Continental Gold Limited (TSX:CNL)(OTCQX:CGOOF) ("Continental" or the "Company")

is pleased to announce results for 12 diamond drill-holes through the Yaragua

and Laurel vein systems at the Company's 100%-owned Buritica project in

Antioquia, Colombia. Drilling continues throughout 2014 with the goal of

upgrading Inferred resources into the Measured and Indicated categories under

National Instrument 43-101 ("NI 43-101") guidelines, and delivering overall

robust mineral resource growth.

Highlights (referenced in Figures 1, 2 and 3)

Yaragua Vein System

-- Drilling from underground was successful in infilling eastern areas of

the May 2014 Yaragua mineral resource envelope across 200 metres of

lateral strike by 400 metres of vertical strike. Importantly, the infill

drill-holes are all within 200 vertical-metre ranges above and below the

elevation of the Higabra Valley Tunnel (approximately 1,190 metres above

sea level), where drilling is focused on converting existing Inferred

resources into the Measured and Indicated categories.

-- Drilling through most of the central and southern Yaragua vein envelope

commonly encountered vein grades X thicknesses that are significantly

above those expected from the May 2014 mineral resource block model.

Related intercepts and veins include:

-- 1.35 metres @ 190.5 g/t gold and 95 g/t silver (BUUY222, MUS1,

elevation of 1,211 metres);

-- 0.9 metres @ 64 g/t gold and 6 g/t silver (BUUY225, VNC2, elevation

of 1,354 metres);

-- 2.5 metres @ 20.4 g/t gold and 44 g/t silver (BUUY225, MU1,

elevation of 1,172 metres);

-- 3.95 metres @ 50.2 g/t gold and 26 g/t silver (BUUY253, PRE,

elevation of 1,299 metres);

-- 0.5 metres @ 70 g/t gold and 19 g/t silver (BUUY253, MU2, elevation

of 1,248 metres);

-- 0.58 metres @ 752 g/t gold and 124 g/t silver (BUUY258, MU,

elevation of 1,231 metres);

-- 4.2 metres @ 25 g/t gold and 18 g/t silver (BUUY264, PRE, elevation

of 1,284 metres);

-- 2.4 metres @ 28 g/t gold and 9 g/t silver (BUUY264, MU, elevation of

1,201 metres);

-- 1.0 metres @ 219.4 g/t gold and 72 g/t silver (BUUY269, VNB,

elevation of 1,301 metres);

-- 4.1 metres @ 17.4 g/t gold and 170 g/t silver (BUUY272, MU3,

elevation of 1,288 metres);

-- 3.8 metres @ 62.4 g/t gold and 249 g/t silver (BUUY274, VNC,

elevation of 1,352 metres);

-- 0.55 metres @ 66.2 g/t gold and 15 g/t silver (BUUY274, MU,

elevation of 1,277 metres);

-- 0.6 metres @ 22.3 g/t gold and 5 g/t silver (BUUY275, MU2, elevation

of 1,273 metres); and

-- 3.2 metres @ 12.7 g/t gold and 93 g/t silver (BUUY276, PRE,

elevation of 1,277 metres).

-- Step-out drilling in nine holes intersected multiple veins below the

south-eastern Yaragua mineral resource envelope. High-grade intercepts

include:

-- 0.5 metres @ 17.4 g/t gold and 9 g/t silver (BUUY264, elevation of

1,085 metres);

-- 0.5 metres @ 10.4 g/t gold and 13 g/t silver (BUUY269, elevation of

1,032 metres); and

-- 2.0 metres @ 7.4 g/t gold and 3 g/t silver (BUUY269, elevation of

1,022 metres).

Laurel Vein System

-- Further to the south, step-out drilling up to 300 metres along strike in

three holes encountered multiple veins interpreted as relatively deep,

eastern extensions of the Laurel vein system. These holes extended the

strike length of Laurel to approximately 1,100 metres, with the system

remaining open to the southwest, northeast and at depth. High-grade

intercepts include:

-- 1.45 metres @ 84 g/t gold and 7 g/t silver (BUUY258, elevation of

976 metres); and

-- 0.6 metres @ 9.2 g/t gold and 20 g/t silver (BUUY269, elevation of

990 metres).

"It's pleasing to see the underground infill drilling successfully demonstrate

consistent and even higher-grade intercepts at elevations around the Higabra

Valley Tunnel, as this is pivotal for our goal of upgrading current Inferred

resources at these elevations into the Measured and Indicated categories",

commented Ari Sussman, CEO of Continental. "Additionally, the size of the Laurel

vein system target continues to grow impressively and we are hopeful that over

time, it will prove economic and represent another mineable front at Buritica."

Details

Continental's 100%-owned, 59,095-hectare project, Buritica, contains several

known areas of high-grade gold and silver mineralization, of base metal

carbonate-style ("Stage I") variably overprinted by texturally and chemically

distinctive high-grade ("Stage II") mineralization. The two most extensively

explored of these areas (the Yaragua and Veta Sur systems) are central to this

land package. The Yaragua system has been drill-outlined along 1,120 metres of

strike and 1,300 vertical metres and partially sampled in underground

developments. The Veta Sur system has been drill-outlined along 1,040 metres of

strike and 1,400 vertical metres. Both systems are characterized by multiple,

steeply-dipping veins and broader, more disseminated mineralization and both

remain open at depth and along strike, at high grades. See "About Continental

Gold" below for a precis of updated mineral resource estimates for the Buritica

project prepared in accordance with NI 43-101. The Laurel vein system, to the

south of Yaragua and Veta Sur, is at an earlier stage of drilling definition.

