Q2 Highlights

- Q2 net sales of $28.3 million

increased 5% from the prior year second quarter, due to higher

sales into material handling markets.

- Q2 gross margin improved to 36.7% of

sales, up 70 basis points over prior year Q2 gross margin of 36.0%

of sales.

- Earnings per share from continuing

operations increased 18% to $.87 per share, compared to $.74 per

share in Q2 last year.

Magnetek, Inc. (“Magnetek” or “the Company,” NASDAQ: MAG) today

reported the results of its second quarter of fiscal year 2015,

ended June 28, 2015.

Second Quarter Results

In the second quarter of fiscal 2015, Magnetek recorded revenue

of $28.3 million, a 5% increase from the prior year second quarter

sales of $27.0 million, as sales of products for material handling

applications increased $1.3 million year-over-year to $21.1

million. Income from continuing operations and earnings per share

were both up year-over-year, due to higher sales volume, lower

pension expense, and lower tax provisions. As a result, second

quarter earnings per share from continuing operations increased 18%

to $.87 per share compared to prior year earnings from continuing

operations of $.74 per share.

“Most of our end markets remained healthy throughout our second

quarter, and we achieved organic sales growth of 5% over last

year’s second quarter. We expanded our profit margins on a

year-over-year basis, with increased gross profit, operating

profit, and net income,” said Peter McCormick, Magnetek’s president

and chief executive officer.

Gross profit amounted to $10.4 million (36.7% of sales) in the

second quarter of 2015 versus $9.7 million (36.0% of sales) in the

same period a year ago. The increase in gross profit and gross

margin was primarily due to higher sales volume and improved sales

mix into material handling markets.

Total operating expenses, consisting of research and

development, pension expense, and selling, general and

administrative costs, were $7.2 million in the second quarter of

2015, compared to $7.0 million in the second quarter of fiscal

2014. Compared to the prior year, the increase in operating expense

was mainly due to higher variable selling expenses and

discretionary spending, partially offset by lower pension expense.

In addition, prior year operating expenses include the favorable

impact of an adjustment to stock compensation expense of

approximately $0.2 million.

Income from continuing operations after provision for income

taxes in the second quarter of fiscal 2015 was $3.2 million, or

$.87 per diluted share, compared to after-tax income from

continuing operations of $2.5 million, or $.74 per diluted share,

in the same period last year.

Including the results of discontinued operations, the Company

recorded net income of $.83 per diluted share in the second quarter

of 2015 versus net income of $.68 per diluted share in the second

quarter of fiscal 2014.

Pension Update

The Company did not make any contributions to its pension plan

during the first six months of fiscal 2015, and currently does not

expect to make any for the remainder of fiscal 2015. Actuarial

projections as of June 28, 2015, indicate that minimum required

pension contributions beyond the current fiscal year are estimated

at between $2 million and $4 million for each of the next six

fiscal years.

The net change in the Company’s pension liability based on

interest rate movements and asset returns was not material during

the first six months of fiscal 2015, as the benefit of higher

interest rates was largely offset by lower than expected returns on

pension plan assets in the six months ended June 28, 2015.

The actual timing and amount of future pension plan

contributions are dependent upon many factors, including returns on

invested assets, the level of certain market interest rates, the

discount rate used to determine pension obligations, voluntary

contributions the Company may elect to make to the plan, and other

potential regulatory actions.

Subsequent Event

Subsequent to the end of the second quarter, on July 27, 2015,

Magnetek and Columbus McKinnon Corporation (NASDAQ: CMCO), a

leading designer, manufacturer, and marketer of material handling

products, announced that they have entered into a definitive

agreement for Columbus McKinnon to acquire all of the outstanding

shares of Magnetek for $50 per share for a total value of $188.9

million. Columbus McKinnon, through a wholly owned subsidiary,

expects to commence a cash tender offer for all of the outstanding

shares of Magnetek on or about August 5, 2015. The tender offer is

subject to the expiration or termination of the waiting period

under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as

amended, and other customary closing conditions. The tender offer

requires as a condition to consummation that at least a majority of

the outstanding shares of Magnetek's common stock be tendered. The

transaction is expected to close within 90 days.

