Transcontinental Realty Investors, Inc. (NYSE: TCI), a

Dallas-based real estate investment company, today reported results

of operations for the second quarter ended June 30, 2018. For the

three months ended June 30, 2018, we reported net income applicable

to common shares of $7.0 million or ($0.81) per share compared to a

net loss applicable to common shares of $10.6 million or ($1.22)

per share for the same period ended 2017.

The Company maintained its overall focus on growing its

portfolio and is working on several strategic initiatives that we

previously announced earlier this year. Overall, management remains

very encouraged about the overall performance of the company;

especially tied to the quality of our assets in our portfolio, and

the new multifamily apartment projects under various stages of

development.

Revenues

Rental and other property revenues were $31.6 million for the

three months ended June 30, 2018. This represents an increase of

$0.3 million compared to the prior period revenues of $31.3

million. The increase is driven primarily by an increase in

revenues of $1.2 million from our apartment operating segment,

offset by a decrease of $0.9 million from our commercial

segment.

Expense

Property operating expenses were $15.5 million for the three

months ended June 30, 2018. This represents an increase of $0.3

million compared to the prior period operating expenses of $15.2

million. The increase is due to increases in operating expenses in

the apartment portfolio of $1.0 million, offset by a decrease in

the commercial portfolio of $0.5 million and a decrease in the land

portfolio of $0.1 million.

Depreciation and amortization expense was $6.5 million for the

three months ended June 30, 2018 for an increase of $0.1 million as

compared to the prior period expense of $6.4 million. The change is

attributable to the depreciation on acquired apartments.

General and Administrative expenses were $2.2 million for the

three months ended June 30, 2018. This represents an increase of

$0.9 million compared to the prior period expense of $1.3 million.

The increase is due to an increase in expense reimbursements

paid to our advisor of approximately $0.7 million and professional

fees for audit and tax services of approximately $0.2 million.

Other income (expense)

Mortgage and loan interest expense was $14.2 million for the

three months ended June 30, 2018. This represents a decrease of

$1.6 million compared to the prior period expense of $15.8 million.

The change by segment is a decrease in the other portfolio of $1.2

million, land portfolio of $0.5 million and a decrease in the

commercial portfolio of $0.2 million, offset by an increase in the

apartment portfolio of $0.3 million. Within the other portfolio,

the decrease is primarily due to $1.2 million of interest expense

savings related to maturing notes payable paid during the first

quarter of 2018.

Other income was $7.5 million for the three months ended June

30, 2018. This represents an increase of $7.6 million compared to

prior period other expense of $0.1 million. The increase is the

result of insurance proceeds of approximately $6.6 million received

subsequent to the "as is" sale of a property damaged by a

hurricane, and other miscellaneous income of approximately $1.0

million.

Foreign currency transaction was a gain of $5.9 million for the

three months ended June 30, 2018. This represents an increase of

$9.3 million compared to prior period foreign currency transaction

loss of $3.4 million. The increase is the result of a gain in

foreign currency exchange as a result of the favorable exchange

rate between the Israel Shekels and the U.S. Dollar related to our

Bond program.

For the three months ended June 30, 2018, we sold a golf course

for a total sales price of $2.3 million and recorded no gain or

loss on the sale. For the same period in 2017, the Company recorded

a loss of approximately $0.5 million from the sale of 8.3 acres of

land for a sales price of $0.5 million.

About Transcontinental Realty Investors, Inc.

Transcontinental Realty Investors, Inc., a Dallas-based real

estate investment company, holds a diverse portfolio of equity real

estate located across the U.S., including apartments, office

buildings, shopping centers, and developed and undeveloped land.

The Company invests in real estate through direct ownership, leases

and partnerships and invests in mortgage loans on real estate. For

more information, visit the Company’s website at

www.transconrealty-invest.com.

TRANSCONTINENTAL REALTY INVESTORS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

Three Months Ended

Six Months Ended June 30,

June 30,

2018 2017 2018

2017 (dollars in thousands, except share and par value

amounts) Revenues: Rental and other property revenues

(including $208 and $199 for the three months and $415 and $389 for

the six months ended 2018 and 2017, respectively, from related

parties) $ 31,607 $ 31,302 $ 62,689 $ 62,837

Expenses: Property operating expenses (including $231 and

$232 for the three months and $458 and $460 for the six months

ended 2018 and 2017, respectively, from related parties) 15,492

15,210 29,947 31,099 Depreciation and amortization 6,522 6,378

12,968 12,681 General and administrative (including $1,187 and $558

for the three months and $2,280 and $1,072 for the six months ended

2018 and 2017, respectively, from related parties) 2,173 1,295

4,365 3,075 Net income fee to related party 53 76 106 136 Advisory

fee to related party 2,726 2,501

5,474 4,806 Total operating expenses

26,966 25,460 52,860

51,797 Net operating income 4,641 5,842 9,829 11,040

Other income (expenses):

Interest income (including $3,486 and

$3,070 for the three months and $6,722 and $6,502 for the six

months ended 2018 and 2017, respectively, from related parties)

