The Euro zone has seen weak GDP growth for yet another quarter,

dropping 0.2% in Q1. Though this marks an improvement from the

previous quarter’s decline of -0.6%, it is yet another major blow

for the single currency bloc struggling to rebound from a debt

crisis.

The region is facing increased hurdles from the need to

restructure domestic markets and the impact of sluggish world trade

growth, in particular from weak demand from emerging markets.

Increasing unemployment, tumbling inflation and fiscal

tightening are already impacting domestic consumption in the

region. Moreover, a rising Euro has made European exports

expensive, hurting their competitiveness (read: Has the Euro ETF

Bottomed Out?).

Unemployment across the Euro zone has reached a record high of

12.1%, well above the whole of European Union rate of 10.9%. In

fact, Greece and Spain have a higher unemployment rate of 27.2% and

26.7%, respectively, followed by Portugal at 17.7% and Italy at

11.5%.

The Long Recession

While the recession is not as deep as what we saw in the

aftermath of the financial crisis of 2008–09, it is the longest

recession in the 14-year history of the Euro, with the region being

in recession since Q4 of 2011.

While the crisis was initially contained to two of the

troubled PIIGS - Greece and Portugal-- the malaise is now

spreading to the other core economies with France being the latest

addition to the list (read: Time to Sell the France ETF?).

According to the data from the European Union, nine of the 17

Euro zone countries are now in recession. France, Europe's

second largest economy, has experienced a recession for the second

time in four years, while Germany recorded weak growth of 0.1% in

the first quarter.

Greece is in its sixth year of recession with the economy

shrinking by 5.3%, while the Spanish and Italian economies

contracted by 0.5% each. Meanwhile, the economies of Finland,

Cyprus, the Netherlands and Portugal also shrank in the same

time-frame, suggesting broad based weakness across the bloc.

Will ECB Succeed In Escaping Recession?

In order to avoid falling into a deeper recession, the European

Central Bank (ECB) cut its benchmark interest rate this month by a

quarter percentage point to a record low of 0.50% (read: ECB Rate

Cut: How Did It Impact Euro ETFs?).

Further, the ECB has promised to provide ample liquidity to the

Euro zone banks until next July in an effort to support the

recession hit economy. It also seeks to support smaller companies

which were affected by poor liquidity conditions.

However, the ECB expects that the economy would not show any

improvement until the second half of the year. But with such poor

economic data, recovery even in the second half of the year could

be elusive.

Euro zone ETFs to Avoid

In such a backdrop, we recommend investors keep away from euro

zone ETFs at least for the short term. Though these funds have

generated decent returns so far in the year, there is no guarantee

of a further surge given the bearish fundamentals for these

economies.

Below, we take a closer look at some of the ETFs that have the

largest exposure to the Euro zone economies and thus could be

European ETFs to avoid this summer (see more ETFs in the Zacks ETF

Center).

SPDR EURO STOXX 50 ETF (FEZ)

This fund seeks to match the price and yield of the EURO STOXX

50 Index, before fees and expenses. The index measures the

performance of some of the largest companies across the components

of the 20 EURO STOXX Supersector Indexes.

Holding 55 securities in its basket, the product puts less than

40% of its assets in top 10 holdings. The ETF is skewed towards

financials, as it takes roughly one-fourth of the total assets,

while healthcare, consumer staples and industrials round to the

next three spots.

In terms of country allocations, France and Germany are at the

top position with 37.51% and 31.90% share, respectively, followed

by Spain (11.71%), Italy (7.77%), the Netherlands (7.01%), Belgium

(3.35%) and Ireland (0.71%) (read: More Trouble Ahead for Italy and

Spain ETFs?).

Launched in October 2002, this is one of the largest and most

popular ETFs in the European space. The fund appears rich with AUM

of over $2.2 billion, and average daily volume of roughly 810,000

shares. The ETF charges 29 bps in fees per year from investors.

The fund returned about 4.21% so far in the year. FEZ currently

has a Zacks ETF Rank of #3 or ‘Hold’.

iShares MSCI EMU Index Fund (EZU)

Like FEZ, this fund is also one of the more popular ones in the

space with AUM of $2.2 billion while charging investors 0.50% in

annual fees. The ETF tracks the MSCI EMU index, which measures the

performance of the equity markets of the EMU member countries

(those European Union members that use the Euro as its

currency).

The fund holds about 250 securities in its basket

which is pretty spread across each security, as no single firm

holds more than 4% of the assets. From a sector look, the product

has a diverse approach with financials, industrials, consumer

discretionary and consumer staples taking a double-digit allocation

(read: Make the Ultimate Consumer Bet with the Gaming ETF).

Country weights for the top three are France (31.63%), Germany

(30.06%) and Spain (10.04%). EZU is a large cap centric fund and is

extremely liquid, trading in volumes of 2 million shares per

day.

The fund is up 5.44% this year and currently has a Zacks ETF

Rank of #3 or ‘Hold’

WisdomTree Euro Debt Fund (EU)

Launched in May 2008, this ETF provides broad exposure to debt

securities of issuers in the Euro zone. It seeks a high level of

returns in the form of both income and capital appreciation.

Holding 34 securities, about 50% of the product’s holdings

mature in less than 10 years, giving EU an effective duration of

5.25 years and average maturity of 5.30 years. In terms of credit

quality, the fund focuses on top rated ‘AAA’ bonds.

Again here, Germany and France occupy the top two positions in

terms of country exposure, closely followed by Luxumberg and the

Netherlands.

The product has so far attracted assets worth just $4.5 million,

charging investors a fee of 35 bps a year. It yields 1.57% in

annual dividends, 0.46% in 30-day SEC yield and 0.86% in yield to

maturity. The ETF has lost 3.85% year-to-date.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

WISDMTR-EURO FD (EU): ETF Research Reports

ISHARS-EMU IDX (EZU): ETF Research Reports

SPDR-EU STX 50 (FEZ): ETF Research Reports

CRYSHS-EURO TR (FXE): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

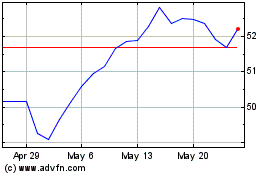

iShares MSCI Eurozone ETF (AMEX:EZU)

Historical Stock Chart

From May 2024 to Jun 2024

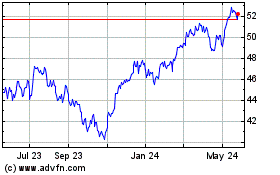

iShares MSCI Eurozone ETF (AMEX:EZU)

Historical Stock Chart

From Jun 2023 to Jun 2024