Firm to Expand upon Efforts; Will Call on Portfolio Companies

to Disclose Gender Diversity Numbers at All Levels of

Management

State Street Global Advisors, the asset management business of

State Street Corporation (NYSE: STT), today announced that since

the arrival of its Fearless Girl on Wall Street one year ago, 152

publicly-traded companies that the firm reached out to, through

either its voice or its vote, that previously had no women on their

boards, now have at least one female board member.

This press release features multimedia. View

the full release here:

http://www.businesswire.com/news/home/20180307005657/en/

Fearless Girl by the numbers (Graphic:

State Street Global Advisors)

“Our stewardship platform, exemplified by Fearless Girl, is

making a significant impact,” said Rakhi Kumar, head of ESG

Investments and Asset Stewardship for State Street Global Advisors.

“Fearless Girl has sparked important conversations around the

world, and has increased shareholder action on the issue of gender

diversity. We applaud the many asset owners and managers

controlling more than $13 trillion that have since joined us in our

call to action. We are proud of the fact that 152 companies have

placed women on their boards in just the last year. However, there

is still important work to be done. The 152 leaves more than 600

companies in our original target universe that have still taken no

action, and we will continue our engagement and voting efforts in

2018 as we look to make additional progress on this important

issue.”

In the year since Fearless Girl was installed, State Street

Global Advisors identified and reached out to 787 companies in the

US, UK and Australia that had no women on their boards through

direct engagement, its letter writing campaign or using its vote to

address their lack of board diversity. Ultimately, State Street

Global Advisors voted against 511 companies for failing to

demonstrate progress on board diversity. In addition to the 152

companies that added a female board member, another 34 companies

committed to adding at least one woman to their board in the near

term. The firm also announced it would be expanding its board

guidance to companies in Japan, Canada and Europe.

To build on Fearless Girl’s impact, State Street Global Advisors

is now calling on portfolio companies to create more transparency

and share more data about the number of women they have at all

levels of management. State Street Global Advisors will begin

screening and engaging with companies in the STOXX 600 and FTSE 350

indexes to start, seeking to understand company practices that

promote diversity, and has plans to expand this effort in the

future.

“Often when we engage with companies on the issue of board

diversity we hear that the biggest challenge is a lack of suitable

female candidates,” continued Kumar. “Our efforts can’t stop at the

board level if we truly want companies to adopt policies and

practices that will help strengthen gender diversity throughout

their organizations, and ultimately contribute to a greater pool of

female directors qualified to serve on a board.”

For more information on State Street Global Advisors’ asset

stewardship efforts and its Fearless Girl campaign, click here.

About State Street Global Advisors

For nearly four decades, State Street Global Advisors has been

committed to helping financial professionals and those who rely on

them achieve their investment objectives. We partner with

institutions and financial professionals to help them reach their

goals through a rigorous, research-driven process spanning both

active and index disciplines. We take pride in working closely with

our clients to develop precise investment strategies, including our

pioneering family of SPDR ETFs. With trillions* in assets under

management, our scale and global footprint provide unrivaled access

to markets and asset classes, and allow us to deliver expert

insights and investment solutions.

State Street Global Advisors is the investment management arm of

State Street Corporation.

*Assets under management were $2.78 trillion as of December 31,

2017. AUM reflects approx. $35 billion (as of December 31, 2017)

with respect to which State Street Global Advisors Funds

Distributors, LLC (SSGA FD) serves as marketing agent; SSGA FD and

State Street Global Advisors are affiliated.

It is not possible to invest in an index.

The information contained in this communication is not a

research recommendation or ‘investment research’ and is classified

as a ‘Marketing Communication’ in accordance with the Markets in

Financial Instruments Directive (2014/65/EU) or applicable Swiss

regulation. This means that this marketing communication (a) has

not been prepared in accordance with legal requirements designed to

promote the independence of investment research (b) is not subject

to any prohibition on dealing ahead of the dissemination of

investment research.

The FTSE 350 Index is a market capitalization weighted

stock market index incorporating the largest 350 companies by

capitalization which have their primary listing on the London Stock

Exchange. It is a combination of the FTSE 100 Index of the largest

100 companies and the FTSE 250 Index of the next largest 250. The

index is maintained by FTSE Russell, a subsidiary of the London

Stock Exchange Group. See the articles about those indices for

lists of the constituents of the FTSE 350.

The STOXX Europe 600, also called STOXX 600, SXXP, is a

stock index of European stocks designed by STOXX Ltd.. This index

has a fixed number of 600 components, among them large companies

capitalized among 17 European countries, covering approximately 90%

of the free-float market capitalization of the European stock

market (not limited to the Eurozone). The countries that make up

the index are Austria, Belgium, Denmark, Finland, France, Germany,

Iceland, Ireland, Italy, Luxembourg, the Netherlands, Norway,

Portugal, Spain, Sweden, Switzerland and the United Kingdom

State Street Global Advisors

One Lincoln St. Boston, MA 02210-2900

United Kingdom: State Street Global Advisors Limited.

Authorised and regulated by the Financial Conduct Authority.

Registered in England. Registered No. 2509928. VAT No. 5776591 81.

Registered office: 20 Churchill Place, Canary Wharf, London, E14

5HJ. Telephone: 020 3395 6000. Facsimile: 020 3395 6350.

Hong Kong: State Street Global Advisors Asia Limited, 68/F,

Two International Finance Centre, 8 Finance Street, Central, Hong

Kong • Telephone: +852 2103-0288 • Facsimile: +852

2103-0200

2043064.1.1.GBL.RTL

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180307005657/en/

State Street CorporationAndrew Hopkins, +1

617-664-2422Ahopkins2@StateStreet.com

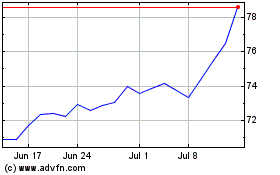

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

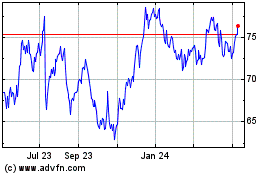

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024