There are a number of misconceptions when it comes to ETF

liquidity. Many investors believe that if a product doesn’t trade

enough shares it will be impossible to invest in the product as a

result.

That simply is not true for the majority of funds because

authorized participants have the ability to step in and create new

baskets of an ETF in order to meet demand and keep prices close to

underlying NAVs. This ability to create new shares, along with

the built-in arbitrage mechanism, ensures that most ETFs trade very

close to their underlying values and that big traders can generally

get into most ETFs with ease.

However, while the importance of volume may be somewhat

overstated, it is still an important consideration in the

investment process nonetheless, especially for traders who get in

and out of a particular security very frequently. For these

traders, high volume levels can help keep bid ask spreads low and

thus reduce the total cost of trading.

For example, many of the top, most liquid ETFs on the market

today have a spread between the bid and the ask of just a few

pennies while a number have a spread that is just one penny wide.

This means that sellers/buyers can often times get in or out of a

particular fund right at the current price, something that is not

always possible in less liquid products.

While a couple of pennies a share isn’t a big deal over decades

to long term buy-and-hold investors, it can really add up to short

term traders or those who have a large position in a particular

fund. For these traders, we have briefly highlighted below 25 of

the most liquid ETFs currently on the market:

SPDR S&P 500

(SPY)

Initiated in January 1993, SPY is the ETF with the highest

traded volume. It has been designed to track the performance of the

S&P 500 Index. The most popular fund among investors has 500

stocks in its basket and an average trading volume of about 135

million shares. This inexpensive fund charges a premium of just

0.09%.

The fund’s concentration risk is also low at 20.53%, which means

the fund is equally spread out. The fund has delivered a

return of 1.99% over a period of one year. Apple Inc. (AAPL) takes

the top position in the top 10 holdings list.

Financial Select Sector SPDR

(XLF)

Introduced in December 1998, XLF replicates the performance of

the Financial Select Sector Index. The second most popular ETF

among investors trades about 58 million shares a day and charges

the lowest premium in the financial category of 0.18%.

With 83 stocks in total, the product has seen some negative

performance thanks to banking weakness and worries over Europe. XLF

has 50.99% of assets in its top 10 holdings which mean the fund has

some concentration issues (Three Financial ETFs Outperforming

XLF).

Russell 2000 Index Fund Profile

(IWM)

Introduced in May 2000, the fund replicates the performance of

the Russell 2000 Index. With total holdings of almost 2,000 stocks,

the fund trades with the fourth highest trading volume of just over

52.7 million shares per day. The fund just has 2.52% of assets

invested in the top 10 holdings with just 0.27% of asset invested

in Parametric Technology Corporation (PMTC), which occupies the

first position in the list. The fund has as expense ratio of

0.26%.( Five Cheaper ETFs You Probably Overlooked)

MSCI Emerging Markets Index Fund

(EEM)

Launched in April 2003, the fund seeks to track the performance

of the MSCI Emerging Markets Index. With total volume of 48,

514,898, the fund occupies the third position in terms of trading

volume. EEM has total holding of 853 with concentration risk of

16.01%. Samsung Electronics Co. Ltd. (SSNLF.PK) occupies the top

position in the fund with 3.45% of assets invested in this stock

(Three Overlooked Emerging Market ETFs).

PowerShares QQQ

(QQQ)

Initiated in March 1999, the fund seeks to track the performance

of the NASDAQ 100 Index. The fund has a total volume of about 40

million shares a day and total holdings of 100 stocks.

The fund appears to have weak diversification prospects as it

has a concentration risk of 57.14%. Apple Inc. (AAPL) occupies the

top position in the fund with 18.57% asset invested in the stock.

Still, the product is relatively cheap at just 20 basis points per

year while the high volume helps to promote a very tight bid ask

spread.

S&P 500 VIX Short-Term Futures ETN

(VXX)

Launched in January 2009, VXX seeks to track the performance of

the S&P 500 VIX Short-Term Futures Index Total Return. The fund

has a total volume of about 36 million shares. This makes it the

most popular volatility product on the market today, helping iPath

cash in thanks to the 89 basis point expense ratio and the massive

AUM of roughly $1.7 billion.

Vanguard MSCI Emerging Markets ETF

(VWO)

Introduced in April 2005, the fund seeks to replicate the

performance of MSCI Emerging Markets Index just like EEM. Current

volume is roughly 34.4 million shares per day, making it another

popular product in the emerging market ETF space.

In terms of holdings, the product has just over 900 stocks in

its portfolio giving the fund a relatively low concentration risk.

