SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2018

(Commission File No. 001-32221) ,

GOL LINHAS AÉREAS INTELIGENTES S.A.

(Exact name of registrant as specified in its charter)

GOL INTELLIGENT AIRLINES INC.

(Translation of Registrant's name into English)

Praça Comandante Linneu Gomes, Portaria 3, Prédio 24

Jd. Aeroporto

04630-000 São Paulo, São Paulo

Federative Republic of Brazil

(Address of Regristrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

GOL LINHAS AÉREAS INTELIGENTES S.A.

CNPJ/MF No 06.164.253/0001-87

NIRE 35.300.314.441

MINUTES OF THE BOARD OF DIRECTORS’ MEETING

HELD ON APRIL 10

th

, 2018

I.

Date, Time and Place

:

April 10

th

, 2018, at 10:00 a.m., on Praça Comte. Linneu Gomes, S/N, Portaria 3 - Prédio 07 - Meeting Room of the Board of Directors, Jardim Aeroporto, São Paulo (“

Company

”).

II.

Calling and Attendance

:

Waived, due to the attendance of all members of the Board of Directors.

III.

Presiding Board

:

Mr. Constantino de Oliveira Junior was the chairman of the meeting, and invited me, Graziela Galli Ferreira Barioni, to act as secretary of the meeting.

IV.

Agenda

:

To pass resolutions on the establishment of the Company’s Share Repurchase Program.

V.

Resolutions

:

After the necessary explanations were provided and after a detailed review of the documents referring to the matters hereof, the establishment of the Company’s Share Repurchase Program, under the terms of article 30, paragraph 1, b, of Law No. 6404/76 (“

Corporations Act

”) and CVM Instruction 567/2015 (“

Program

”), whereby the Company will acquire up to 740,000 (seven hundred and forty thousand) preferred shares of its own issuance through transactions on the Brazilian stock exchange B3 was approved by unanimous vote. Further details of the Program are described in the Notice about Trading of Company’s Own Shares, based on the Exhibit 30-XXXVI of CVM Instruction 480/2009, provided for in Exhibit I and approved by the members of the Board of Directors present for the disclosure to the market, clarifying the following: (i) the purpose of the Program is to comply with the Company’s obligations related to the

Restricted Shares Plan approved at the Extraordinary Shareholder’s Meeting held on October 19, 2012 (“

Plan

”); (ii) the Company currently has 266,559,135 outstanding preferred shares (as defined in article 8, paragraph 3, I of CVM Instruction 567/2015) and holds 278,612 preferred shares in treasury, which will also be used for the purpose of the Plan; (iii) acquisition of shares under the terms of the Program, may be performed during a 12 day period, beginning on April 11, 2018 and ending on April 23, 2018; (iv) the Executive Officers of the Company are authorized to establish the time and quantity of the acquisitions within the limits authorized by the Program; and (v) the Company retained CoinValores CCVM Ltda. and CM Capital Markets CCTVM Ltda. to act as an intermediary in the acquisition of the preferred shares under the terms of the Program. The repurchase of the shares under the terms of the Program shall be limited to the amount of the Capital Reserve account eligible for the repurchase of shares, according to the terms of the Corporations Act.

VI.

Suspension of the Meeting and Drawing-up of the Minutes

:

The floor was offered to whoever might wish to use it, and since nobody did so, the meeting was suspended for the time necessary for these minutes to be drawn-up. Upon the reopening of the meeting, these minutes were read, checked and signed by the attendees. Signatures: Presiding Board: Constantino de Oliveira Junior - Chairman; Graziela Galli Ferreira Barioni - Secretary. Members of the Board of Directors: Constantino de Oliveira Junior, Joaquim Constantino Neto, Ricardo Constantino, William Charles Carroll, Antonio Kandir, Germán Pasquale Quiroga Vilardo, André Béla Jánszky, Anna Luiza Serwy Constantino and Francis James Leahy Meaney.

I hereby certify

that this is a faithful copy of the minutes that were drawn-up in the proper book.

São Paulo, April 10

th

, 2018.

____________________________ ____________________________

Constantino de Oliveira Junior Graziela Galli Ferreira Barioni

Chairman Secretary

EXHIBIT I

to the minutes of the Board of Directors Meeting of Gol Linhas Aéreas Inteligentes S.A. held on April 10

th

, 2018

Exhibit 30-XXXVI

Trading of Company’s Own Shares

1.

Justify in detail the objective and expected economic effects of the transaction

The purpose of the transaction is the Company’s acquisition of preferred shares issued by the Company to comply with the Restricted Shares Plan approved at the General Extraordinary Shareholders' Meeting of the Company held on October 19, 2012 ("

Plan

"). Under the terms of the Plan, the Company's Board of Directors approved, at a meeting held on August 11, 2015, the granting of stock options to beneficiaries, with the vesting period of three (3) years ending in April 2018, resulting in the Company’s obligation to deliver 1,014,269 preferred shares to the Plan’s beneficiaries.

