By Kirsten Grind

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (March 23, 2018).

Facebook Inc.'s handling of user data has upset lawmakers and

regulators in multiple countries. But the biggest risk to its

business could come from angry users.

Throughout previous controversies in recent years, Facebook's

user population climbed steadily, fortifying the basis for an

ever-growing gusher of advertising revenue.

Now Facebook is contending with a groundswell of users -- some

of whom are tweeting under the hashtag #DeleteFacebook -- who claim

to be abandoning the social-media giant, prompting some analysts to

warn that its growth juggernaut could sputter.

"The biggest issue we see for Facebook is if the DeleteFacebook

leads to user attrition and eventually ad dollars allocated

elsewhere," Barclays analysts said in a research note Tuesday. The

public backlash also could impinge on Facebook's ability to recruit

talented engineers, they said.

Facebook's crisis escalated Thursday as members of the U.S.

House Energy and Commerce Committee called on Chief Executive Mark

Zuckerberg to testify.

"After committee staff received a briefing yesterday from

Facebook officials, we felt that many questions were left

unanswered," Rep. Greg Walden (R. Ore.), chairman of the committee,

and Rep. Frank Pallone, Jr. (D., N.J.) said in a prepared

statement. "We believe, as CEO of Facebook, he is the right witness

to provide answers to the American people."

Late Wednesday, financial-services firm Stifel slashed its

target price for Facebook shares to $168 from $195, saying,

"Facebook's current plight reminds us of eBay in 2004 -- an

unstructured content business built on trust that lost that trust

prior to implementing policies to add structure and process."

The latest crisis began late Friday when Facebook said it was

looking into reports that analytics firm Cambridge Analytica ,

which worked with the Donald Trump campaign in 2016, improperly

accessed data from its platform on tens of millions of users, and

then retained it even after having agreed to delete it. Cambridge

Analytica said it followed Facebook policies.

The controversy knocked a total of 9%, or $50 billion, off

Facebook's market value Monday and Tuesday, before shares rebounded

0.7% on Wednesday. The stock lost another 2.7% to close at $164.89

on Thursday. Facebook is facing legislative inquiries on two

continents and an investigation by the Federal Trade

Commission.

Mr. Zuckerberg broke his silence on the issue Wednesday,

admitting mistakes and pledging an investigation and improvements

to user-data policies. "We have a responsibility to protect your

data, and if we can't, then we don't deserve to serve you," Mr.

Zuckerberg wrote in a Facebook post.

On Thursday, Facebook operating chief Sheryl Sandberg addressed

criticism that company leaders are too slow to respond to crises.

"Sometimes, and I would say certainly this past week, we speak too

slowly," she said on CNBC. "If I could live this past week again, I

would definitely have had Mark and myself out speaking

earlier."

Facebook "definitely didn't realize the gravity of this issue

sooner," Ms. Sandberg said.

The fierce criticism of Facebook could ease. For now, its

founder's reassurances aren't enough for some users already put off

by Facebook's handling of Russian interference on the platform

around the 2016 U.S. election.

Sabine Stanley, a 42-year-old professor at Johns Hopkins

University, says she had been thinking about deleting her Facebook

account for months as the company battled one crisis after another,

and the revelation about Cambridge Analytica and Facebook's slow

response pushed her over the edge.

"You combine that with the election scandal, and I decided I

couldn't support Facebook anymore," says Ms. Stanley, who also

deleted her account on Facebook's Instagram app.

A Facebook spokeswoman declined to comment.

The number of people world-wide who use Facebook at least once a

month has more than doubled since it went public in 2012, hitting

2.13 billion in last year's final quarter. Revenue and profit have

grown even faster, thanks to Facebook's use of its wealth of data

to help advertisers target their messages to those users.

Warning signs began appearing last year, as anger rose in the

U.S. over Facebook's lax controls over misinformation and abuse on

its platform tied to the 2016 election. Facebook's U.S. users spent

7% less time on the site in August compared with a year earlier and

4.7% less time in September, according an analysis of Nielsen data

done by Pivotal Research Group.

Last month, Facebook said its users collectively spent 5% less

time on the platform a day in the last three months of 2017,

translating to a little more than two minutes per day, per

user.

The company also said it experienced its first-ever

quarter-to-quarter drop in the number of people who log in daily in

its most lucrative market, the U.S. and Canada, where Facebook lost

about 700,000 daily users out of 184 million overall. Facebook said

the decline was a blip and that the figure was likely to

fluctuate.

Analysts are less sanguine in light of recent events. Brian

Weiser, an analyst with New York-based Pivotal Research, says he

expects the Cambridge Analytica issue to reduce the amount of time

users spend on Facebook by 10% to 15%.

"The biggest, most concerning thing here is the scale of this

problem," Mr. Weiser says. "All the operational failures indicate a

real management problem."

Gabrielle Estres, a 34-year-old industrial adviser in London,

deleted her Facebook account this week after the recent data issues

at the company, but said even before that she had been using it

less.

"It was this supercool thing and now at this point it's more the

thing that always reminds me of birthdays," she said. "The

threshold of deleting your account is not that high anymore."

Other users are more circumspect: "#DeleteFacebook isn't the

answer," one Facebook user said on Twitter. "You just have to be

smart when you use them."

So far, there's little indication that advertisers will change

their view of Facebook because of the latest furor -- though some

prominent executives have criticized the firm in recent months.

Investors will get their next glimpse of Facebook's performance

with its first-quarter report more than a month from now.

"If time goes on and it appears they still seem disconnected

from how users feel, then they might have a problem," says Colin

Sebastian, a senior research analyst at Robert W. Baird & Co.

in San Francisco. "We can see now they're in crisis management

mode, which is a good thing."

Deepa Seetharaman contributed to this article.

Write to Kirsten Grind at kirsten.grind@wsj.com

(END) Dow Jones Newswires

March 23, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

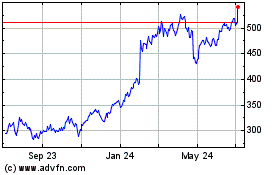

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

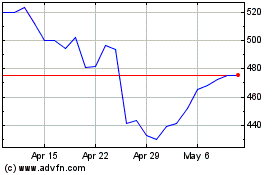

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024