Samsung Electronics Co. Ltd. (SSNLF.PK) occupies the top position

in the top 10 holding list. The fund which has the lowest expense

ratio in the category at 0.20% making it extremely cheap when

compared to EEM. (The Trend Is Your Friend With These Three

ETFs)

MSCI EAFE Index Fund

(EFA)

Initiated in August 2001, the fund replicates the performance of

the MSCI EAFE Index. The benchmark measures the performance of

equity markets in European, Australasian, and Far Eastern markets.

The fund trades with volume of about 25.4 million shares a day and

total asset of $38.4 billion. Total holdings of the fund stands at

929 with 13.02% of asset invested in the top 10 holdings. EFA

charges a premium of 0.34% from investors while it has seen some

weakness as of late thanks to the sovereign debt crisis in

Europe.

FTSE China 25 Index Fund

(FXI)

Introduced in October 2004, the fund replicates the performance

of the FTSE China 25 Index. The index measures the performance of

the largest companies in the Chinese equity market.

The fund has a total volume of roughly 24 million shares per day

while the holdings list—unsurprisingly—consists of 25 stocks. FXI

appears to be non-diversified as it has a concentration risk of

60.77%. The fund has an expense ratio of 0.72% like other

emerging market ETFs has been under pressure during 2012 (What

Bubble? China ETFs Soaring To Start 2012)

Industrial Select Sector SPDR Fund

(XLI)

Launched in December 1998, the fund replicates the performance

of the Industrial Select Sector Index. With volume of roughly 24.3

million shares and 62 stocks in total in its basket, the fund

appears to be non-diversified in nature as the fund’s concentration

risk stands at 49.6%.

General Electric Company (GE) occupies the top position in the

top 10 holding list. The fund which has the lowest expense ratio in

the category of 0.18% while its AUM is just over $3 billion (Three

Industrial ETFs for a Manufacturing Revival)

Daily Small Cap Bear 3X Shares Fundamentals

(TZA)

Launched in November 2008, the Small Cap Bear 3X ETF seeks daily

investment results, before fees and expenses, of 300% of the

inverse (or opposite) of the performance of the Russell 2000. The

fund has a volume of roughly 21.1 million shares per day and

charges an expense ratio of 0.95%, among the most expensive in the

category.

Still, the fund represents one of the best ways to access the

small cap market from a bearish perspective while simultaneously

using leverage.

Energy Select Sector SPDR Fund

(XLE)

Launched in December 1998, the fund replicates the performance

of the Energy Select Sector Index. With volume of roughly 17

million shares and 44 stocks in its basket, the fund appears to be

non-diversified in nature as the fund’s concentration risk stands

at 68.3%.

Exxon Mobil Corporation (XOM) occupies the top position in the

top 10 holding list. The fund which has the lowest expense ratio in

the category of 0.18%, currently has about $6.6 billion in AUM

(Play An Oil Bull With These Three Emerging Market ETFs)

UltraShort S&P500

(SDS)

Launched in July 2006, the fund seeks to track the performance

of the S&P 500 Index (-200%). The fund’s volume stands at

roughly 17.3 million shares a day and has an expense ratio of

0.95%, making it among the most expensive ETF in the category.

Silver Trust ETF

(SLV)

Introduced in April 2006, SLV seeks to track the performance of

the spot price of Silver Bullion. Trading with the volume of

just under 16 million shares day, SLV is also one of the most

expensive funds in the category with a cost of 0.50%. With AUM of

$10,088.4 million, the fund has delivered solid long term returns

but has been weak as of late (Silver ETFs Outshine Gold).

Direxion Daily Financial Bear 3x Shares

(FAZ)

Launched in November 2008, The Financial Bear 3X ETF seeks daily

investment results, before fees and expenses, of 300% of the

inverse of the performance of the Russell 1000 Financial Services

Index. Currently, the average volume comes in around 14.2 million

shares per day while the cost, much like other leveraged ETFs on

the list, is somewhat high at 95 basis points a year.

Market Vectors TR Gold Miners ETF

(GDX)

Introduced in March 2006, the fund replicates the performance of

the NYSE Arca Gold Miners Index. The fund trades with volume of

about 12.7 million shares a day while it has AUM 2,795,594 and AUM

of $8 billion. Total holdings of the fund stands at 32 with 77.29%

of asset invested in the top 10 holdings. GDX charges a premium of

0.53% from the investors and tends to act as a leveraged play on

the underlying metal.

MSCI Japan Index Fund

(EWJ)

Introduced in December 1996, the fund seeks to track the

performance of the MSCI Japan Index. The index measures the

performance of the Japanese equity market.

