China Currency ETFs: Slow and Steady Growth In 2012? - ETF News And Commentary

March 23 2012 - 9:13AM

Zacks

The Chinese economy is the world’s second largest economy and a

key driver of the global economic growth. It amounts to over 10% of

world GDP and about 25% of world GDP growth. Given China’s

importance in the global economy, it appears inevitable that its

currency will become a reserve currency like the Dollar and the

Euro, sometime in future.

Earlier this week, the IMF head stated that Yuan (also known as

Renminbi) could become a global reserve currency if China

implemented market-oriented changes including flexible exchange

rate system, well-developed financial markets and opening up of the

capital account. While China has been slowly loosening controls on

capital flows, its financial markets and exchange rate system still

remain very tightly controlled. (Read: The Guide to China Bond

ETFs)

It has been general belief that China manipulates its currency

to keep it at artificially low levels in order to support its

exports. In July 2005, China removed its decade-old peg to the

dollar, revalued its currency by 2.1% and moved to reference to a

basket of currencies of its major trading partners. The currency

has appreciated roughly 30% against the Dollar since then. China

pegged the currency to the Dollar again in 2008 but returned to

basket based approach in July 2010. While the currency

appreciated 5% against the Dollar in 2011, it has remained largely

unchanged this year.

Recently the World Bank released a report co-authored with a

Chinese cabinet think tank (State Council’s DRC) that outlined

some critical reforms needed in China’s financial markets for

maintaining its growth rate. The fact that the report had official

endorsement implies that the Chinese political leaders are aware of

the necessity to implement reforms. But as the country prepares for

big leadership transition later this year, the reforms may not come

anytime soon. (Read: What Bubble? China ETFs Soaring to Start

2012)

Further, China's capital-intensive and export-oriented economy

is already facing strong headwinds due to economic conditions in

its major export markets. Economists expect China's annual

economic growth to slow to close to 8% in the first quarter of

2012, down from 8.9% in the last quarter of 2011. That would be the

fifth successive quarter of slower growth and China is likely to

end this year with its weakest expansion in a decade.

Last month, China reported its biggest monthly trade deficit

since 1998, with imports exceeding exports by $31.5 billion. Given

the state of economy, the People’s Bank of China is far more likely

to try and keep the Yuan from rising significantly in the next few

months. (Read: Forget FXI, Try These Three China ETFs Instead)

Even if appreciation in the currency is expected to be moderate,

there remains significant attraction in establishing exposure to

the currency of world’s second largest economy and the Yuan

currency ETFs present a great way to playing the growth in

China.

WisdomTree Dreyfus Chinese Yuan Fund (CYB)

CYB aims to achieve total returns reflective of both money

market rates in China and changes in value of the Chinese Yuan

relative to the U.S. dollar. The Fund, which was launched in May

2008, invests in a combination of U.S.money market securities and

forward currency contracts and swaps. It also invests in money

market securities and other instruments, including forward currency

contracts and swaps, denominated in Chinese Yuan that trade and

settle in Hong Kong and other markets outside of mainland China. In

terms of asset groups, T Bills occupy the heaviest weight at 59.5%.

Repos and time deposits follow with 21.7% weight and 18.3% weight

respectively.

The fund had returned 0.52% year-to-date and charges an expense

ratio of 0.45%. The fund however had an attractive distribution

yield of 2.19%, as of the end of last quarter of 2011. Since

inception, it had total returns of 7.26% and currently manages

assets worth $395.6 million.

Market Vectors Chinese Renminbi/USD ETF

(CNY)

Started in March 2008, this fund with AUM at $77.7 million seeks

to replicate, net of expenses, the S&P Chinese Renminbi Total

Return Index. The index tracks the value of the Chinese currency

relative to the U.S. dollar. It follows the value of

non-deliverable, three-month currency forward contracts that are

rolled at three-month intervals and includes daily accrued

interest. The ETNs are senior unsecured debt obligations of Morgan

Stanley. The fund charges 0.55% to the investors and has returned

negative 0.15% year-to-date.

CurrencyShares Chinese Renminbi (FXCH)

FXCH, which made its debut in October last year, seeks to track

the price of Renminbi, plus any accrued interest. The depository

for the trust maintains an account denominated in the Chinese

currency. The interest earned is used to pay the expenses and the

any excess interest in distributed to the shareholders. The fund

charges 0.40% annually to the investors and has returned 0.15%

year-to-date. It has so far attracted assets worth $7.9

million.

FXCH provides investors with direct exposure to the Yuan without

using derivatives and is backed by the underlying currency, held in

deposit accounts. On the other hand, CYB and CNY mostly use

non-deliverable forward currency contracts to gain exposure to the

currency (CYB also invests in some Yuan denominated money market

instruments). As the Chinese currency is rather stable, future

appreciation is usually already priced into the forward contracts,

which results in these two ETFs lagging the currency. FXCH on the

other hand, is more likely to closely track the currency.

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

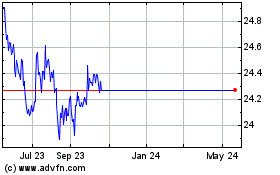

WisdomTree Chinese Yuan ... (AMEX:CYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

WisdomTree Chinese Yuan ... (AMEX:CYB)

Historical Stock Chart

From Apr 2023 to Apr 2024