This release documents the results of infill and extension drilling (completed

after the December 31, 2013 closure of the database for the Buritica 2014

mineral resource estimate) through eastern Yaragua and to the south of the

Yaragua vein system. Significant new drill intercepts are listed below in Table

I and are referenced in Figures 1, 2 and 3.

Table I: Drilling Highlights

----------------------------------------------------------------------------

HoleID m m Intercept Au Ag Zn Intercept Vein(ii)

From To Interval(i) (g/t) (g/t) (%) RL (m)

----------------------------------------------------------------------------

BUUY219 54.05 54.90 0.85 1.34 3.1 0.16 1358 MU1

76.00 77.20 1.20 1.71 2.0 0.01 1348 MUS

100.80 102.00 1.20 3.38 11.7 1.12 1337 MUS11

103.90 104.60 0.70 3.13 15.1 0.29 1336 MUS1

135.20 135.70 0.50 5.52 4.0 0.34 1322 MUS2

137.60 138.10 0.50 4.98 45.2 3.16 1321 MUS2

BUUY222 25.25 26.50 1.25 2.00 1.3 0.01 1360 MU2

56.90 58.10 1.20 1.11 2.2 0.31 1334 MU10

79.00 79.50 0.50 4.96 161.0 3.49 1317 MU11

90.00 91.00 1.00 1.39 6.3 0.81 1308 CNT

132.20 133.83 1.63 4.73 13.5 0.07 1274 MIC

145.95 147.10 1.15 11.43 46.4 1.66 1264 MUS

162.83 163.35 0.52 3.92 5.9 6.23 1251 MUS11

171.86 172.50 0.64 2.28 11.3 0.26 1244 Below

184.43 185.01 0.58 4.20 46.6 0.94 1234 Below

214.00 215.35 1.35 190.50 94.8 4.54 1211 MUS1

220.20 221.20 1.00 4.61 11.9 0.39 1206 MUS21

236.50 237.08 0.58 2.08 1.1 0.06 1194 MUS2

264.20 264.90 0.70 1.48 10.5 1.00 1173 MUS31

297.30 297.90 0.60 3.71 2.5 0.22 1148 Below

345.00 345.80 0.80 2.28 17.3 0.24 1112 Below

366.80 367.30 0.50 1.96 4.0 0.30 1096 ?Laurel

BUUY225 26.70 27.70 1.00 3.96 1.4 0.01 1357 SOF

30.30 31.20 0.90 64.00 6.1 0.03 1354 VNC2

38.35 39.50 1.15 2.85 1.3 0.07 1347 VNC1

46.30 47.35 1.05 1.83 0.8 0.01 1340 VNC

58.50 59.00 0.50 3.23 34.3 0.33 1330 CBE

75.30 76.50 1.20 3.59 13.1 0.01 1315 VNB

87.70 92.00 4.30 3.57 29.0 3.95 1301 PRE

113.60 114.15 0.55 2.73 10.6 1.86 1282 MU4

118.20 119.40 1.20 2.87 8.7 2.90 1277

121.90 122.40 0.50 6.44 5.9 3.43 1275 MU3

131.00 132.00 1.00 2.16 78.9 4.15 1266 MU2

146.20 146.70 0.50 10.65 7.8 0.01 1254 MU

170.30 178.50 8.20 2.31 4.2 0.37 1227 MU10

215.50 216.50 1.00 3.35 2.6 0.11 1194 MU11

225.80 227.60 1.80 2.95 16.8 0.56 1185 CNT

240.90 243.40 2.50 20.43 44.3 1.23 1172 MU1

incl 241.70 243.20 1.50 32.44 69.9 1.74

252.30 254.10 1.80 2.67 4.4 0.14 1163 MIC

288.80 289.40 0.60 4.49 10.7 0.12 1134 Below

291.80 294.20 2.40 2.22 3.4 0.11 1130 Below

311.80 312.30 0.50 3.76 6.6 1.07 1115 Below

367.50 370.20 2.70 1.00 7.1 0.61 1069 Below

382.80 384.60 1.80 2.07 25.7 0.82 1056 Below

412.20 418.20 6.00 2.15 17.4 1.27 1030 Below

BUUY242 33.60 34.20 0.60 2.39 32.7 1.89 1350 VNC2

39.90 40.40 0.50 1.62 1.4 0.17 1345 VNC1

54.95 57.00 2.05 2.20 42.7 0.06 1330 CBE

67.20 68.60 1.40 7.25 2.1 0.01 1320 VNC

91.00 92.00 1.00 5.79 8.0 0.47 1299

96.75 99.00 2.25 7.88 8.7 0.66 1292

incl 96.75 98.00 1.25 12.76 2.0 0.01 VNB

102.70 103.30 0.60 39.10 47.3 3.75 1288 PRE

115.00 115.50 0.50 3.26 3.8 2.38 1278 VNE

123.00 124.00 1.00 1.99 23.5 0.07 1270 MU4

153.60 154.10 0.50 2.02 3.1 0.27 1244

173.00 173.75 0.75 10.70 1.7 0.02 1227 MU2

180.00 182.45 2.45 9.13 7.9 0.02 1219

incl 181.00 182.45 1.45 13.49 12.1 0.02 CNT