The fund has a total volume of 12.3 million shares a day, and

total net assets of roughly five billion.

The fund holds a total stock of 311 with concentration risk of

22.31%, suggesting the fund is diversified. EWJ has an expense

ratio of 0.51% and easily the most popular and liquid ETF in the

Japan market (For Japan ETFs, Think Small Caps).

UltraPro Short S&P500

(SPXU)

Launched in June 2009, UltraPro Short S&P500 seeks daily

investment results, before fees and expenses, of 300% of the

inverse (or opposite) of the performance of the S&P 500Index.

The fund has a volume of roughly 10.2 million a day while it

charges 95 basis points a year in fees for its short leveraged

exposure.

MSCI Brazil Index Fund

(EWZ)

Introduced in July 2000, the fund seeks to track the performance

of the MSCI Brazil Index. The index measures the performance of the

Brazilian equity market with a focus on large cap stocks. The fund

has a total volume of 8.4 million shares a day and total net assets

of $6.8 billion. The fund holds roughly 83 stocks in total, while

it has a concentration risk of 55.11%, suggesting the fund is

non-diversified in nature. EWZ has an expense ratio of 0.59% and

like many other emerging market ETFs on the list, has seen some

weakness in the summer of 2012. (Brazil Small-Cap ETF Showdown: BRF

vs. EWZS)

Daily Financial Bull 3X Shares

(FAS)

Launched in November 2008, The Daily Financial Bull 3X Shares

ETF seeks daily investment results, before fees and expenses, of

300% of the performance of the Russell 1000 Financial Services

Index. Currently, the product has a volume of about 8.7 million

shares a day while expenses come in at 95 basis points a year.

VelocityShares Daily 2x VIX Short-Term ETN

(TVIX)

Initiated in November 2010, the fund trades with the volume of

eight million shares a day0 and seeks to track the performance of

the S&P 500 VIX Short Term Futures Index Excess Return (200%).

Over a period of one year, the product has been beaten down thanks

to contango issues but in short time periods it is capable of big

moves higher.

United States Oil Fund

(USO)

Initiated in April 2006, USO tracks the price and performance of

crude oil. The fund consists of futures contracts for WTI Crude the

American benchmark. Volume of the fund stands at 7.6 million shares

a day while AUM is high at $1.2 billion.

SPDR Gold Shares

(GLD)

Launched in November 2011, GLD seeks to track the performance of

the spot price of Gold Bullion. Trading with volume of 7.5 million

shares a day, GLD is also one of the expensive funds in the

category with the expense ratio of 0.40%. With total net assets of

$64 billion, the fund is also one of the most widely held ETFs as

well.

UltraShort Barclays 20+ Year Treasury

(TBT)

Launched in April 2008, the fund seeks to track the performance

of the Barclays Capital US 20 Year Treasury Index (-200%). The

fund’s volume stands at roughly 11.1 million shares a day while the

expenses are at 0.95%.

United States Natural Gas Fund (UNG)

For investors looking to make a play on natural gas, UNG is one

of the most popular options. The product trades about 9.8 million

shares a day and has AUM of about one billion.

Unfortunately, fees on the ETF are somewhat high at 98 basis

points a year, but the product does crush all others in the space

in terms of total volume and tradability.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-EMG MKT (EEM): ETF Research Reports

ISHARS-EAFE (EFA): ETF Research Reports

ISHARS-FT CH25 (FXI): ETF Research Reports

ISHARES TR-2000 (IWM): ETF Research Reports

NASDAQ-100 SHRS (QQQ): ETF Research Reports

PRO-ULSH S&P500 (SDS): ETF Research Reports

ISHARS-SLVR TR (SLV): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

DIRX-SC BEAR 3X (TZA): ETF Research Reports

VIPERS-M EM MKT (VWO): ETF Research Reports

SPDR-EGY SELS (XLE): ETF Research Reports

SPDR-FINL SELS (XLF): ETF Research Reports

SPDR-INDU SELS (XLI): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

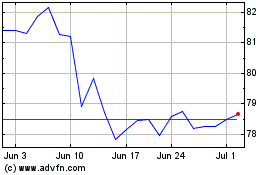

iShares MSCI EAFE (AMEX:EFA)

Historical Stock Chart

From Mar 2024 to Apr 2024

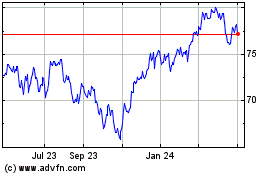

iShares MSCI EAFE (AMEX:EFA)

Historical Stock Chart

From Apr 2023 to Apr 2024