PRINCETON, N.J., July 14 /PRNewswire-FirstCall/ -- AMREP

Corporation (NYSE:AXR) today announced that it recorded a pre-tax,

non-cash impairment charge in the fourth quarter of its fiscal year

2009 ended April 30, 2009 of $50,246,000 ($41,557,000 after tax, or

$6.93 per share). This impairment charge reflected the write-off of

all of the goodwill of the Company's Subscription Fulfillment

Services segment. After giving effect to this impairment charge,

the Company reported a net loss of $43,466,000, or $7.25 per share,

for fiscal 2009 compared to net income of $13,705,000, or $2.19 per

share, in fiscal 2008. Revenues were $145,901,000 compared to

$172,061,000 in the prior year. For the fourth quarter of 2009, the

net loss after the impairment charge was $46,332,000, or $7.73 per

share, compared to net income of $529,000, or $0.09 per share, in

the same period of 2008. Fourth quarter 2009 revenues were

$34,321,000 versus fourth quarter 2008 revenues of $35,177,000.

Results for 2009 were entirely from continuing operations,

including the impairment charge, while 2008's results included a

net loss from discontinued operations of $57,000, or $0.01 per

share, that reflected costs incurred in connection with the

settlement of all litigation related to the Company's El Dorado,

New Mexico water utility subsidiary that were in addition to costs

that had been accrued for this matter in fiscal year 2007.

Excluding the impairment charge, the net loss from continuing

operations was $4,775,000, or $0.80 per share, in the fourth

quarter of 2009, and $1,909,000, or $0.32 per share, for the full

year of 2009. This included in both periods the write-off of a

$6,500,000 receivable from a major magazine wholesaler which

recently closed its business ($4,095,000 after tax, or $0.68 per

share). The primary reason for the fourth quarter 2009 non-cash

goodwill impairment charge was the lower than expected fiscal 2009

revenues and operating results of the Company's Subscription

Fulfillment Services segment and a change in the Company's

internally projected future cash flows from that segment based on

current industry trends. These reduced results and expectations

reflected the well-publicized decline in the magazine publishing

industry during fiscal 2009, which represents the Subscription

Fulfillment Services segment's principal customer base, as well as

the deep recession which has impacted the U.S. economy and

consumers and the uncertainty about when this recession will end.

The goodwill impairment charge is a non-cash item which is not

expected to affect the day-to-day operations of either the Company

or its Subscription Fulfillment Services segment. Revenues from

land sales at the Company's AMREP Southwest subsidiary were

$2,320,000 and $8,914,000 in the fourth quarter and full year of

2009 compared to $289,000 and $27,902,000 for the comparable

periods of 2008. AMREP Southwest continues to experience

substantially lower land sales in its principal market of Rio

Rancho, New Mexico due to the continuing severe decline in the real

estate market in the greater Albuquerque-metro and Rio Rancho

areas. Total acres sold were 148 in 2009 and 406 in 2008. The trend

of declining permits for new home construction in the Rio Rancho

area also continues, with 27% fewer single-family residential

building permits issued during fiscal 2009 than in fiscal 2008. The

Company believes that this decline has been consistent with the

well-publicized problems of the national home building industry and

credit markets, including fewer sales of both new and existing

homes, an increasing number of mortgage delinquencies and

foreclosures and a tightening of mortgage availability. Faced with

these adverse conditions, builders have slowed the pace of building

on developed lots previously purchased from the Company in Rio

Rancho and delayed or cancelled the purchase of additional

developed lots. These factors have also contributed to a steep

decline in the sale of undeveloped land to both builders and

investors. In Rio Rancho, the Company offers for sale both

developed and undeveloped lots to national, regional and local home

builders, commercial and industrial property developers and others.

The average selling price of land sold by the Company in Rio Rancho

was $60,200 per acre in fiscal 2009 and $68,700 per acre in fiscal

2008, reflecting differences in the mix of properties sold in each

period. As a result of these and other factors, including the

nature and timing of specific transactions, revenues and related

gross profits from real estate land sales can vary significantly

from period to period and prior results are not necessarily a good

indication of what may occur in future periods. Revenues from the

Company's Media Services operations decreased 2% from $138,696,000

for fiscal 2008 to $136,206,000 for fiscal 2009, while fourth

quarter revenues declined 7%, from $34,379,000 in 2008 to

$31,878,000 in 2009. Magazine publishers, who are the principal

customers of the Company's Media Services operations, suffered

generally from lower advertising revenues and lower subscription

and newsstand sales during both periods, which led to reduced

business for the Company's Media Services operations. Revenues from

Subscription Fulfillment Services decreased from $122,521,000 and

$30,410,000 for the full year and fourth quarter of 2008 to

$115,964,000 and $25,789,000 in the same periods of 2009, primarily

reflecting the net effect of reduced and lost business that

resulted from lower publisher customer volumes and higher attrition

of magazine titles than has been previously experienced, offset in

part by revenue gains from new and some existing clients. Revenues

from Newsstand Distribution Services decreased from $12,916,000 and

$3,105,000 for the full year and fourth quarter of 2008 to

$12,400,000 and $3,026,000 in the same periods of 2009, with the

decline being due in part to the effects of a disruption in the

wholesale distribution industry during the fourth quarter of 2009

caused by the closing of a major newsstand distribution wholesaler.