188.30 190.75 2.45 7.82 29.9 1.67 1212

incl 189.00 190.15 1.15 13.40 25.9 2.35 MU

197.40 198.40 1.00 4.11 44.3 1.29 1205

202.10 203.50 1.40 2.63 12.8 0.54 1201 MU10

235.00 239.40 4.40 4.82 15.0 0.28 1170 MU11

253.50 255.60 2.10 2.55 4.8 0.30 1157 MU1

283.00 284.65 1.65 2.33 3.3 0.20 1133 MUS1

287.00 289.50 2.50 1.97 2.3 0.35 1129 Below

312.00 313.60 1.60 1.84 3.6 0.10 1109 Below

353.50 354.50 1.00 3.72 32.3 0.26 1075 Below

376.60 377.30 0.70 2.93 9.2 2.75 1056 Below

389.70 391.70 2.00 2.01 29.8 0.36 1044 Below

434.28 434.90 0.62 3.16 3.8 0.42 1009 Below

460.20 460.78 0.58 1.16 2.0 0.02 988 Below

BUUY253 24.00 25.65 1.65 1.81 1.6 0.08 1360 SOF

30.70 33.20 2.50 2.44 1.4 0.02 1353 VNC2

34.60 36.20 1.60 2.34 2.3 0.11 1350 VNC1

61.00 63.10 2.10 5.74 11.0 0.01 1327 VNC

65.50 66.75 1.25 25.20 1.0 0.01 1324 CBE

70.80 72.00 1.20 6.10 6.2 0.01 1319 VNB

87.60 89.10 1.50 4.08 1.5 0.01 1305

91.55 95.50 3.95 50.22 26.4 1.04 1299 PRE

incl 91.55 94.00 2.45 74.25 34.6 0.99

99.10 102.00 2.90 14.01 22.2 2.76 1294 MU3

103.80 107.60 3.80 3.95 6.8 1.35 1288

110.25 111.20 0.95 9.76 34.6 0.34 1285 VNE

153.75 154.25 0.50 70.00 18.9 0.82 1248 MU2

161.00 161.70 0.70 26.30 39.9 1.02 1242 CNT

168.00 168.60 0.60 7.37 100.0 0.47 1236

181.70 182.30 0.60 5.04 206.0 1.92 1224 MU

185.65 188.05 2.40 2.28 20.2 2.57 1219

221.75 222.50 0.75 4.49 34.3 0.04 1190 MU11

237.55 238.70 1.15 2.12 2.0 0.18 1176 MIC

263.15 264.40 1.25 1.17 0.6 0.03 1154 MAR

287.15 288.85 1.70 5.15 5.6 0.41 1134 MUS

314.20 315.68 1.48 2.19 2.9 0.22 1112 Below

317.70 318.25 0.55 3.94 5.6 0.05 1109 Below

351.90 352.60 0.70 1.46 12.1 0.21 1081 Below

412.25 412.75 0.50 1.07 2.5 0.07 1031 Below

499.10 500.58 1.48 1.97 0.8 0.09 959 Below

505.40 506.20 0.80 7.93 2.9 0.17 954 Below

BUUY258 25.40 25.90 0.50 3.03 18.8 2.00 1359 SOF

70.10 72.77 2.67 5.81 43.3 0.08 1318 BC

78.30 82.32 4.02 5.65 40.4 1.75 1310 VNB

incl 78.30 79.50 1.20 13.19 102.5 2.64 1312

90.30 91.35 1.05 1.11 880.0 0.81 1302 PRE

124.30 124.90 0.60 1.67 18.0 2.37 1272 MU4

135.65 136.70 1.05 2.66 8.0 0.88 1262

147.90 148.40 0.50 1.60 3.0 0.01 1252 MU2

171.07 171.65 0.58 752.00 124.0 3.00 1231 MU

178.40 179.10 0.70 8.47 7.7 0.32 1225 CNT

188.60 189.20 0.60 4.41 16.6 3.00 1216 MU10

190.90 193.13 2.23 1.52 10.6 0.84 1213

208.00 209.60 1.60 2.63 3.7 0.36 1198 MU11

220.45 221.45 1.00 1.95 16.0 2.58 1188

240.00 241.50 1.50 6.96 39.3 4.67 1171 MU1

247.70 257.35 9.65 3.30 10.4 1.12 1157 MUS

278.50 279.00 0.50 3.97 123.0 4.59 1137 MUS1

306.00 306.50 0.50 5.01 11.5 0.25 1114 Below

350.45 352.00 1.55 1.33 14.7 0.47 1075 Below

414.00 415.30 1.30 4.80 0.5 0.01 1020 Below

437.20 439.00 1.80 1.32 7.5 0.05 1000 Below

465.85 467.30 1.45 84.03 6.7 0.01 976 ?Laurel

473.80 477.40 3.60 0.90 2.9 0.11 968 ?Laurel

BUUY264 26.30 29.50 3.20 2.62 11.5 0.35 1355 SOF

51.00 51.60 0.60 2.09 34.1 0.85 1334 VNC1

103.40 107.60 4.20 25.04 18.0 1.52 1284 PRE

incl 106.00 107.60 1.60 61.44 24.1 2.30

121.20 121.70 0.50 5.77 45.6 3.15 1271 MU3

127.20 127.80 0.60 41.10 61.2 0.49 1265 VNE

151.50 152.10 0.60 2.04 16.2 1.26 1243 MU4

169.50 171.05 1.55 2.48 8.4 0.03 1227

178.60 179.10 0.50 4.80 71.8 4.47 1219 MU2

198.20 200.60 2.40 27.96 9.4 0.60 1201 MU

214.65 215.30 0.65 2.25 1.9 0.05 1187