About Magnetek

Magnetek, Inc. (NASDAQ: MAG) manufactures digital power and

motion control systems used in material handling, elevator, and

mining applications. The Company is headquartered in Menomonee

Falls, Wis. in the greater Milwaukee area and operates

manufacturing plants in Pittsburgh, Pa. and Bridgeville, Pa. as

well as Menomonee Falls.

ADDITIONAL INFORMATION AND WHERE YOU CAN FIND IT: This

news release does not constitute an offer to sell or the

solicitation of an offer to buy any securities. The tender offer

for the outstanding shares of the Company’s common stock described

in this news release has not commenced. At the time the tender

offer is commenced, Columbus McKinnon Corporation will file or

cause to be filed a Tender Offer Statement on Schedule TO with the

Securities and Exchange Commission (“SEC”) and the Company will

file a Solicitation/Recommendation Statement on Schedule 14D-9 with

the SEC related to the tender offer. The Tender Offer Statement

(including an Offer to Purchase, a related Letter of Transmittal

and other tender offer documents) and the

Solicitation/Recommendation Statement will contain important

information that should be read carefully before any decision is

made with respect to the tender offer. Those materials will be made

available to the Company’s stockholders at no expense to them by

the information agent to the tender offer, which will be announced.

In addition, all of those materials (and any other documents filed

with the SEC) will be available at no charge on the SEC’s website

at www.sec.gov.

Safe Harbor Statement

This news release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

including statements regarding the Company's anticipated financial

results for its 2015 through 2021 fiscal years. Statements

contained in this news release regarding the proposed transaction

between the Company and Columbus McKinnon Corporation and the

expected timetable for completing the transaction are also

forward-looking statements. These forward-looking statements are

based on the Company's expectations and are subject to risks and

uncertainties that cannot be predicted or quantified and are beyond

the Company's control. Future events and actual results could

differ materially from those set forth in, contemplated by, or

underlying these forward-looking statements. These include, but are

not limited to, economic conditions in general, business conditions

in material handling, elevator, and mining markets, operating

conditions, competitive factors such as pricing and technology,

risks associated with acquisitions and divestitures, legal

proceedings and the risk that the Company’s ultimate costs of doing

business exceed present estimates. Other factors that could cause

actual results to differ materially from expectations are described

in the Company's reports filed with the Securities and Exchange

Commission pursuant to the Securities Exchange Act of 1934. The

Company assumes no obligation to update the forward-looking

statements contained in this news release, except as expressly

required by law.

Non-GAAP Financial Measures

The Company may, in the course of its financial presentations,

earnings releases, earnings conference calls, and otherwise,

publicly disclose certain numerical measures which are or may be

considered "non-GAAP financial measures” under SEC Regulation G.

"GAAP" refers to generally accepted accounting principles in the

United States. Non-GAAP financial measures disclosed by management

are provided as additional information to investors in order to

provide them with an alternative method for assessing the Company’s

financial condition and operating results. These measures are not

in accordance with, or a substitute for, GAAP, and may be different

from or inconsistent with non-GAAP financial measures used by other

companies. The Company’s public disclosures may include non-GAAP

measures such as EBITDA and adjusted EBITDA. EBITDA represents its

GAAP results adjusted to exclude interest, taxes, depreciation and

amortization. Adjusted EBITDA represents EBITDA adjusted to exclude

non-cash pension and stock compensation expenses. Company

management believes that adjusted EBITDA is useful to investors as

it provides a measure of the Company’s cash flow prior to capital

investments, changes in working capital, and pension contributions.

As a result, management believes investors can use this metric as a

measure of the Company’s ability to fund its growth initiatives and

its pension obligations.

Magnetek, Inc. Consolidated Results of

Operations (in thousands except per share data)

Three months ended Six months

ended (Unaudited) (Unaudited) (13 weeks)

(13 weeks) (26 weeks) (26 weeks) June

28, June 29, June 28, June 29, Results

of Operations: 2015 2014

2015 2014 Net sales $ 28,348 $ 27,009 $ 54,960

$ 51,122 Cost of sales 17,937

17,294 35,150 33,255

Gross profit 10,411 9,715 19,810 17,867 Operating expenses:

Research and development 800 790 1,699 1,589 Pension expense 502

925 1,004 1,850 Selling, general and administrative

5,884 5,250 11,374

10,240 Total operating expenses 7,186

6,965 14,077

13,679 Income from operations 3,225 2,750 5,733 4,188

Provision for income taxes 41

240 82 480 Income from

continuing operations 3,184 2,510 5,651 3,708 Income (loss) from

discontinued operations (146 ) (213 )

