SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

F O R M 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of

May 2024

Commission File Number 001-36258

Crescent Point Energy Corp.

(Name of Registrant)

Suite 2000, 585 - 8th Avenue S.W.

Calgary, Alberta, T2P 1G1

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x

The following documents attached as exhibits to this Form 6-K: Exhibit 99.1, the Interim Consolidated Financial Statements (unaudited) for the period ended March 31, 2024; and Exhibit 99.2, the Company's Management's Discussion and Analysis for the period ended March 31, 2024, shall be deemed to be filed with and shall be incorporated by reference into the Company's Registration Statements on Form F-3D (File No. 333-205592), Form S-8 (File No. 333-226210) and Form F-10 (333-275312).

The following documents attached as exhibits hereto are incorporated by reference herein:

| | | | | |

| Exhibit No. | Description |

| 99.1 | Interim Consolidated Financial Statements (unaudited) for the period ended March 31, 2024. |

| 99.2 | Management's Discussion and Analysis for the period ended March 31, 2024. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| Crescent Point Energy Corp. | |

| (Registrant) | |

| | | |

| By: | /s/ Ken Lamont | |

| Name: | Ken Lamont | |

| Title: | Chief Financial Officer | |

Date: May 10, 2024

EXHIBITS

| | | | | |

| Interim Consolidated Financial Statements (unaudited) for the period ended March 31, 2024. |

| Management's Discussion and Analysis for the period ended March 31, 2024. |

Exhibit 99.1

CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | | | | | | | |

| | As at | |

| | March 31, | | December 31, | |

| (UNAUDITED) (Cdn$ millions) | Notes | 2024 | | 2023 | |

| ASSETS | | | | | |

| Cash | | 21.8 | | | 17.3 | | |

| Accounts receivable | | 409.0 | | | 377.9 | | |

| | | | | |

| Prepaids and deposits | | 105.1 | | | 87.8 | | |

| Derivative asset | 21 | 114.8 | | | 240.7 | | |

| Other current assets | 4 | 90.2 | | | 79.2 | | |

| Assets held for sale | 6 | 637.0 | | | 247.1 | | |

| Total current assets | | 1,377.9 | | | 1,050.0 | | |

| Derivative asset | 21 | 21.7 | | | 14.3 | | |

| Other long-term assets | | 22.6 | | | 7.4 | | |

| Exploration and evaluation | 5 | 531.3 | | | 607.0 | | |

| Property, plant and equipment | 6, 8 | 9,743.9 | | | 10,718.3 | | |

| Right-of-use asset | 12 | 94.3 | | | 102.8 | | |

| Goodwill | 9 | 243.8 | | | 275.9 | | |

| | | | | |

| Total assets | | 12,035.5 | | | 12,775.7 | | |

| LIABILITIES | | | | | |

| Accounts payable and accrued liabilities | | 593.6 | | | 634.9 | | |

| Dividends payable | | 71.3 | | | 56.8 | | |

| Current portion of long-term debt | 11 | 388.5 | | | 380.0 | | |

| Derivative liability | 21 | 74.3 | | | 51.4 | | |

| Other current liabilities | 10 | 106.6 | | | 118.0 | | |

| Liabilities associated with assets held for sale | 6 | 98.5 | | | 132.4 | | |

| Total current liabilities | | 1,332.8 | | | 1,373.5 | | |

| Long-term debt | 11 | 3,202.7 | | | 3,186.3 | | |

| Derivative liability | 21 | 10.7 | | | 3.8 | | |

| Other long-term liabilities | | 33.0 | | | 31.0 | | |

| Lease liability | 12 | 99.0 | | | 104.2 | | |

| Decommissioning liability | 6, 13 | 454.7 | | | 566.4 | | |

| Deferred income tax | | 526.7 | | | 643.0 | | |

| Total liabilities | | 5,659.6 | | | 5,908.2 | | |

| SHAREHOLDERS’ EQUITY | | | | | |

| Shareholders’ capital | 14 | 17,042.7 | | | 17,052.7 | | |

| Contributed surplus | | 18.9 | | | 17.4 | | |

| Deficit | 15 | (10,685.5) | | | (10,202.5) | | |

| Accumulated other comprehensive income | | (0.2) | | | (0.1) | | |

| | | | | |

| Total shareholders' equity | | 6,375.9 | | | 6,867.5 | | |

| Total liabilities and shareholders' equity | | 12,035.5 | | | 12,775.7 | | |

Subsequent Events (Note 24)

See accompanying notes to the consolidated financial statements.

| | | | | |

| CRESCENT POINT ENERGY CORP. | 1 |

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

| | | | | | | | | | | | | | | | | | | | | |

| | | | Three months ended March 31 | |

| (UNAUDITED) (Cdn$ millions, except per share and shares outstanding amounts) | Notes | | | | | 2024 | | 2023 Revised (1) | |

| REVENUE AND OTHER INCOME | | | | | | | | | |

Oil and gas sales | 23 | | | | | 1,107.9 | | | 762.0 | | |

Purchased product sales | | | | | | 28.3 | | | 19.8 | | |

Royalties | | | | | | (113.9) | | | (86.0) | | |

| Oil and gas revenue | | | | | | 1,022.3 | | | 695.8 | | |

| Commodity derivative gains (losses) | 17, 21 | | | | | (213.3) | | | 13.2 | | |

| Other income | | | | | | 1.5 | | | 8.5 | | |

| | | | | | 810.5 | | | 717.5 | | |

| EXPENSES | | | | | | | | | |

| Operating | | | | | | 251.0 | | | 169.0 | | |

| Purchased product | | | | | | 29.8 | | | 20.5 | | |

| Transportation | | | | | | 81.8 | | | 32.8 | | |

| General and administrative | | | | | | 28.6 | | | 24.0 | | |

| Interest | 18 | | | | | 60.8 | | | 16.0 | | |

| Foreign exchange gain | 19 | | | | | (1.8) | | | (3.0) | | |

| Share-based compensation | | | | | | 12.2 | | | 17.5 | | |

| Depletion, depreciation and amortization | 5, 8, 12 | | | | | 344.1 | | | 186.4 | | |

| Impairment | 8, 9 | | | | | 512.3 | | | — | | |

| Accretion and financing | 12, 13 | | | | | 6.8 | | | 7.0 | | |

| | | | | | 1,325.6 | | | 470.2 | | |

| Net income (loss) before tax from continuing operations | | | | | | (515.1) | | | 247.3 | | |

| | | | | | | | | |

| Tax expense (recovery) | | | | | | | | | |

Current | | | | | | — | | | — | | |

Deferred | | | | | | (116.2) | | | 62.5 | | |

| Net income (loss) from continuing operations | | | | | | (398.9) | | | 184.8 | | |

| Net income (loss) from discontinued operations | 7 | | | | | (12.8) | | | 31.9 | | |

| Net income (loss) | | | | | | (411.7) | | | 216.7 | | |

| | | | | | | | | |

| Other comprehensive income | | | | | | | | | |

| Items that may be subsequently reclassified to profit or loss | | | | | | | | |

Foreign currency translation of foreign operations | | | | | | (0.1) | | | (0.2) | | |

| | | | | | | | | |

| Comprehensive income (loss) | | | | | | (411.8) | | | 216.5 | | |

| | | | | | | | | |

| Net income (loss) per share | | | | | | | | | |

Continuing operations - basic | | | | | | (0.64) | | | 0.33 | | |

Discontinued operations - basic | | | | | | (0.02) | | | 0.06 | | |

| Net income (loss) per share - basic | | | | | | (0.66) | | | 0.39 | | |

| | | | | | | | | |

| Continuing operations - diluted | | | | | | (0.64) | | | 0.33 | | |

| Discontinued operations - diluted | | | | | | (0.02) | | | 0.06 | | |

| Net income (loss) per share - diluted | | | | | | (0.66) | | | 0.39 | | |

| | | | | | | | | |

| Weighted average shares outstanding | | | | | | | | | |

| Basic | | | | | | 619,935,208 | | | 548,879,167 | | |

| Diluted | | | | | | 619,935,208 | | | 552,727,141 | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

(1)Comparative period revised to reflect current period presentation. See Note 7 - "Discontinued Operations" for additional information.

See accompanying notes to the consolidated financial statements.

| | | | | |

| CRESCENT POINT ENERGY CORP. | 2 |

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(UNAUDITED)

(Cdn$ millions, except per share amounts) | Notes | Shareholders’ capital | | Contributed surplus | | Deficit | | Accumulated other comprehensive income | | Total shareholders’ equity | |

| December 31, 2022 | | 16,419.3 | | | 17.1 | | | (10,563.3) | | | 620.3 | | | 6,493.4 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Common shares repurchased for cancellation | | (48.5) | | | | | | | | | (48.5) | | |

| | | | | | | | | | | |

| Share-based compensation | | | | 1.5 | | | | | | | 1.5 | | |

| Stock options exercised | | 0.1 | | | (0.1) | | | | | | | — | | |

| | | | | | | | | | | |

| Net income | | | | | | 216.7 | | | | | 216.7 | | |

Dividends declared ($0.032 per share) | | | | | | (17.1) | | | | | (17.1) | | |

| Foreign currency translation adjustment | | | | | | | | (0.2) | | | (0.2) | | |

| March 31, 2023 | | 16,370.9 | | | 18.5 | | | (10,363.7) | | | 620.1 | | | 6,645.8 | | |

| | | | | | | | | | | |

| December 31, 2023 | | 17,052.7 | | | 17.4 | | | (10,202.5) | | | (0.1) | | | 6,867.5 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Common shares repurchased for cancellation | 14 | (10.0) | | | | | | | | | (10.0) | | |

| Share issue costs, net of tax | 14 | (0.1) | | | | | | | | | (0.1) | | |

| Share-based compensation | | | | 1.5 | | | | | | | 1.5 | | |

| Stock options exercised | 14 | 0.1 | | | | | | | | | 0.1 | | |

| | | | | | | | | | | |

| Net income (loss) | | | | | | (411.7) | | | | | (411.7) | | |

Dividends declared ($0.115 per share) | | | | | | (71.3) | | | | | (71.3) | | |

Foreign currency translation adjustment | | | | | | | | (0.1) | | | (0.1) | | |

| | | | | | | | | | | |

| March 31, 2024 | | 17,042.7 | | | 18.9 | | | (10,685.5) | | | (0.2) | | | 6,375.9 | | |