241.20 241.70 0.50 3.82 10.2 0.78 1164 MU10

249.50 251.70 2.20 2.62 20.2 0.03 1155

254.50 255.60 1.10 11.51 125.9 0.20 1152 MU11

257.30 258.30 1.00 21.95 27.0 0.36 1150 CNT

283.80 284.40 0.60 2.44 32.4 0.05 1127 Below

332.00 332.50 0.50 17.40 9.3 1.46 1085 Below

346.00 346.50 0.50 2.14 12.7 0.21 1073 Below

382.80 383.35 0.55 1.87 28.7 0.92 1041 Below

400.00 401.15 1.15 1.38 34.3 0.08 1027 Below

435.00 436.20 1.20 2.09 1.7 0.07 997 Below

466.50 467.10 0.60 3.05 7.5 0.40 971 Below

BUUY269 10.00 10.50 0.50 0.50 94.5 0.09 1372 HWV

31.80 32.80 1.00 3.76 0.6 0.01 1352 SOF

36.00 36.70 0.70 3.42 2.9 0.01 1348 VNC2

66.30 66.95 0.65 11.90 259.0 1.09 1321 CBE

89.00 90.00 1.00 219.35 71.7 0.31 1301 VNB

105.30 106.00 0.70 36.40 121.0 2.83 1286 MU3

135.90 136.40 0.50 15.90 21.2 5.17 1259 MU4

154.00 156.20 2.20 1.63 16.3 0.83 1242

157.80 158.30 0.50 4.97 7.1 0.24 1240 MU2

179.10 179.80 0.70 1.29 13.6 1.77 1221

185.00 185.50 0.50 2.49 2.1 0.18 1216 MU

200.00 200.50 0.50 1.78 153.0 0.99 1203

218.70 219.85 1.15 1.10 17.0 4.47 1186

221.00 223.30 2.30 2.73 12.4 2.25 1183 MU11

229.95 231.40 1.45 2.06 5.7 0.47 1177 MU10

256.50 257.00 0.50 1.20 11.8 2.20 1154

265.87 266.37 0.50 22.40 51.2 1.01 1146 MU1

282.40 282.90 0.50 2.77 30.5 4.77 1132 MUS1

331.80 333.20 1.40 1.40 7.5 0.79 1090 Below

337.75 338.25 0.50 0.08 116.0 0.06 1086 Below

342.00 342.50 0.50 1.47 7.6 0.36 1082 Below

371.50 374.00 2.50 1.79 3.1 0.40 1056 Below

395.50 396.00 0.50 7.88 19.5 0.33 1037 Below

401.30 401.80 0.50 10.40 13.3 0.37 1032 Below

412.00 414.00 2.00 7.44 2.7 0.21 1022 Below

445.50 446.50 1.00 3.66 1.5 0.12 995 ?Laurel

452.20 452.80 0.60 9.19 19.8 0.03 990 ?Laurel

459.00 460.00 1.00 6.71 5.2 0.33 984 ?Laurel

464.70 465.30 0.60 3.88 8.1 0.03 979 ?Laurel

510.90 511.40 0.50 1.03 0.5 0.01 941 ?Laurel

BUUY272 18.00 18.65 0.65 16.05 26.3 3.48 1365 SOF

29.05 29.55 0.50 1.29 4.2 0.87 1355

35.00 36.00 1.00 1.54 4.2 0.35 1349 VNC2

53.00 53.55 0.55 5.91 94.3 0.94 1333 VNC

69.00 70.50 1.50 1.33 0.8 0.01 1318 CBE

98.20 98.70 0.50 5.99 39.6 1.69 1293 PRE

100.90 105.00 4.10 17.38 169.8 7.19 1288 MU3

incl 101.40 102.60 1.20 42.03 487.3 10.55

106.00 109.10 3.10 2.93 8.2 1.61 1284 VNE

124.75 125.35 0.60 1.22 175.0 0.92 1269 MU4

152.00 152.55 0.55 1.94 6.2 0.06 1246

160.35 160.95 0.60 3.17 10.5 0.58 1238 MU2

171.65 172.90 1.25 1.05 14.4 1.00 1228

177.10 178.00 0.90 2.94 4.2 0.09 1224

181.10 188.70 7.60 8.86 16.3 0.44 1215 MU

incl 181.10 184.50 3.40 17.31 13.6 0.32

190.70 192.20 1.50 9.57 143.0 0.94 1212 MU10

229.50 232.00 2.50 9.61 80.3 0.18 1178 MU11

incl 230.10 232.00 1.90 11.93 101.9 0.22

BUUY274 21.70 23.05 1.35 4.64 41.6 1.10 1364 VNC2

35.40 39.20 3.80 62.41 249.3 0.12 1352 VNC

incl 36.00 37.00 1.00 171.78 496.0 0.21

45.25 45.75 0.50 2.02 48.6 0.38 1346 CBE

66.30 69.05 2.75 0.94 3.4 1.00 1329 PRE

76.80 78.40 1.60 17.60 10.7 0.89 1322 MU3

82.00 84.75 2.75 3.48 4.9 0.40 1317 VNE

130.50 131.00 0.50 21.50 35.5 6.14 1282 MU2

137.15 137.70 0.55 66.20 15.1 1.38 1277 MU

149.60 150.10 0.50 2.34 13.6 0.96 1268 MU10

159.85 160.50 0.65 2.40 31.2 1.47 1260 MU11

172.10 175.55 3.45 3.96 11.4 4.76 1249 MU1

195.00 195.50 0.50 1.19 8.3 0.49 1234 MIC

214.55 216.35 1.80 1.18 3.1 0.26 1220 MUS11

244.50 245.00 0.50 1.28 3.7 0.17 1199 MUS1