Revenues from other operations within Media Services increased from

$3,259,000 and $810,000 for the full year and fourth quarter of

2008 to $7,842,000 and $3,063,000 in the same periods of 2009,

primarily from the inclusion of a product repackaging and

fulfillment business and a temporary staffing company from the date

of their asset purchases in November 2008. For more detail

regarding the non-cash goodwill impairment charge and additional

information regarding the Company's financial results for fiscal

2009, please refer to the Annual Report on Form 10-K that the

Company filed today with the Securities and Exchange Commission.

AMREP Corporation's AMREP Southwest Inc. subsidiary is a major

landholder and leading developer of real estate in Rio Rancho, New

Mexico, and its Kable Media Services, Inc. subsidiary distributes

magazines to wholesalers and provides subscription fulfillment and

related services to publishers and others. The statements in this

news release regarding the future operations of the Company and its

Subscription Fulfillment Services segment are forward-looking

statements within the meaning of the federal securities laws. These

statements are subject to numerous risks and uncertainties, many of

which are beyond the control of AMREP Corporation and that could

cause actual results to differ materially from such statements,

including, without limitation, the Company's ability to accurately

estimate future cash flows and predict when the economy will

recover. Further information about these and other relevant risks

and uncertainties may be found in the Company's Form 10-K and its

other filings with the Securities and Exchange Commission, all of

which are available from the Commission as well as from other

sources. Recipients of this news release are cautioned to consider

these risks and uncertainties and to not place undue reliance on

the forward-looking statements contained therein. AMREP Corporation

disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. (Two Schedules Follow) Schedule 1 AMREP

CORPORATION AND SUBSIDIARIES FINANCIAL HIGHLIGHTS Three Months

Ended April 30, 2009 (a) 2008 Revenues $34,321,000 $35,177,000 Net

income (loss) $(46,332,000) $529,000 Earnings (loss) per share -

Basic and Diluted: $(7.73) $0.09 Weighted average number of common

shares outstanding 5,996,000 5,995,000 Twelve Months Ended April

30, 2009 (a) 2008 Revenues $145,901,000 $172,061,000 Net income

(loss): Continuing operations $(43,466,000) $13,762,000

Discontinued operations - (57,000) $(43,466,000) $13,705,000

Earnings (loss) per share - Basic and Diluted: Continuing

operations $(7.25) $2.20 Discontinued operations - (0.01) $(7.25)

$2.19 Weighted average number of common shares outstanding

5,996,000 6,248,000 (a) Includes after tax, non-cash impairment

charge of $41,557,000 ($6.93 per share) in 2009 Schedule 2 The

Company's land sales in Rio Rancho, New Mexico were as follows

(dollar amounts in thousands): 2009 2008 Acres Revenues Acres

Revenues Sold Revenues per Acre Sold Revenues per Acre Three months

ended April 30: Developed Residential 10 $2,320 $232 (a) $74 $296

Commercial - - - - - - Total Developed 10 2,320 232 - 74 296

Undeveloped - - - 11 215 20 Total 10 $2,320 $232 11 $289 $26 Twelve

months ended April 30: Developed Residential 13 $3,109 $239 30

$9,542 $318 Commercial 1 126 126 39 8,651 222 Total Developed 14

3,235 231 69 18,193 264 Undeveloped 134 5,679 42 337 9,709 29 Total

148 $8,914 $60 406 $27,902 $69 (a) less than 0.5 acres. DATASOURCE:

AMREP Corporation CONTACT: Peter M. Pizza, Vice President and Chief

Financial Officer, +1-609-716-8210, +1-609-716-8255 (fax)

Copyright

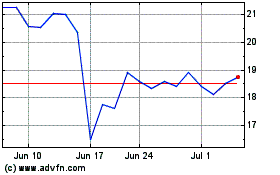

AMREP (NYSE:AXR)

Historical Stock Chart

From Mar 2024 to Apr 2024

AMREP (NYSE:AXR)

Historical Stock Chart

From Apr 2023 to Apr 2024