Zacks.com ETF Strategist Eric Dutram highlights: Three great ETF picks for an IRA investment - Press Releases

April 18 2012 - 4:30AM

Zacks

For Immediate Release

Chicago, IL – April 18, 2012 - Stocks and funds in this article

include: Market Vectors Agribusiness ETF

(MOO), WisdomTree Emerging Markets Small Cap

Dividend Fund (DGS), iShares MSCI Germany Index

Fund (EWG). Eric Dutram looks at six easy

ways investors can reduce the volatility in their portfolios while

still being exposed to broad markets.

Three Great ETFs For Your IRA written by Eric Dutram of

Zacks Investment Research:

Thanks to a holiday in Washington D.C., U.S. residents had a brief

extension over the traditional April 15th deadline in

order to get income tax returns in on time. With many (including

yours truly) waiting until this past weekend to get their returns

in, this extra two day time frame was welcomed news to say the

least.

The extra time has also allowed some investors to make one last

contribution to their IRAs, just squeezing by the deadline for the

2011 tax year, or at the very least getting a head start on 2012

deposits. Yet with markets slumping as of late—but still near 52

week highs—some might be wondering what is the best place to put

their new cash (see more in the Zacks ETF Center).

In light of this trend, it is important to remember that IRA

investing should be focused on the long-term. After all, besides a

few exceptions, investors must wait until they are 59 and ½ before

taking any distributions, lest they pay a penalty. Thanks to this

reality, investors should look beyond the present troubles in the

market and consider what will be big or important years into the

future.

While there are a number of great ETFs that can help investors

accomplish this task, we have selected three equity ETFs below that

could offer outsized opportunities for those willing to invest for

the long term. These three products could be ideal for those with a

decent risk tolerance and the ability to overlook short term

fluctuations for long-term gains (read A Primer On ETF

Investing).

Furthermore, investors should note that all three of these

choices stay outside of the fixed income world. This approach looks

to cut down on risks and promote growth as fixed income ETFs could

be in for a rough patch at some point in the future should yields

spike.

As a result, fixed income may not be the best idea—at least in

large quantities—for an IRA investment, suggesting that investors

should look to these three equity ETFs for their allocations

instead:

Market Vectors Agribusiness ETF

(MOO

)

According to some estimates, the world population will reach

nine billion by 2050, a nearly two billion increase from today.

This means that the world population will grow by about a billion

once every twenty years, a scenario that looks to put a huge strain

on the carrying capacity of the globe (read Teucrium Launches New

Basket Agriculture ETF).

One of the biggest beneficiaries of this trend looks to be the

broad agribusiness industry as farmers scramble to produce more

food for the world’s hungry population. Thanks to this, as well as

the very likely possibility of higher food prices, farmers look to

have a ton to spend on agricultural products ranging from machinery

to fertilizer and everything in between.

In order to play this trend, investors should look no further

than Market Vectors’ Agribusiness ETF (MOO). This ultra popular

fund has assets under management over $5.5 billion and sees robust

volume approaching 900,000 shares a day.

Nearly 40% of the portfolio goes to…

For the rest of this ETF article, please visit Zacks.com

at:

http://www.zacks.com/stock/news/73144/three-great-etfs-for-your-ira

Disclosure: Officers, directors and/or employees of Zacks

Investment Research may own or have sold short securities and/or

hold long and/or short positions in options that are mentioned in

this material. An affiliated investment advisory firm may own or

have sold short securities and/or hold long and/or short positions

in options that are mentioned in this material.

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leonard Zacks. As a PhD in mathematics

Len knew he could find patterns in stock market data that would

lead to superior investment results. Amongst his many

accomplishments was the formation of his proprietary stock picking

system; the Zacks Rank, which continues to outperform the market by

nearly a 3 to 1 margin. The best way to unlock the profitable stock

recommendations and market insights of Zacks Investment Research is

through our free daily email newsletter; Profit from the Pros.

In short, it's your steady flow of Profitable ideas

GUARANTEED to be worth your time! Register for your free

subscription to Profit from the Pros

http://at.zacks.com/?id=113

Follow Eric on Twitter: http://twitter.com/ericdutram

Join Zacks on Facebook:

http://www.facebook.com/ZacksInvestmentResearch

Zacks Investment Research is under common control with

affiliated entities (including a broker-dealer and an investment

adviser), which may engage in transactions involving the foregoing

securities for the clients of such affiliates.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Contact: Eric Dutram

Company: Zacks.com

Phone: 312-265-9462

Email: pr@zacks.com

Visit: www.Zacks.com

To read this article on Zacks.com click here.

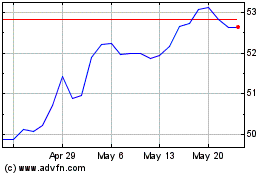

WisdomTree Emerging Mark... (AMEX:DGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

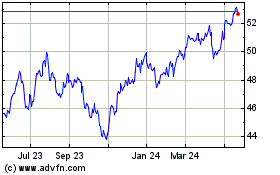

WisdomTree Emerging Mark... (AMEX:DGS)

Historical Stock Chart

From Apr 2023 to Apr 2024