TIDMTNI

RNS Number : 9225K

Trinity Mirror PLC

13 April 2018

Trinity Mirror plc

13 April 2018

Trinity Mirror plc (the "Company")

Grant of Awards under the Trinity Mirror Long Term Incentive

Plan 2012

Long Term Incentive Plan 2012 (the "LTIP")

The independent trustee (the "Trustee") of the Trinity Mirror

Employees' Benefit Trust based in Jersey (the "Trust") notified the

Company that on 13 April 2018, it granted Awards under the LTIP to

acquire ordinary shares in the capital of the Company in the form

of nil-cost options to Persons Discharging Managerial

Responsibility ("PDMR") within the Company, in the amounts set out

below. Under the terms of the LTIP, Awards would normally vest on

the third anniversary of their date of grant subject to the

satisfaction of conditions relating to the performance of the

Company over the three financial years to which an award relates

(the Performance Period").

Upon vesting, Awards are subject to a holding period of a

further two years. During the holding period restrictions will

apply to the sale or other disposal of the shares.

During the holding period, the Awards will be subject to the

malus provisions of the LTIP rules (the "Rules") which would allow

for forfeiture of all of the shares or a reduction in the number

released in circumstances as set out in the Rules.

The Awards will be exercisable based on two performance

measures. 60% of the Shares under Award depend on the satisfaction

of an Absolute TSR Condition. 40% of the Shares under Award depend

on the satisfaction of a Net Cash Flow Condition.

Under the Absolute TSR condition:

-- An Award will be exercisable over 0% of the Absolute TSR

shares if the Company's share price is below 115p.

-- An Award will be exercisable over 20% of the Absolute TSR

shares if the Company's share price is 115p.

-- An Award will be exercisable over 100% of the Absolute TSR

shares if the Company's share price is 180p or above.

If the Company's share price is between 115p and 180p, the

number of Shares over which the Award will be exercisable will be

determined by straight-line interpolation between 20% and 100%.

Whether a target share price has been achieved will be

determined by reference to the Company's volume-weighted average

share price over the final quarter of the Performance Period. The

share price for these purposes includes dividends reinvested over

the performance period.

In addition, for an Award to become exercisable over the TSR

award shares, the Remuneration Committee ("Committee") must be

satisfied that the Company's share price performance is a genuine

reflection of the underlying business performance of the Company

over the Performance Period. When assessing whether they are

satisfied that the Company's share price performance is a genuine

reflection of the Company's business performance the Committee will

take into account factors including revenues, free cash flow,

change in net debt over the period (each based on the audited

results), as well as the Company's 3-year TSR relative to the TSR

of relevant listed indices. The Committee will consider both a

quantitative and qualitative analysis of the performance and will

take account of any relevant internal and external factors to help

ensure that unexpected events during the period are considered

properly.

Under the Net Cash Flow Condition:

-- An Award will be exercisable over 0% of the Net Cash Flow

Shares if the cumulative adjusted Net Cash Flow for the whole of

the Performance Period is below GBP300 million.

-- An Award will be exercisable over 20% of the Net Cash Flow

Shares if the cumulative adjusted Net Cash Flow for the whole of

the Performance Period is GBP300 million.

-- An Award will be exercisable over 100% of the Net Cash Flow

Shares if the cumulative adjusted Net Cash Flow for the whole of

the Performance Period reaches or exceeds GBP345 million.

If the Company's cumulative Adjusted Net Cash Flow for the whole

of the Performance Period is between GBP300 million and GBP345

million then the number of Net Cash Flow Shares will be determined

by straight-line interpolation between 20% and 100%.

Adjusted Net Cash Flow is defined as the net cash flows

generated by the business before the payment of dividends, before

pension deficit funding payments, and before any cash outflows in

relation to items that have been treated as non-recurring in the

financial statements. In assessing the Adjusted Net Cash Flow, the

Remuneration Committee may, if appropriate in exceptional

circumstances, include or exclude other payments to better reflect

underlying business performance. The Remuneration Committee may

adjust the Net Cash Flow Condition as it considers appropriate

including but not limited to where the Company or Group has bought

or sold businesses or companies to maintain the same level of

difficulty and the Remuneration Committee may adjust for unbudgeted

items which are wholly outside management control.

Following the completion of the acquisition of the publishing

assets of Northern & Shell (the "Acquisition"), the

Remuneration Committee resolved to adjust the Net Cash Flow targets

in respect of the 2016 and 2017 cycles of the LTIP as appropriate

to maintain the same level of difficulty. In assessing the Adjusted

Net Cash Flow, the Remuneration Committee has excluded pension

deficit funding payments from the 2016 Award, applying a consistent

methodology to 2016 and 2017 Awards.

In respect of the 2016 Award, under the Net Cash Flow

Condition:

-- An Award will be exercisable over 0% of the Net Cash Flow

Shares if the cumulative adjusted Net Cash Flow for the whole of

the Performance Period is at or below GBP299 million.

-- An Award will be exercisable over 100% of the Net Cash Flow

Shares if the cumulative adjusted Net Cash Flow for the whole of

the Performance Period reaches or exceeds GBP345 million.