260.10 261.13 1.03 6.73 13.6 0.62 1188 MUS21

275.10 275.60 0.50 2.16 17.8 1.38 1178 MUS2

282.90 284.15 1.25 1.17 4.5 3.09 1172 MUS31

BUUY275 8.70 9.20 0.50 0.83 167.0 0.23 1374 HWV

25.00 26.00 1.00 2.98 3.7 0.50 1360 VNC2

41.50 44.20 2.70 2.16 77.4 4.76 1345 VNC

50.75 51.50 0.75 2.13 34.5 1.60 1339

53.08 54.68 1.60 10.02 111.5 7.38 1337 CBE

58.00 61.50 3.50 5.10 25.4 1.37 1331

incl 60.15 61.50 1.35 9.88 10.5 1.85 VNBC

64.10 67.30 3.20 4.32 13.7 2.09 1326

70.30 73.00 2.70 8.83 76.0 4.64 1322 VNB

74.50 77.50 3.00 2.92 5.0 0.28 1318 PRE

79.50 81.00 1.50 1.15 4.0 0.21 1315 MU3

95.00 95.50 0.50 3.10 33.4 0.05 1303 VNE

114.40 115.50 1.10 1.07 1.5 0.16 1286 MU4

130.70 131.30 0.60 22.30 5.4 0.41 1273 MU2

143.20 143.70 0.50 2.11 32.6 12.60 1263

160.00 160.60 0.60 1.30 8.9 0.71 1249 MU

187.80 188.43 0.63 2.22 4.6 0.22 1226 MU10

192.00 192.80 0.80 3.18 0.7 0.02 1223 MU11

218.40 219.20 0.80 2.00 1.9 0.02 1201 MU1

238.75 241.85 3.10 2.51 20.2 1.09 1183 MUS

245.80 246.30 0.50 20.90 15.8 0.11 1179 MUS11

250.50 251.40 0.90 4.64 1.3 0.01 1175 MUS1

253.00 254.00 1.00 2.68 25.6 0.14 1173

302.00 305.00 3.00 2.21 1.6 0.14 1132 Below

330.10 331.00 0.90 1.91 10.5 1.02 1110 Below

BUUY276 14.50 15.90 1.40 2.90 0.9 0.01 1367 HWV

29.50 30.00 0.50 1.70 29.7 2.04 1354 SOF

68.75 69.60 0.85 2.21 16.2 0.16 1319 VNC

79.00 79.55 0.55 2.01 30.7 0.48 1309 CB

83.00 84.20 1.20 4.70 2.1 0.06 1306 VNBC

112.80 116.00 3.20 12.74 92.9 0.61 1277 PRE

117.80 124.15 6.35 8.87 33.7 0.14 1269

incl 117.80 119.95 2.15 16.14 29.5 0.07 MU3

132.65 133.25 0.60 4.92 20.1 2.26 1261 VNE

159.60 162.70 3.10 5.40 5.4 1.13 1235

incl 159.60 161.00 1.40 9.25 6.5 1.35 1236 MU4

165.25 165.75 0.50 4.45 15.9 0.20 1232

170.10 172.10 2.00 1.23 10.0 0.51 1227

188.20 188.70 0.50 6.84 13.6 0.63 1211 MU2

196.90 198.40 1.50 1.19 7.3 0.75 1203

213.85 216.15 2.30 1.61 8.8 0.26 1187

218.70 219.20 0.50 4.50 17.9 0.01 1184 MU

243.20 243.70 0.50 6.51 48.9 0.80 1162 MU11

260.70 261.30 0.60 1.78 5.7 0.31 1147

274.00 274.60 0.60 5.02 32.9 10.45 1135 MU1

280.50 281.00 0.50 5.06 32.1 2.11 1129 MUS

302.05 304.40 2.35 4.01 23.1 3.89 1109 Below

315.90 316.50 0.60 2.91 10.5 0.02 1098 Below

322.90 323.40 0.50 1.76 27.2 1.04 1092 Below

369.50 370.00 0.50 0.95 8.3 0.59 1051 Below

389.70 390.50 0.80 1.43 9.6 1.79 1033 Below

404.20 405.00 0.80 1.53 18.3 0.08 1020 Below

----------------------------------------------------------------------------

(i) Intercepts calculated at 1 g/t gold + 50 g/t silver cut-off grades for

minimum intervals of 0.5 metres, with up to 30% internal dilution. True

widths not accurately known but generally are between 30% of the down-hole

interval and near true width. Drill-holes designated "BUUY" were collared

from underground, and drill-holes designated "BUSY" were collared at

surface.

(ii) Intercepts in Yaragua vein domains are respectively nominated by vein

code (e.g. VNC) or as "below" the mineral resource envelope. Intercepts

interpreted as Laurel vein extensions are labelled accordingly.

Two fans of holes were drilled to the south of Yaragua, from underground

platforms in the Yaragua mine (Figure 1). Drilling was primarily focused on

infilling the Yaragua mineral resource envelope, but some holes also targeted