See accompanying notes to the consolidated financial statements.

| | | | | |

| CRESCENT POINT ENERGY CORP. | 3 |

CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | | | | | | | | | | | | | | | | | | |

| | | | Three months ended March 31 | |

| (UNAUDITED) (Cdn$ millions) | Notes | | | | | 2024 | | 2023 | |

| CASH PROVIDED BY (USED IN): | | | | | | | | | |

| OPERATING ACTIVITIES | | | | | | | | | |

Net income (loss) | | | | | | (411.7) | | | 216.7 | | |

Items not affecting cash | | | | | | | | | |

Other (income) loss | | | | | | 12.0 | | | (7.4) | | |

Deferred tax expense (recovery) | | | | | | (116.2) | | | 71.5 | | |

Share-based compensation | | | | | | 1.5 | | | 1.5 | | |

Depletion, depreciation and amortization | 5, 8, 12 | | | | | 344.1 | | | 231.7 | | |

| Impairment | 8, 9 | | | | | 512.3 | | | — | | |

Accretion | 13 | | | | | 4.9 | | | 5.8 | | |

Unrealized losses on derivatives | 21 | | | | | 152.9 | | | 3.9 | | |

Translation of US dollar long-term debt | 19 | | | | | 65.8 | | | (0.9) | | |

| | | | | | | | | |

| Translation of US dollar derivatives | 21 | | | | | (1.1) | | | — | | |

| | | | | | | | | |

Realized loss on cross currency swap maturity | 19 | | | | | 2.4 | | | 0.3 | | |

Decommissioning expenditures | 13 | | | | | (7.3) | | | (9.9) | | |

Change in non-cash working capital | 22 | | | | | (148.4) | | | (39.8) | | |

| | | | | | 411.2 | | | 473.4 | | |

| INVESTING ACTIVITIES | | | | | | | | | |

Development capital and other expenditures | 5, 8 | | | | | (417.9) | | | (327.4) | | |

Capital acquisitions, net of cash acquired | | | | | | — | | | (372.0) | | |

Capital dispositions | 6 | | | | | 105.8 | | | 2.6 | | |

| | | | | | | | | |

| Other long-term assets | | | | | | (15.2) | | | — | | |

| | | | | | | | | |

| | | | | | | | | |

Change in non-cash working capital | 22 | | | | | 50.5 | | | (40.6) | | |

| | | | | | (276.8) | | | (737.4) | | |

| FINANCING ACTIVITIES | | | | | | | | | |

Issue of shares, net of issue costs | | | | | | — | | | 0.1 | | |

Common shares repurchased for cancellation | 14 | | | | | (10.0) | | | (48.5) | | |

Increase (decrease) in bank debt, net | 22 | | | | | (40.9) | | | 106.8 | | |

| | | | | | | | | |

| | | | | | | | | |

Realized loss on cross currency swap maturity | 19, 22 | | | | | (2.4) | | | (0.3) | | |

Payments on principal portion of lease liability | 12, 22 | | | | | (8.6) | | | (5.3) | | |

Dividends declared | 22 | | | | | (71.3) | | | (17.1) | | |

Change in non-cash working capital | 22 | | | | | 3.0 | | | (47.2) | | |

| | | | | | (130.2) | | | (11.5) | | |

Impact of foreign currency on cash balances | | | | | | 0.3 | | | 0.6 | | |

| INCREASE (DECREASE) IN CASH | | | | | | 4.5 | | | (274.9) | | |

| CASH AT BEGINNING OF PERIOD | | | | | | 17.3 | | | 289.9 | | |

| CASH AT END OF PERIOD | | | | | | 21.8 | | | 15.0 | | |

See accompanying notes to the consolidated financial statements.

Supplementary Information:

| | | | | | | | | | | | | | | | | | |

Cash taxes refunded (paid) | | | | | 0.2 | | | (0.1) | | |

Cash interest paid | | | | | (59.4) | | | (1.8) | | |

| | | | | |

| CRESCENT POINT ENERGY CORP. | 4 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2024 (UNAUDITED)

1.STRUCTURE OF THE BUSINESS

The principal undertaking of Crescent Point Energy Corp. (the “Company” or “Crescent Point”) is to carry on the business of acquiring, developing and holding interests in petroleum and natural gas properties and assets related thereto through a general partnership and wholly owned subsidiaries.

Crescent Point is the ultimate parent and is amalgamated in Alberta, Canada under the Alberta Business Corporations Act. The address of the principal place of business is 2000, 585 - 8th Ave S.W., Calgary, Alberta, Canada, T2P 1G1.

These interim consolidated financial statements were approved and authorized for issue by the Company's Board of Directors on May 9, 2024.

2.BASIS OF PREPARATION

These interim consolidated financial statements are presented under IFRS Accounting Standards as issued by the International Accounting Standards Board. These interim consolidated financial statements have been prepared in accordance with IFRS applicable to the preparation of interim consolidated financial statements, including International Accounting Standard (“IAS”) 34 Interim Financial Reporting and have been prepared following the same accounting policies as the annual consolidated financial statements for the year ended December 31, 2023. Certain information and disclosures included in the notes to the annual consolidated financial statements are condensed herein or are disclosed on an annual basis only. Accordingly, these interim consolidated financial statements should be read in conjunction with the annual consolidated financial statements for the year ended December 31, 2023.

The policies applied in these consolidated financial statements are based on IFRS Accounting Standards issued and outstanding as of May 9, 2024, the date the Board of Directors approved the statements.

The Company’s presentation currency is Canadian dollars and all amounts reported are Canadian dollars unless noted otherwise. References to “US$” and "US dollars" are to United States ("U.S.") dollars. Crescent Point's Canadian operations are presented herein as continuing operations. The Company's U.S. operations have been classified and presented as discontinued operations. See Note 7 - "Discontinued Operations" for additional information.

3.CHANGES IN ACCOUNTING POLICIES

Presentation of Financial Statements

IAS 1 Presentation of Financial Statements was amended in January 2020 by the International Accounting Standards Board to clarify the presentation requirements of liabilities as either current or non-current within the statement of financial position. The Company adopted this amendment in 2024 and the adoption did not have an impact on the Company's interim consolidated financial statements.

Income Taxes

IAS 12 Income Taxes was amended in May 2023 by the International Accounting Standards Board to provide guidance on deferred taxes arising in jurisdictions implementing the Pillar Two model rules published by the Organisation for Economic Co-operation and Development. This amendment was effective immediately and has been adopted by the Company with no impact to the Company's interim consolidated financial statements.

4.OTHER CURRENT ASSETS

At March 31, 2024, other current assets relates to deferred consideration receivable from capital dispositions of $90.2 million (December 31, 2023 - $79.2 million). Deferred consideration receivable includes US$60.0 million from the disposition of the Company's North Dakota assets, which will be settled in two equal installments due June 2024 and December 2024. Deferred consideration receivable also includes $9.0 million from the disposition of the Company's Southern Alberta assets. An additional $15.2 million is included in other long-term assets. Deferred consideration from the Southern Alberta disposition will be settled in monthly installments until paid in full. See Note 6 - "Capital Acquisitions and Dispositions" for additional information.

| | | | | |

| CRESCENT POINT ENERGY CORP. | 5 |

5.EXPLORATION AND EVALUATION ASSETS

| | | | | | | | | | | | | | |

($ millions) | March 31, 2024 | | December 31, 2023 (1) | |

Exploration and evaluation assets at cost | 1,532.4 | | | 1,578.6 | | |

Accumulated amortization | (1,001.1) | | | (971.6) | | |

Net carrying amount | 531.3 | | | 607.0 | | |

| | | | |

Reconciliation of movements during the period | | | | |

Cost, beginning of period | 1,578.6 | | | 1,453.4 | | |

Accumulated amortization, beginning of period | (971.6) | | | (1,349.2) | | |

Net carrying amount, beginning of period | 607.0 | | | 104.2 | | |

| | | | |

Net carrying amount, beginning of period | 607.0 | | | 104.2 | | |

Acquisitions through business combinations | — | | | 515.2 | | |

Additions | 9.8 | | | 224.8 | | |

Dispositions | — | | | (0.1) | | |

| Reclassified as assets held for sale | — | | | (1.8) | | |

Transfers to property, plant and equipment | (55.9) | | | (204.3) | | |

Amortization | (29.6) | | | (30.9) | | |

Foreign exchange | — | | | (0.1) | | |

Net carrying amount, end of period | 531.3 | | | 607.0 | | |

(1)Comparative period revised to reflect current period presentation.

Impairment test of exploration and evaluation assets

There were no indicators of impairment at March 31, 2024.

6.CAPITAL ACQUISITIONS AND DISPOSITIONS

In the three months ended March 31, 2024, the Company incurred $1.3 million (three months ended March 31, 2023 - $1.8 million) of total transaction costs related to acquisitions through business combinations and dispositions.

a) Major property dispositions

North Dakota disposition

In 2023, the Company completed the disposition of its producing North Dakota assets. In the three months ended March 31, 2024, the Company incurred $12.8 million in final closing adjustments related to the disposition. See Note 7 - "Discontinued Operations" for additional information.

