CPI Card Group White Paper Lights the Road to a Rewarding Dual Interface Card Program

April 19 2018 - 9:00AM

Business Wire

“Catching the Dual Interface Wave” Explores the

Contactless Card Trend and Offers Guidance to Financial

Institutions on Successfully Transitioning Their Portfolios

CPI Card Group Inc. (Nasdaq:PMTS, TSX:PMTS) (“CPI” or the

“Company”), a global leader in financial and EMV® chip card

production and related services, today released “Catching the Dual

Interface Wave,” a white paper that highlights the imminent rise of

dual interface cards in the U.S. and factors driving the timeliness

for financial institutions to embrace the contactless card

trend.

Dual interface cards have already forged a dominant presence in

countries across the globe, with Juniper Research predicting they

will account for 80 percent of total global contactless

transactions in 2019. A contactless future in the U.S. is now on

the horizon given the fast, frictionless experience dual interface

cards can provide consumers, the new technologies and design

capabilities being employed in their production and the positive

impacts they can offer a financial institution’s business.

“Issuers can find opportunity to capitalize on the

consumer-driven shift to contactless with impressive dual interface

offerings available today – from advanced, air coupling

construction and a multitude of application technologies to robust

card design features,” said Jason Bohrer, SVP and General Manager -

Secure Card Solutions, CPI Card Group. “Through this white paper,

we hope to guide issuers towards efficiently launching high-quality

dual interface cards in the market.”

“Catching the Dual Interface Wave,” breaks down the different

factors contributing to the momentum behind contactless cards in

the U.S. – exploring the mutually rewarding benefits available to

consumers and financial institutions alike, given expanding

merchant acceptance and the projected volume of contactless

transactions expected over the next few years. To download

“Catching the Dual Interface Wave,” click here.

About CPI Card Group

CPI Card Group is a leading provider in payment card production

and related services, offering a single source for credit, debit

and prepaid debit cards including EMV chip, personalization,

instant issuance, fulfillment and mobile payment services. With

more than 20 years of experience in the payments market and as a

trusted partner to financial institutions, CPI’s solid reputation

of product consistency, quality and outstanding customer service

supports our position as a leader in the market. Serving our

customers from locations throughout the United States, Canada and

the United Kingdom, we have the largest network of high security

facilities in North America, each of which is certified by one or

more of the payment brands: Visa, Mastercard®, American Express,

Discover and Interac in Canada. Learn more at

www.cpicardgroup.com.

EMV is a registered trademark or trademark of EMVCo LLC in the

United States and other countries.

Card@Once is a registered trademark of CPI Card Group, Inc. The

Card@Once product is protected by the US Patent No.:8429075 of CPI

Card Group, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180419005336/en/

ICR Inc. for CPI Card GroupLaura Anderson,

203-682-8267media@cpicardgroup.com

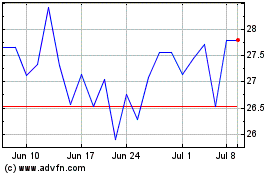

CPI Card (NASDAQ:PMTS)

Historical Stock Chart

From Mar 2024 to Apr 2024

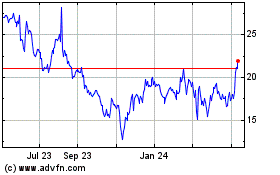

CPI Card (NASDAQ:PMTS)

Historical Stock Chart

From Apr 2023 to Apr 2024