In respect of the 2017 Award, under the Net Cash Flow

Condition:

-- An Award will be exercisable over 0% of the Net Cash Flow

Shares if the cumulative adjusted Net Cash Flow for the whole of

the Performance Period is below GBP284 million.

-- An Award will be exercisable over 20% of the Net Cash Flow

Shares if the cumulative adjusted Net Cash Flow for the whole of

the Performance Period is GBP284 million.

-- An Award will be exercisable over 100% of the Net Cash Flow

Shares if the cumulative adjusted Net Cash Flow for the whole of

the Performance Period reaches or exceeds GBP328 million.

There are no changes to the Absolute TSR Condition in relation

to the 2016 or 2017 LTIP awards.

The total exercise price payable on any exercise of a LTIP award

is GBP1. Nothing is paid for the grant of the award.

The base price for calculating the level of award was 84.1p, the

average market closing price between 10 April 2018 and 12 April

2018.

Details of the transactions are set out below.

1 Details of the person discharging managerial

responsibilities / person closely associated

---- --------------------------------------------------------------------

a) Name Simon Fox

---- ------------------------------ ------------------------------------

2 Reason for the notification

---- --------------------------------------------------------------------

a) Position/status Chief Executive

---- ------------------------------ ------------------------------------

b) Initial notification Initial Notification

/Amendment

---- ------------------------------ ------------------------------------

3 Details of the issuer, emission allowance

market participant, auction platform, auctioneer

or auction monitor

---- --------------------------------------------------------------------

a) Name Trinity Mirror plc

---- ------------------------------ ------------------------------------

b) LEI 213800GNI5XF3XOATR61

---- ------------------------------ ------------------------------------

4 Details of the transaction(s): section to

be repeated for (i) each type of instrument;

(ii) each type of transaction; (iii) each

date; and (iv) each place where transactions

have been conducted

---- --------------------------------------------------------------------

a) Description of Ordinary 10p Shares

the financial

instrument, type

of instrument

----

Identification GB0009039941

code

b) Nature of the Grant of share options under

transaction the Long Term Incentive Plan

2012.

---- ------------------------------ ------------------------------------

c) Price(s) and volume(s)

---- ---------------- ---------------

Price(s) Volume(s)

---- ---------------- ---------------

GBP0.841 890,625

---------------------------------------------------- ---------------

d) Aggregated information

----

- Aggregated volume N/A

- Price N/A

e) Date of the transaction 13 April 2018

---- ------------------------------ ------------------------------------

f) Place of the transaction Outside a trading venue

---- ------------------------------ ------------------------------------

1 Details of the person discharging managerial

responsibilities / person closely associated

---- --------------------------------------------------------------------

a) Name Vijay Vaghela

---- ------------------------------ ------------------------------------

2 Reason for the notification

---- --------------------------------------------------------------------

a) Position/status Group Finance Director and

Company Secretary

---- ------------------------------ ------------------------------------

b) Initial notification Initial Notification

/Amendment

---- ------------------------------ ------------------------------------

3 Details of the issuer, emission allowance

market participant, auction platform, auctioneer

or auction monitor

---- --------------------------------------------------------------------

a) Name Trinity Mirror plc

---- ------------------------------ ------------------------------------

b) LEI 213800GNI5XF3XOATR61

---- ------------------------------ ------------------------------------

4 Details of the transaction(s): section to

be repeated for (i) each type of instrument;

(ii) each type of transaction; (iii) each

date; and (iv) each place where transactions

have been conducted

---- --------------------------------------------------------------------

a) Description of Ordinary 10p Shares

the financial

instrument, type

of instrument

----

Identification GB0009039941

code

b) Nature of the Grant of share options under

transaction the Long Term Incentive Plan

2012.

---- ------------------------------ ------------------------------------

c) Price(s) and volume(s)

---- ---------------- ---------------

Price(s) Volume(s)

---- ---------------- ---------------

GBP0.841 638,781

---------------------------------------------------- ---------------

d) Aggregated information

----

- Aggregated volume N/A

- Price N/A

e) Date of the transaction 13 April 2018

---- ------------------------------ ------------------------------------

f) Place of the transaction Outside a trading venue

---- ------------------------------ ------------------------------------

Enquiries

Trinity Mirror

Simon Fox, Chief Executive 020 7293

Vijay Vaghela, Group Finance Director 3553

Brunswick

020 7404

Nick Cosgrove, Partner 5959

Will Medvei, Director

This information is provided by RNS

The company news service from the London Stock Exchange

END

DSHLLFFSSSIVLIT

(END) Dow Jones Newswires

April 13, 2018 10:30 ET (14:30 GMT)

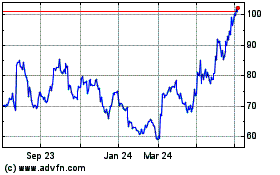

Reach (LSE:RCH)

Historical Stock Chart

From Aug 2024 to Sep 2024

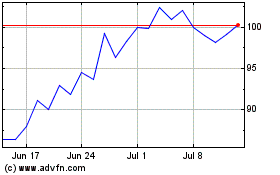

Reach (LSE:RCH)

Historical Stock Chart

From Sep 2023 to Sep 2024