Southern Alberta disposition

On January 26, 2024, the Company completed the disposition of its Southern Alberta assets for total consideration of $38.1 million, including interim closing adjustments. Total consideration consisted of $13.1 million in cash and $25.0 million of deferred consideration receivable. See Note 4 - "Other Current Assets" for additional information. These assets were recorded as assets held for sale at December 31, 2023.

Swan Hills disposition

On March 21, 2024, the Company completed the disposition of its Swan Hills assets in Northern Alberta for total consideration of $80.5 million, including interim closing adjustments. These assets were recorded as assets held for sale at December 31, 2023.

| | | | | |

| CRESCENT POINT ENERGY CORP. | 6 |

The following table summarizes the Company's capital dispositions:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ millions) | | | North Dakota Disposition | | Southern Alberta Disposition (1) | | Swan Hills Disposition (1) | | | | Other minor dispositions | |

| Cash | | | (12.8) | | | 13.1 | | | 80.5 | | | | | — | | |

| | | | | | | | | | | | |

Deferred consideration receivable (2) | | | — | | | 25.0 | | | — | | | | | — | | |

| Consideration (paid) received | | | (12.8) | | | 38.1 | | | 80.5 | | | | | — | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Property, plant and equipment | | | — | | | (129.5) | | | (117.5) | | | | | (0.1) | | |

| | | | | | | | | | | | |

| Goodwill | | | — | | | (3.7) | | | (2.9) | | | | | — | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Decommissioning liability | | | — | | | 92.4 | | | 39.9 | | | | | 0.1 | | |

| Derivative liability | | | — | | | — | | | 3.5 | | | | | — | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Carrying value of net assets disposed | | | — | | | (40.8) | | | (77.0) | | | | | — | | |

| | | | | | | | | | | | |

| Gain (loss) on capital dispositions | | | (12.8) | | | (2.7) | | | 3.5 | | | | | — | | |

(1)These assets were recorded as assets held for sale at December 31, 2023.

(2)See Note 4 - "Other Current Assets" for additional information on deferred consideration receivable.

b) Assets held for sale

At March 31, 2024, the Company classified certain non-core assets in its Southeast Saskatchewan and Southwest Saskatchewan cash-generating units ("CGUs") as held for sale. Upon classification, assets held for sale were recorded at their recoverable amount. The Company announced the disposition of these assets in May 2024. See Note 24 - "Subsequent Events" for additional information.

| | | | | | | | | | | | | | | | | |

($ millions) | | March 31, 2024 | | December 31, 2023 (1) | |

| Assets held for sale - PP&E | | 637.0 | | | 247.1 | | |

| Liabilities held for sale - Decommissioning liability | | (98.5) | | | (132.4) | | |

(1)Assets held for sale at December 31, 2023 were disposed of during the first quarter of 2024.

For additional information on the Company's assets and liabilities held for sale see Note 8 - "Property, Plant and Equipment" and Note 13 - "Decommissioning Liability", respectively.

| | | | | |

| CRESCENT POINT ENERGY CORP. | 7 |

7.DISCONTINUED OPERATIONS

In 2023, the Company completed the disposition of its North Dakota assets, which made up its Northern U.S. CGU. The Northern U.S. CGU represented a geographical area of the Company's operations, therefore, its results were classified as a discontinued operation in accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operations.

a) Results from discontinued operations

The following table summarizes the Company's financial results from discontinued operations:

| | | | | | | | | | | | | | | | | | |

| | | Three months ended March 31 | |

| (Cdn$ millions) | | | | | 2024 | | 2023 | |

| REVENUE AND OTHER INCOME | | | | | | | | |

| Oil and gas sales | | | | | — | | | 151.6 | | |

| Royalties | | | | | — | | | (38.5) | | |

| Oil and gas revenue | | | | | — | | | 113.1 | | |

| | | | | | | | |

| Other loss | | | | | (12.8) | | | — | | |

| | | | | (12.8) | | | 113.1 | | |

| EXPENSES | | | | | | | | |

| Operating | | | | | — | | | 23.4 | | |

| Transportation | | | | | — | | | 2.7 | | |

| General and administrative | | | | | — | | | 0.7 | | |

| | | | | | | | |

| | | | | | | | |

| Depletion, depreciation and amortization | | | | | — | | | 45.3 | | |

| | | | | | | | |

| Accretion and financing | | | | | — | | | 0.1 | | |

| | | | | — | | | 72.2 | | |

| Net income (loss) before tax from discontinued operations | | | | | (12.8) | | | 40.9 | | |

| | | | | | | | |

| Tax expense | | | | | | | | |

| Current | | | | | — | | | — | | |

| Deferred | | | | | — | | | 9.0 | | |

| Net income (loss) from discontinued operations | | | | | (12.8) | | | 31.9 | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

b) Cash flows from discontinued operations

The following table summarizes cash flows from discontinued operations reported in the consolidated statements of cash flows:

| | | | | | | | | | | | | | | | | | |

| | | Three months ended March 31 | |

| (Cdn$ millions) | | | | | 2024 | | 2023 | |

| Cash provided by (used in) discontinued operations | | | | | | | | |

| Operating activities | | | | | — | | | 103.6 | | |

| Investing activities | | | | | (12.8) | | | (119.6) | | |

| | | | | | | | |

| Decrease in cash from discontinued operations | | | | | (12.8) | | | (16.0) | | |

| | | | | |

| CRESCENT POINT ENERGY CORP. | 8 |

8.PROPERTY, PLANT AND EQUIPMENT

| | | | | | | | | | | | | | |

($ millions) | March 31, 2024 | | December 31, 2023 (1) | |

Development and production assets | 21,299.3 | | | 24,580.6 | | |

Corporate assets | 133.2 | | | 132.1 | | |

Property, plant and equipment at cost | 21,432.5 | | | 24,712.7 | | |

Accumulated depletion, depreciation and impairment | (11,688.6) | | | (13,994.4) | | |

Net carrying amount | 9,743.9 | | | 10,718.3 | | |

| | | | |

Reconciliation of movements during the period | | | | |

Development and production assets | | | | |

Cost, beginning of period | 24,580.6 | | | 22,340.0 | | |

Accumulated depletion and impairment, beginning of period | (13,901.4) | | | (14,651.8) | | |

Net carrying amount, beginning of period | 10,679.2 | | | 7,688.2 | | |

| | | | |

Net carrying amount, beginning of period | 10,679.2 | | | 7,688.2 | | |

| | | | |

Acquisitions through business combinations | — | | | 4,348.6 | | |

Additions | 399.0 | | | 1,025.8 | | |

Dispositions | (0.1) | | | (26.9) | | |

Transfers from exploration and evaluation assets | 55.9 | | | 204.3 | | |

Reclassified as assets held for sale | (637.0) | | | (729.5) | | |

Depletion | (304.3) | | | (1,009.3) | | |

Impairment | (486.8) | | | (822.2) | | |

Foreign exchange | (0.1) | | | 0.2 | | |

Net carrying amount, end of period | 9,705.8 | | | 10,679.2 | | |

| | | | |

Cost, end of period | 21,299.3 | | | 24,580.6 | | |

Accumulated depletion and impairment, end of period | (11,593.5) | | | (13,901.4) | | |

Net carrying amount, end of period | 9,705.8 | | | 10,679.2 | | |

| | | | |

Corporate assets | | | | |

Cost, beginning of period | 132.1 | | | 126.2 | | |

Accumulated depreciation, beginning of period | (93.0) | | | (85.0) | | |

Net carrying amount, beginning of period | 39.1 | | | 41.2 | | |

| | | | |

Net carrying amount, beginning of period | 39.1 | | | 41.2 | | |

Additions | 1.1 | | | 5.9 | | |

Depreciation | (2.1) | | | (8.0) | | |

| | | | |

Net carrying amount, end of period | 38.1 | | | 39.1 | | |

| | | | |

Cost, end of period | 133.2 | | | 132.1 | | |

Accumulated depreciation, end of period | (95.1) | | | (93.0) | | |

Net carrying amount, end of period | 38.1 | | | 39.1 | | |

(1)Comparative period revised to reflect current period presentation.

Direct general and administrative costs capitalized by the Company during the three months ended March 31, 2024, were $13.6 million (year ended December 31, 2023 - $42.4 million), including $3.2 million of share-based compensation costs (year ended December 31, 2023 - $5.7 million).

| | | | | |

| CRESCENT POINT ENERGY CORP. | 9 |

Assets Held for Sale

At March 31, 2024, the Company classified certain non-core assets in its Southeast Saskatchewan and Southwest Saskatchewan CGUs as held for sale. Immediately prior to classifying the assets as held for sale, the Company conducted a review of the assets' recoverable amounts and recorded an impairment loss of $486.8 million on Property, Plant & Equipment ("PP&E"). The recoverable amount was determined based on the assets' fair value less costs of disposal and based on expected consideration. The Company announced the disposition of these assets in May 2024. See Note 24 - "Subsequent Events" for additional information.

Impairment test of property, plant and equipment

At March 31, 2024, there were no indicators of impairment or impairment reversal on its remaining PP&E.

9.GOODWILL

| | | | | | | | | | | | | | |

($ millions) | March 31, 2024 | | December 31, 2023 | |

| Goodwill, beginning of period | 275.9 | | | 203.9 | | |

| Hammerhead acquisition | — | | | 72.6 | | |

| Impairment | (25.5) | | | — | | |

| Southern Alberta disposition | (3.7) | | | — | | |

| Swan Hills disposition | (2.9) | | | — | | |

| Other dispositions | — | | | (0.6) | | |

| | | | |

| Goodwill, end of period | 243.8 | | | 275.9 | | |

Goodwill has been assigned to the Canadian operating segment.