depth extensions of the Yaragua vein system and, further south, possible

extensions to the Laurel vein system (Figures 2 and 3).

Within the Yaragua mineral resource envelope, drilling through most of the

central and southern Yaragua vein system commonly encountered vein grades X

thicknesses that are significantly above those expected from the May 2014

mineral resource block model. Related intercepts and veins include:

-- 1.35 metres @ 190.5 g/t gold and 95 g/t silver (BUUY222, MUS1, elevation

of 1,211 metres);

-- 0.9 metres @ 64 g/t gold and 6 g/t silver (BUUY225, VNC2, elevation of

1,354 metres);

-- 2.5 metres @ 20.4 g/t gold and 44 g/t silver, including 1.5 metres @

32.4 g/t gold and 70 g/t silver (BUUY225, MU1, elevation of 1,172

metres);

-- 2.25 metres @ 7.9 g/t gold and 9 g/t silver, including 1.25 metres @

12.8 g/t gold and 2 g/t silver (BUUY242, VNB, elevation of 1,292

metres);

-- 0.6 metres @ 39.1 g/t gold and 47 g/t silver (BUUY242, PRE, elevation of

1,288 metres);

-- 2.45 metres @ 9.1 g/t gold and 8 g/t silver, including 1.45 metres @

13.5 g/t gold and 12 g/t silver (BUUY242, CNT, elevation of 1,219

metres);

-- 1.25 metres @ 25.2 g/t gold and 1 g/t silver (BUUY253, CBE, elevation of

1,324 metres);

-- 3.95 metres @ 50.2 g/t gold and 26 g/t silver, including 2.45 metres @

74.3 g/t gold and 35 g/t silver (BUUY253, PRE, elevation of 1,299

metres);

-- 2.9 metres @ 14 g/t gold and 22 g/t silver (BUUY253, MU3, elevation of

1,294 metres);

-- 0.5 metres @ 70 g/t gold and 19 g/t silver (BUUY253, MU2, elevation of

1,248 metres);

-- 0.7 metres @ 26.3 g/t gold and 40 g/t silver (BUUY253, CNT, elevation of

1,242 metres);

-- 1.05 metres @ 1.11 g/t gold and 880 g/t silver (BUUY258, PRE, elevation

of 1,302 metres);

-- 0.58 metres @ 752 g/t gold and 124 g/t silver (BUUY258, MU, elevation of

1,231 metres);

-- 4.2 metres @ 25 g/t gold and 18 g/t silver, including 1.6 metres @ 61.4

g/t gold and 24 g/t silver (BUUY264, PRE, elevation of 1,284 metres);

-- 0.6 metres @ 41.1 g/t gold and 61 g/t silver (BUUY264, VNE, elevation of

1,265 metres);

-- 2.4 metres @ 28 g/t gold and 9 g/t silver (BUUY264, MU, elevation of

1,201 metres);

-- 1.0 metres @ 219.4 g/t gold and 72 g/t silver (BUUY269, VNB, elevation

of 1,301 metres);

-- 0.7 metres @ 36.4 g/t gold and 121 g/t silver (BUUY269, MU3, elevation

of 1,286 metres);

-- 4.1 metres @ 17.4 g/t gold and 170 g/t silver, including 1.2 metres @ 42

g/t gold and 487 g/t silver (BUUY272, MU3, elevation of 1,288 metres);

-- 7.6 metres @ 8.9 g/t gold and 16 g/t silver, including 3.4 metres @ 17.3

g/t gold and 14 g/t silver (BUUY272, MU, elevation of 1,215 metres);

-- 3.8 metres @ 62.4 g/t gold and 249 g/t silver, including 1.0 metres @

171.8 g/t gold and 496 g/t silver (BUUY274, VNC, elevation of 1,352

metres);

-- 0.55 metres @ 66.2 g/t gold and 15 g/t silver (BUUY274, MU, elevation of

1,277 metres);

-- 0.6 metres @ 22.3 g/t gold and 5 g/t silver (BUUY275, MU2, elevation of

1,273 metres);

-- 3.2 metres @ 12.7 g/t gold and 93 g/t silver (BUUY276, PRE, elevation of

1,277 metres); and

-- 6.35 metres @ 8.9 g/t gold and 34 g/t silver, including 2.15 metres @

16.1 g/t gold and 30 g/t silver (BUUY276, MU3, elevation of 1,269

metres).

