

$ |

(3,229,927 |

) |

|

$ |

(2,382,127 |

) |

|

$ |

(5,319,190 |

) |

|

$ |

(4,529,395 |

) |

| Interest (Income) Expense |

|

$ |

(3,070 |

) |

|

|

7,991 |

|

|

|

2,071 |

|

|

|

30,380 |

|

| Depreciation |

|

|

372,939 |

|

|

|

314,106 |

|

|

|

729,732 |

|

|

|

619,634 |

|

| Amortization |

|

|

270,563 |

|

|

|

537,530 |

|

|

|

627,741 |

|

|

|

1,086,730 |

|

|

EBITDA |

|

|

(2,589,495 |

) |

|

|

(1,522,500 |

) |

|

|

(3,959,646 |

) |

|

|

(2,792,651 |

) |

| Stock-based compensation |

|

|

684,376 |

|

|

|

557,602 |

|

|

|

1,355,534 |

|

|

|

952,472 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-recurring transactions:Expense of fraudulent media |

|

|

1,367,800 |

|

|

|

- |

|

|

|

1,367,800 |

|

|

|

- |

|

| Unrealized loss on

investments |

|

|

395,177 |

|

|

|

- |

|

|

|

377,475 |

|

|

|

- |

|

| Adjusted EBITDA |

|

|

(142,142 |

) |

|

|

(964,898 |

) |

|

|

(858,837 |

) |

|

|

(1,840,179 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Operating Loss to EBITDA and Adjusted

EBITDA We present EBITDA and Adjusted EBITDA as a

supplemental measure of our performance. We defined EBITDA as Net

loss plus (i) interest expense, (ii) depreciation, and (iii)

amortization. We further define Adjusted EBITDA as EBITDA plus (iv)

stock-based compensation and (v) certain identified expenses that

are not expected to recur or be representative of future ongoing

operation of the business. These adjustments are itemized above.

You are encouraged to evaluate these adjustments and the reasons we

consider them appropriate for supplemental analysis. In evaluating

EBITDA and Adjusted EBITDA, you should be aware that in the future

we may incur expenses that are the same or similar to some of the

adjustments in the presentation. Our presentation of EBITDA and

Adjusted EBITDA should not be construed as an inference that our

future results will be unaffected by unusual or non-recurring

items.

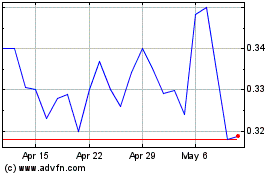

Inuvo (AMEX:INUV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Inuvo (AMEX:INUV)

Historical Stock Chart

From Apr 2023 to Apr 2024