At March 31, 2024, the Company classified certain non-core assets in the Canadian operating segment as held for sale. Immediately prior to classifying the assets as held for sale, the Company conducted a review of the assets' recoverable amounts and recorded an impairment loss of $25.5 million related to goodwill. The Company announced the disposition of these assets in May 2024. See Note 6 - "Capital Acquisitions and Dispositions" and Note 24 - "Subsequent Events" for additional information.

10.OTHER CURRENT LIABILITIES

| | | | | | | | | | | | | | |

($ millions) | March 31, 2024 | | December 31, 2023 | |

Long-term compensation liability | 27.0 | | | 37.5 | | |

Lease liability | 36.9 | | | 40.5 | | |

| Decommissioning liability | 42.7 | | | 40.0 | | |

Other current liabilities | 106.6 | | | 118.0 | | |

11.LONG-TERM DEBT

| | | | | | | | | | | | | | |

| ($ millions) | March 31, 2024 | | December 31, 2023 | |

| Revolving bank debt | 1,969.7 | | | 1,932.9 | | |

| Bank term loan | 718.7 | | | 750.0 | | |

| Senior guaranteed notes | 902.8 | | | 883.4 | | |

| Long-term debt | 3,591.2 | | | 3,566.3 | | |

Long-term debt due within one year | 388.5 | | | 380.0 | | |

| Long-term debt due beyond one year | 3,202.7 | | | 3,186.3 | | |

Bank debt

Revolving bank debt

At March 31, 2024, the Company had total combined revolving bank credit facilities of $2.82 billion. This includes a $2.26 billion unsecured syndicated credit facility and a $100.0 million unsecured operating facility, both with a maturity date of November 26, 2026, and are extendible annually. The Company also has an additional $400.0 million unsecured syndicated credit facility that matures on May 10, 2025, and a $60.0 million unsecured demand letter of credit facility.

The credit facilities have covenants which restrict the Company's ratio of senior debt to adjusted EBITDA to a maximum of 3.5:1.0, the ratio of total debt to adjusted EBITDA to a maximum of 4.0:1.0 and the ratio of senior debt to capital, adjusted for certain non-cash items as noted above, to a maximum of 0.55:1.0. The Company was in compliance with all debt covenants at March 31, 2024.

The Company had letters of credit in the amount of $39.7 million outstanding at March 31, 2024 (December 31, 2023 - $26.2 million).

| | | | | |

| CRESCENT POINT ENERGY CORP. | 10 |

Bank term loan

At March 31, 2024, the Company had $718.7 million outstanding under its syndicated bank term loan. The term loan matures on November 26, 2026, and has financial covenants similar to those of the revolving credit facilities described above.

Senior guaranteed notes

At March 31, 2024, the Company had senior guaranteed notes of US$589.5 million and Cdn$105.0 million outstanding. The notes are unsecured and rank pari passu with the Company's bank credit facilities and carry a bullet repayment on maturity. The senior guaranteed notes have financial covenants similar to those of the combined bank credit facilities described above.

Concurrent with the issuance of senior guaranteed notes with total principal of US$517.0 million, the Company entered into cross currency swaps ("CCS") to manage the Company's foreign exchange risk. The CCS fix the US dollar amount of the individual tranches of notes for purposes of interest and principal repayments at a notional amount of $606.9 million. See Note 21 - "Financial Instruments and Derivatives" for additional information.

The following table summarizes the Company's senior guaranteed notes:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Principal ($ millions) | Coupon Rate | Hedged Principal (1) (Cdn$ millions) | Unhedged Principal (2) (Cdn$ millions) | Interest Payment Dates | Maturity Date | Financial statement carrying value |

| March 31, 2024 | | December 31, 2023 | |

| Cdn$40.0 | 3.85 | % | 40.0 | | — | | December 20 and June 20 | June 20, 2024 | 40.0 | | | 40.0 | | |

| US$257.5 | 3.75 | % | 276.4 | | — | | December 20 and June 20 | June 20, 2024 | 348.5 | | | 340.0 | | |

| US$82.0 | 4.30 | % | 67.9 | | 40.6 | | October 11 and April 11 | April 11, 2025 | 111.0 | | | 108.3 | | |

| Cdn$65.0 | 3.94 | % | 65.0 | | — | | October 22 and April 22 | April 22, 2025 | 65.0 | | | 65.0 | | |

| US$230.0 | 4.08 | % | 262.6 | | 30.4 | | October 22 and April 22 | April 22, 2025 | 311.2 | | | 303.7 | | |

| US$20.0 | 4.18 | % | — | | 27.1 | | October 22 and April 22 | April 22, 2027 | 27.1 | | | 26.4 | | |

| Senior guaranteed notes | 711.9 | | 98.1 | | | | 902.8 | | | 883.4 | | |

| Due within one year | 316.4 | | — | | | | 388.5 | | | 380.0 | | |

| Due beyond one year | 395.5 | | 98.1 | | | | 514.3 | | | 503.4 | | |

(1)Includes underlying derivatives which fix the Company's foreign exchange exposure on its US dollar senior guaranteed notes or represents the Canadian dollar principal on Canadian dollar denominated senior guaranteed notes.

(2)Includes the principal balance translated at the period end foreign exchange rate on US dollar senior guaranteed notes that do not have underlying CCS.

12.LEASES

Right-of-use asset

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ millions) | Office (1) | | Fleet Vehicles | | Equipment | | Total | |

| Right-of-use asset at cost | 124.8 | | | 37.2 | | | 38.2 | | | 200.2 | | |

| Accumulated depreciation | (67.7) | | | (24.6) | | | (13.6) | | | (105.9) | | |

| Net carrying amount | 57.1 | | | 12.6 | | | 24.6 | | | 94.3 | | |

| | | | | | | | |

Reconciliation of movements during the period | | | | | | | | |

| Cost, beginning of period | 124.8 | | | 37.2 | | | 38.6 | | | 200.6 | | |

| Accumulated depreciation, beginning of period | (65.1) | | | (23.0) | | | (9.7) | | | (97.8) | | |

| Net carrying amount, beginning of period | 59.7 | | | 14.2 | | | 28.9 | | | 102.8 | | |

| | | | | | | | |

| Net carrying amount, beginning of period | 59.7 | | | 14.2 | | | 28.9 | | | 102.8 | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Dispositions | — | | | — | | | (0.4) | | | (0.4) | | |

| Depreciation | (2.6) | | | (1.6) | | | (3.9) | | | (8.1) | | |

| | | | | | | | |

| | | | | | | | |

| Net carrying amount, end of period | 57.1 | | | 12.6 | | | 24.6 | | | 94.3 | | |

(1)A portion of the Company's office space is subleased. During the three months ended March 31, 2024, the Company recorded sublease income of $0.7 million (three months ended March 31, 2023 - $1.1 million) as a component of other income.

| | | | | |

| CRESCENT POINT ENERGY CORP. | 11 |

Lease liability

| | | | | | | | | | | | | | |

| ($ millions) | March 31, 2024 | | December 31, 2023 | |

Lease liability, beginning of period | 144.7 | | | 124.1 | | |

| Acquisitions through business combinations | — | | | 4.3 | | |

| Additions | — | | | 38.2 | | |

| Dispositions | (0.2) | | | — | | |

| Reclassified as liabilities associated with assets held for sale | — | | | (1.1) | | |

| Financing | 1.9 | | | 5.2 | | |

Payments on lease liability | (10.5) | | | (26.0) | | |

| | | | |

| | | | |

| | | | |

| Lease liability, end of period | 135.9 | | | 144.7 | | |

| Expected to be incurred within one year | 36.9 | | | 40.5 | | |

| Expected to be incurred beyond one year | 99.0 | | | 104.2 | | |

The undiscounted cash flows relating to the lease liability are as follows:

| | | | | | | | |

| ($ millions) | March 31, 2024 | |

1 year | 42.5 | | |

| 2 to 3 years | 53.0 | | |

| 4 to 5 years | 34.9 | | |

More than 5 years | 20.9 | | |

Total (1) | 151.3 | | |

(1)Includes both the principal and amounts representing financing.

13.DECOMMISSIONING LIABILITY

Upon retirement of its oil and gas assets, the Company anticipates incurring substantial costs associated with decommissioning. The estimated cash flows have been discounted using a risk-free rate of 3.34 percent and a derived inflation rate of 1.84 percent (December 31, 2023 - risk-free rate of 3.02 percent and inflation rate of 1.62 percent).

| | | | | | | | | | | | | | |

($ millions) | March 31, 2024 | | December 31, 2023 (1) | |

Decommissioning liability, beginning of period | 606.4 | | | 675.5 | | |

| | | | |

Liabilities incurred | 2.7 | | | 19.8 | | |

Liabilities acquired through capital acquisitions | — | | | 40.1 | | |

Liabilities disposed through capital dispositions | (0.1) | | | (4.1) | | |

Liabilities settled (2) | (7.3) | | | (45.4) | | |

Revaluation of acquired decommissioning liabilities (3) | — | | | 38.5 | | |

Change in estimates | — | | | (3.0) | | |

Change in discount and inflation rate estimates | (10.7) | | | (19.6) | | |

Accretion | 4.9 | | | 22.7 | | |

| | | | |

Reclassified as liabilities associated with assets held for sale | (98.5) | | | (118.1) | | |

| | | | |

Decommissioning liability, end of period | 497.4 | | | 606.4 | | |

Expected to be incurred within one year | 42.7 | | | 40.0 | | |

Expected to be incurred beyond one year | 454.7 | | | 566.4 | | |

(1)Comparative period revised to reflect current period presentation.

(2)Includes nil received from government grant programs during the three months ended March 31, 2024 (year ended December 31, 2023 - $5.4 million).