Elsewhere, within the mineral resource envelope, intercepts were generally of

grade X thicknesses consistent with the May 2014 Yaragua mineral resource block

model. Intercepts between modelled vein domains are presented in Table 1 without

vein domain names.

Nine drill-holes intersected multiple veins below the south-eastern Yaragua

mineral resource envelope, representing extensions at depth of the southern

Yaragua vein system. Higher-grade intercepts included:

-- 0.8 metres @ 7.9 g/t gold and 3 g/t silver (BUUY253, elevation of 954

metres);

-- 0.5 metres @ 17.4 g/t gold and 9 g/t silver (BUUY264, elevation of 1,085

metres);

-- 0.5 metres @ 10.4 g/t gold and 13 g/t silver (BUUY269, elevation of

1,032 metres); and

-- 2.0 metres @ 7.4 g/t gold and 3 g/t silver (BUUY269, elevation of 1,022

metres).

The southern Yaragua vein system remains open at depth and to the west and east

of these intersections.

Further to the south, three drill-holes encountered multiple veins interpreted

as relatively deep, eastern extensions of the Laurel vein system, up to 300

metres to the northeast of previous drill intercepts. High-grade intersections

included:

-- 1.45 metres @ 84 g/t gold and 7 g/t silver (BUUY258, elevation of 976

metres); and

-- 0.6 metres @ 9.2 g/t gold and 20 g/t silver (BUUY269, elevation of 990

metres).

All of the infill drill intercepts and also extensions to the vein systems are

within 200 vertical-metre ranges above and below the 1,190-metre elevation of

proposed development infrastructure from the Higabra Valley Tunnel (Figures 2

and 3).

Technical Information

Vic Wall, PhD, special advisor to the Company and a qualified person for the

purpose of NI 43-101, has prepared or supervised the preparation of, or

approved, as applicable, the technical information contained in this press

release. Dr. Wall is a geologist with 35 years' experience in the minerals

mining, consulting, exploration and research industries. Following a career in

Australian and North American academes, he held senior positions in a number of

multinational major and junior minerals companies. A Fellow of the Australian

Institute of Geoscientists, Dr. Wall is Principal of Vic Wall & Associates, a

Brisbane-based consultancy that provides geoscientific services to mineral

companies and government agencies, worldwide.

The Company utilizes a rigorous, industry-standard QA/QC program. HQ core is

sawn or split with one-half shipped to a sample preparation lab in Medellin run

by ALS Colombia Limited ("ALS") in Colombia, whereas BQ core samples are full

core. Samples are then shipped for analysis to an ALS-certified assay laboratory

in Lima, Peru. The remainder of the core is stored in a secured storage facility

for future assay verification. Blanks, duplicates and certified reference

standards are inserted into the sample stream to monitor laboratory performance

and a portion of the samples are periodically check assayed at ACME Analytical

Laboratories in Vancouver, British Columbia and/or Inspectorate America Corp. in

Reno, Nevada.

The Company does not receive assay results for drill-holes in sequential order;

however, all significant assay results are publicly reported. A listing of assay

results to date for the Buritica project is available on the Company's website

at www.continentalgold.com.

For additional technical information on the Buritica project, please refer to

the Company's technical report (the "Technical Report") entitled "Independent

Technical Report and Resource Estimate on the Buritica Gold Project 2013" with

an effective date of December 31, 2013, prepared by Andrew J Vigar, BappSc Geo,

FAusIMM, MSEG, and Martin Recklies, BappSC Geo, MAIG, each of Mining Associates

Pty Limited, available on SEDAR at www.sedar.com on the OTCQX(R) at

www.otcmarkets.com and on the Company website at www.continentalgold.com.

About Continental Gold

Continental Gold Limited is an advanced-stage exploration and development

company with an extensive portfolio of 100%-owned gold projects in Colombia.

Spearheaded by a team with over 40 years of exploration and mining experience in

Colombia, the Company is focused on advancing its high-grade Buritica gold

project to production. On May 13, 2014, the Company announced an updated mineral

resource estimate for the Buritica project prepared in accordance with NI

43-101. This estimate covers the Yaragua and Veta Sur vein systems, with a

combined Measured mineral resource of 0.99 million tonnes of mineralized

material containing 0.65 million ounces of gold grading 20.4 g/t gold, 1.54

million ounces of silver grading 48 g/t silver, and 15.0 million pounds of zinc

grading 0.7% zinc, and a combined Indicated mineral resource of 7.41 million

tonnes of mineralized material containing 2.15 million ounces of gold grading

9.0 g/t gold, 6.89 million ounces of silver grading 29 g/t silver, and 75.1

million pounds of zinc grading 0.5% zinc. The combined Inferred mineral resource

is 16.7 million tonnes of mineralized material containing 4.2 million ounces

grading 7.8 g/t gold, 13.1 million ounces of silver grading 24 g/t silver and

111 million pounds of zinc grading 0.3% zinc.