The Company currently holds 278,612 preferred shares in treasury, with a deficit of 735,657 preferred shares to comply with the Plan, which led management to consider alternatives to comply with the Plan. After analyzing these alternatives, and based on the recommendation of the Company’s Corporate Governance and Personnel Management Committee, the Board of Directors approved this Repurchase Program.

The Program will be implemented based on the use of the Company's Capital Reserve, with an estimated cost for the acquisition of the preferred shares subject to the Program and related expenses between R$ 14,5 million and R$ 17 million.

2.

Inform the number of shares (i) outstanding and (ii) held in treasury

The Company currently holds 266,559,135 outstanding preferred shares (as defined in article 8, paragraph 3, I of CVM Instruction 567/2015) and 278,612 preferred shares already held in treasury.

3.

Inform the number of shares that may be acquired or sold

The Company may acquire up to 740,000 (seven hundred and forty thousand)

preferred shares of its own issuance.

4.

Describe the main characteristics of the derivative instruments that the company may use, if any

Not applicable. The Company shall not use derivative instruments.

5.

Describe, if any, the agreements or voting guidelines that exist between the company and the counterpart of the transactions

Not applicable, considering that the Company shall carry out the transactions on the stock exchange and is not aware of who the counterparties of the transactions will be.

6.

In the case of transactions carried out outside organized securities markets, inform:

a.

the maximum (minimum) price by which the shares will be acquired (sold)

Not applicable, considering that the transactions will be traded on a stock exchange.

b. If applicable, state the reasons justifying the transaction at prices 10% (ten percent) higher, in the case of an acquisition, or 10% (ten percent) lower, in the case of a sale, of the average of the quoted price, weighted by volume, in the previous 10 (ten) trading sessions

Not applicable, considering that the transactions will be traded on a stock exchange.

7.

Inform the impacts that the negotiation will have on the composition of the share control or the administrative structure of the company, if any

Not applicable, considering that the Company understands that the negotiation will not impact the shareholding composition or the administrative structure of the Company.

8.

Identify the counterparties, if known, and, if they are related parties of the company, as such term is defined by the accounting rules regarding the matter, disclose the information required by article 8 of CVM Instruction 481 dated December 17, 2009

Not applicable, considering that the Company will carry out the transactions on the stock Exchange and is not aware who the counterparties in such transactions will be.

9.

Indicate the use of proceeds, if any

Not applicable, considering that the Company will not receive any proceeds, considering that the shares to be acquired will be held in treasury and will be used for purposes of compliance with the Restricted Shares Plan approved by the General Extraordinary Shareholders’ Meeting of the Company held on October 19, 2012 and the grants made by the Board of Directors at the meeting held August 11, 2015.

10.

Indicate the deadline for the liquidation of the approved transactions

The acquisition of shares under the terms of the Program may be performed during a 12 day period, beginning on April 11, 2018 and ending on April 23, 2018.

11.

Identify the institutions that will act as intermediaries, if any

The following financial institutions will act as intermediaries for the transactions involving the acquisition of shares:

CoinValores CCVM Ltda. and CM Capital Markets CCTVM Ltda.

12.

Specify the resources available that will be used, as provided in article 7, § 1 of CVM Instruction 567 dated September 17, 2015

The acquisition of preferred shares for purposes of the Program is subject to the limit of the total amount of the account “Capital Reserve” of the Company eligible for the repurchase of shares, according to the terms of the Corporations Act.

13.

Specify the reasons that make the members of the Board of Directors feel comfortable that the repurchase of shares will not harm the compliance with the obligations undertaken with creditors or the obligations regarding mandatory, fixed or minimum dividends

The members of the Board of Directors of the Company are comfortable with the repurchase of shares and they believe that the repurchase will not harm compliance with obligations undertaken by the Company with creditors and the obligations regarding mandatory dividends, since the financial condition and the liquidity of the

Company allow the disbursement of the amounts required for the repurchase. Additionally, the contractual obligations of the Company under the Plan would require, in any case, the delivery of shares or the payment in cash of equivalent amounts, so that the Company would be required to do a disbursement potentially higher, if it decided to opt to honor the obligations undertaken under the Plan in cash. For this reason, the Board of Directors believes that the repurchase is made taking into consideration the economic interest of creditors or shareholders.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: April 10, 2018

|

GOL LINHAS AÉREAS INTELIGENTES S.A.

|

|

|

|

|

|

|

|

By:

|

/S/ Richard Freeman Lark Junior

|

|

|

Name: Richard Freeman Lark Junior

Title: Investor Relations Officer

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates offuture economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will a ctually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

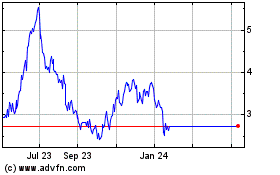

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Mar 2024 to Apr 2024

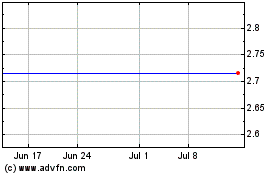

Gol Linhas Aereas Inteli... (NYSE:GOL)

Historical Stock Chart

From Apr 2023 to Apr 2024