(3)These amounts relate to the revaluation of acquired decommissioning liabilities at the end of the period using a risk-free discount rate. At the date of acquisition, acquired decommissioning liabilities are fair valued.

| | | | | |

| CRESCENT POINT ENERGY CORP. | 12 |

14.SHAREHOLDERS' CAPITAL

Crescent Point has an unlimited number of common shares authorized for issuance.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 | |

| Number of shares | | Amount ($ millions) | | Number of shares | | Amount ($ millions) | |

Common shares, beginning of period | 619,929,490 | | | 17,324.6 | | | 550,888,983 | | | 16,675.8 | | |

| | | | | | | | |

Issued on capital acquisition | — | | | — | | | 53,202,339 | | | 493.0 | | |

| Issued for cash | — | | | — | | | 48,550,000 | | | 500.1 | | |

Issued on redemption of restricted shares | — | | | — | | | 1,436,017 | | | 4.9 | | |

| Issued on exercise of stock options | 20,894 | | | 0.1 | | | 464,051 | | | 0.7 | | |

Common shares repurchased for cancellation | (923,100) | | | (10.0) | | | (34,611,900) | | | (349.9) | | |

| | | | | | | | |

Common shares, end of period | 619,027,284 | | | 17,314.7 | | | 619,929,490 | | | 17,324.6 | | |

Cumulative share issue costs, net of tax | — | | | (272.0) | | | — | | | (271.9) | | |

Total shareholders’ capital, end of period | 619,027,284 | | | 17,042.7 | | | 619,929,490 | | | 17,052.7 | | |

Normal Course Issuer Bids ("NCIBs")

On March 7, 2024, the Company announced the approval by the Toronto Stock Exchange of its notice to implement a NCIB. The NCIB allows the Company to purchase, for cancellation, up to 61,663,522 common shares, or 10 percent of the Company's public float, as at February 29, 2024. The NCIB commenced on March 11, 2024 and is due to expire on March 10, 2025. The Company's previous NCIB commenced on March 9, 2023 and expired on March 8, 2024.

During the three months ended March 31, 2024, the Company purchased 0.9 million common shares for total consideration of $10.0 million under its current NCIB. The total cost paid, including commissions and fees, was recognized directly as a reduction in shareholders' equity. Under the NCIB, all common shares purchased are cancelled.

15.DEFICIT

| | | | | | | | | | | | | | |

| ($ millions) | March 31, 2024 | | December 31, 2023 | |

Accumulated earnings (deficit) | (2,542.0) | | | (2,130.3) | | |

Accumulated gain on shares issued pursuant to DRIP (1) and SDP (2) | 8.4 | | | 8.4 | | |

Accumulated tax effect on redemption of restricted shares | 18.2 | | | 18.2 | | |

Accumulated dividends | (8,170.1) | | | (8,098.8) | | |

| Deficit | (10,685.5) | | | (10,202.5) | | |

(1)Premium Dividend TM and Dividend Reinvestment Plan – suspended in 2015.

(2)Share Dividend Plan – suspended in 2015.

16.CAPITAL MANAGEMENT

| | | | | | | | | | | | | | |

| ($ millions) | March 31, 2024 | | December 31, 2023 | |

Long-term debt (1) | 3,591.2 | | | 3,566.3 | | |

Adjusted working capital deficiency (2) | 82.0 | | | 196.3 | | |

| Unrealized foreign exchange on translation of hedged US dollar long-term debt | (90.3) | | | (24.5) | | |

| Net debt | 3,582.9 | | | 3,738.1 | | |

| Shareholders’ equity | 6,375.9 | | | 6,867.5 | | |

| Total capitalization | 9,958.8 | | | 10,605.6 | | |

(1)Includes current portion of long-term debt.

(2)Adjusted working capital deficiency is calculated as accounts payable and accrued liabilities, dividends payable and long-term compensation liability net of equity derivative contracts, less cash, accounts receivable, prepaids and deposits, and deferred consideration receivable.

| | | | | |

| CRESCENT POINT ENERGY CORP. | 13 |

The following table reconciles cash flow from operating activities to adjusted funds flow from operations for the three months ended March 31, 2024 and March 31, 2023:

| | | | | | | | | | | | | | |

| ($ millions) | March 31, 2024 | | March 31, 2023 | |

| Cash flow from operating activities | 411.2 | | | 473.4 | | |

Changes in non-cash working capital | 148.4 | | | 39.8 | | |

| Transaction costs | 1.3 | | | 1.8 | | |

| Decommissioning expenditures | 7.3 | | | 9.9 | | |

| Adjusted funds flow from operations | 568.2 | | | 524.9 | | |

Crescent Point's objective for managing its capital structure is to maintain a strong balance sheet and capital base to provide financial flexibility, position the Company to fund future development projects and provide returns to shareholders.

Crescent Point manages its capital structure and short-term financing requirements using a measure not defined in IFRS Accounting Standards, or standardized, the ratio of net debt to adjusted funds flow from operations. Net debt to adjusted funds flow from operations is used to measure the Company's overall debt position and to measure the strength of the Company's balance sheet and may not be comparable to similar financial measures disclosed by other issuers. Crescent Point's objective is to manage this metric to be well positioned to execute its business objectives during periods of volatile commodity prices. Crescent Point monitors this ratio and uses it as a key measure in capital allocation decisions including capital spending levels, returns to shareholders including dividends and share repurchases, and financing considerations. The Company's net debt to adjusted funds flow from operations ratio for the trailing four quarters at March 31, 2024 was 1.5 times (December 31, 2023 - 1.6 times).

Crescent Point is subject to certain financial covenants on its credit facilities and senior guaranteed notes agreements and was in compliance with all financial covenants as at March 31, 2024. See Note 11 - "Long-term Debt" for additional information regarding the Company's financial covenant requirements.

Crescent Point retains financial flexibility with liquidity on its credit facilities. The Company continuously monitors the commodity price environment and manages its counterparty exposure to mitigate credit losses and protect its balance sheet.

17.COMMODITY DERIVATIVE GAINS (LOSSES)

| | | | | | | | | | | | | | | | | | |

| | | Three months ended March 31 | |

($ millions) | | | | | 2024 | | 2023 | |

Realized gains (losses) | | | | | 4.5 | | | (7.4) | | |

Unrealized gains (losses) | | | | | (217.8) | | | 20.6 | | |

Commodity derivative gains (losses) | | | | | (213.3) | | | 13.2 | | |

18.INTEREST EXPENSE

| | | | | | | | | | | | | | | | | | |

| | | Three months ended March 31 | |

($ millions) | | | | | 2024 | | 2023 | |

Interest expense on long-term debt | | | | | 61.3 | | | 16.1 | | |

| Unrealized gain on interest derivative contracts | | | | | (0.5) | | | (0.1) | | |

Interest expense | | | | | 60.8 | | | 16.0 | | |

19.FOREIGN EXCHANGE GAIN

| | | | | | | | | | | | | | | | | | |

| | | Three months ended March 31 | |

($ millions) | | | | | 2024 | | 2023 | |

| Realized loss on CCS - principal | | | | | (2.4) | | | (0.3) | | |

| Translation of US dollar long-term debt | | | | | (65.8) | | | 0.9 | | |

| Unrealized gain on CCS - principal and foreign exchange swaps | | | | | 64.3 | | | 2.9 | | |

| Other | | | | | 5.7 | | | (0.5) | | |

| Foreign exchange gain | | | | | 1.8 | | | 3.0 | | |

| | | | | |

| CRESCENT POINT ENERGY CORP. | 14 |

20.SHARE-BASED COMPENSATION

The following table reconciles the number of restricted shares, Employee Share Value Plan ("ESVP") awards, Performance Share Units ("PSUs") and Deferred Share Units ("DSUs") for the three months ended March 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Restricted Shares | | ESVP | | PSUs (1) | | DSUs | |

Balance, beginning of period | 1,380,685 | | | 2,660,066 | | | 1,623,248 | | | 1,728,423 | | |

Granted | — | | | 148,614 | | | 1,221,275 | | | 29,166 | | |

| | | | | | | | |

Redeemed | — | | | (2,656) | | | — | | | — | | |

Forfeited | — | | | (46,393) | | | — | | | — | | |

| | | | | | | | |

Balance, end of period | 1,380,685 | | | 2,759,631 | | | 2,844,523 | | | 1,757,589 | | |

(1)Based on underlying units before any effect of performance multipliers.

The following tables summarize information regarding stock options outstanding as at March 31, 2024:

| | | | | | | | | | | | | | |

| Stock options (number of units) | | Weighted average exercise price ($) | |

Balance, beginning of period | 3,224,260 | | | 4.74 | | |

| | | | |

Exercised | (21,000) | | | 3.83 | | |

| | | | |

| | | | |

Balance, end of period | 3,203,260 | | | 4.74 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Range of exercise prices ($) | | Number of stock options outstanding | | Weighted average remaining term for stock options outstanding (years) | | Weighted average exercise price per share for stock options outstanding ($) | | Number of stock options exercisable | | Weighted average exercise price per share for stock options exercisable ($) | |

| 1.09 - 1.65 | | 1,540,362 | | | 3.00 | | 1.09 | | | 504,996 | | | 1.09 | | |

| 1.66 - 5.45 | | 573,769 | | | 3.19 | | 4.71 | | | 303,744 | | | 4.31 | | |

| 5.46 - 9.86 | | 99,598 | | | 1.57 | | 8.64 | | | 99,598 | | | 8.64 | | |

| 9.87 - 10.06 | | 989,531 | | | 0.77 | | 10.06 | | | 989,531 | | | 10.06 | | |

| | 3,203,260 | | | 2.30 | | 4.74 | | | 1,897,869 | | | 6.68 | | |

| | | | | | | | | | | |

The volume weighted average trading price of the Company's common shares was $9.60 per share during the three months ended March 31, 2024.