3,544 3,709 7,420 7,130 Other income (expense) 7,482 (104 ) 9,308

1,338 Mortgage and loan interest (including $327 and $283 for the

three months and $645 and $836 for the six months ended 2018 and

2017, respectively, from related parties) (14,175 ) (15,783 )

(28,268 ) (30,973 ) Foreign currency transaction gain (loss) 5,889

(3,425 ) 7,645 (3,748 ) Earnings (losses) from unconsolidated joint

ventures and investees (9 ) (10 ) 2

(18 ) Total other income (expenses) 2,731

(15,613 ) (3,893 ) (26,271 ) Gain (Loss)

before gain on land sales, non-controlling interest, and taxes

7,372 (9,771 ) 5,936 (15,231 ) (Loss) gain on land sales -

(476 ) 1,335 (31 ) Net income

(loss) from continuing operations before taxes 7,372

(10,247 ) 7,271 (15,262 ) Net income

(loss) from continuing operations 7,372 (10,247 ) 7,271 (15,262 )

Net income (loss) 7,372 (10,247 ) 7,271 (15,262 ) Net (income)

attributable to non-controlling interest (126 ) (163

) (258 ) (282 ) Net income (loss) attributable to

Transcontinental Realty Investors, Inc. 7,246 (10,410 ) 7,013

(15,544 ) Preferred dividend requirement (224 ) (224

) (446 ) (446 ) Net income (loss )applicable to

common shares $ 7,022 $ (10,634 ) $ 6,567 $ (15,990 )

Earnings per share - basic

Net income (loss) from continuing operations $ 0.81 $

(1.22 ) $ 0.75 $ (1.83 )

Earnings per share -

diluted Net income (loss) from

continuing operations $ 0.81 $ (1.22 ) $ 0.75 $ (1.83

) Weighted average common shares used in computing earnings

per share 8,717,767 8,717,767 8,717,767 8,717,767 Weighted average

common shares used in computing diluted earnings per share

8,717,767 8,717,767 8,717,767 8,717,767

Amounts

attributable to Transcontinental Realty Investors, Inc. Net

income (loss) from continuing operations $ 7,246 $ (10,410 )

$ 7,013 $ (15,544 ) Net income (loss) applicable to

Transcontinental Realty, Investors, Inc. $ 7,246 $ (10,410 )

$ 7,013 $ (15,544 )

TRANSCONTINENTAL REALTY

INVESTORS, INC. CONSOLIDATED BALANCE SHEETS

June 30, December 31,

2018 2017 (unaudited) (audited)

(dollars in thousands, except share and par value amounts)

Assets Real estate, at cost $ 1,150,055 $ 1,112,721 Real

estate subject to sales contracts at cost 43,767 45,739 Less

accumulated depreciation (184,741 ) (178,590 ) Total

real estate 1,009,081 979,870 Notes and interest receivable

(including $50,020 in 2018 and $45,155 in 2017 from related

parties) 83,463 70,166 Cash and cash equivalents 28,105

42,705 Restricted cash 64,669 45,637 Investments in unconsolidated

joint ventures and investees 2,474 2,472 Receivable from related

party 126,181 111,665 Other assets 54,772

60,907 Total assets $ 1,368,745 $ 1,313,422

Liabilities and Shareholders’ Equity Liabilities:

Notes and interest payable $ 915,183 $ 892,149 Notes related to

real estate held for sale 376 376 Notes related to real estate

subject to sales contracts - 1,957 Bond and bond interest payable

143,897 113,047 Deferred revenue (including $40,907 in 2018 and

$40,574 in 2017 to related parties) 62,166 60,949

Accounts payable and other liabilities

(including $6,930 in 2018 and $7,236 in 2017 to related

parties)

32,037 36,683 Total liabilities

1,153,659 1,105,161 Shareholders’ equity: Preferred stock,

Series C: $0.01 par value, authorized 10,000,000 shares; issued and

outstanding zero shares in 2018 and 2017. Series D: $0.01 par

value, authorized, issued and outstanding 100,000 shares in 2018

and 2017 (liquidation preference $100 per share) 1 1 Common stock,

$0.01 par value, authorized 10,000,000 shares; issued 8,717,967

shares in 2018 and 2017; outstanding 8,717,767 shares in 2018 and

2017 87 87 Treasury stock at cost, 200 shares in 2018 and 2017 (2 )

(2 ) Paid-in capital 268,503 268,949 Retained deficit

(72,852 ) (79,865 ) Total Transcontinental Realty Investors,

Inc. shareholders' equity 195,737 189,170 Non-controlling interest

19,349 19,091 Total shareholders'

equity 215,086 208,261 Total

liabilities and shareholders' equity $ 1,368,745 $ 1,313,422

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180814005732/en/

Transcontinental Realty Investors, Inc.Investor

RelationsGene Bertcher,

800-400-6407investor.relations@transconrealty-invest.com

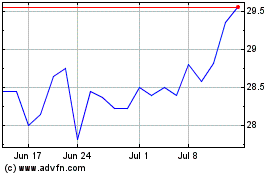

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

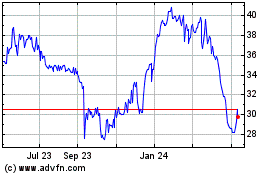

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Apr 2023 to Apr 2024