TIDMCLIG

RNS Number : 9644V

City of London Investment Group PLC

23 January 2012

23(rd) January 2012

CITY OF LONDON INVESTMENT GROUP PLC

("City of London" or "the Group")

HALF YEAR RESULTS TO 30(th) NOVEMBER 2011

City of London (LSE: CLIG) announces half year results for the

six months to 30(th) November 2011.

HIGHLIGHTS

-- Revenues stable at GBP17.2 million (2010: GBP17.2 million)

-- Funds under Management ("FuM") of US$4.8 billion (GBP3.0

billion) at 30(th) November 2011. This compares to US$5.8 billion

(GBP3.5 billion) at the beginning of this financial year on 1(st)

June 2011 and US$5.5 billion (GBP3.6 billion) at 30th November

2010. The MSCI Emerging Markets Index (MXEF) declined by 19.3% over

the period compared to the 17.2% fall in FuM in US dollar

terms.

-- Profit before tax of GBP6.1 million, including a GBP0.4

million gain on the sale of an investment (2010: GBP5.7 million,

including GBP0.4 million of main market Listing costs)

-- Maintained interim dividend of 8p per share payable on 27(th)

February 2012 to shareholders on the register on 10(th) February

2012

-- Cash and cash equivalents at the period end of GBP5.9 million (2010: GBP3.1 million)

Andrew Davison, Chairman, said, "We have carefully and

deliberately built our business to be resilient in the face of the

sometimes extreme volatility inherent in investing in emerging and

frontier markets around the world. Our aversion to risk has enabled

us to build a loyal client base by being able to offer long-term

benchmark outperformance in a risky asset class. It is our ability

to retain and grow the client base which allows us to pay

consistent dividends to reward our shareholders."

Barry Olliff, CEO, added, "Bearing in mind that our FuM have

been significantly impacted by the adverse market conditions, we

consider that we have done a relatively good job of controlling our

costs. Very early in 2011 we battened down the hatches. Our main

focus was on expenses that we considered could be cut that would

not damage our long term business plans.

"While this has been a difficult year for our Equities products,

our Market Neutral, Frontier and Developed CEF funds have done very

well and are a potential source of additional FuM. We are as a

result bringing forward our marketing plans in this regard."

For further information, please visit www.citlon.co.uk or

contact:

Doug Allison (Finance Director) Simon Hudson / Andrew Dunn

City of London Investment Group Tavistock Communications

PLC

Tel: +44 (0)20 7860 8347 Tel: +44 (0)20 7920 3150

Claes Spang Simon Bridges / Martin Green

Singer Capital Markets Limited Canaccord Genuity Limited

Financial Adviser & Joint Broker Joint Broker

Tel: +44 (0)20 3205 7500 Tel: +44 (0)20 7050 6500

Chairman's statement

Despite the sometimes extreme volatility of emerging markets in

the first half of our financial year, the Group has performed

creditably in financial terms. Our ability to deal with declining

and volatile markets whilst still generating profits and dividends

for shareholders illustrates well the Group's risk averse approach

and our relentless focus on keeping fixed costs to a minimum.

Total funds under management (FuM) at 30(th) November 2011, our

half-year end, were US$4.8 billion (GBP3.0 billion). This compares

to US$5.8 billion (GBP3.5 billion) at the beginning of this

financial year on 1(st) June 2011 and US$5.5 billion (GBP3.6

billion) at 30(th) November 2010. The MSCI Emerging Markets Index

(MXEF) declined by 19.3% over our first half-year as against the

17.2% fall in FuM in US dollar terms. As we announced during the

period under review, although markets have been very volatile,

clients remained loyal with net new inflows of US$41.4 million,

made up of US$281.8 million of redemptions and US$323.2 million of

new allocations. At the most recent month end, 31(st) December, FuM

stood at US$4.7 billion.

Results - unaudited

Revenues for the six months to 30th November 2011 were unchanged

at GBP17.2 million (2010: GBP17.2 million). The average net fee,

after allowing for commissions payable, weighted across the

portfolio, is currently 86 basis points. Given our fixed cost base,

which has remained stable at some GBP0.9 million per month, this

makes operating profitability (before profit sharing of 30%)

remarkably predictable with a high level of visibility. We

announced in an Interim Management Statement on 5th December 2011

that we expected profit before taxation for the six months ended

30th November 2011 to be approximately GBP6.1 million. The outturn

was exactly in line with profit before tax of GBP6.1 million (2010:

GBP6.1 million before Listing costs of GBP0.4 million incurred in

that period).