21.FINANCIAL INSTRUMENTS AND DERIVATIVES

The Company's financial assets and liabilities are comprised of cash, accounts receivable, deferred consideration receivable, derivative assets and liabilities, accounts payable and accrued liabilities, dividends payable and long-term debt.

a) Carrying amount and fair value of financial instruments

The fair value of cash, accounts receivable, accounts payable and accrued liabilities and dividends payable approximate their carrying amount due to the short-term nature of those instruments. The fair value of the amounts drawn on bank debt is equal to its carrying amount as the facilities and term loan bear interest at floating rates and credit spreads that are indicative of market rates. These financial instruments are classified as financial assets and liabilities at amortized cost and are reported at amortized cost.

A portion of the deferred consideration receivable is short-term in nature and its fair value approximates its carrying value. The remaining portion of the deferred consideration receivable bears interest. Both receivables are classified as financial assets at amortized cost and reported at amortized cost.

Crescent Point's derivative assets and liabilities are transacted in active markets, classified as financial assets and liabilities at fair value through profit or loss and fair valued at each period with the resulting gain or loss recorded in net income.

At March 31, 2024, the senior guaranteed notes had a carrying value of $902.8 million and a fair value of $888.1 million (December 31, 2023 - $883.4 million and $853.0 million, respectively).

Derivative assets and liabilities

Derivative assets and liabilities arise from the use of derivative contracts. Crescent Point's derivative assets and liabilities are classified as Level 2 with values based on inputs including quoted forward prices for commodities, time value and volatility factors. Accordingly, the Company's derivative financial instruments are classified as fair value through profit or loss and are reported at fair value with changes in fair value recorded in net income.

| | | | | |

| CRESCENT POINT ENERGY CORP. | 15 |

The following table summarizes the fair value as at March 31, 2024 and the change in fair value for the three months ended March 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ millions) | Commodity (1) | | Interest (2) | | Foreign exchange (3) | | Equity | | | | Total | |

| Derivative assets, beginning of period | 173.5 | | | 3.3 | | | 21.4 | | | 1.6 | | | | | 199.8 | | |

| | | | | | | | | | | | |

| Dispositions | 3.5 | | | — | | | — | | | — | | | | | 3.5 | | |

| Unrealized change in fair value | (217.8) | | | 0.5 | | | 64.3 | | | 0.1 | | | | | (152.9) | | |

| | | | | | | | | | | | |

Foreign exchange | 1.1 | | | — | | | — | | | — | | | | | 1.1 | | |

| Derivative assets (liabilities), end of period | (39.7) | | | 3.8 | | | 85.7 | | | 1.7 | | | | | 51.5 | | |

| | | | | | | | | | | | |

| Derivative assets, end of period | 41.0 | | | 3.8 | | | 90.0 | | | 1.7 | | | | | 136.5 | | |

| Derivative liabilities, end of period | (80.7) | | | — | | | (4.3) | | | — | | | | | (85.0) | | |

(1)Includes crude oil, crude oil differentials, natural gas and natural gas differential contracts.

(2)Interest payments on CCS.

(3)Includes principal portion of CCS and foreign exchange contracts.

b) Risks associated with financial assets and liabilities

The Company is exposed to financial risks from its financial assets and liabilities. The financial risks include market risk relating to commodity prices, interest rates, foreign exchange rates and equity price as well as credit and liquidity risk.

Commodity price risk

The Company is exposed to commodity price risk on crude oil and condensate, NGLs and natural gas revenues. To manage a portion of this risk, the Company has entered into various derivative agreements.

The following table summarizes the unrealized gains (losses) on the Company's commodity financial derivative contracts and the resulting impact on income before tax due to fluctuations in commodity prices or differentials, with all other variables held constant:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| ($ millions) | March 31, 2024 | | March 31, 2023 | |

| Increase 10% | | Decrease 10% | | Increase 10% | | Decrease 10% | |

| Commodity price | | | | | | | | |

| Crude oil | (133.1) | | | 109.1 | | | (22.4) | | | 25.5 | | |

| Natural gas | (25.5) | | | 25.7 | | | (5.2) | | | 5.2 | | |

| | | | | | | | |

| Differential | | | | | | | | |

| Crude oil | — | | | — | | | 0.8 | | | (0.8) | | |

| Natural gas | 15.0 | | | (15.0) | | | 2.5 | | | (2.5) | | |

Interest rate risk

The Company is exposed to interest rate risk on amounts drawn on its bank debt to the extent of changes in market interest rates. Based on the Company's floating rate debt position, as at March 31, 2024, a 1 percent increase or decrease in the interest rate on floating rate debt would amount to an impact on income before tax of $6.7 million for the three months ended March 31, 2024 (three months ended March 31, 2023 - $0.3 million).

Foreign exchange risk

The Company is exposed to foreign exchange risk in relation to its US dollar denominated long-term debt, US dollar denominated working capital, US dollar denominated commodity derivative contracts, investment in its U.S. subsidiary and on a portion of its commodity sales. Crescent Point utilizes foreign exchange derivatives to hedge its foreign exchange exposure on its US dollar denominated long-term debt. To reduce foreign exchange risk relating to commodity sales, the Company utilizes a combination of foreign exchange swaps and fixed price WTI crude oil contracts that settle in Canadian dollars.

The following table summarizes the resulting unrealized gains (losses) impacting income before tax due to the respective changes in the period end and applicable foreign exchange rates, with all other variables held constant:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

($ millions) | Exchange Rate | March 31, 2024 | | March 31, 2023 | |

Cdn$ relative to US$ | | Increase 10% | | Decrease 10% | | Increase 10% | | Decrease 10% | |

US dollar long-term debt | Period End | 263.6 | | | (263.6) | | | 124.6 | | | (124.6) | | |

Cross currency swaps | Forward | (254.9) | | | 254.9 | | | (125.3) | | | 125.3 | | |

| Foreign exchange swaps | Forward | 14.1 | | | (14.1) | | | 1.7 | | | (1.7) | | |

| | | | | |

| CRESCENT POINT ENERGY CORP. | 16 |

Equity price risk

The Company is exposed to equity price risk on its own share price in relation to certain share-based compensation plans detailed in Note 20 - "Share-based Compensation". The Company has entered into total return swaps to mitigate its exposure to fluctuations in its share price by fixing the future settlement cost on a portion of its cash settled plans.

The following table summarizes the unrealized gains (losses) on the Company's equity derivative contracts and the resulting impact on income before tax due to the respective changes in the applicable share price, with all other variables held constant:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

($ millions) | March 31, 2024 | | March 31, 2023 (1) | |

Share price | Increase 25% | | Decrease 25% | | Increase 25% | | Decrease 25% | |

Total return swaps | 7.0 | | | (7.0) | | | 3.6 | | | (3.6) | | |

(1)Comparative period revised to reflect current period presentation.

Credit risk

The Company is exposed to credit risk in relation to its physical oil and gas sales, financial counterparty and joint venture receivables. A substantial portion of the Company's accounts receivable are with customers in the oil and gas industry and are subject to normal industry credit risks. To mitigate credit risk associated with its physical sales portfolio, Crescent Point obtains financial assurances such as parental guarantees, letters of credit, prepayments and third party credit insurance. Including these assurances, approximately 99 percent of the Company's oil and gas sales are with entities considered investment grade.

At March 31, 2024, approximately 3 percent (December 31, 2023 - 4 percent) of the Company's accounts receivable balance was outstanding for more than 90 days and the Company's average expected credit loss was 0.97 percent (December 31, 2023 - 0.83 percent) on a portion of the Company’s accounts receivable balance relating to joint venture receivables.

Liquidity risk

The Company manages its liquidity risk through managing its capital structure and continuously monitoring forecast cash flows and available credit under existing banking facilities as well as other potential sources of capital.

At March 31, 2024, the Company had available unused borrowing capacity on bank credit facilities of approximately $796.0 million, including cash of $21.8 million.

c) Derivative contracts

The following is a summary of the derivative contracts in place as at March 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Financial WTI Crude Oil Derivative Contracts – Canadian Dollar (1) |

| Swap | | Collar | | | | | |

| Term | Volume (bbls/d) | | Average Price ($/bbl) | | Volumes (bbls/d) | | Average

Sold

Call Price

($/bbl) | | Average Bought Put Price ($/bbl) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

April 2024 - December 2024 (2) | 19,336 | | | 102.17 | | | 30,304 | | | 112.98 | | | 97.21 | | | | | | | | | | | | | | |

| January 2025 - March 2025 | 6,000 | | | 95.82 | | | 4,000 | | | 105.42 | | | 95.42 | | | | | | | | | | | | | | |

(1)The volumes and prices reported are the weighted average volumes and prices for the period.

(2)Includes 5,000 bbls/d which can be extended at the option of the counterparty for the second half of 2024 at an average swap price of $102.68/bbl and 6,000 bbls/d which can be extended at the option of the counterparty for the first half of 2025 at an average swap price of $101.11/bbl.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Financial WTI Crude Oil Differential Derivative Contracts – Canadian Dollar (1) |

| Term | Volume (bbls/d) | | Contract | | Basis | | Fixed Differential ($/bbl) | |

| | | | | | | | |

| October 2024 - December 2024 | 1,500 | | | Basis Swap | | MSW (2) | | (3.58) | | |

(1)The volumes and prices reported are the weighted average volumes and prices for the period.

