FCPT Closes First Tranche (10 Restaurant Properties) of Washington Prime Transaction

January 12 2018 - 5:35PM

Business Wire

Four Corners Property Trust (NYSE:FCPT), a real

estate investment trust engaged in the ownership of high-quality,

net-leased restaurant properties (“FCPT” or the “Company”), closed

on the purchase of ten restaurant properties today from Washington

Prime Group Inc. (“WPG”). This is the first of two tranches in the

forty-one property acquisition announced in September 2017. Closing

of the thirty-one remaining properties in the second tranche is

expected to be completed by the end of the second quarter of 2018,

subject to remaining due diligence and customary closing

conditions.

The purchase price for the first tranche was approximately $13.8

million and represents a capitalization rate consistent with our

investment thresholds and past transactions. The leases have a

current weighted average remaining term of approximately 7.5 years.

Four of the ten properties are ground leases (i.e., the tenant

built its own building with ownership reverting to the landlord

upon lease expiry).

The first tranche restaurant properties consist entirely of

outparcels to WPG properties and are well located within highly

trafficked retail corridors in Florida, Illinois, Iowa and Ohio.

All ten properties are on out-lots to either open air or WPG’s

“Tier One Enclosed” properties. None of the ten restaurant

properties or the adjacent WPG properties are currently encumbered

by property-level debt.

The ten properties represent ten different restaurant brands:

Arby’s, BJ’s Restaurant, Buffalo Wild Wings, Chick-Fil-A, Chili’s,

McDonald’s, Olive Garden, Panda Express, Red Lobster, and

Starbucks. Of the ten leases, eight are with corporate operators

and two are with franchisees.

Additional detail on all properties acquired from WPG will be

disclosed upon the closing of the second tranche.

About FCPT

FCPT, headquartered in Mill Valley, CA, is a real estate

investment trust primarily engaged in the acquisition and leasing

of restaurant properties. The Company seeks to grow its portfolio

by acquiring additional real estate to lease for use in the

restaurant and related food services industry. Additional

information about FCPT can be found on the website at

www.fcpt.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements include all statements that are not historical

statements of fact and those regarding FCPT’s intent, belief or

expectations, including, but not limited to, statements regarding:

the proposed transactions, the anticipated consequences and

benefits of the transactions and the targeted close date for the

transactions, and other future events and their potential effects

on FCPT, including, but not limited to, statements relating to

anticipated financial and operating results, the company’s plans,

objectives, expectations and intentions, cost savings and other

statements. Words such as “anticipate(s),” “expect(s),”

“intend(s),” “plan(s),” “believe(s),” “may,” “will,” “would,”

“could,” “should,” “seek(s)” and similar expressions, or the

negative of these terms, are intended to identify such

forward-looking statements. Forward-looking statements speak only

as of the date on which such statements are made and, except in the

normal course of FCPT’s public disclosure obligations, FCPT

expressly disclaims any obligation to publicly release any updates

or revisions to any forward-looking statements to reflect any

change in FCPT’s expectations or any change in events, conditions

or circumstances on which any statement is based. Forward-looking

statements are based on management’s current expectations and

beliefs and FCPT can give no assurance that its expectations or the

events described will occur as described. For a further discussion

of these and other factors that could cause FCPT’s future results

to differ materially from any forward-looking statements, see the

section entitled “Risk Factors” in FCPT’s most recent annual report

on Form 10-K, and other risks described in documents subsequently

filed by FCPT from time to time with the Securities and

Exchange Commission.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180112005700/en/

Four Corners Property Trust:Bill Lenehan, 415-965-8031CEOorGerry

Morgan, 415-965-8032CFO

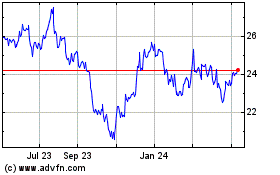

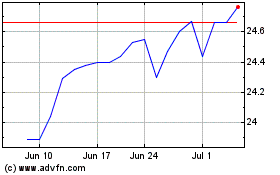

Four Corners Property (NYSE:FCPT)

Historical Stock Chart

From Aug 2024 to Sep 2024

Four Corners Property (NYSE:FCPT)

Historical Stock Chart

From Sep 2023 to Sep 2024