In August 2012, Continental achieved an important milestone, receiving formal

approval for the modification of its existing Environmental Impact Assessment.

The amendment allows the Company to build a six-kilometre switchback road and

begin underground development by constructing a one-kilometre access tunnel.

With a goal of being the newest hard rock gold producer in Colombia, Continental

has achieved major advances with the access tunnel, which is providing access

for underground drilling and will eventually be used for commercial production.

A Phase V drill program is underway at the Buritica project to further delineate

the mineral resources and drill new target zones identified within its

concessions.

Additional details on the Buritica project and the rest of Continental's suite

of gold exploration properties are available at www.continentalgold.com.

Forward-Looking Statements

This press release contains or refers to forward-looking information under

Canadian securities legislation, including statements regarding the estimation

of mineral resources, exploration results, potential mineralization, and

exploration and mine development plans, and is based on current expectations

that involve a number of business risks and uncertainties. Forward-looking

statements are subject to significant risks and uncertainties, and other factors

that could cause actual results to differ materially from expected results.

Readers should not place undue reliance on forward-looking statements. Factors

that could cause actual results to differ materially from any forward-looking

statement include, but are not limited to, failure to convert estimated mineral

resources to reserves, capital and operating costs varying significantly from

estimates, the preliminary nature of metallurgical test results, delays in

obtaining or failures to obtain required governmental, environmental or other

project approvals, political risks, uncertainties relating to the availability

and costs of financing needed in the future, changes in equity markets,

inflation, changes in exchange rates, fluctuations in commodity prices, delays

in the development of projects and the other risks involved in the mineral

exploration and development industry forward-looking statements are subject to

significant risks and uncertainties, and other factors that could cause actual

results to differ materially from expected results. These forward-looking

statements are made as of the date hereof and the Company assumes no

responsibility to update them or revise them to reflect new events or

circumstances other than as required by law.

Differences in Reporting of Resource Estimates

This press release was prepared in accordance with Canadian standards, which

differ in some respects from United States standards. In particular, and without

limiting the generality of the foregoing, the terms "inferred mineral

resources," "indicated mineral resources," "measured mineral resources" and

"mineral resources" used or referenced in this press release are Canadian mining

terms as defined in accordance with National Instrument 43-101 - Standards of

Disclosure for Mineral Projects under the guidelines set out in the Canadian

Institute of Mining, Metallurgy and Petroleum (the "CIM") Standards on Mineral

Resources and Mineral Reserves (the "CIM Standards"). The CIM Standards differ

significantly from standards in the United States. While the terms "mineral

resource," "measured mineral resources," "indicated mineral resources," and

"inferred mineral resources" are recognized and required by Canadian

regulations, they are not defined terms under standards in the United States.

"Inferred mineral resources" have a great amount of uncertainty as to their

existence, and great uncertainty as to their economic and legal feasibility. It

cannot be assumed that all or any part of an inferred mineral resource will ever

be upgraded to a higher category. Under Canadian securities laws, estimates of

inferred mineral resources may not form the basis of feasibility or other

economic studies. Readers are cautioned not to assume that all or any part of

measured or indicated mineral resources will ever be converted into reserves.

Readers are also cautioned not to assume that all or any part of an inferred

mineral resource exists, or is economically or legally mineable. Disclosure of

"contained ounces" in a resource is permitted disclosure under Canadian

regulations; however, United States companies are only permitted to report

mineralization that does not constitute "reserves" by standards in the United

States as in place tonnage and grade without reference to unit measures.

Accordingly, information regarding resources contained or referenced in this

press release containing descriptions of our mineral deposits may not be

comparable to similar information made public by United States companies.

To view Figure 1 - Plan View of highlights of new drilling, please click the

following link:

http://www.marketwire.com/library/20140725-July282014_Figure1.jpg

To view Figure 2 - Long Section, (line A-B on Figure 1), please click the

following link:

http://www.marketwire.com/library/20140725-July282014_Figure2.jpg

To view Figure 3 - Cross Section (line C-D on Figure 1), please click the

following link:

http://www.marketwire.com/library/20140725-July282014_Figure3.jpg

FOR FURTHER INFORMATION PLEASE CONTACT:

Continental Gold Limited

+1.416.583.5610

info@continentalgold.com

www.continentalgold.com

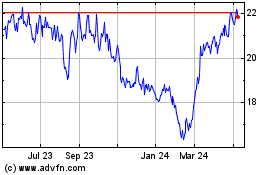

Altius Minerals (TSX:ALS)

Historical Stock Chart

From Mar 2024 to Apr 2024

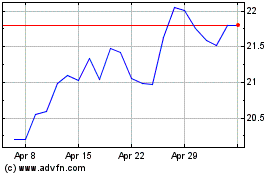

Altius Minerals (TSX:ALS)

Historical Stock Chart

From Apr 2023 to Apr 2024