(2)MSW refers to Mixed Sweet Blend crude oil differential.

| | | | | | | | | | | | | | | | | | |

Financial AECO Natural Gas Derivative Contracts – Canadian Dollar (1) | | | | | |

| Swap | | | |

| Volume (GJ/d) | | Average Price ($/GJ) | | | | | |

| Term | | | |

| April 2024 - October 2024 | 32,000 | | | 3.12 | | | | | | |

| | | | | | | | |

(1)The volumes and prices reported are the weighted average volumes and prices for the period.

| | | | | |

| CRESCENT POINT ENERGY CORP. | 17 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Financial NYMEX Natural Gas Derivative Contracts – US Dollar (1) | | | | | | | | |

| Swap | | Collar | | | |

| Term | Volume

(mmbtu/d) | | Average Price

(US$/mmbtu) | | Volume

(mmbtu/d) | | Average Sold Call Price (US$/mmbtu) | | Average Bought Put Price (US$/mmbtu) | | | | | | | | | |

| April 2024 - December 2024 | 32,691 | | | 3.45 | | | 60,000 | | | 4.21 | | | 3.14 | | | | | | | | | | |

| January 2025 - December 2025 | 51,000 | | | 3.43 | | | 65,000 | | | 3.92 | | | 3.32 | | | | | | | | | | |

(1)The volumes and prices reported are the weighted average volumes and prices for the period.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Financial NYMEX Natural Gas Differential Derivative Contracts – US Dollar (1) |

| Term | Volume

(mmbtu/d) | | Contract | | Basis | | Fixed Differential

(US$/mmbtu) | |

| April 2024 - December 2024 | 178,771 | | | Basis Swap | | AECO | | (1.11) | | |

| January 2025 - December 2025 | 193,000 | | | Basis Swap | | AECO | | (1.11) | | |

| | | | | | | | |

| | | | | | | | |

(1)The volumes and prices reported are the weighted average volumes and prices for the period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Cross Currency Derivative Contracts | | | | | |

| Term | Contract | Receive Notional Principal (US$ millions) | | Fixed Rate (US%) | | Pay Notional Principal (Cdn$ millions) | | Fixed Rate (Cdn%) | |

| April 2024 | Swap | 786.0 | | | 7.12 | | | 1,061.5 | | | 6.71 | | |

| April 2024 - May 2024 | Swap | 572.0 | | | 7.12 | | | 778.2 | | | 6.72 | | |

| | | | | | | | | |

| April 2024 - June 2024 | Swap | 257.5 | | | 3.75 | | | 276.4 | | | 4.03 | | |

| April 2024 - April 2025 | Swap | 52.0 | | | 4.30 | | | 67.9 | | | 3.98 | | |

| April 2024 - April 2025 | Swap | 207.5 | | | 4.08 | | | 262.6 | | | 4.13 | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Financial Foreign Exchange Forward Derivative Contracts |

| Settlement Date | Contract | Receive Currency | | Receive Notional Principal

($ millions) | | Pay

Currency | | Pay Notional Principal ($ millions) | |

| April 2024 | Swap | US$ | | 15.0 | | | Cdn$ | | 20.3 | | |

| April 2024 | Swap (1) | Cdn$ | | 81.2 | | | US$ | | 60.0 | | |

| June 2024 | Swap | Cdn$ | | 40.5 | | | US$ | | 30.0 | | |

| December 2024 | Swap | Cdn$ | | 40.5 | | | US$ | | 30.0 | | |

(1)Based on an average floating exchange rate.

| | | | | | | | | | | | | | | | | | | | |

Financial Equity Derivative Contracts | | | Notional Principal ($ millions) | | Number of shares | |

Term | Contract | | | |

| | | | | | |

| April 2024 - March 2025 | Swap | | 17.1 | | 1,676,910 | |

| April 2024 - March 2026 | Swap | | 9.3 | | 855,519 | |

| | | | | |

| CRESCENT POINT ENERGY CORP. | 18 |

22.SUPPLEMENTAL DISCLOSURES

Cash flow statement presentation

| | | | | | | | | | | | | | | | | | |

| | | Three months ended March 31 | |

| ($ millions) | | | | | 2024 | | 2023 | |

| Operating activities | | | | | | | | |

Changes in non-cash working capital: | | | | | | | | |

Accounts receivable | | | | | (33.9) | | | (39.8) | | |

Prepaids and deposits | | | | | (2.8) | | | 4.0 | | |

Accounts payable and accrued liabilities | | | | | (103.4) | | | (2.3) | | |

Other current liabilities | | | | | (10.3) | | | 8.5 | | |

Other long-term liabilities | | | | | 2.0 | | | (10.2) | | |

| | | | | (148.4) | | | (39.8) | | |

Investing activities | | | | | | | | |

Changes in non-cash working capital: | | | | | | | | |

Accounts receivable | | | | | 2.6 | | | 1.6 | | |

| Other current assets | | | | | (11.0) | | | (49.3) | | |

| | | | | | | | |

Accounts payable and accrued liabilities | | | | | 58.9 | | | 7.1 | | |

| | | | | 50.5 | | | (40.6) | | |

| Financing activities | | | | | | | | |

Changes in non-cash working capital: | | | | | | | | |

| Prepaids and deposits | | | | | (14.5) | | | (10.5) | | |

| Accounts payable and accrued liabilities | | | | | 3.0 | | | 8.0 | | |

| Dividends payable | | | | | 14.5 | | | (44.7) | | |

| | | | | 3.0 | | | (47.2) | | |

| | | | | |

| CRESCENT POINT ENERGY CORP. | 19 |

Supplementary financing cash flow information

The Company's reconciliation of cash flow from financing activities is outlined in the table below:

| | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | |

($ millions) | | Dividends payable | | Long-term debt (1) | | Lease liability (2) | |

| December 31, 2022 | | 99.4 | | | 1,441.5 | | | 124.1 | | |

| Changes from cash flow from financing activities: | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Increase in bank debt, net | | | | 106.8 | | | | |

| | | | | | | |

| | | | | | | |

| Realized loss on cross currency swap maturity | | | | (0.3) | | | | |

| Dividends paid | | (61.8) | | | | | | |

Payments on principal portion of lease liability | | | | | | (5.3) | | |

Non-cash changes: | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Dividends declared | | 17.1 | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Foreign exchange | | | | (0.5) | | | | |

| March 31, 2023 | | 54.7 | | | 1,547.5 | | | 118.8 | | |

| | | | | | | |

| December 31, 2023 | | 56.8 | | | 3,566.3 | | | 144.7 | | |

Changes from cash flow from financing activities: | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Decrease in bank debt, net | | | | (40.9) | | | | |

| | | | | | | |

| | | | | | | |

| Realized loss on cross currency swap maturity | | | | (2.4) | | | | |

| Dividends paid | | (56.8) | | | | | | |

Payments on principal portion of lease liability | | | | | | (8.6) | | |

Non-cash changes: | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Dividends declared | | 71.3 | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Dispositions | | | | | | (0.2) | | |

Foreign exchange | | | | 68.2 | | | | |

| March 31, 2024 | | 71.3 | | | 3,591.2 | | | 135.9 | | |

(1)Includes current portion of long-term debt.

(2)Includes current portion of lease liability.

23.OIL AND GAS SALES

The following table reconciles oil and gas sales by country:

| | | | | | | | | | | | | | | | | | |

| | | Three months ended March 31 | |

($ millions) (1) | | | | | 2024 | | 2023 | |

| Canada | | | | | | | | |

| Crude oil and condensate sales | | | | | 932.7 | | | 652.0 | | |

| NGL sales | | | | | 64.9 | | | 50.8 | | |

| Natural gas sales | | | | | 110.3 | | | 59.2 | | |

| Total Canada | | | | | 1,107.9 | | | 762.0 | | |

| U.S. | | | | | | | | |

| Crude oil and condensate sales | | | | | — | | | 134.0 | | |

| NGL sales | | | | | — | | | 11.0 | | |

| Natural gas sales | | | | | — | | | 6.6 | | |

Total U.S. (2) | | | | | — | | | 151.6 | | |

| Total oil and gas sales | | | | | 1,107.9 | | | 913.6 | | |

(1)Oil and gas sales are reported before realized derivatives.

(2)Discontinued operations.

24.SUBSEQUENT EVENTS

Disposition of Non-core Saskatchewan Assets

On May 6, 2024, the Company announced the disposition of non-core Saskatchewan assets for $600.0 million, prior to closing adjustments.

| | | | | |

| CRESCENT POINT ENERGY CORP. | 20 |

| | | | | | | | |

Directors Barbara Munroe, Chair (6) James Craddock (2) (3) (5) John Dielwart (3) (4) Mike Jackson (1) (5) Jennifer Koury (2) (5) Francois Langlois (1) (3) (4) Myron Stadnyk (1) (2) (4) Mindy Wight (1) (2) Craig Bryksa (4) (1) Member of the Audit Committee of the Board of Directors (2) Member of the Human Resources and Compensation Committee of the Board of Directors (3) Member of the Reserves Committee of the Board of Directors (4) Member of the Environment, Safety and Sustainability Committee of the Board of Directors (5) Member of the Corporate Governance and Nominating Committee (6) Chair of the Board serves in an ex officio capacity on each Committee Officers Craig Bryksa President and Chief Executive Officer Ken Lamont Chief Financial Officer Ryan Gritzfeldt Chief Operating Officer Mark Eade Senior Vice President, General Counsel and Corporate Secretary Garret Holt Senior Vice President, Strategy and Planning Michael Politeski Senior Vice President, Finance and Treasurer Shelly Witwer Senior Vice President, Business Development Justin Foraie Vice President, Operations and Marketing Head Office Suite 2000, 585 - 8th Avenue S.W. Calgary, Alberta T2P 1G1 Tel: (403) 693-0020 Fax: (403) 693-0070 Toll Free: (888) 693-0020 Banker The Bank of Nova Scotia Calgary, Alberta | | Auditor PricewaterhouseCoopers LLP Calgary, Alberta Legal Counsel Norton Rose Fulbright Canada LLP Calgary, Alberta Evaluation Engineers McDaniel & Associates Consultants Ltd. Calgary, Alberta Registrar and Transfer Agent Investors are encouraged to contact Crescent Point's Registrar and Transfer Agent for information regarding their security holdings: Computershare Trust Company of Canada 600, 530 - 8th Avenue S.W. Calgary, Alberta T2P 3S8 Tel: (403) 267-6800 Stock Exchanges Toronto Stock Exchange - TSX New York Stock Exchange - NYSE Stock Symbol CPG Investor Contacts Sarfraz Somani Manager, Investor Relations (403) 693-0020 |

| | |

| | | | | |

| CRESCENT POINT ENERGY CORP. | 21 |

Exhibit 99.2

MANAGEMENT’S DISCUSSION AND ANALYSIS

Management's discussion and analysis (“MD&A”) is dated May 9, 2024 and should be read in conjunction with the unaudited consolidated financial statements for the period ended March 31, 2024 for a full understanding of the financial position and results of operations of Crescent Point Energy Corp. (the “Company” or “Crescent Point”). Except as otherwise noted, the results of operations present only continuing operations. Comparative period results have been revised to reflect current period presentation.

