Aluminum Extends Rally After Exchanges Ban Rusal Metal

April 11 2018 - 7:17AM

Dow Jones News

By David Hodari

Aluminum futures pushed higher on Wednesday, extending their

rally as White House sanctions on Russian companies continued to

ripple through the market.

The industrial metal was up 2.6% at $2,267 a metric ton in

late-morning trading in London--matching its year-to-date

high--having risen 10.5% so far this week.

In other major metals markets, copper edged down 0.1% to $6,963

a metric ton, and gold ticked up 0.3% to $1,344.61 a troy

ounce.

Aluminum's gains intensified late Tuesday after the London Metal

Exchange fell in line with U.S. sanctions on Russian individuals

and announced a "temporary conditional suspension" on metal from

the world's second-largest aluminum producer, United Co. Rusal.

While the LME's ban takes effect April 17, CME Group Inc.'s

Comex index also announced on Tuesday that it had "revoked the

approved status for registration for delivery, and delivery of" 11

aluminum brands from its exchange "with immediate effect." Of those

11 brands, six were from Rusal and all were Russian.

Rusal was one of 12 companies owned by seven Russian tycoons

that the U.S. government sanctioned last week over Russian activity

around the world including military interventions in Ukraine and

Syria and cyberattacks. The sanctions froze the U.S. assets of

those targeted and prohibited Americans from doing business with

them.

The LME's move was "completely [down to] political pressure [as]

the LME cannot be seen to be doing business with a company that has

sanctions placed on it," said Geordie Wilkes, head of research at

Sucden Financial Limited.

Aluminum's leap between Friday and Tuesday marked its hottest

three-day streak since 2009, said John Meyer, an analyst at SP

Angel.

Tuesday's announcement from the LME was a departure from the

exchange's initial divergence from Washington, and was "a game

changer," according to analysts ING in a note.

Many in the market had previously warned that the LME's earlier

decision not to echo sanctions on Russia would prompt a divergence

between various local premiums around the world. The LME's

about-turn on the matter meant that was no longer as likely.

"We could now see a rush of Rusal stock on to the LME, and

thereafter all eyes are on the Shanghai Futures Exchange-London

Metal Exchange arbitrage... as it becomes profitable for China to

export," ING added.

China is relatively insulated from the supply anxieties rattling

aluminum markets, as the country is largely self-sufficient in

aluminum production.

Investors were bracing for further tremors.

"Rusal metal is likely not to be deliverable to the LME and if

this is the case... we would expect to see the rally continue,"

Sucden's Mr. Wilkes said.

Still, there might be some temporary volatility. "Traders can

only deliver Rusal metal if they can prove that it was produced and

supplied before April 6th," when the U.S. announced its sanctions,

Mr. Wilkes said.

Among precious metals, silver was down 0.24% at $16.53 a troy

ounce, platinum was up 0.20% at $931.15 a troy ounce and palladium

was up 0.18% at $957 a troy ounce.

Among base metals, zinc was up 0.03% to $3,250.50 a metric ton,

tin was up 0.53% at $21,025 a metric ton, nickel was up 0.29% at

$13,780 a metric ton and lead was up 0.17% at $2,392 a metric

ton.

Write to David Hodari at David.Hodari@wsj.com

(END) Dow Jones Newswires

April 11, 2018 07:02 ET (11:02 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

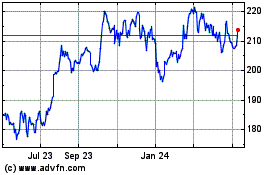

CME (NASDAQ:CME)

Historical Stock Chart

From Mar 2024 to Apr 2024

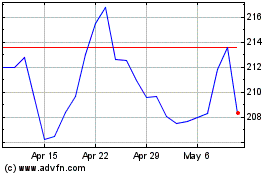

CME (NASDAQ:CME)

Historical Stock Chart

From Apr 2023 to Apr 2024