(309 ) (357 ) Net income $ 3,038

$ 2,297 $ 5,342 $ 3,351

Earnings per common share - basic:

Income from continuing

operations $ 0.89 $ 0.77 $ 1.59 $ 1.14 Income (loss) from

discontinued operations $ (0.04 ) $ (0.07 ) $ (0.09 ) $ (0.11 ) Net

income per common share $ 0.85 $ 0.70

$ 1.50 $ 1.03

Earnings per

common share - diluted:

Income from continuing operations $ 0.87 $ 0.74 $

1.54 $ 1.10 Income (loss) from discontinued operations $ (0.04 ) $

(0.06 ) $ (0.09 ) $ (0.11 ) Net income per common share $

0.83 $ 0.68 $ 1.45 $ 0.99

Weighted average shares outstanding: Basic

3,566 3,267 3,558 3,265 Diluted 3,679

3,372 3,678 3,375

Reconciliation of

Non-GAAP Financial Measures:

The following table reconciles operating income, the most directly

comparable GAAP measure, to adjusted operating income and adjusted

EBITDA, non-GAAP financial measures:

Three months

ended Six months ended (Unaudited)

(Unaudited) June 28, June 29, June 28,

June 29, 2015 2014 2015

2014 Income from operations (GAAP) $ 3,225 $ 2,750 $ 5,733 $

4,188 As a percent of sales 11.4 % 10.2 % 10.4 % 8.2 % Add: pension

expense 502 925

1,004 1,850 Adjusted income from

operations (non-GAAP) $ 3,727 $ 3,675 $

6,737 $ 6,038 As a percent of sales 13.1 %

13.6 % 12.3 % 11.8 % Add: depreciation and amortization 200 203 399

405 Add: stock compensation expense 208

48 389 231

Adjusted EBITDA (non-GAAP) $ 4,135 $ 3,926

$ 7,525 $ 6,674 As a percent of sales

14.6 % 14.5 % 13.7 % 13.1 %

Three months ended Six

months ended (Unaudited) (Unaudited) June

28, June 29, June 28, June 29, Other

Data: 2015 2014 2015

2014 Depreciation expense $ 186 $ 189 $ 372 $ 378

Amortization expense 14 14 27 27

Capital expenditures

491 188 698 359

Consolidated Balance Sheet (in

thousands ) June 28,

2015 December 28, (Unaudited) 2014 Cash

$ 13,072 9,702 Restricted cash 262 262 Accounts receivable 17,515

16,975 Inventories 14,234 13,626 Prepaid and other current assets

546 801 Total current assets 45,629

41,366 Property, plant & equipment, net 3,253 2,931

Goodwill 30,323 30,364 Other assets 4,010

4,039 Total assets $ 83,215 $ 78,700

Accounts payable $ 9,989 $ 10,375 Accrued liabilities

5,524 6,703 Total current liabilities

15,513 17,078 Pension benefit obligations, net 25,012 27,360

Other long-term obligations 780 845 Deferred income taxes

9,828 9,798 Total liabilities 51,133

55,081 Common stock 36 35 Paid in

capital in excess of par value 150,576 150,641 Accumulated deficit

(4,833 ) (10,175 ) Accumulated other comprehensive loss

(113,697 ) (116,882 ) Total stockholders' equity

32,082 23,619 Total liabilities and

stockholders' equity $ 83,215 $ 78,700

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150804005421/en/

Magnetek, Inc.Marty

Schwenner262-703-4282mschwenner@magnetek.com

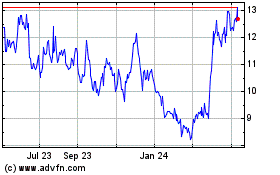

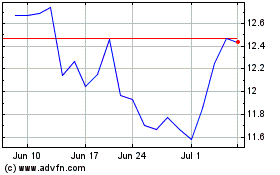

MAG Silver (AMEX:MAG)

Historical Stock Chart

From Mar 2024 to Apr 2024

MAG Silver (AMEX:MAG)

Historical Stock Chart

From Apr 2023 to Apr 2024