By Laura Stevens and Khadeeja Safdar

Amazon.com Inc. unveiled Monday its first small-format grocery

store, Amazon Go, one of at least three brick-and-mortar formats

the online retail giant is exploring as it makes a play for an area

of shopping that remains stubbornly in-store.

Two of the other store formats Amazon is considering are bigger

than the convenience-style Go store, according to people familiar

with the matter. In November, Amazon's technology team approved a

proposal to open large, multifunction stores with curbside pickup

capability, clearing the way to start hiring and planning,

according to one of the people.

Two drive-through prototype locations, which don't offer an

in-store shopping option, are also slated to open within the next

few weeks in Seattle, the people said.

Amazon envisions opening more than 2,000 brick-and-mortar

grocery stores under its name, depending on the success of the new

test locations, according to the people. By comparison, Kroger Co.

operates about 2,800 locations across 35 states.

Adding grocery pickups will be "part of their secret sauce in

terms of all of the different ways in which they can engage the

customer in bringing the product to them," says Bill Bishop, chief

architect at grocery and retail consultancy Brick Meets Click.

"Everyone is looking at grocery because of frequency. Frequency

guarantees that you have density."

The developments are the next step in Project Como, Amazon's

plan to capture more food sales, opening the door to a key driver

of consumer spending that would broaden the online retailer's

increasing dominance in the retail market.

It will also help Amazon better compete against rivals such as

Target Corp. and Wal-Mart Stores Inc., which plans to expand a

service that lets shoppers order online and pickup curbside to

1,000 stores by the end of next year.

An Amazon spokeswoman declined to comment.

Until now, Amazon has centered its grocery strategy around

Amazon Fresh, a subscription service that promises quick food

delivery for online orders. But delivering groceries is

logistically complex, requiring fast delivery for cold items as

part of large orders on less profitable routes, where stops are

spread far apart. And many consumers still prefer to touch, smell

and pick out fresh items like fruits and vegetables for

themselves.

Online purchases comprise about 1% of the $674 billion market

for edible groceries in the U.S., according to Kantar Retail.

The Amazon Go store, at roughly 1,800 square feet in downtown

Seattle, resembles a convenience store-format in a video Amazon

released Monday. It features artificial intelligence-powered

technology that eliminates checkouts, cash registers and lines.

Instead, customers scan their phone on a kiosk as they walk in, and

Amazon automatically determines what items customers take from the

shelves. After leaving the store, Amazon charges their account for

the items and sends a receipt.

Meanwhile, in the suburban Seattle neighborhood of Ballard, a

handful of workers on Monday were finishing up one of Amazon's two

drive-through prototypes in the area, which according to the people

close to the situation are slated to open in the next few weeks.

The wood-paneled building with green trim and an overhang appeared

to have at least three covered bays for cars to pull up and pick up

orders, with a paved driveway in front.

The third concept, the newly approved multi-format store,

combines in-store shopping with curbside pickups, according to the

people. It will likely adopt a 30,000- to 40,000-square-foot floor

plans and spartan stocking style like European discount grocery

chains Aldi or Lidl, offering a limited fresh selection in store

and more via touch-screen orders for delivery later. Stores in this

format, which are smaller than traditional U.S. grocery stores,

could start appearing late next year.

That concept bears strong resemblance to a 2013 report by former

Deloitte consultant Brittain Ladd, who now works for Amazon Fresh.

The paper, previously reported by GeekWire, describes stores

focusing on a core 20% of foods -- eggs, dairy, meat, fruit,

vegetables and bread -- that generate 80% of traditional grocery

sales, with drive-through and touch-screen ordering options.

Amazon declined to make Mr. Ladd or other Amazon executives

available for comment.

While Amazon is moving into brick-and-mortar grocery shopping,

other large retailers are expanding their online services.

Wal-Mart's curbside pickup service offers some convenience without

the cost of home delivery. Last week Wal-Mart opened its second

Pickup and Fuel store in Denver, a small-format store that offers a

limited selection of fresh food, snack and gas as well as allowing

shoppers to pick up online grocery orders.

Target in recent months began considering a pilot to deliver its

own groceries, which face declining sales as too few shoppers are

buying perishable items like milk and eggs. But it hasn't moved

forward with the idea, according to a person familiar with the

matter.

"While we don't currently have plans to pursue a full-service,

Target-owned grocery delivery service in the near term, we will

continue to discuss the idea, among many others, and assess if it

is the right fit for the future," said Target spokeswoman Katie

Boylan.

The retailer currently offers a grocery-delivery service in

select cities through a partnership with Instacart Inc., a

grocery-delivery startup. However, executives are concerned the

service is boosting Instacart's brand rather than the retailer's

own brand, according to the person.

As Target pauses grocery delivery, Amazon envisions filling in

the gap. The online retailer hopes to one day function as a

grocery-delivery service and distributor for brick-and-mortar

retailers, according to one of the people, a move that will help

lower its own costs as it builds out its own transportation

network. The more deliveries, the more cost-effective its service

becomes -- including lower food prices as the online retailer

purchases more.

Analysts say that many retailers would be reluctant to hand over

the reins to Amazon.

Grocery sales produce slim profits for chains like Target and

Wal-Mart but are important because they drive traffic to their

stores where consumers buy higher-margin products like apparel and

home items.

A future in which Amazon is delivering Target's groceries is

"very very very unlikely," said Amy Koo, principal analyst at

Kantar Retail. "Target is not going to give that benefit to

Amazon."

--Jay Greene and Greg Bensinger contributed to this article.

Write to Laura Stevens at laura.stevens@wsj.com and Khadeeja

Safdar at khadeeja.safdar@wsj.com

(END) Dow Jones Newswires

December 05, 2016 18:59 ET (23:59 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

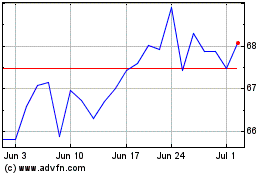

Walmart (NYSE:WMT)

Historical Stock Chart

From Aug 2024 to Sep 2024

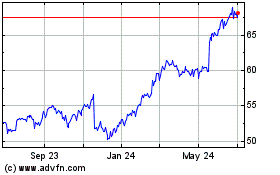

Walmart (NYSE:WMT)

Historical Stock Chart

From Sep 2023 to Sep 2024