This year's profit before tax includes a gain of US$0.7 million

(GBP0.4 million) on the sale of an investment in options on

unquoted equity, which could potentially increase during the second

half year to a total gain of US$1.2 million (GBP0.7 million), in

accordance with a contingency clause in the sale agreement. The

Group has not previously highlighted this investment as its cost

and prior value were deemed immaterial.

Administrative expenses increased by just 5% to GBP11.6 million

(2010: GBP11.0 million before the exceptional costs of the upgrade

to the main market of GBP0.4 million). Administrative expenses

include both variable costs as well as fixed overheads, with

variable costs representing some 53% of the total (2010: 56%)

including profit-share distribution. Variable costs also include

commission payable to our ex-third party marketing consultant,

North Bridge Capital, of GBP2.6 million (2010: GBP2.7 million).

The commissions payable to North Bridge Capital will begin to

fall significantly from 2014 as a result of our decision to bring

marketing in-house. We have recruited two additional experienced

marketing executives during the period - one to broaden our reach

in the US and the other to focus on European markets. They are

already making a real contribution to our profile generally and to

FuM via new mandates for our Natural Resources product.

Basic earnings per share, after a 33% tax charge of GBP2.0

million (2010: GBP1.8 million representing 31% of profit before

tax), were 16.2p (2010: 16.0p). Diluted earnings per share were

15.7p (2010: 15.4p).

Dividends

In a statement released on the day of our Annual General Meeting

on 3(rd) October 2011, we said that the Board expected to maintain

or increase the dividend during the current year unless there was a

further very significant deterioration in markets over the

remainder of the year. We also said that this may require a

relaxation of the Group's 1.5x dividend cover policy, which, we

said, the Group was well placed to accommodate in terms of both

capital adequacy and liquidity.

The Board has decided to pay a maintained interim dividend of 8p

per share. The dividend will be paid on 27(th) February 2012 to

shareholders on the register on 10(th) February 2012. Our dividend

payment policy is based on a split of one third/two thirds between

the interim and the final. In the absence of a marked deterioration

in emerging markets, this means that shareholders can expect to

receive a minimum payment of 16p as a final dividend with upside

available depending on the performance of, and outlook for,

emerging markets.

Board

At the beginning of the financial year we appointed a new US

based Non-executive Director, Rian Dartnell. Rian is Chief

Investment Officer for Granite Associates, having spent his career

managing global multi-asset class funds. Effective today, George

Robb has retired from the Board as a Non-executive Director, and is

replaced by Lynn Ruddick. Lynn is Non-executive Chairman or

Director of a number of investment trusts, as well as serving as an

investment committee member or trustee of two pension plans. She is

also a former Chairman of the Investment Committee of the National

Association of Pension Funds.

George Robb has been a Non-executive Director of City of London

since 1997, with a brief gap in 2004-5. As a long term Board

member, and shareholder, George's contribution to the development

of the Group has been important and we will miss his participation

in our discussions. On behalf of the Directors, I wish George a

long and happy retirement.

Outlook

The management team and Board of City of London have carefully

and deliberately built our business to be resilient in the face of

the sometimes extreme volatility inherent in investing in emerging

and frontier markets around the world. Our aversion to risk has

enabled us to build a loyal client base by being able to offer

long-term benchmark outperformance in a risky asset class. It is

our ability to retain and grow the client base which allows us to

pay consistent dividends to reward our shareholders.

As we begin the second half of the year, the outlook for

emerging markets remains opaque but the Board is confident that the

Group has done all that it can to structure the business to deliver

continuing value to clients, staff and shareholders.

Andrew Davison

Chairman

19(th) January 2012

Chief Executive Officer's review

This has been a tough half year in terms of both investment

performance and also the firm's results. I thought that the best

way to confront this was by going into some of the details

associated with what we have been doing in our attempt to mitigate

these issues.

Investment Performance.

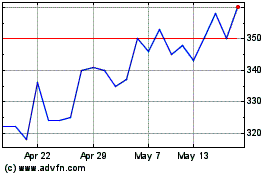

City Of London Investment (LSE:CLIG)

Historical Stock Chart

From Aug 2024 to Sep 2024

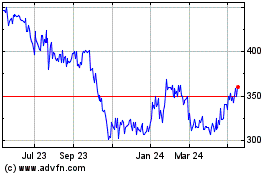

City Of London Investment (LSE:CLIG)

Historical Stock Chart

From Sep 2023 to Sep 2024