The unaudited consolidated financial statements and comparative information for the period ended March 31, 2024, are presented under IFRS Accounting Standards as issued by the International Accounting Standards Board.

Structure of the Business

The principal undertaking of Crescent Point is to carry on the business of acquiring, developing and holding interests in petroleum and natural gas properties and assets related thereto through a general partnership and wholly owned subsidiaries. Amounts in this MD&A are in Canadian dollars unless noted otherwise. References to “US$” and "US dollars" are to United States (“U.S.”) dollars.

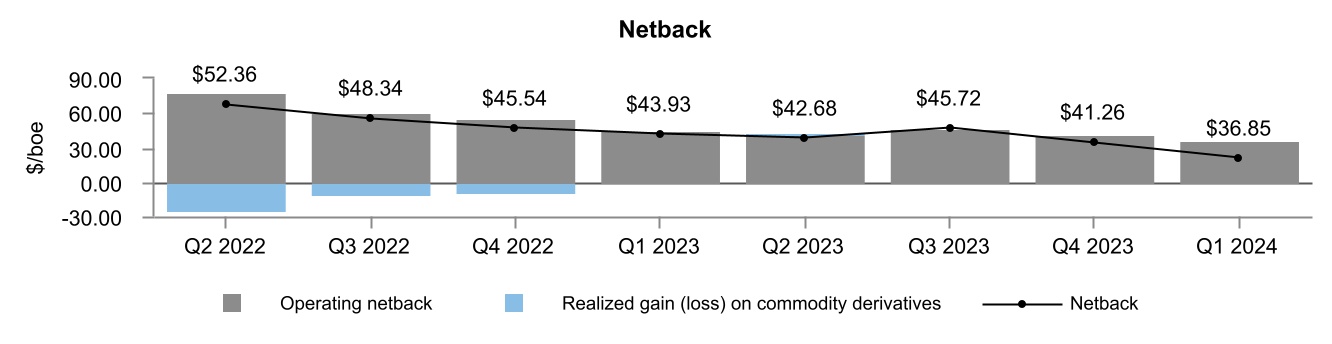

Overview

Crescent Point's first quarter 2024 results were highlighted by continued operational execution and the successful integration of the Alberta Montney assets of Hammerhead Energy Inc. ('Hammerhead"), which were acquired in December 2023. Total production averaged 198,551 boe/d for the quarter, up 43 percent from the first quarter of 2023, primarily attributable to growing volumes in the Alberta Montney. The first quarter saw an active capital program, with development capital expenditures of $398.6 million and 45 (38.8 net) wells drilled. The Company continued to realize a strong operating netback of $36.60 per boe despite weaker oil differentials during the first quarter, mainly due to the Company's improved cost structure associated with its Kaybob Duvernay and Alberta Montney assets.

Crescent Point achieved strong first quarter financial results, with adjusted funds flow from operations of $568.2 million, adjusted net earnings from operations of $187.0 million, and excess cash flow of $130.8 million. The Company reduced net debt by $155.2 million, ending the quarter with net debt of $3.58 billion or 1.5 times net debt to adjusted funds flow from operations. The Company recorded a non-cash impairment during the quarter related to certain assets being classified as held for sale, which resulted in a net loss of $411.7 million.

During the first quarter, the Company closed the sale of its Southern Alberta assets for total consideration of $38.1 million after closing adjustments along with the disposition of its Swan Hills assets for total consideration of $80.5 million after closing adjustments.

The Company remained active with its hedging portfolio during the quarter, protecting against commodity price volatility. The Company has approximately 45 percent of its oil and liquids production and over 30 percent of its natural gas production hedged throughout the remainder of 2024, and approximately 10 percent of its oil and liquids production and 30 percent of its natural gas production hedged in the first half of 2025, net of royalty interest.

Subsequent to the quarter, the Company announced the disposition of non-core Saskatchewan assets for $600.0 million, prior to closing adjustments. The Company expects to direct net proceeds from the disposition toward its balance sheet to reduce long-term debt. In conjunction with the disposition, Crescent Point revised its 2024 annual average production guidance to 191,000 - 199,000 boe/d. Development capital expenditures guidance of $1.40 - $1.50 billion remained unchanged as a result of minimal spending budgeted for these assets for the remainder of 2024.

Development capital expenditures, operating netback, adjusted funds flow from operations, adjusted net earnings from operations, excess cash flow, net debt and net debt to adjusted funds flow from operations are specified financial measures that do not have any standardized meaning prescribed by IFRS and, therefore, may not be comparable with the calculation of similar measures presented by other entities. Refer to the Specified Financial Measures section in this MD&A for further information.

| | | | | |

| CRESCENT POINT ENERGY CORP. | 1 |

Presentation of Continuing and Discontinued Operations

In 2023, the Company completed the disposition of its North Dakota assets, which made up its Northern U.S. cash-generating unit ("CGU"). The Northern U.S. CGU represented a geographical area of the Company's operations, therefore, its results were classified as a discontinued operation in accordance with IFRS 5 Non-current Assets Held for Sale and Discontinued Operations. Refer to the Discontinued Operations in this MD&A for further information. The financial results for the period ended March 31, 2024 and March 31, 2023, are presented below to reconcile continuing and discontinued operations to total results.

The following table summarizes the Company's financial results from continuing and discontinued operations for the period ended March 31, 2024 and March 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended March 31, 2024 | | Three months ended March 31, 2023 | |

| ($ millions) | | Continuing | | Discontinued | | Total | | Continuing (1) | | Discontinued (1) | | Total | |

| REVENUE AND OTHER INCOME | | | | | | | | | | | | | |

Oil and gas sales | | 1,107.9 | | | — | | | 1,107.9 | | | 762.0 | | | 151.6 | | | 913.6 | | |

Purchased product sales | | 28.3 | | | — | | | 28.3 | | | 19.8 | | | — | | | 19.8 | | |

Royalties | | (113.9) | | | — | | | (113.9) | | | (86.0) | | | (38.5) | | | (124.5) | | |

| Oil and gas revenue | | 1,022.3 | | | — | | | 1,022.3 | | | 695.8 | | | 113.1 | | | 808.9 | | |

| Commodity derivative gains (losses) | | (213.3) | | | — | | | (213.3) | | | 13.2 | | | — | | | 13.2 | | |

| Other income (loss) | | 1.5 | | | (12.8) | | | (11.3) | | | 8.5 | | | — | | | 8.5 | | |

| | 810.5 | | | (12.8) | | | 797.7 | | | 717.5 | | | 113.1 | | | 830.6 | | |

| EXPENSES | | | | | | | | | | | | | |

| Operating | | 251.0 | | | — | | | 251.0 | | | 169.0 | | | 23.4 | | | 192.4 | | |

| Purchased product | | 29.8 | | | — | | | 29.8 | | | 20.5 | | | — | | | 20.5 | | |

| Transportation | | 81.8 | | | — | | | 81.8 | | | 32.8 | | | 2.7 | | | 35.5 | | |

| General and administrative | | 28.6 | | | — | | | 28.6 | | | 24.0 | | | 0.7 | | | 24.7 | | |

| Interest | | 60.8 | | | — | | | 60.8 | | | 16.0 | | | — | | | 16.0 | | |

| Foreign exchange gain | | (1.8) | | | — | | | (1.8) | | | (3.0) | | | — | | | (3.0) | | |

| Share-based compensation | | 12.2 | | | — | | | 12.2 | | | 17.5 | | | — | | | 17.5 | | |

| Depletion, depreciation and amortization | | 344.1 | | | — | | | 344.1 | | | 186.4 | | | 45.3 | | | 231.7 | | |

| Impairment | | 512.3 | | | — | | | 512.3 | | | — | | | — | | | — | | |

| Accretion and financing | | 6.8 | | | — | | | 6.8 | | | 7.0 | | | 0.1 | | | 7.1 | | |

| | 1,325.6 | | | — | | | 1,325.6 | | | 470.2 | | | 72.2 | | | 542.4 | | |

| Net income (loss) before tax | | (515.1) | | | (12.8) | | | (527.9) | | | 247.3 | | | 40.9 | | | 288.2 | | |

| | | | | | | | | | | | | |

| Tax expense (recovery) | | | | | | | | | | | | | |

Current | | — | | | — | | | — | | | — | | | — | | | — | | |

Deferred | | (116.2) | | | — | | | (116.2) | | | 62.5 | | | 9.0 | | | 71.5 | | |